Alaska Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

If you want to thoroughly download or create official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the website's straightforward and convenient search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have located the form you want, click the Buy now button. Select the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Alaska Agreement for Dissolution and Termination of Partnership involving Sale to Partner and Unequal Distribution of Assets.

Each legal document template you purchase is yours permanently. You have access to every form you obtained through your account. Click on the My documents section and select a form to print or download again.

Complete your download and print the Alaska Agreement for Dissolution and Termination of Partnership involving Sale to Partner and Unequal Distribution of Assets with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to find the Alaska Agreement for Dissolution and Termination of Partnership involving Sale to Partner and Unequal Distribution of Assets with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and then click the Download button to obtain the Alaska Agreement for Dissolution and Termination of Partnership involving Sale to Partner and Unequal Distribution of Assets.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have chosen the form for the correct region/state.

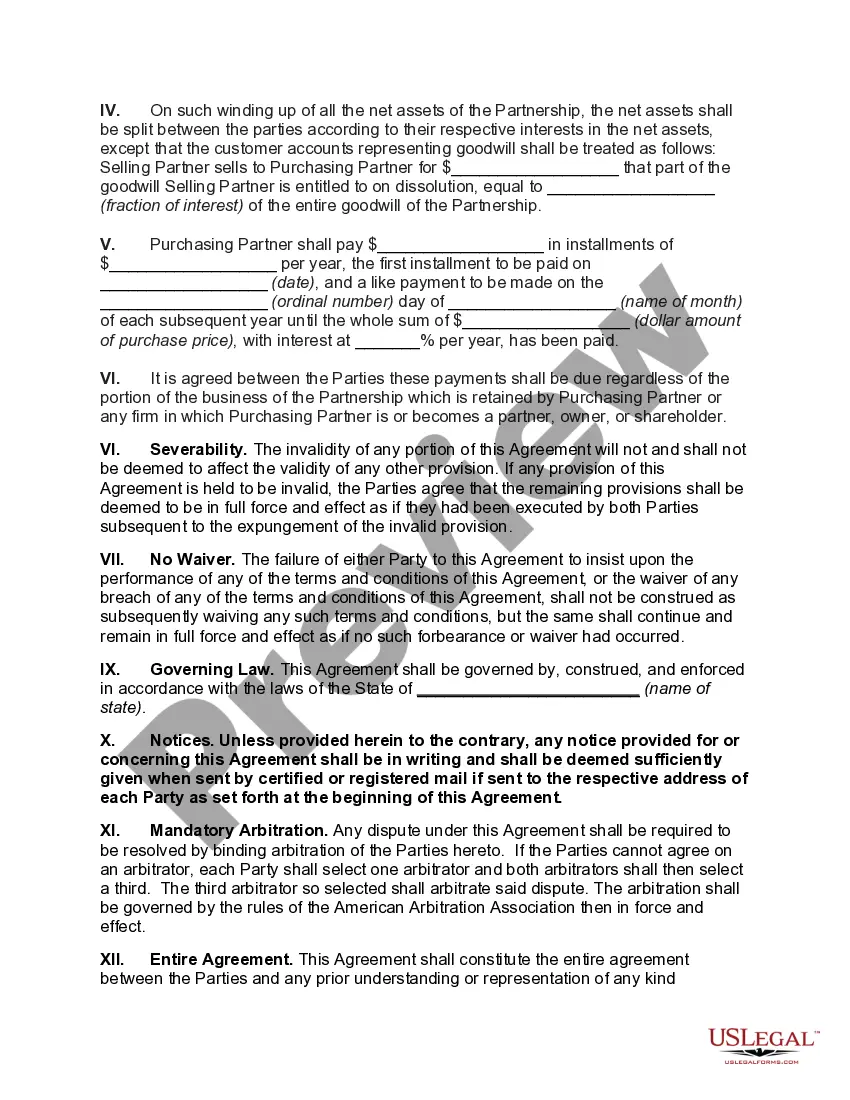

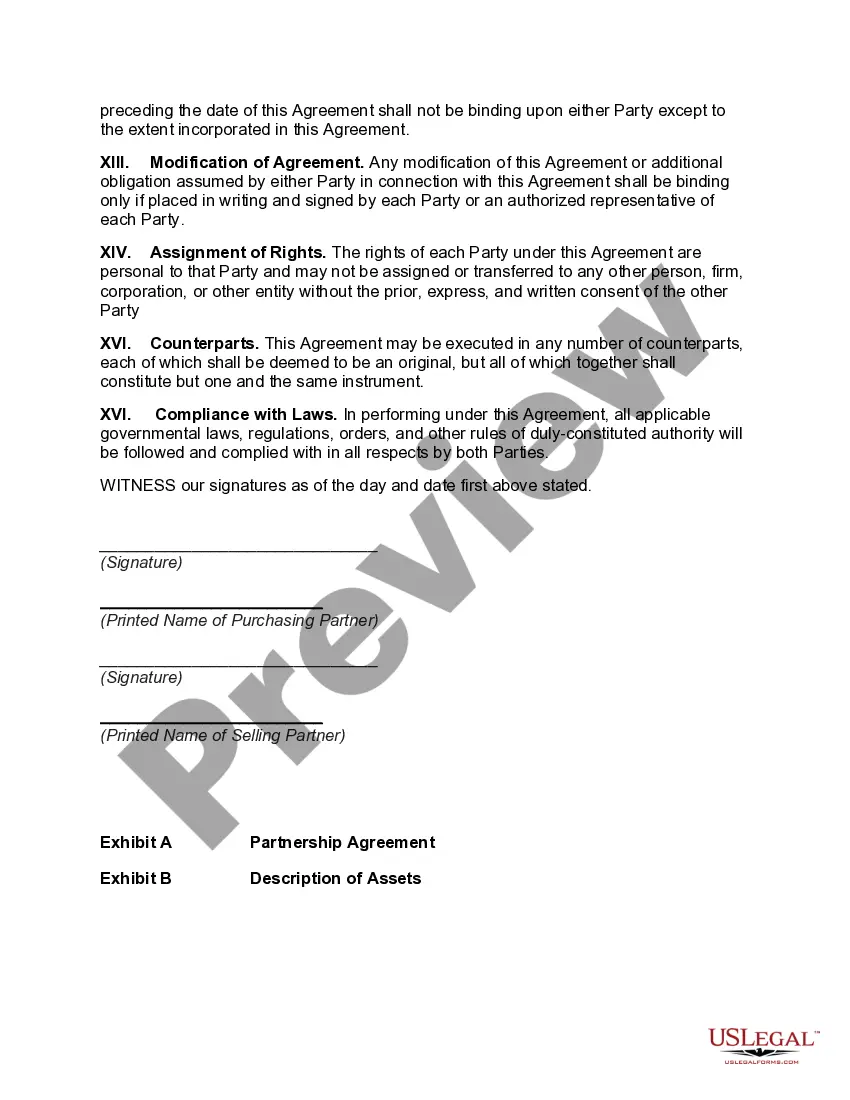

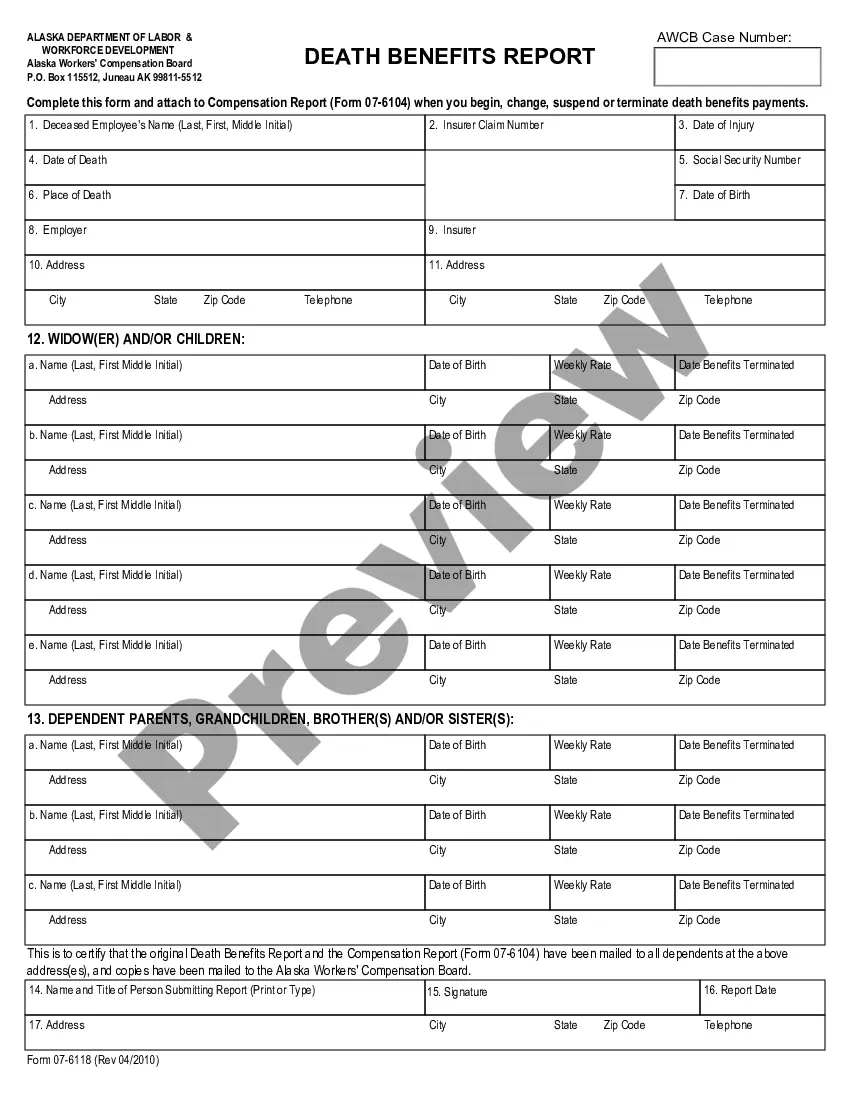

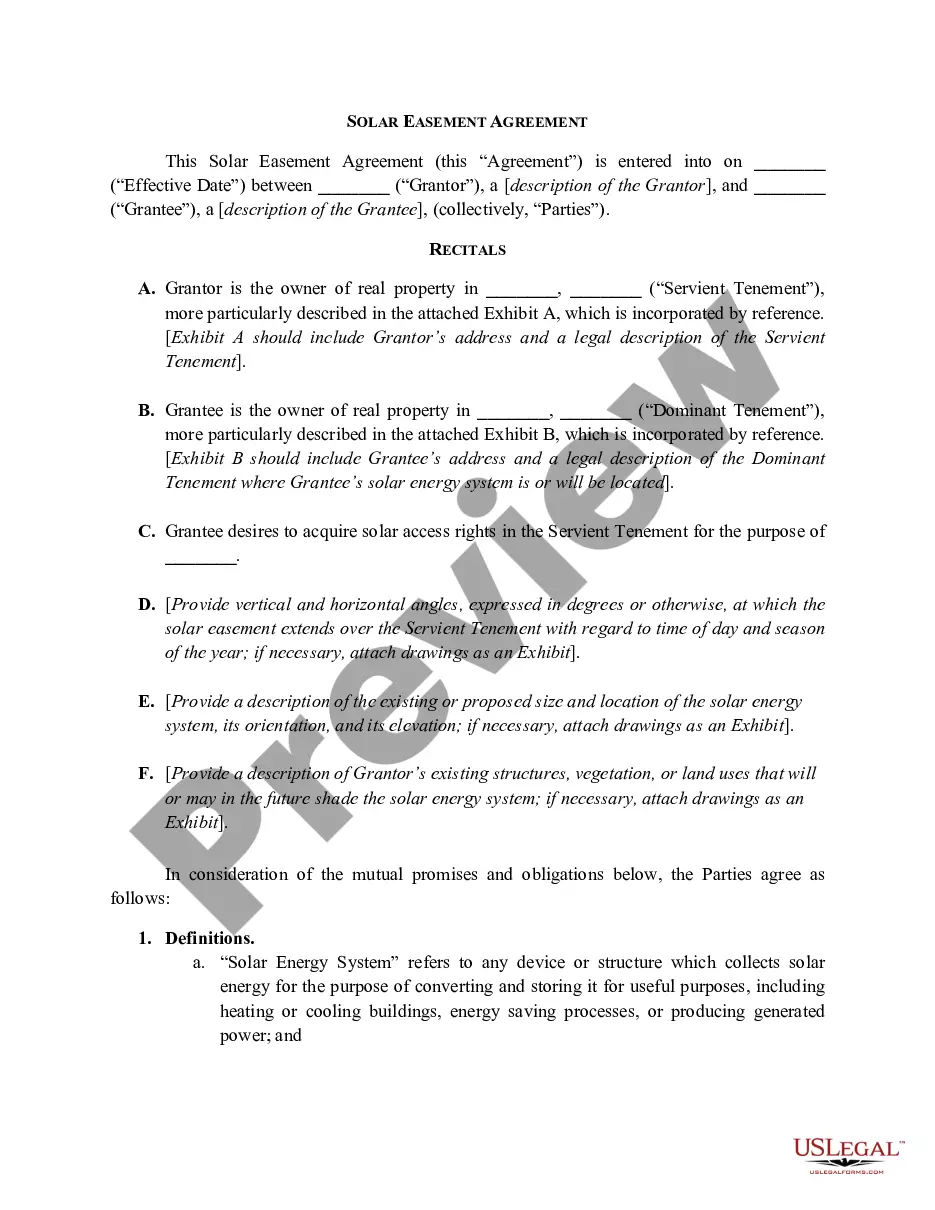

- Step 2. Utilize the Preview option to review the contents of the form. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format.

Form popularity

FAQ

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

A disproportionate distribution is a payout of corporate profits whereby some shareholders receive cash or other assets and others receive an increased interest in the company.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.