Alaska New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

If you desire to finalize, retrieve, or create legitimate document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Employ the site’s user-friendly and convenient search to obtain the documents you require.

Various templates for commercial and personal purposes are categorized by type and jurisdiction, or keywords.

All the legal document templates you acquire are yours indefinitely. You have access to every form you bought in your account.

Click on the My documents section and select a form to print or download again. Stay competitive and download or print the Alaska New Company Benefit Notice with US Legal Forms. There are countless industry-specific and state-specific forms available for your personal and business needs.

- Use US Legal Forms to obtain the Alaska New Company Benefit Notice in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Alaska New Company Benefit Notice.

- You can also find forms you previously obtained within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps detailed below.

- Step 1. Ensure you have chosen the form for the correct region.

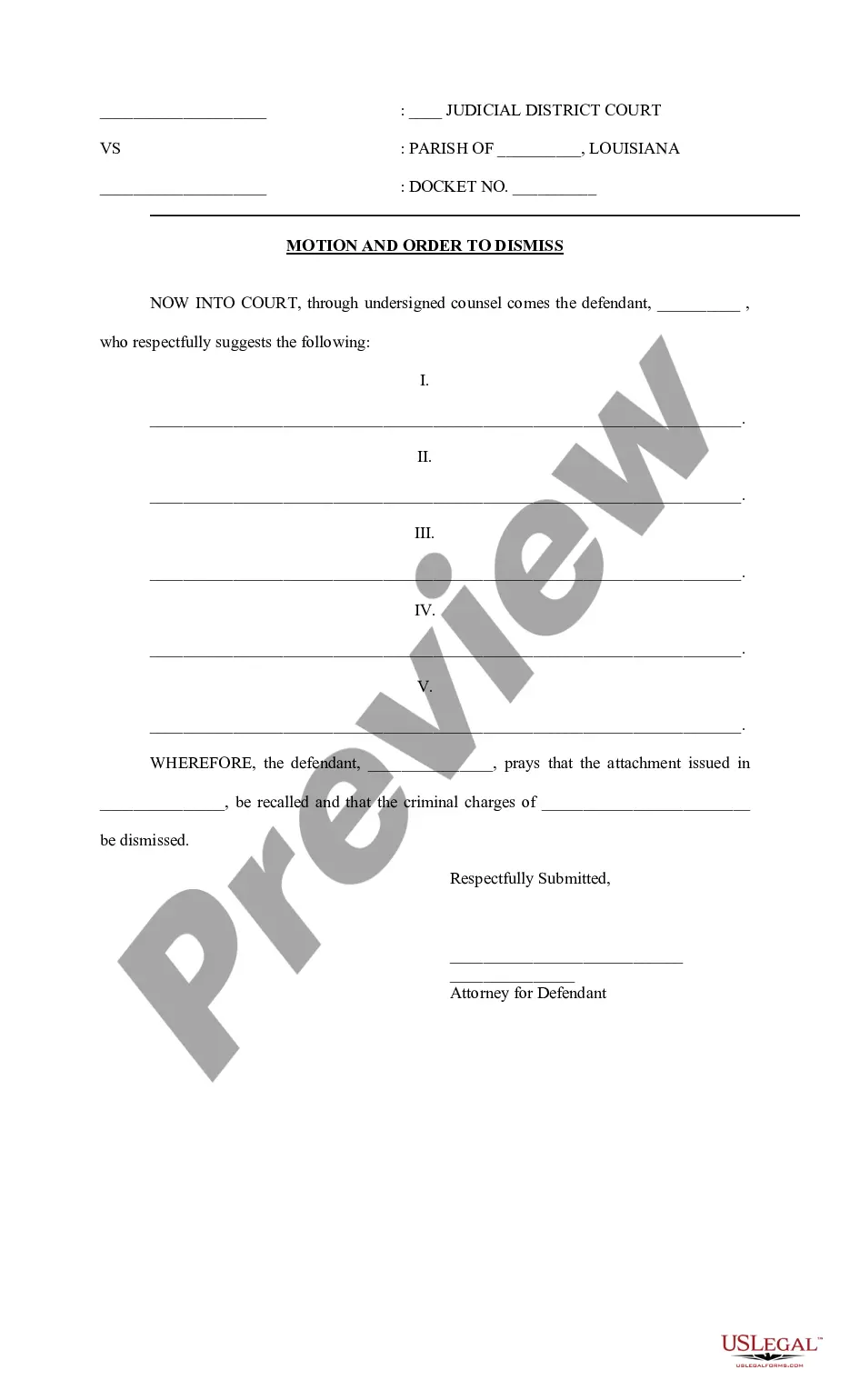

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose your pricing plan and enter your details to create an account.

- Step 5. Complete the purchase. You can use your Мisa or Ьastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Alaska New Company Benefit Notice.

Form popularity

FAQ

As long as you haven't breached the contract, you don't have to pay someone for their notice if they refuse to work it. Do you have to work your notice period? Yes, employees will normally be contractually obligated to work their notice period.

The health benefits that the State of Alaska provides to its eligible employees is commonly referred to as AlaskaCare. AlaskaCare Health Plans can help you and your eligible dependents pay for medical, dental, pharmacy and vision expenses.

"Alaska law doesn't require employees to provide their employers with two weeks' notice of resignation. This notice is only required if an employment contract or company policy requires it and even then the notice requirement can sometimes be excused."

What Happens If You Don't Give 2 Weeks' Notice? You could break the provisions of your contract, and that could have legal repercussions. If you have no choice, then notifying your employer and giving as much notice as possible (or perhaps even working out a new deal) can potentially make the fallout less serious.

WHAT IS THE PURPOSE OF THIS AUDIT? Pennsylvania UC audits are performed to verify your reported payroll and exclusions taken for UC purposes, to ensure that benefits have been charged correctly to your account, and to answer any questions you may have regarding the UC Law.

It is an audit of the records of a random sample of claimants who are either approved for benefits or denied for benefits.

While it's perfectly legal for an employee to quit without reason and not provide two weeks' notice, some employers may have company policies requiring their employees to give two weeks' notice. There isn't a lot an employer can do, however, if the employee ignores this policy.

The Benefit Payment Control (BPC) unit promotes and maintains the integrity of the Unemployment Insurance program through prevention, detection, investigation, establishment, recovery and prosecution of UI overpayments made to claimants. Unemployment Insurance Overpayment.

In general, good cause means that your reason for leaving the position was job-related and was so compelling that you had no other choice than to leave. For example, if you left your job because of dangerous working conditions or sexual harassment that your employer refused to stop, you may be able to collect benefits.

In California, there is generally no requirement that an employee or an employer give two weeks notice, or any notice, before quitting or terminating a job. This is because California is an at-will employment state. At-will employment laws mean that employers can layoff, fire, or let their employees go at any time.