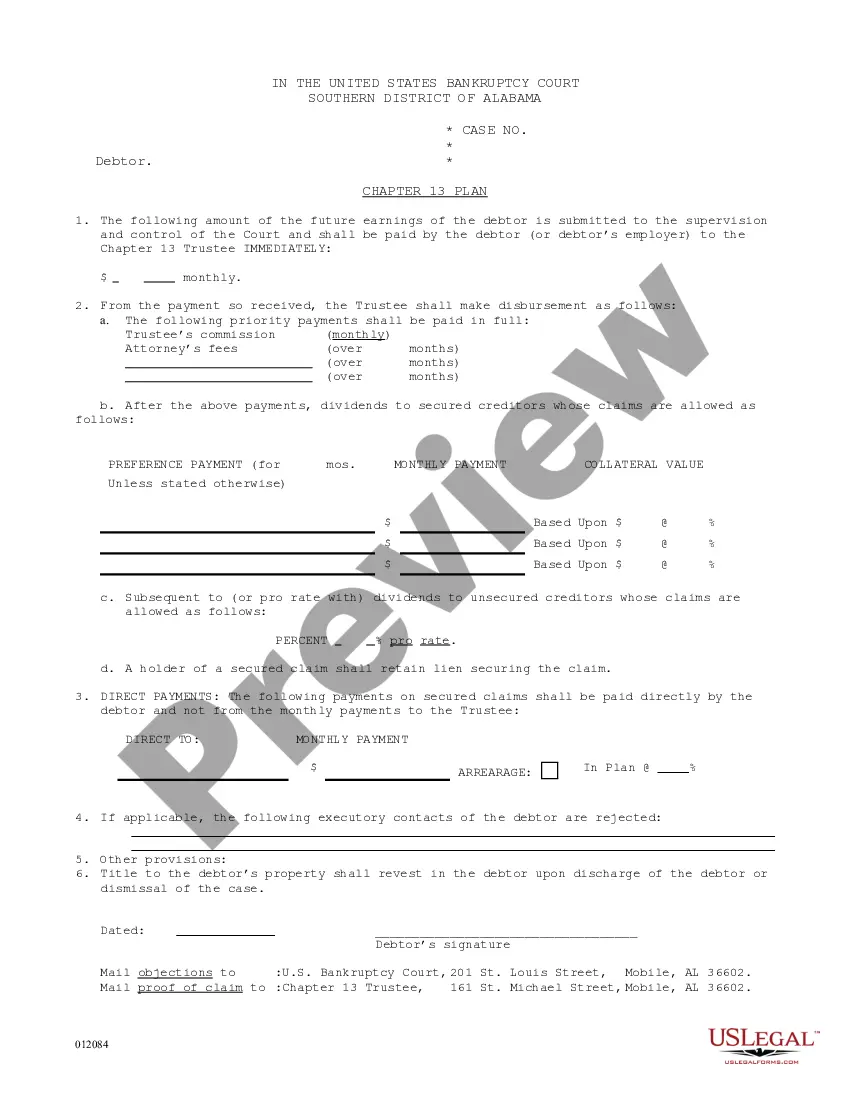

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The document provides information concerning: secured creditors, unsecured creditors, and the date of plan termination.

Alabama Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

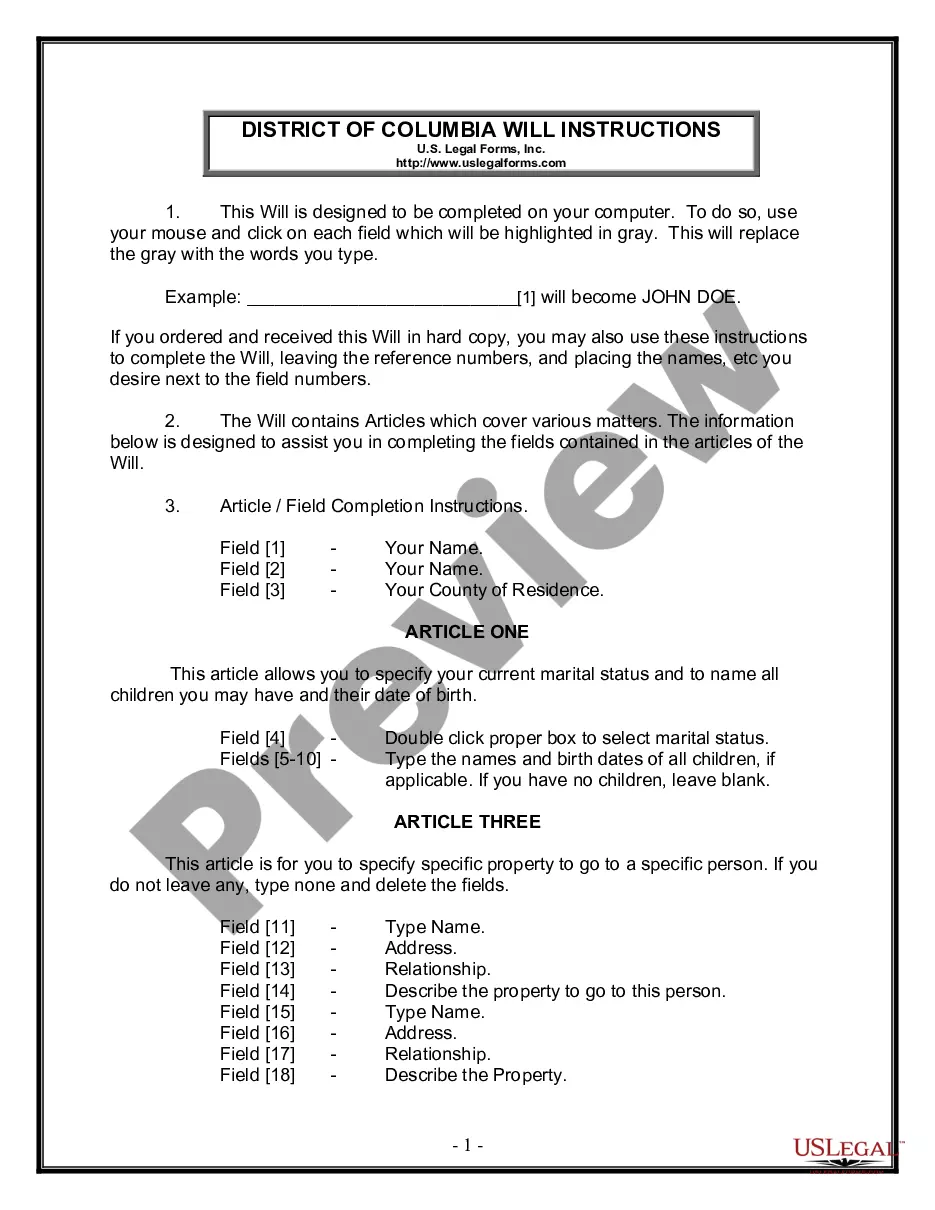

How to fill out Alabama Chapter 13 Plan?

Utilizing Alabama Chapter 13 Plan examples crafted by expert attorneys helps you steer clear of complications when preparing paperwork.

Simply download the template from our site, fill it in, and have an attorney review it.

By doing this, you will save a considerable amount of time and expenses compared to having a legal expert draft a document entirely from the beginning to meet your requirements.

Utilize the Preview feature and review the description (if provided) to ascertain whether you require this specific template, and if so, just click Buy Now.

- If you already possess a US Legal Forms membership, just access your account and revisit the sample page.

- Locate the Download button next to the template you are examining.

- Once you have downloaded a template, all your saved samples will be available in the My documents section.

- If you lack a subscription, it’s no issue.

- Simply adhere to the instructions below to register for your account online, obtain, and complete your Alabama Chapter 13 Plan template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

In Alabama, filing an Alabama Chapter 13 Plan allows you to reorganize your debts while keeping your property. You propose a repayment plan to the bankruptcy court that outlines how you will repay your creditors over the designated period. Once the court approves your plan, you can stop foreclosure, repossession, and wage garnishments. Utilizing platforms like uslegalforms can simplify the filing process and ensure compliance with state-specific requirements.

A typical Alabama Chapter 13 Plan spans three to five years, during which you make regular payments to a bankruptcy trustee. Your plan generally prioritizes secured debts, such as your home or car, while also addressing priority debts, like taxes. The plan's goal is to help you keep your assets while repaying a portion of your debts. This structured approach allows you to regain financial stability over time.

Your monthly payment for an Alabama Chapter 13 Plan depends on various factors, including your income, expenses, and the total amount of your debt. Typically, payments range from a few hundred to several thousand dollars. A detailed budget will help you estimate your monthly obligations more accurately. Consulting with a bankruptcy attorney can provide valuable insights tailored to your specific circumstances.

To file an Alabama Chapter 13 Plan, your unsecured debt must be less than $419,275, and your secured debt must be under $1,257,850. This limit is important as it determines eligibility for Chapter 13 bankruptcy. If your debt exceeds these amounts, you may need to explore other options. Understanding your financial situation can help you make informed decisions.

To start filing for an Alabama Chapter 13 Plan, you should first gather all necessary financial documents, including income statements and debt records. Next, you can either seek the help of a legal professional or use a reliable online platform like US Legal Forms to access detailed guides and templates. This approach allows you to fill out the required forms accurately and submit them to the court. Remember, starting with a clear understanding of the process is crucial for a smooth filing experience.

Certainly, you have the option to file your own Chapter 13. However, this path may prove to be challenging without a solid understanding of bankruptcy laws and procedures. For many, leveraging tools offered by US Legal Forms simplifies the process, providing clear instructions and necessary forms tailored to the Alabama Chapter 13 Plan. Taking advantage of these resources can significantly enhance your chances of a successful filing.

Yes, you can file for an Alabama Chapter 13 Plan on your own, but it may not be the easiest route. Filing independently requires careful attention to detail, as improper forms or mistakes can delay your case. Many individuals find it beneficial to use platforms like US Legal Forms, which offer comprehensive guidance and templates to help streamline the process. By utilizing such services, you can ensure that your paperwork meets all necessary legal requirements.

To get approved for an Alabama Chapter 13 Plan, you must file a petition in bankruptcy court, along with specific financial documents. The court will review your income, debt, and expenses to ensure you can adhere to the proposed repayment plan. It's essential to show a steady income sufficient to make the required payments. Working with uslegalforms can simplify the process, ensuring you meet all necessary requirements to secure approval smoothly.

Yes, the Alabama Chapter 13 Plan can significantly reduce your monthly payments. When you file for Chapter 13, you create a repayment plan that makes your payments more manageable based on your income and expenses. This approach allows you to catch up on missed payments over time while keeping your essential assets. Many individuals find this relief from overwhelming debt beneficial for achieving financial stability.

The average monthly payment for an Alabama Chapter 13 Plan varies widely based on your income, expenses, and total debt amount. Typically, these payments range from $250 to $1,500 each month. It's essential to create a budget that outlines your disposable income to determine what you can afford, and USLegalForms can help you streamline this calculation.