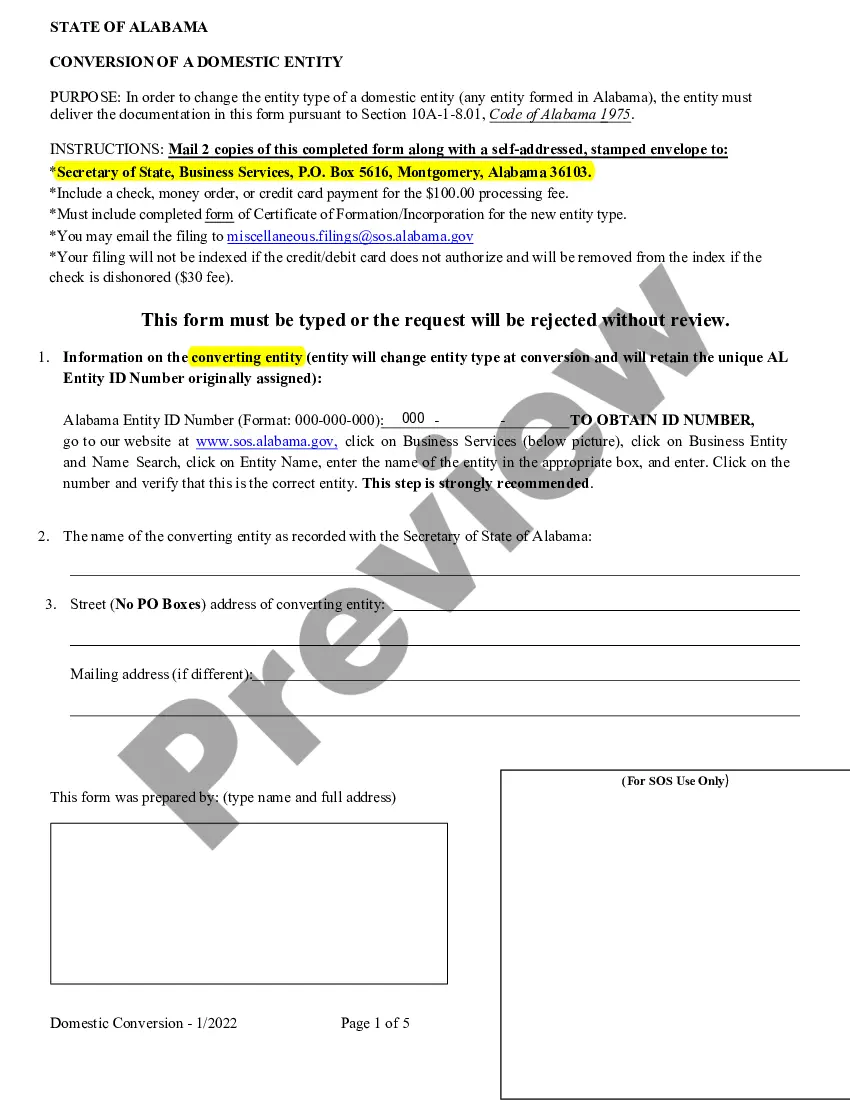

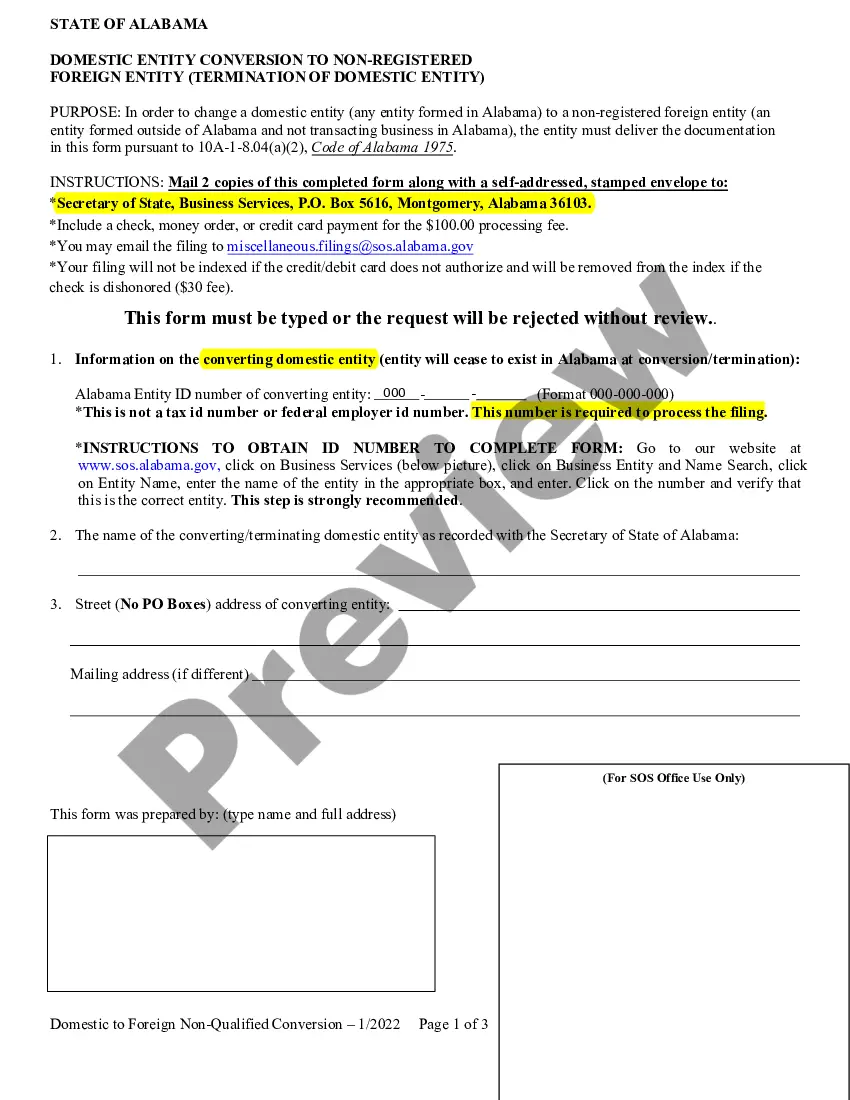

Alabama Domestic Entity Conversion to Registered Foreign Entity is a process that allows an Alabama-based business to change its formation from a domestic entity to a foreign entity in another jurisdiction. This process is also known as domestication, re-domestication, or conversion. It is often used to change an entity’s legal status to take advantage of more favorable tax and operational benefits offered in the new jurisdiction. Types of Alabama Domestic Entity Conversion to Registered Foreign Entity include converting a Domestic Corporation to a Foreign Corporation, converting a Domestic Limited Liability Company to a Foreign Limited Liability Company, and converting a Domestic Limited Partnership to a Foreign Limited Partnership.

Alabama Domestic Entity Conversion to Registered Foreign Entity

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Domestic Entity Conversion To Registered Foreign Entity?

How much duration and resources do you typically allocate for creating official documentation.

There’s a more efficient way to obtain such forms than engaging legal professionals or squandering hours searching the internet for an appropriate template.

Another advantage of our library is that you can access documents you have obtained earlier, which you securely store in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Conserve time and effort in handling formal documentation with US Legal Forms, one of the most dependable online solutions. Register with us now!

- Browse through the document content to verify its adherence to your state criteria. For this, review the form description or use the Preview option.

- If your legal template doesn’t meet your expectations, find another one using the search bar at the top of the page.

- If you already possess an account with us, sign in and download the Alabama Domestic Entity Conversion to Registered Foreign Entity. If not, continue with the next steps.

- Click Buy now once you identify the appropriate template. Select the subscription plan that fits you best to access the complete features of our library.

- Establish an account and complete your subscription payment. You can process the payment using your credit card or via PayPal - our service is completely secure for such transactions.

- Obtain your Alabama Domestic Entity Conversion to Registered Foreign Entity on your device and complete it either on a printed hard copy or electronically.

Form popularity

FAQ

Transacting business in Alabama involves engaging in commercial activities, which may include conducting sales, providing services, and maintaining an office. The state requires that any business entity, including foreign ones, register to do business if they meet certain thresholds. To ensure compliance during the process of Alabama Domestic Entity Conversion to Registered Foreign Entity, it is advisable to consult with a legal professional or utilize platforms like uslegalforms to guide you accurately.

A domestic company operates in the state where it was established, subject to local law, whereas a foreign company is one that has been registered to conduct business in a state different from its origin. Understanding these distinctions is crucial when determining your business strategy. By utilizing the Alabama Domestic Entity Conversion to Registered Foreign Entity, you can seamlessly transition your business operations as you expand into Alabama.

The primary difference lies in where the corporation is formed. A domestic corporation is formed in its home state, adhering to local laws and regulations, while a foreign corporation is registered to do business in a state other than its formation state. If you are considering the Alabama Domestic Entity Conversion to Registered Foreign Entity, this process allows your corporation to operate legally in Alabama while remaining registered in another state.

Deciding if your LLC should be domestic or foreign depends on where you wish to conduct business. A domestic LLC operates within the state where it is formed, while a foreign LLC operates in states outside its formation state. If you are relocating or expanding your business into Alabama, understanding the Alabama Domestic Entity Conversion to Registered Foreign Entity is essential to ensure compliance with state regulations.

Yes, Alabama requires corporations to file annual reports. These reports must be submitted to maintain good standing with the state. For those considering an Alabama Domestic Entity Conversion to Registered Foreign Entity, keeping track of annual reporting obligations is essential. Utilizing a reliable service like USLegalForms can simplify this process, ensuring compliance and minimizing the risk of penalties.

A converting business is one that is in the process of changing its legal entity type. This can involve converting from an LLC to a corporation or vice versa. The Alabama Domestic Entity Conversion to Registered Foreign Entity allows your converting business to comply with state laws while pursuing new opportunities for growth and operation across state lines.

Yes, ownership of an LLC in Alabama can be transferred. This transfer typically requires amending the LLC's operating agreement and filing the appropriate paperwork. This process can become more complex with multiple members or if the LLC undergoes an Alabama Domestic Entity Conversion to Registered Foreign Entity, which can also impact ownership structure.

A converted entity is the new legal structure of a business after it has undergone a conversion. For instance, if an LLC becomes a corporation through the conversion process, it is now a converted entity. This change can offer enhanced benefits, including liability protections and easier capital raising. The Alabama Domestic Entity Conversion to Registered Foreign Entity explains how to manage this transition effectively.

A converting entity is a business that is changing its legal structure from one entity type to another. This process can help a business adapt to new legal or financial needs. When a company opts for the Alabama Domestic Entity Conversion to Registered Foreign Entity, it becomes a converting entity, enabling it to operate in multiple states under a single legal framework.

Domestic corporations are formed in Alabama, while foreign corporations are those created in another state but wish to operate in Alabama. The distinction affects regulatory requirements, taxation, and legal protections. If a foreign corporation wants to operate in Alabama, it must undergo the Alabama Domestic Entity Conversion to Registered Foreign Entity process to ensure full compliance.