Alaska Form of Revolving Promissory Note

Description

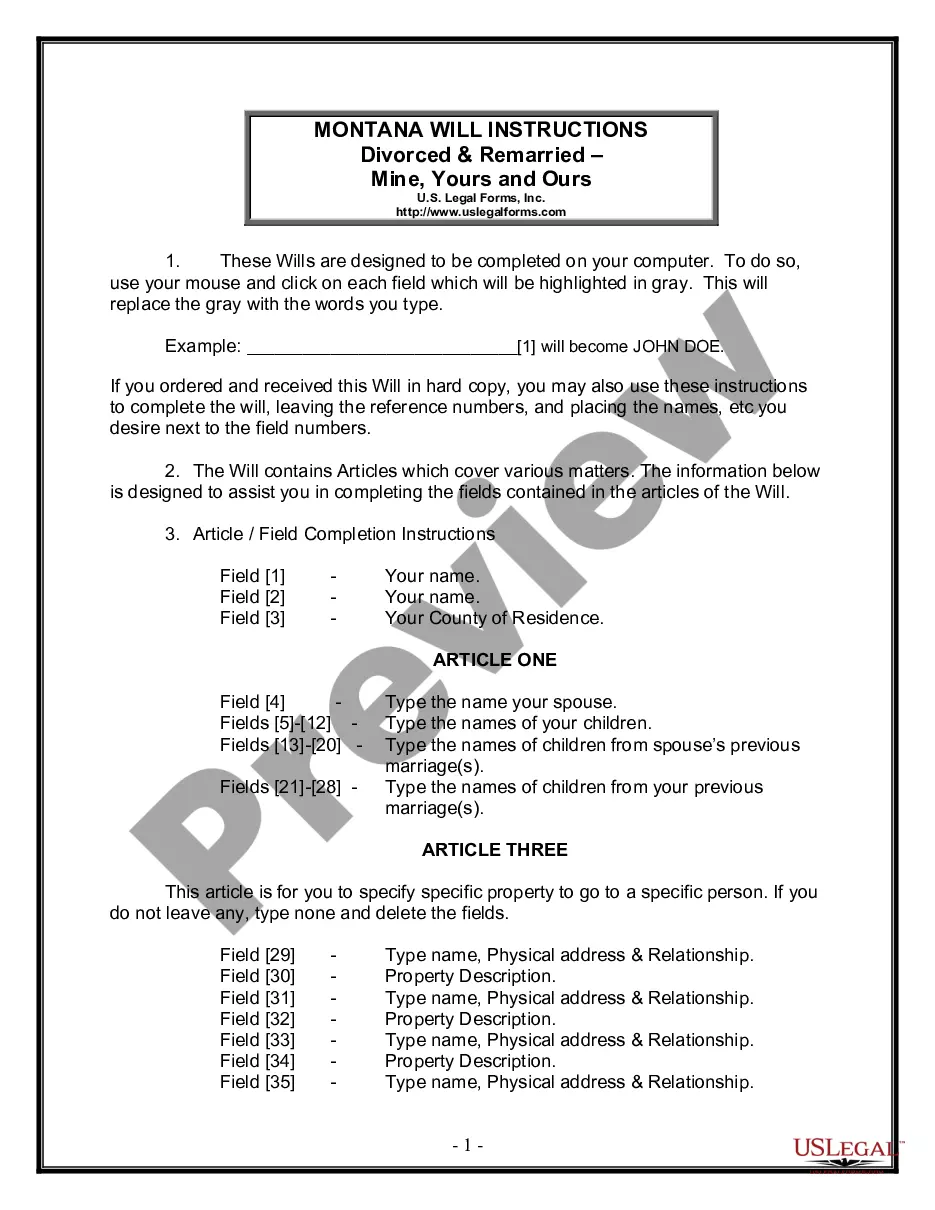

How to fill out Form Of Revolving Promissory Note?

US Legal Forms - one of the greatest libraries of authorized types in the States - offers an array of authorized papers web templates you can obtain or produce. Making use of the web site, you can get 1000s of types for business and individual reasons, sorted by categories, suggests, or search phrases.You will discover the most up-to-date types of types like the Alaska Form of Revolving Promissory Note within minutes.

If you have a subscription, log in and obtain Alaska Form of Revolving Promissory Note from your US Legal Forms local library. The Download option will show up on each kind you see. You have accessibility to all earlier saved types inside the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, allow me to share straightforward guidelines to help you started:

- Ensure you have picked the proper kind for your area/region. Select the Preview option to check the form`s information. See the kind information to actually have selected the right kind.

- When the kind does not satisfy your demands, utilize the Research area near the top of the screen to get the one that does.

- In case you are happy with the form, verify your choice by simply clicking the Get now option. Then, pick the pricing prepare you like and provide your credentials to sign up for an accounts.

- Method the deal. Utilize your Visa or Mastercard or PayPal accounts to complete the deal.

- Pick the file format and obtain the form on your system.

- Make modifications. Fill out, change and produce and indication the saved Alaska Form of Revolving Promissory Note.

Every single format you put into your money lacks an expiration time and is also the one you have permanently. So, if you wish to obtain or produce yet another backup, just visit the My Forms segment and click on about the kind you require.

Gain access to the Alaska Form of Revolving Promissory Note with US Legal Forms, by far the most considerable local library of authorized papers web templates. Use 1000s of skilled and status-particular web templates that satisfy your small business or individual needs and demands.

Form popularity

FAQ

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

A promissory note is a legally binding promise to repay a debt. These agreements could be used for personal loans, student loans, mortgages and more. Promissory note laws vary by state, but they typically include the loan amount, loan terms and signatures from both the lending and borrowing party.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. If the payor does not have sufficient assets, the payee is out of luck.

There are three types of promissory notes: unsecured, secured and demand.

A promissory note is a written promise for one person (or company) to pay a specific amount of money to someone else. A promissory note includes much more detail than a simple IOU. It lays out all the specifics of the loan, including the amount, the interest rate, and when payments are due.

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.