Alabama Conversion of a Domestic Entity — Professional Corporation to Business Corporation is a process of legally changing a professional corporation in the state of Alabama to a business corporation. The process involves filing Articles of Conversion with the Alabama Secretary of State’s office, in accordance with the Alabama Business Corporation Act. The conversion is effective upon filing the articles. The Articles of Conversion must include the following information: name and type of domestic entity; name and type of entity after the conversion; name and address of the registered agent; any changes to the name of the entity; any changes to the purpose of the entity; any changes to the capital structure; and the date on which the conversion is to become effective. The types of Alabama Conversion of a Domestic Entity — Professional Corporation to Business Corporation include: Statutory Conversion; Domestication; and Merger Conversion. Statutory Conversion is the process of converting a Professional Corporation in the state of Alabama to a Business Corporation in accordance with the Alabama Business Corporation Act. Domestication is the process of converting a Professional Corporation in one state to a Business Corporation in Alabama. Merger Conversion is the process of converting a Professional Corporation in one state to a Business Corporation in Alabama through a merger.

Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation

Description

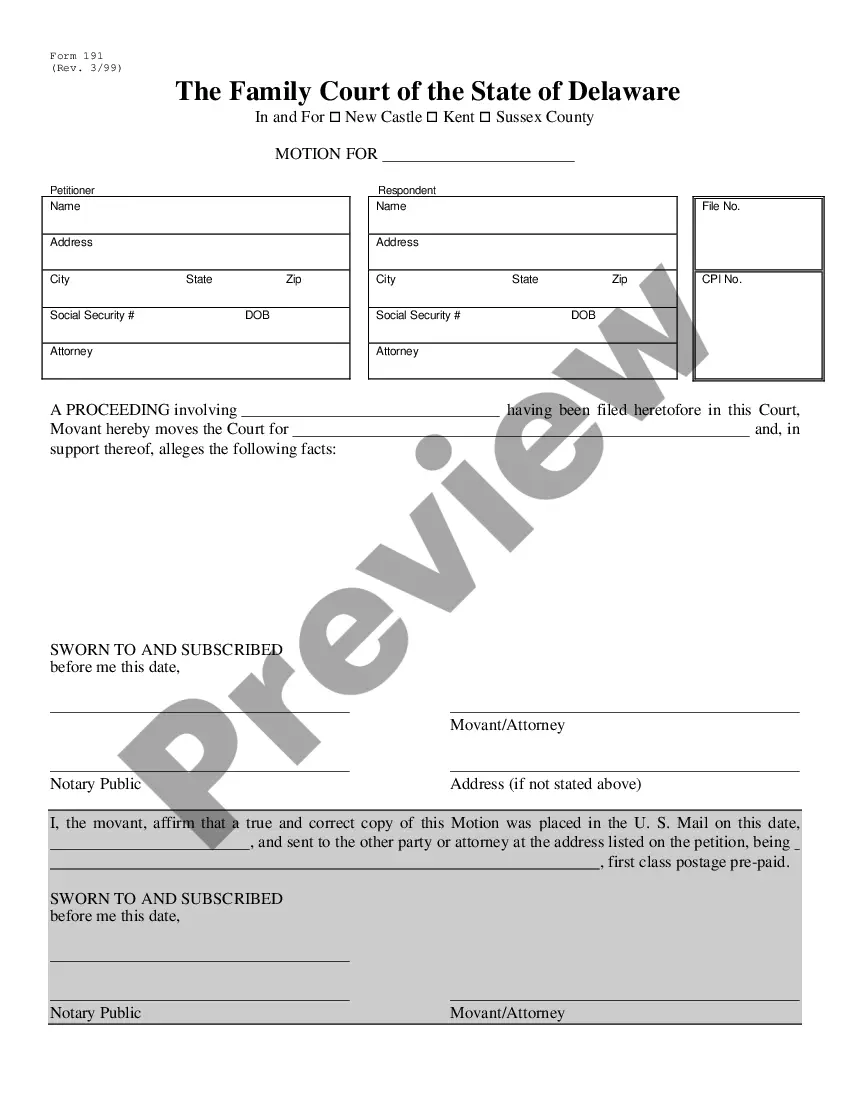

How to fill out Alabama Conversion Of A Domestic Entity - Professional Corporation To Business Corporation?

If you’re seeking a method to accurately finalize the Alabama Transition of a Domestic Entity - Professional Corporation to Business Corporation without hiring a legal professional, then you’ve found the perfect place. US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every personal and commercial need.

Every document you encounter on our online service is designed in accordance with federal and state laws, so you can be assured that your paperwork is properly organized.

Another significant benefit of US Legal Forms is that you will never misplace the documents you obtained - you can access any of your downloaded forms in the My documents section of your account whenever you need them.

- Verify that the document visible on the page aligns with your legal situation and state laws by reviewing its text description or examining the Preview mode.

- Input the document title in the Search tab located at the top of the page and choose your state from the list to locate an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you feel confident that the paperwork meets all legal requirements.

- Log In to your account and click Download. Create a profile with the service and select a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The template will be available for download immediately after.

- Choose the format in which you would like to save your Alabama Transition of a Domestic Entity - Professional Corporation to Business Corporation and download it by clicking the corresponding button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare your paper copy manually.

Form popularity

FAQ

The conversion of a company means changing its legal structure to better align with its business goals and operational needs. This might include transforming a professional corporation into a business corporation in Alabama, which can provide advantages like easier capital allocation and management flexibility. Learning about the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation helps business owners make informed decisions about their future.

A domestic professional corporation and a Limited Liability Company (LLC) are not the same; they serve different purposes and offer distinct benefits. While both provide liability protection, a professional corporation typically suits licensed professions, whereas an LLC is more versatile for general business activities. Understanding the differences can significantly impact the options available during the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation.

Entity conversion is the legal process through which a business changes its organizational structure. For instance, transforming from a domestic professional corporation to a business corporation affects how the entity is managed and taxed. Navigating the complexities of the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation can be streamlined through resources like US Legal Forms, ensuring a smooth transition.

An example of conversion in business is when a small professional corporation decides to switch its status to a business corporation. By doing this, the company may gain advantages such as increased capital raising options and different tax treatments. This transformation aligns with the process known as Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation, enabling a company to strategically position itself for future challenges.

Business conversion refers to the process of changing a company's legal structure. For example, when a professional corporation in Alabama converts to a business corporation, it alters its operational flexibility and regulatory obligations. This change can create new opportunities for growth and expansion, making it essential for business owners to understand the implications of the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation.

Registering a business in Alabama typically takes about two to three weeks if all paperwork is in order. However, processing times can vary based on the volume of applications at the Secretary of State's office. To expedite the process, consider using services like uslegalforms, which can help ensure you accurately complete the forms required for an Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation.

Yes, even if you have an LLC in Alabama, obtaining a business license is essential. Depending on your specific business activities and location, local regulations may require additional permits or licenses. Stay compliant by checking with your city or county government's office, ensuring that your LLC adheres to the requirements of an Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation if necessary.

To incorporate a business in Alabama, you must first choose a unique name for your entity. Next, prepare and file the Articles of Incorporation with the Secretary of State. You will then need to designate a registered agent for service of process. Finally, after obtaining the necessary approvals, you can proceed with compliance requirements such as creating bylaws and holding initial meetings, all while considering an Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation if applicable.

A business entity conversion is the legal process of changing a company's structure, such as from an LLC to a corporation or vice versa. This enables you to shift to a business structure that better suits your goals and needs. If you are considering this option, the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation can help clarify your options and guide you through the necessary steps.

Yes, when you convert your LLC to an S corporation, you will need to obtain a new Employer Identification Number (EIN). The IRS requires a different EIN for different business structures to maintain proper tax records. As you navigate the Alabama Conversion of a Domestic Entity - Professional Corporation to Business Corporation process, ensure you secure your new EIN to comply with federal regulations.