Alaska Form of Convertible Promissory Note, Preferred Stock

Description

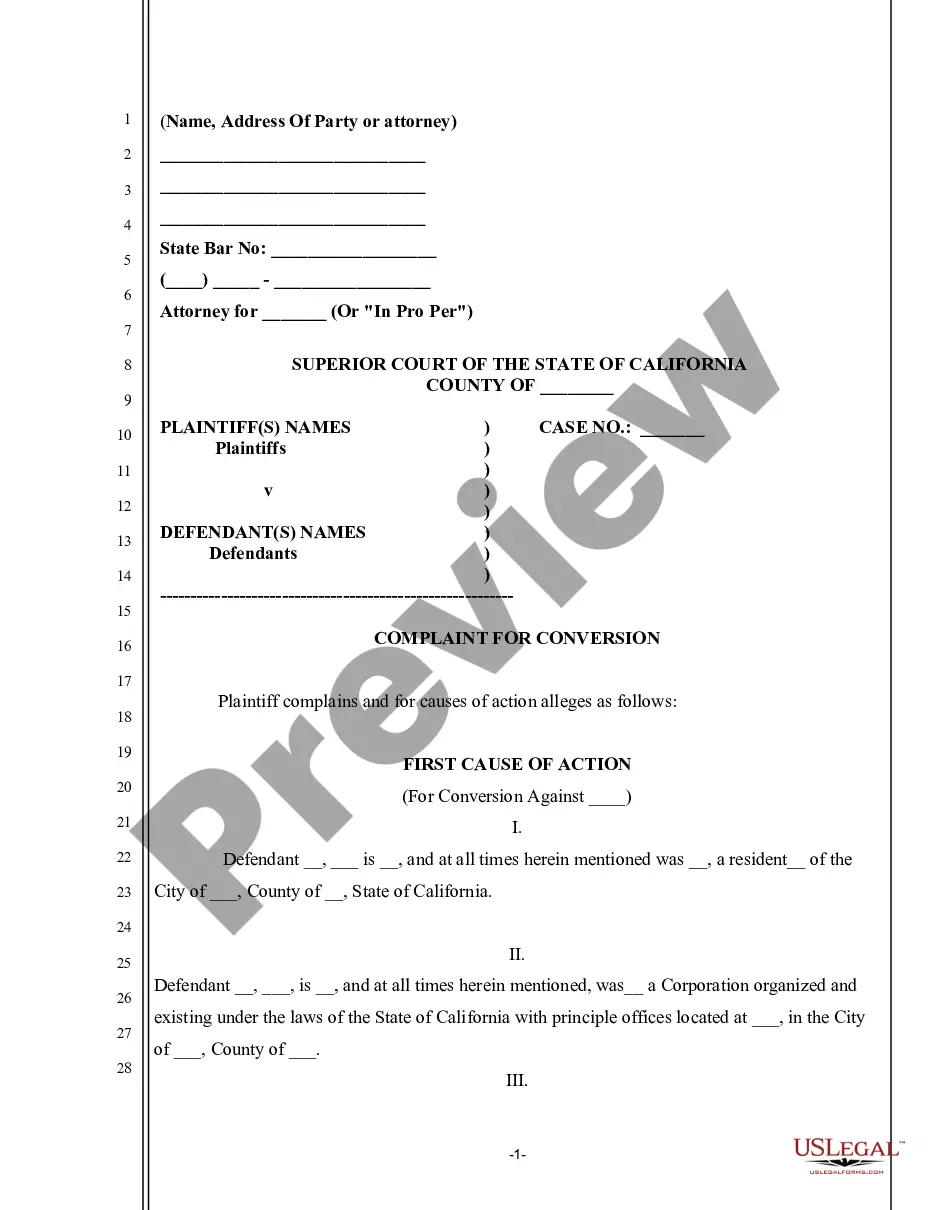

How to fill out Form Of Convertible Promissory Note, Preferred Stock?

US Legal Forms - one of several greatest libraries of legal kinds in the USA - offers a wide range of legal papers themes you are able to down load or print. Using the internet site, you can find a huge number of kinds for business and person reasons, sorted by groups, says, or keywords.You can get the newest types of kinds like the Alaska Form of Convertible Promissory Note, Preferred Stock in seconds.

If you already have a membership, log in and down load Alaska Form of Convertible Promissory Note, Preferred Stock from your US Legal Forms catalogue. The Acquire option can look on every single develop you perspective. You have accessibility to all in the past delivered electronically kinds within the My Forms tab of your bank account.

If you wish to use US Legal Forms initially, here are easy guidelines to obtain started off:

- Make sure you have picked the correct develop for the town/region. Select the Preview option to examine the form`s information. Browse the develop outline to ensure that you have chosen the proper develop.

- When the develop doesn`t fit your specifications, make use of the Research field at the top of the screen to find the the one that does.

- When you are pleased with the shape, validate your choice by clicking the Buy now option. Then, pick the prices program you like and provide your references to register on an bank account.

- Process the financial transaction. Make use of bank card or PayPal bank account to complete the financial transaction.

- Select the structure and down load the shape on your device.

- Make changes. Fill up, change and print and sign the delivered electronically Alaska Form of Convertible Promissory Note, Preferred Stock.

Each and every format you added to your account does not have an expiry date and is yours for a long time. So, if you want to down load or print one more version, just go to the My Forms area and click on in the develop you require.

Get access to the Alaska Form of Convertible Promissory Note, Preferred Stock with US Legal Forms, the most extensive catalogue of legal papers themes. Use a huge number of specialist and express-specific themes that satisfy your business or person requires and specifications.

Form popularity

FAQ

Convertible debt is a loan, note or bond instrument that converts to equity when a specified future event occurs. A convertible promissory note is a promissory note that converts in the same way as all other convertible debt.

(Both have priority over holders of common stock.) Convertible preferred shares typically pay a fixed cash dividend out of a company's retained earnings. Convertible bonds pay a coupon rate, which is a periodic interest payment.

Interest Rate. Any convertible note can be considered a loan since it requires an investor to invest money that will accrue in the same manner as any debt or loan with interest. ... Discount Rate. ... Maturity Date. ... Valuation Cap. ... Liquidation Preference.

Convertible notes are loans that (ideally) convert into the preferred stock that is sold in a subsequent equity round of investmet. The note might also cover contingencies, such as what happens if the company does not get to the investment by the maturity date of the loan, or if the company is sold prior to conversion.

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.