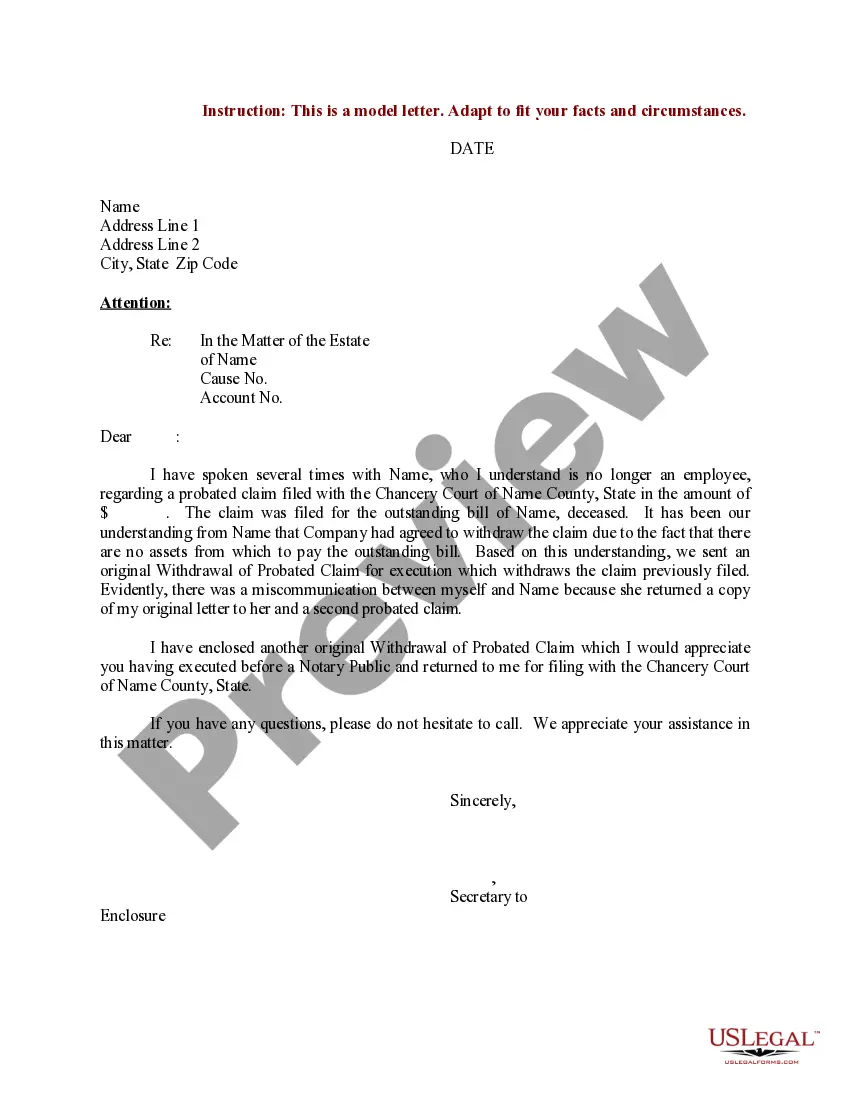

Massachusetts Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

Are you currently in a position where you require documentation for various business or personal activities almost every day? There are numerous legal document templates available online, but locating reliable ones is not straightforward.

US Legal Forms offers a vast collection of form templates, such as the Massachusetts Final Notice of Past Due Account, that are designed to comply with federal and state standards.

If you are already familiar with the US Legal Forms site and have an account, just Log In. Then, you can download the Massachusetts Final Notice of Past Due Account template.

- Find the form you need and ensure it is for your correct state/region.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find one that fits your requirements.

- Once you find the appropriate form, click on Get now.

- Choose the pricing plan you prefer, fill in the required details to complete your purchase, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

DOR's mission is to gain full compliance with the tax, child support, and municipal finance laws of the Commonwealth. DOR is committed to enforcing these laws in a fair-minded and respectful manner.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

The reason for the IRS certified mail is because the IRS is statutorily required to give you notice 30 days before serving an actual levy on a bank, your clients, or your wages.

A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws.

What is a letter ID? The Letter ID is a unique number printed on all correspondence and has a letter prefix of L. The Letter ID is always in the upper right-hand corner of the letter.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.

DOR manages state taxes and child support. We also help cities and towns manage their finances, and administer the Underground Storage Tank Program. Similarly, our mission includes rulings and regulations, tax policy analysis, communications, and legislative affairs.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.

The Massachusetts DOR has various types of notices and bills that are issued to individuals and businesses if it is determined that additional taxes might be or are owed. Notices and bills ask for and provide information and request payment when necessary.