Alaska Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Are you in a position in which you need files for both enterprise or individual purposes nearly every time? There are a lot of lawful papers themes available online, but locating types you can rely on is not simple. US Legal Forms provides a large number of kind themes, just like the Alaska Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, that are created to meet federal and state needs.

If you are already informed about US Legal Forms web site and also have an account, simply log in. Next, it is possible to acquire the Alaska Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease format.

Unless you offer an accounts and want to begin using US Legal Forms, abide by these steps:

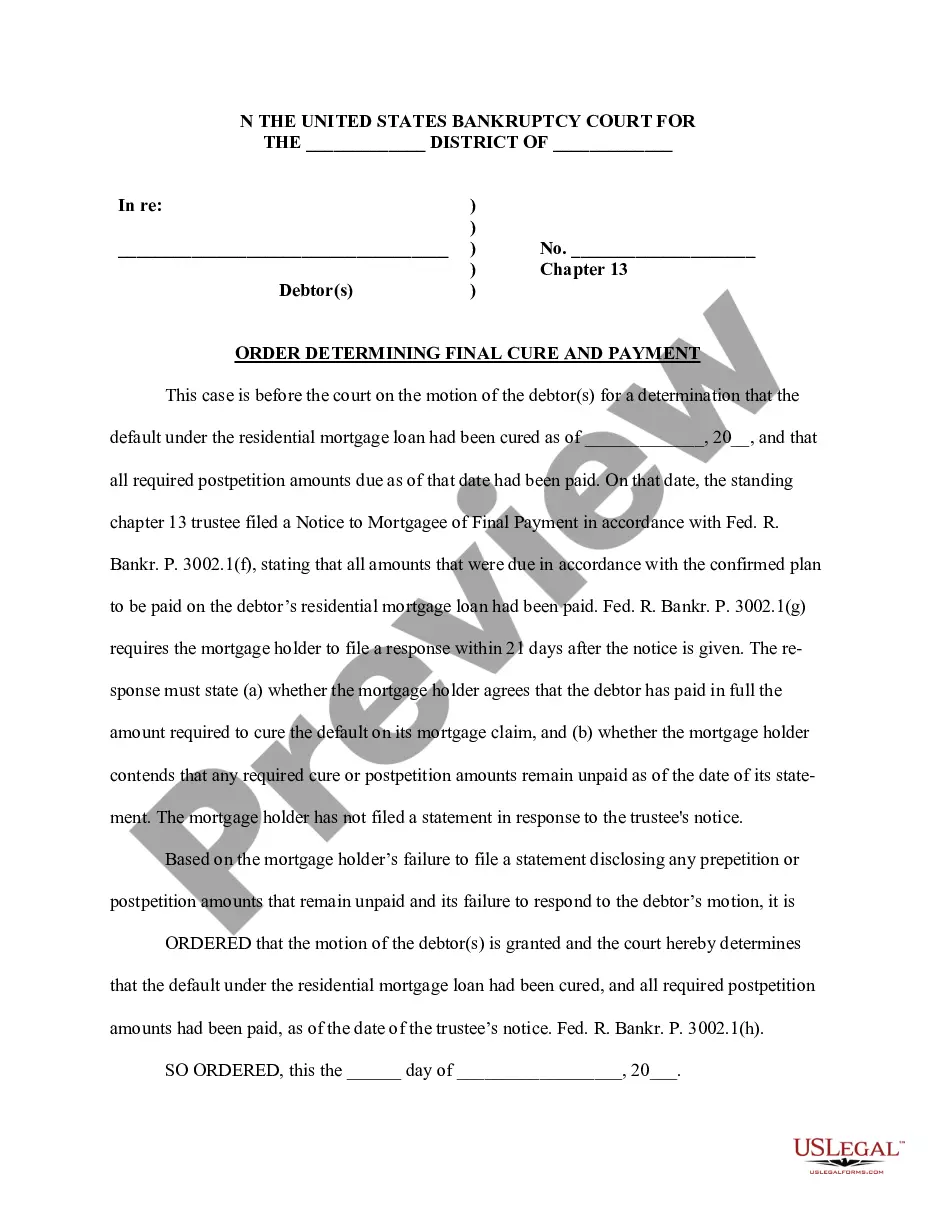

- Get the kind you want and ensure it is for that proper metropolis/area.

- Utilize the Preview option to examine the form.

- Read the outline to ensure that you have chosen the right kind.

- In the event the kind is not what you`re searching for, make use of the Search industry to discover the kind that suits you and needs.

- If you get the proper kind, simply click Get now.

- Select the rates program you desire, fill out the desired info to produce your bank account, and buy an order making use of your PayPal or charge card.

- Select a hassle-free data file structure and acquire your duplicate.

Discover every one of the papers themes you possess purchased in the My Forms food list. You can obtain a additional duplicate of Alaska Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease whenever, if necessary. Just select the essential kind to acquire or print the papers format.

Use US Legal Forms, probably the most extensive variety of lawful types, to save lots of some time and prevent faults. The assistance provides skillfully manufactured lawful papers themes that you can use for a selection of purposes. Generate an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

The political cost of the benefit is high. JUNEAU, Alaska (AP) ? Nearly every Alaskan will receive a $1,312 check starting this week, their annual share from the earnings of the state's nest-egg oil fund.

While royalties on oil and gas produced from state territory generally hover between 12.5% and 16.67%, state law gives the commissioner of the Department of Natural Resources the authority to vary those terms if doing so is deemed in the state's best interest.

A royalty is the percentage of revenue paid to the federal government by energy companies from the sale of oil, gas, or coal extracted from the nation's public lands. The current royalty rate officially charged for oil, gas, and coal drilled or mined from U.S. public lands is 12.5 percent.

Alaska's oil royalty rate varies ing to the terms of the lease agreement. It can range from 5% to 60% but is most often 12.5%. Some leases receive royalty rate reductions for new discoveries or economic considerations.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Alaska residents have been receiving annual dividend payments from the state's Permanent Fund for 41 years, but the 2022 payout is one of the largest in history. Every resident received $3,284 this year, with most payments issued in September and October.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.