Letter Requesting a Collection Agency to Validate That You Owe Them a Debt

About this form

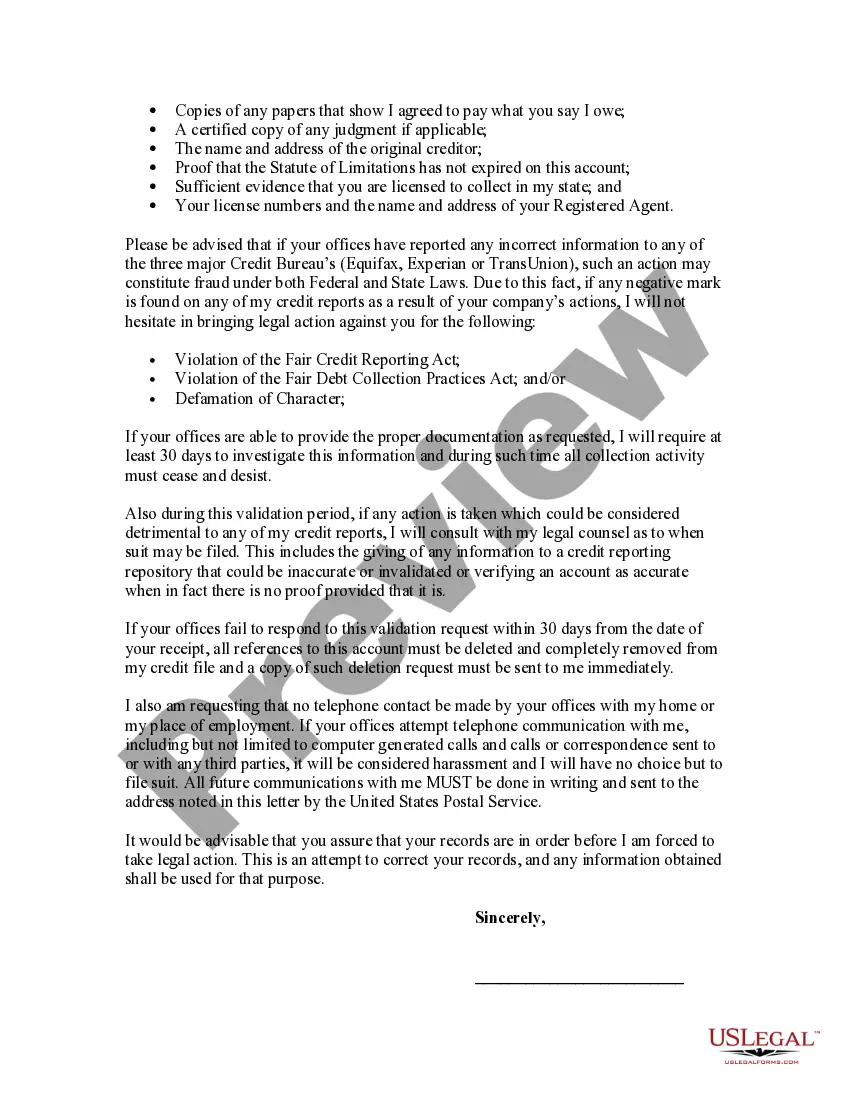

This Letter Requesting a Collection Agency to Validate That You Owe Them a Debt is a formal document that allows you to challenge the validity of a debt claimed by a collection agency. Under the Fair Debt Collection Practices Act, you have the right to request evidence that the debt is valid and legally owed. This form is essential when you believe a collection agency is incorrectly pursuing you for a debt and distinguishes itself by specifically demanding validation of the claimed debts.

State-specific compliance details

This form is suitable for use across multiple states but may need changes to align with your state’s laws. Review and adapt it before final use.

Common use cases

You should use this form if you have received a notice from a collection agency claiming that you owe a debt, and you dispute the validity of that debt. It is particularly useful when you lack sufficient information about the debt, such as the original creditor's name or documentation of the amount owed. This form helps halt collection activities while you seek verification.

Who should use this form

- Consumers who have been contacted by a collection agency

- Individuals who believe they are wrongfully pursued for a debt

- Debtors who want to exercise their rights under the Fair Debt Collection Practices Act

- Anyone looking for a structured way to request debt validation

How to complete this form

- Enter your personal contact information at the top of the form.

- Add the date when the letter is being sent.

- Fill in the name and address of the collection agency.

- Clearly state that you are disputing the debt and request validation.

- List the specific documentation you require from the agency.

- Sign and print your name at the bottom of the letter.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Avoid these common issues

- Failing to specify the date of the original notice from the collection agency

- Not clearly mentioning that the request is for validation and not a refusal to pay

- Omitting any of the documentation requests that strengthen your case

- Ignoring to sign the letter, which can render it invalid

Advantages of online completion

- Convenience of downloading and filling out from anywhere

- Editability to tailor the form to your specific situation

- Access to legally drafted templates ensuring compliance with laws

- Quick turnaround time without the need for in-person visits

Form popularity

FAQ

For the name and contact information of the original creditor. why the collector believes you own the debt in the first place. for a record of all owners of the debt. the amount and age of the debt (including an account number if you're able). under what authority the collector has to collect.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

If the collector completely fails to respond to the validation letter, again they have 30 days to do so, then legally they must cease collection efforts, and remove negative items placed by them on your credit report.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.