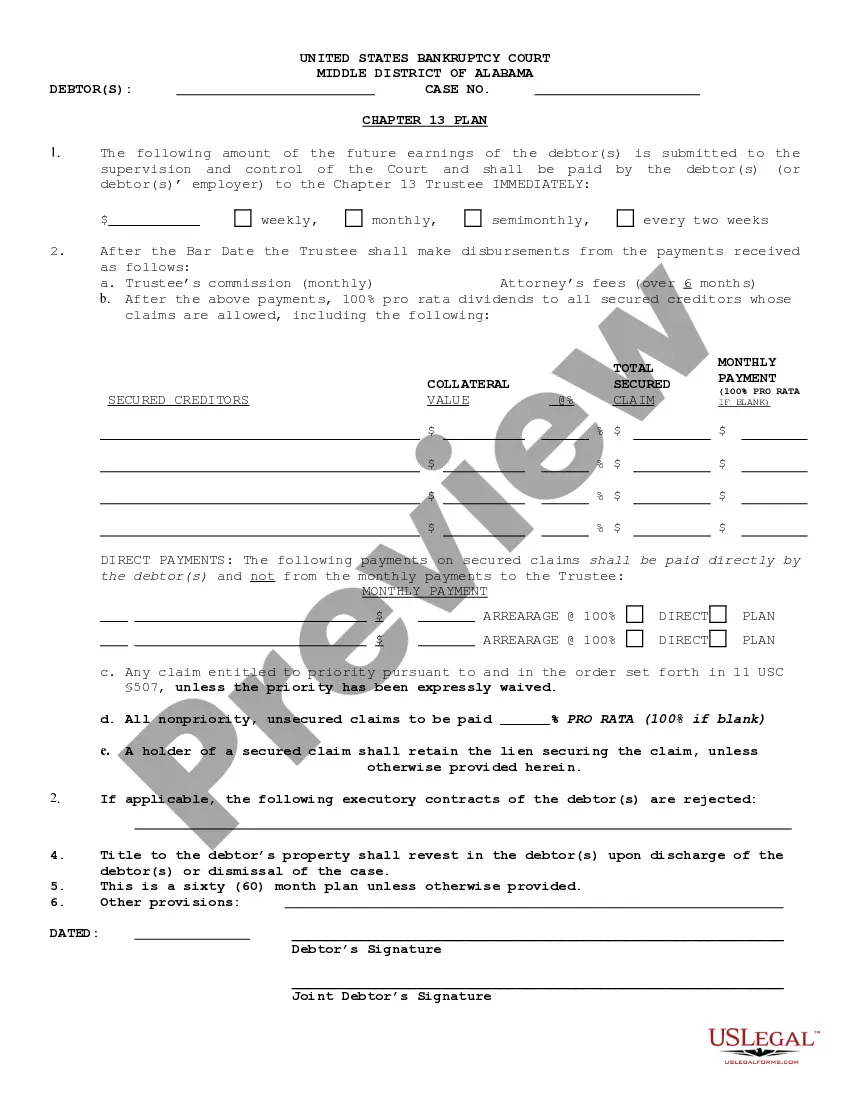

The chapter 13 plan provides that the future earnings of the debtor(s) is submitted to the supervision and control of the court and will be paid by the debtor(s) to the chapter 13 trustee immediately. The form requires the debtor's signature and the signature of the joint debtor, if applicable.

Alabama Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Chapter 13 Plan?

Leveraging Alabama Chapter 13 Plan samples developed by skilled lawyers provides you the chance to eliminate stress when completing paperwork. Simply download the format from our site, complete it, and have legal advice review it.

By doing this, you can save significantly more time and expenses than if you were to have a legal expert create a document from the ground up for you.

If you possess a US Legal Forms membership, just Log In to your profile and return to the sample page. Search for the Download button near the template you are reviewing.

Once you have completed all the steps above, you can finish, print, and sign the Alabama Chapter 13 Plan template. Remember to double-check all entered information for accuracy before submitting or sending it out. Minimize the time you spend on document creation with US Legal Forms!

- After downloading a template, you will find all your saved samples in the My documents section.

- If you lack a subscription, it’s not an issue. Simply follow the steps below to register for an account online, acquire, and finalize your Alabama Chapter 13 Plan template.

- Verify and ensure that you are obtaining the correct state-specific form.

- Utilize the Preview option and review the description (if available) to confirm if you need this particular template, and if so, click Buy Now.

- If needed, look for another template using the Search feature.

- Select a subscription that meets your requirements.

- Begin using your credit card or PayPal.

Form popularity

FAQ

In Alabama, Chapter 13 allows individuals to reorganize their debts while keeping their assets. You propose a repayment plan to the court, which must be approved before you can start making payments. During the repayment period, you can catch up on missed payments and protect your property from foreclosure. For assistance in navigating the process, Uslegalforms offers valuable tools and templates to help you create your Alabama Chapter 13 Plan.

Your monthly payment for an Alabama Chapter 13 Plan varies based on your income, expenses, and total debt. Generally, it ranges from a few hundred to several thousand dollars monthly. It would help if you considered all your debts and living expenses when calculating your payment. With Uslegalforms, you can find resources to help you estimate your payment accurately.

A typical Alabama Chapter 13 Plan lasts three to five years, during which you make monthly payments based on your income and budget. The plan prioritizes your debts, focusing on secured loans and certain unsecured debts. Your exact payment amount will depend on various factors, including your income level and overall debt. With Uslegalforms, you can easily create a personalized plan that meets your financial needs.

To file an Alabama Chapter 13 Plan, individuals typically need to have unsecured debts below $465,275 and secured debts below $1,395,875. These limits can change, so it's wise to check current figures. If your debts fall within these limits, you can proceed with your filing. Uslegalforms can guide you through understanding your eligibility and the necessary steps.

Several factors can render you ineligible for an Alabama Chapter 13 Plan, such as failing to complete credit counseling, not meeting the debt limits, or having previously dismissed cases within a certain time frame. Understanding these criteria can help you assess your situation better. If you're unsure of your eligibility, uslegalforms provides valuable resources to help you navigate these regulations efficiently.

The average monthly payment for an Alabama Chapter 13 Plan varies, typically falling between $300 and $600, depending on your income and debt level. This payment aims to manage your debts effectively while allowing you to maintain essential living expenses. For better insight into payments tailored to your situation, consult the resources at uslegalforms.

Completing your Alabama Chapter 13 Plan involves proposing a repayment structure that demonstrates your ability to repay debts over three to five years. Be diligent in ensuring your proposal meets legal requirements. Leveraging the tools and support from uslegalforms can help you accurately finalize your plan and prepare for court approval.

Filling out an Alabama Chapter 13 Plan requires a series of forms detailing your income, expenses, debts, and property. Start by gathering your financial documents to ensure accuracy. Resources and templates available on uslegalforms can simplify your experience, allowing you to complete the forms efficiently and with confidence.

To file an Alabama Chapter 13 Plan, your secured debts must be less than $1,257,850, and your unsecured debts must be below $419,275. This unique structure allows individuals with significant debt to find relief and organize payments. Understanding these limits is essential for crafting a successful plan, and seeking assistance from a trusted platform like uslegalforms can guide you through the process.

Disqualifying factors for an Alabama Chapter 13 Plan include having excessive debts that surpass the established limits, failure to complete a required credit counseling course, or recent dismissals of bankruptcy filings. If you have delinquent payments on your current obligations, that might also hinder your qualifications. Consulting a platform like US Legal Forms can assist you in understanding your options better.