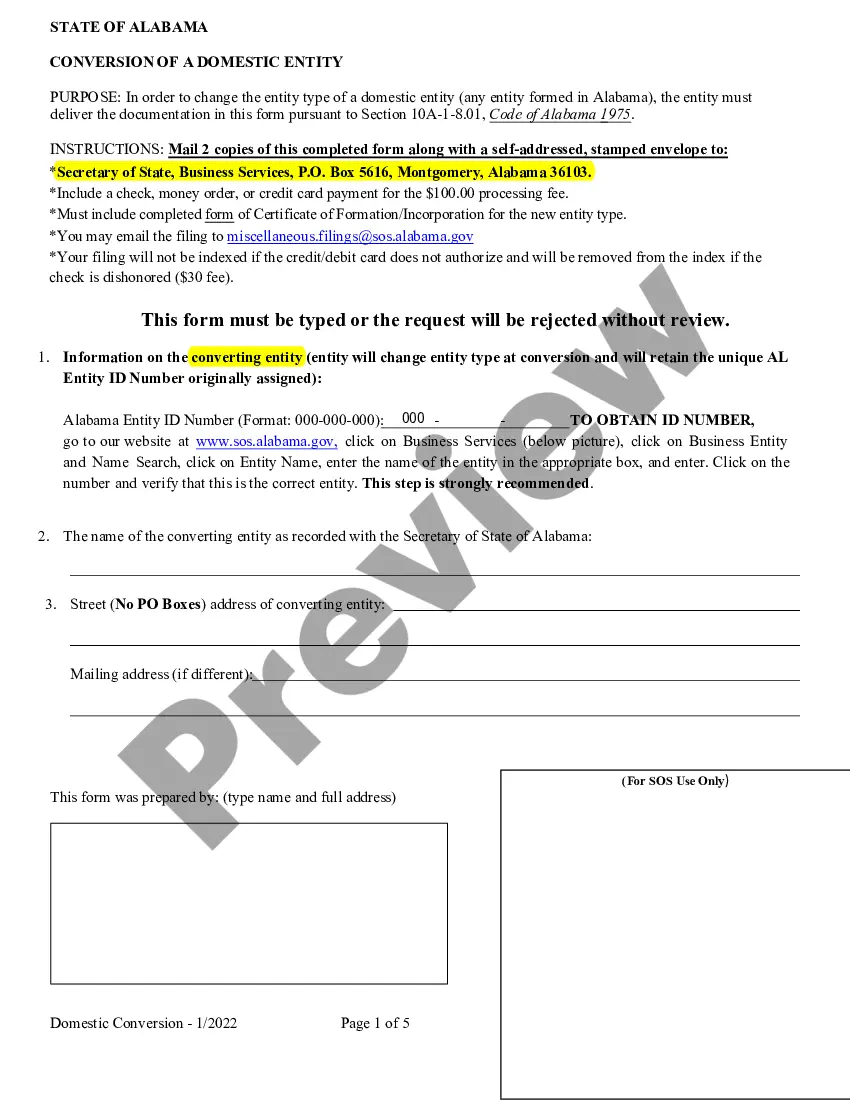

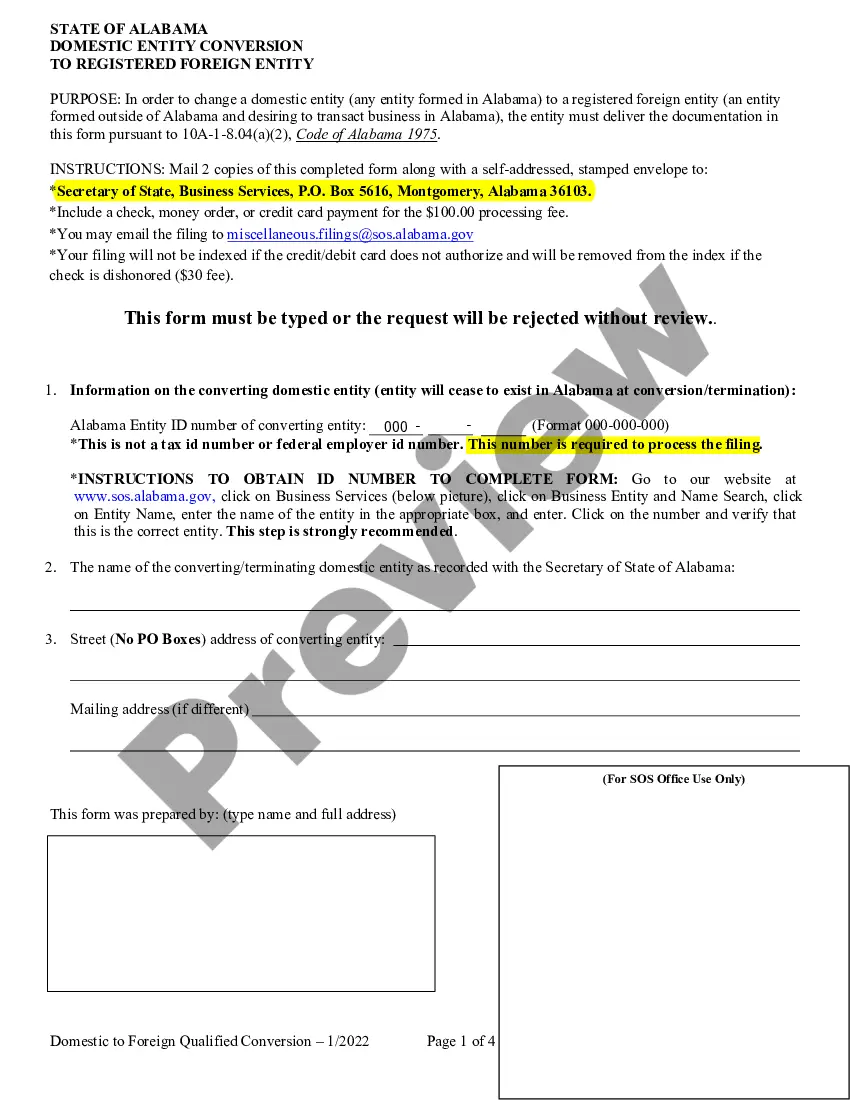

Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) is a process that allows an existing Alabama domestic entity, such as a corporation, limited liability company, limited partnership, or business trust, to convert to a non-registered foreign entity, usually by filing documents with the Alabama Secretary of State. This process is also referred to as domestication or re-domestication. Depending on the type of entity being converted, the documents required for this process may vary. Generally speaking, the documents required for an Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) include a Certificate of Conversion, a Certificate of Domestication (if applicable), and a Certificate of Termination. Depending on the type of entity being converted, additional documents may be required, such as an agreement of merger, a certificate of limited partnership, or an application for a certificate of authority. The documents must be filed with the Alabama Secretary of State, and the filing fee will vary depending on the type of entity and the documents being filed. The two types of Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) are: 1. Conversion of an Alabama Corporation to a Non-Registered Foreign Entity: This process involves filing a Certificate of Conversion, a Certificate of Domestication, and a Certificate of Termination with the Alabama Secretary of State. 2. Conversion of an Alabama Limited Liability Company, Limited Partnership, or Business Trust to a Non-Registered Foreign Entity: This process involves filing a Certificate of Conversion, a Certificate of Domestication (if applicable), and a Certificate of Termination with the Alabama Secretary of State. Depending on the type of entity being converted, additional documents may be required.

Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Domestic Entity Conversion To Non-Registered Foreign Entity (Termination Of Domestic Entity)?

How much time and resources do you typically allocate to creating formal documents.

There’s a superior alternative to obtaining such forms rather than employing legal experts or spending countless hours searching online for a suitable template. US Legal Forms is the premier online repository that provides expertly crafted and validated state-specific legal paperwork for any reason, including the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity).

Another advantage of our library is that you can retrieve previously purchased documents, which you securely store in your profile under the My documents tab. Access them at any time and re-complete your documents as often as necessary.

Conserve time and energy in completing legal paperwork with US Legal Forms, one of the most dependable online services. Sign up with us today!

- Browse through the content of the form to ensure it meets your state's specifications. To verify this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find an alternative using the search feature located at the top of the page.

- If you possess an account with us, Log In and download the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity). Otherwise, continue to the subsequent steps.

- Hit Buy now once you locate the correct document. Select the subscription plan that fits your needs best to gain access to our comprehensive library.

- Establish an account and process your payment for the subscription. You can complete the payment using your credit card or via PayPal - our service is entirely trustworthy for that.

- Download your Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) onto your device and finish it on a hard copy or digitally.

Form popularity

FAQ

To shut down your LLC in Alabama, you should begin by gathering your company’s records and notifying all involved parties. After that, you will need to file the proper dissolution paperwork with the state. Additionally, consider utilizing services like uslegalforms, which can streamline the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) process and ensure compliance.

Shutting down an LLC in Alabama involves several crucial steps. First, notify all members and creditors of your intent to close. Next, file the Articles of Dissolution with the Secretary of State. This process includes completing the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) to confirm that your LLC has been properly terminated.

To officially close an LLC, you must follow the necessary steps for dissolution in your state. Begin by holding a meeting with members to agree on the closure. Then, file the appropriate dissolution document with the Alabama Secretary of State. Completing the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) ensures all legalities are satisfied.

Changing ownership of an LLC in Alabama starts with understanding the process laid out in your operating agreement. You will need to draft and sign a transfer agreement to outline the change in ownership. After executing the transfer, ensure you notify the Alabama Secretary of State and update your LLC's records. This may connect to an Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) if your changes align with such a transition.

Transferring ownership of an LLC in Alabama requires proper documentation and adherence to state laws. Begin by consulting your operating agreement for any stipulations regarding ownership changes. You will need to execute a transfer agreement and inform the Alabama Secretary of State if applicable. This is crucial, especially when considering an Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity).

Transferring an LLC to someone else involves several steps. First, review your operating agreement for any restrictions on ownership transfer. You may need to obtain consent from other members before completing the transfer. Finally, complete a membership transfer document and update the state records, particularly if this leads to an Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity).

To remove someone from an LLC in Alabama, you must first check your operating agreement for guidelines on member removal. If there are no specific provisions, you can call a meeting to discuss and vote on the removal. After making the decision, you should document it and file appropriate forms with the state. This process relates to the Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity), as it may involve changes to your business structure.

A foreign LLC in Alabama refers to an LLC that was formed in another state but operates in Alabama. This requires registration with the state to legally conduct business there. If you are looking to transition your business, understanding Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) can enhance your operational strategy and streamline your business processes.

To change the address of your LLC in Alabama, you’ll need to file a change of address form with the Secretary of State. This form updates your official records to reflect the new address, ensuring compliance with local laws. If you are considering Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity), ensuring your address is current can be crucial for maintaining good standing.

The difference lies in their registration and operational territories. A domestic corporation is formed and operates within its home state, while a foreign corporation operates in states where it is not incorporated, like Alabama. Understanding Alabama Domestic Entity Conversion to Non-Registered Foreign Entity (Termination of Domestic Entity) can help corporations ease into foreign status when necessary, avoiding legal complications.