Massachusetts Notice of Unpaid Invoice

Description

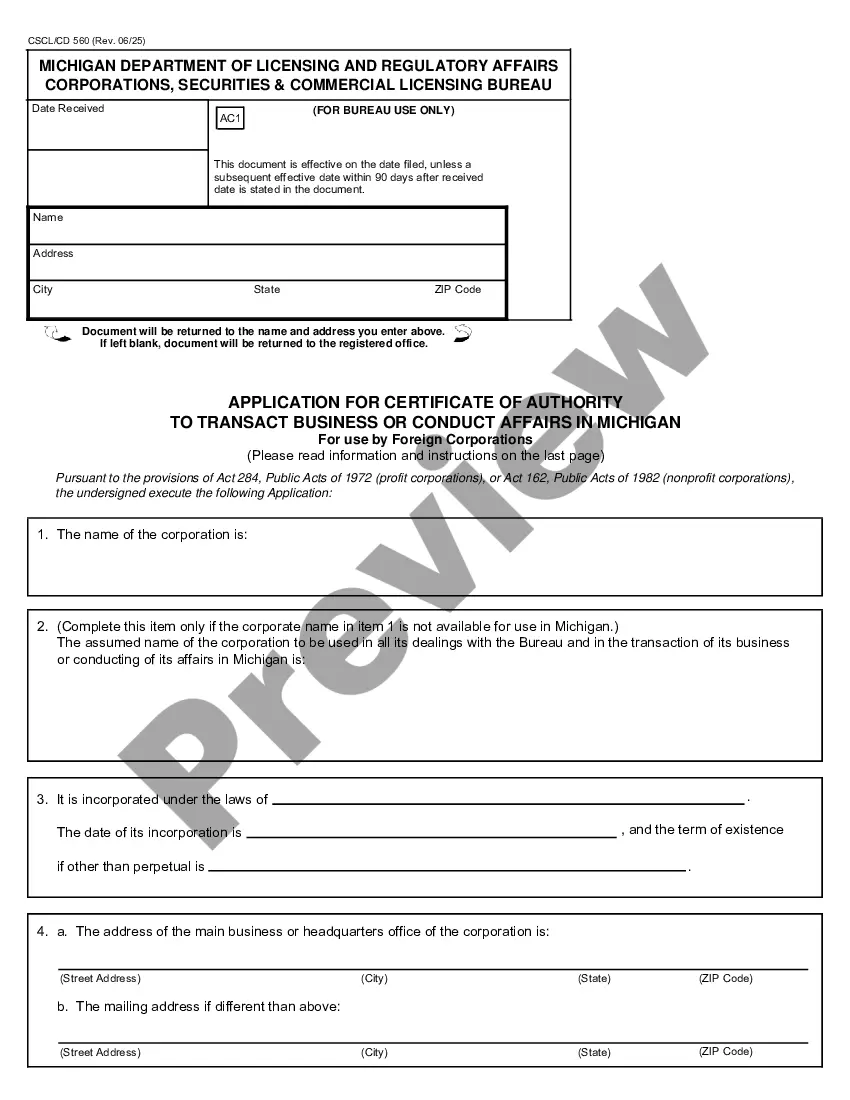

How to fill out Notice Of Unpaid Invoice?

Finding the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates available online, but how do you obtain the legal document you need.

Utilize the US Legal Forms website. The service offers a wide array of templates, including the Massachusetts Notice of Unpaid Invoice, for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the correct one.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Massachusetts Notice of Unpaid Invoice.

- Use your account to search through the legal documents you have acquired previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the right form for your city/county. You can preview the form using the Review option and read the description to confirm it’s suitable for you.

Form popularity

FAQ

What is a letter ID? The Letter ID is a unique number printed on all correspondence and has a letter prefix of L. The Letter ID is always in the upper right-hand corner of the letter.

DOR manages state taxes and child support. We also help cities and towns manage their finances, and administer the Underground Storage Tank Program. Similarly, our mission includes rulings and regulations, tax policy analysis, communications, and legislative affairs.

The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days. Regardless of what you agree upon, the payment terms and the due date should be clearly stated on the invoice.

The Department of Revenue administers the state's tax system, collecting state taxes including income, sales and use, corporate, estate, and other taxes. It offers taxpayers assistance by toll-free telephone. The department offers taxpayers assistance, audits tax returns, and enforces state tax laws.

The Massachusetts DOR has various types of notices and bills that are issued to individuals and businesses if it is determined that additional taxes might be or are owed. Notices and bills ask for and provide information and request payment when necessary.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.

DOR's mission is to gain full compliance with the tax, child support, and municipal finance laws of the Commonwealth. DOR is committed to enforcing these laws in a fair-minded and respectful manner.

A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.