Alabama Conversion of a Domestic Entity — Corporation to Professional Corporation is a process of converting a Domestic Corporation to a Professional Corporation. This process allows a company to provide professional services to its clients. The process involves filing a Certificate of Conversion with the Probate Judge of the county where the Domestic Corporation's principal office is located. The conversion must be approved by the Probate Judge, and the Professional Corporation must meet all requirements specified in the Alabama Professional Corporation Law. Types of Alabama Conversion of Domestic Entity — Corporation to Professional Corporation include conversion of a regular corporation to a professional medical corporation, a professional legal corporation, a professional engineering corporation, and a professional accounting corporation.

Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation

Description

How to fill out Alabama Conversion Of A Domestic Entity - Corporation To Professional Corporation?

Handling official documentation necessitates focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation template from our platform, you can be assured it adheres to federal and state regulations.

Utilizing our service is simple and fast. To acquire the needed document, all you require is an account with an active subscription. Here’s a brief guideline for you to obtain your Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation in just minutes.

All documents are designed for multiple usages, like the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation you find on this webpage. If you require them later, you can complete them without additional payment - just access the My documents section in your profile and finalize your document whenever necessary. Experience US Legal Forms and prepare your business and personal documentation swiftly and in full legal compliance!

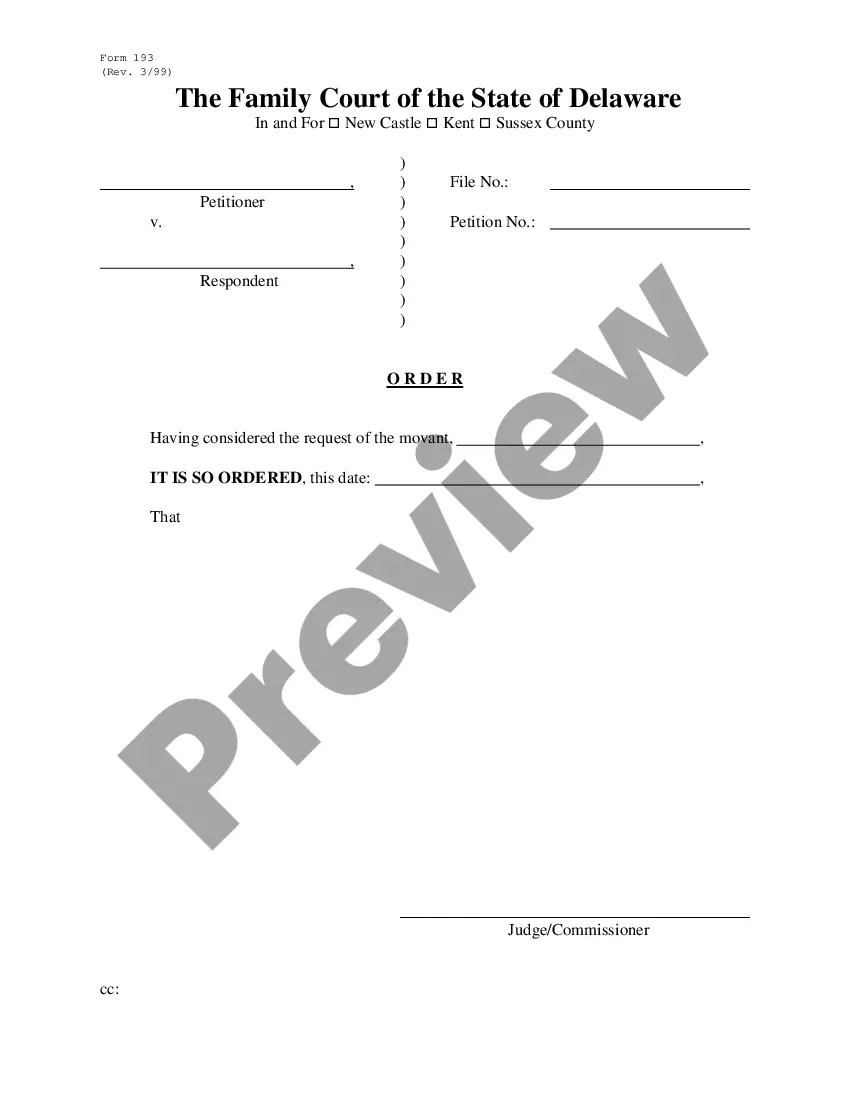

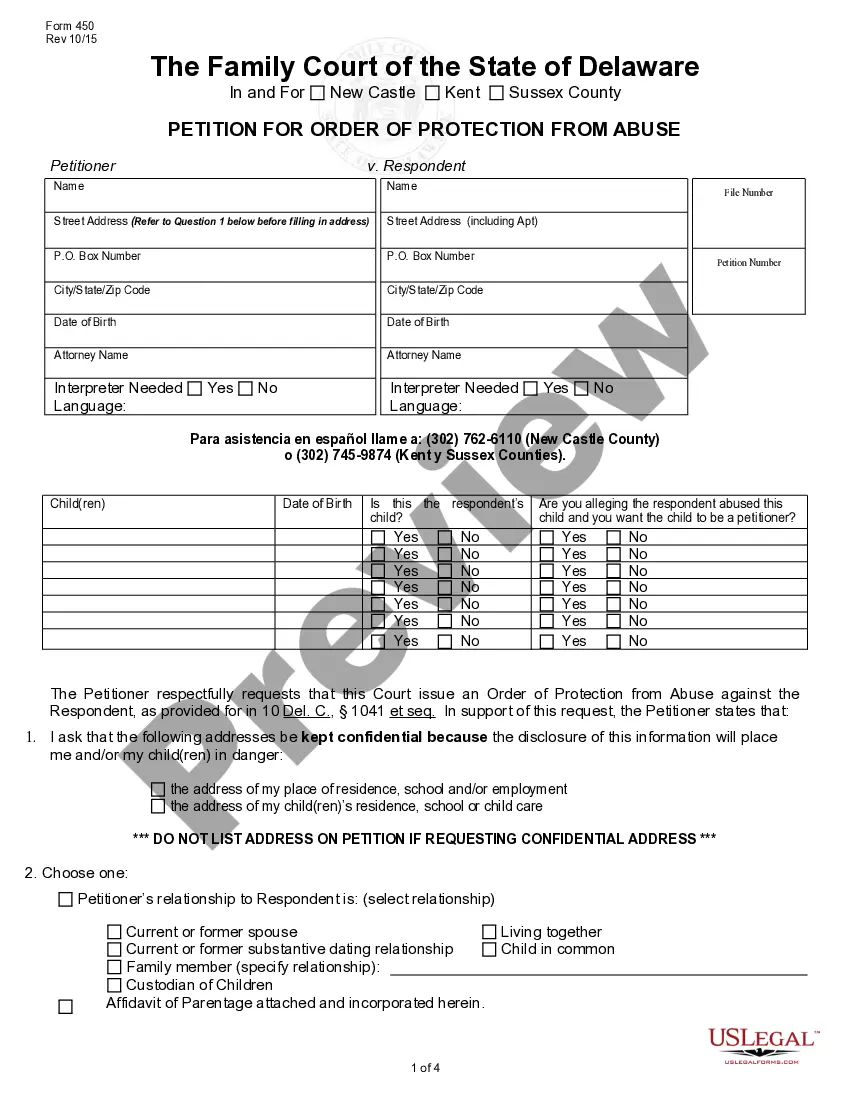

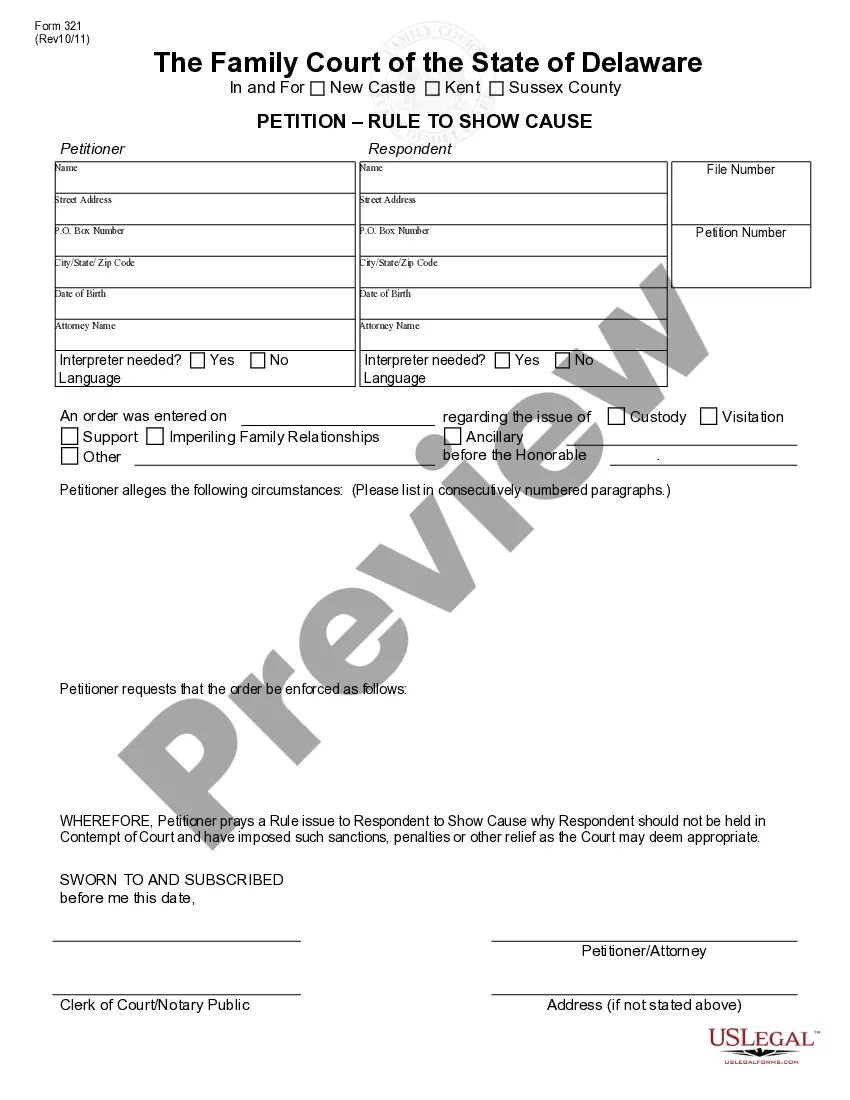

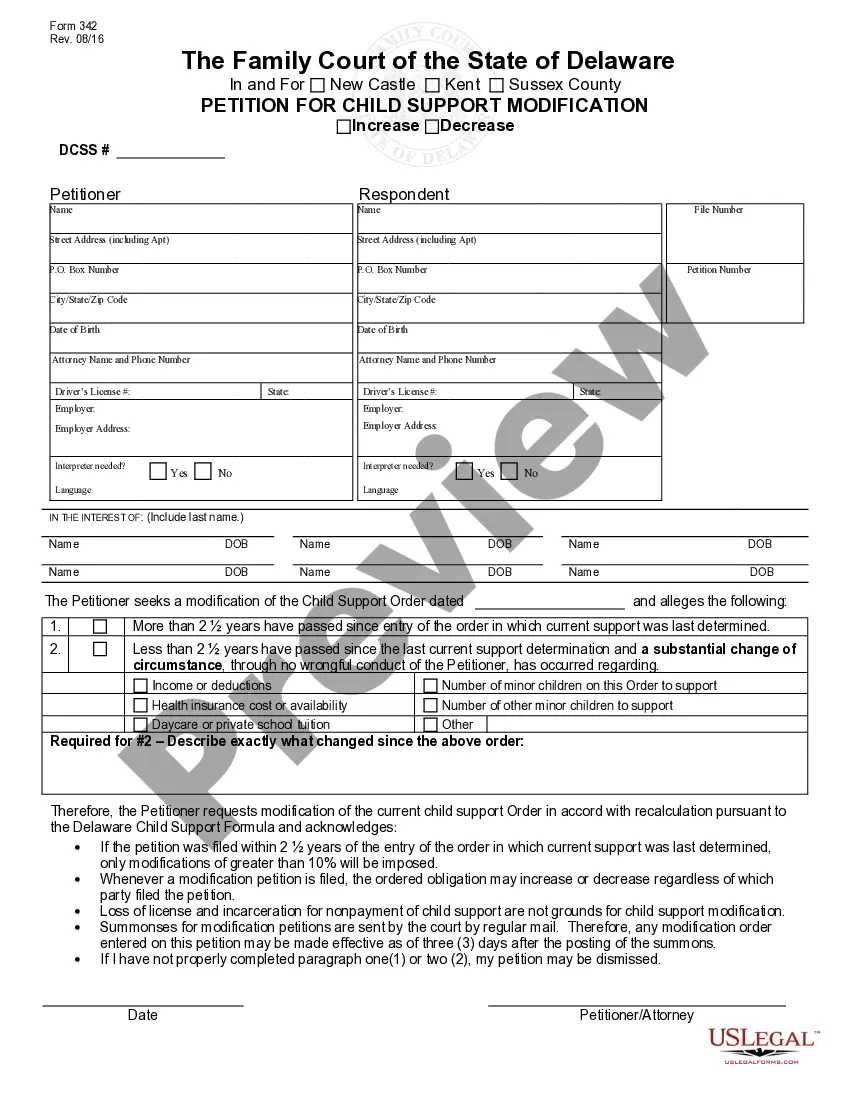

- Ensure to carefully review the form content and its alignment with general and legal criteria by previewing it or reviewing its description.

- Search for an alternative official template if the one previously accessed does not suit your needs or state requirements (the link for this is located at the upper corner of the page).

- Log In to your account and save the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation in the desired format. If this is your initial visit to our site, click Buy now to proceed.

- Establish an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the document or upload it to a professional PDF editor to prepare it without paper.

Form popularity

FAQ

The primary difference lies in the purpose and structure of the entities. A corporation can be formed for any legitimate business purpose, while a professional association is specifically for licensed professionals offering specialized services. In an Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, understanding these structures helps define your business's regulatory environment and tax obligations.

No, an LLC does not file articles of incorporation; instead, it files articles of organization. While articles of incorporation are specific to corporations, articles of organization serve a similar purpose for LLCs. If you are contemplating the implications of an Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, understanding these distinctions is crucial.

In Alabama, you file articles of incorporation with the Secretary of State’s Office. This filing can often be done online or through mail, depending on your preference. It's essential to ensure that all documents are correctly completed to avoid delays. If you undergo the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, you will still follow this process for your new designation.

To file articles of incorporation, you will need to prepare a document that includes basic information about your corporation. This typically includes your corporation's name, purpose, registered agent, and management structure. You will then submit this document to the appropriate state agency, along with any required fees. For efficient assistance during the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, consider using a platform like uslegalforms.

Yes, if you convert a corporation to an LLC, you typically need to obtain a new EIN. The Internal Revenue Service requires that different business structures have unique identification numbers for tax purposes. If you are considering an Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, consult a tax professional to ensure compliance and proper transition.

A corporation qualifies as a professional corporation when it is formed by licensed professionals to provide specific services. This includes fields like law, medicine, or accounting, where members must hold state licenses. By ensuring that shareholders are licensed professionals, the entity is recognized as a professional corporation. Thus, during your Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation process, you should verify compliance with state licensing requirements.

One disadvantage of a professional corporation is the increased regulatory oversight. Professional corporations must adhere to strict compliance requirements specific to their profession. Additionally, owners may face limitations on ownership shares, as only licensed professionals can typically hold shares in the company. Thus, when considering an Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, weigh these factors carefully.

To change the name of your business in Alabama, you must follow specific procedures. First, ensure that your new business name is compliant with state regulations and not already in use. After that, file a name change amendment to your Articles of Incorporation with the Secretary of State. If you're considering an Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, the name change should be part of that process, and using a platform like USLegalForms can help streamline the necessary paperwork.

Incorporating a business in Alabama involves several key steps. First, you need to choose a business name that complies with Alabama's naming rules and confirm its availability. Then, prepare and file your Articles of Incorporation with the appropriate state office, along with any required fees. Remember, if you are considering the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, additional documentation and adherence to specific professional regulations will be necessary.

No, a domestic professional corporation is not an LLC. While both provide limited liability, a domestic professional corporation is designed for licensed professionals to work together, while an LLC can have various business purposes. If you're considering the Alabama Conversion of a Domestic Entity - Corporation to Professional Corporation, it's vital to understand how these distinctions may affect your business approach.