Alaska Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

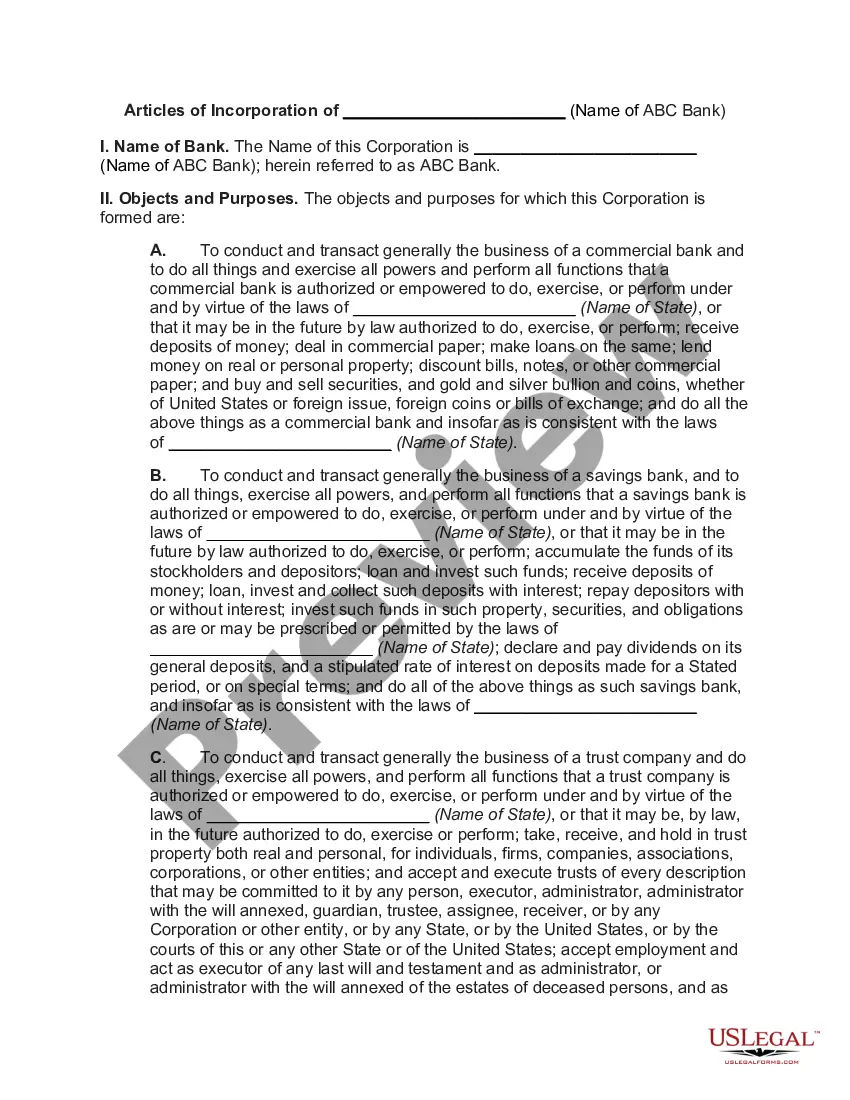

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Discovering the right legitimate file design can be a struggle. Of course, there are tons of web templates accessible on the Internet, but how can you find the legitimate kind you want? Make use of the US Legal Forms website. The assistance offers thousands of web templates, for example the Alaska Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which you can use for company and personal requires. Each of the types are checked by experts and satisfy state and federal specifications.

In case you are presently listed, log in for your profile and then click the Down load button to have the Alaska Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Make use of profile to check through the legitimate types you might have ordered in the past. Check out the My Forms tab of your own profile and have an additional version from the file you want.

In case you are a new end user of US Legal Forms, listed below are easy guidelines that you can follow:

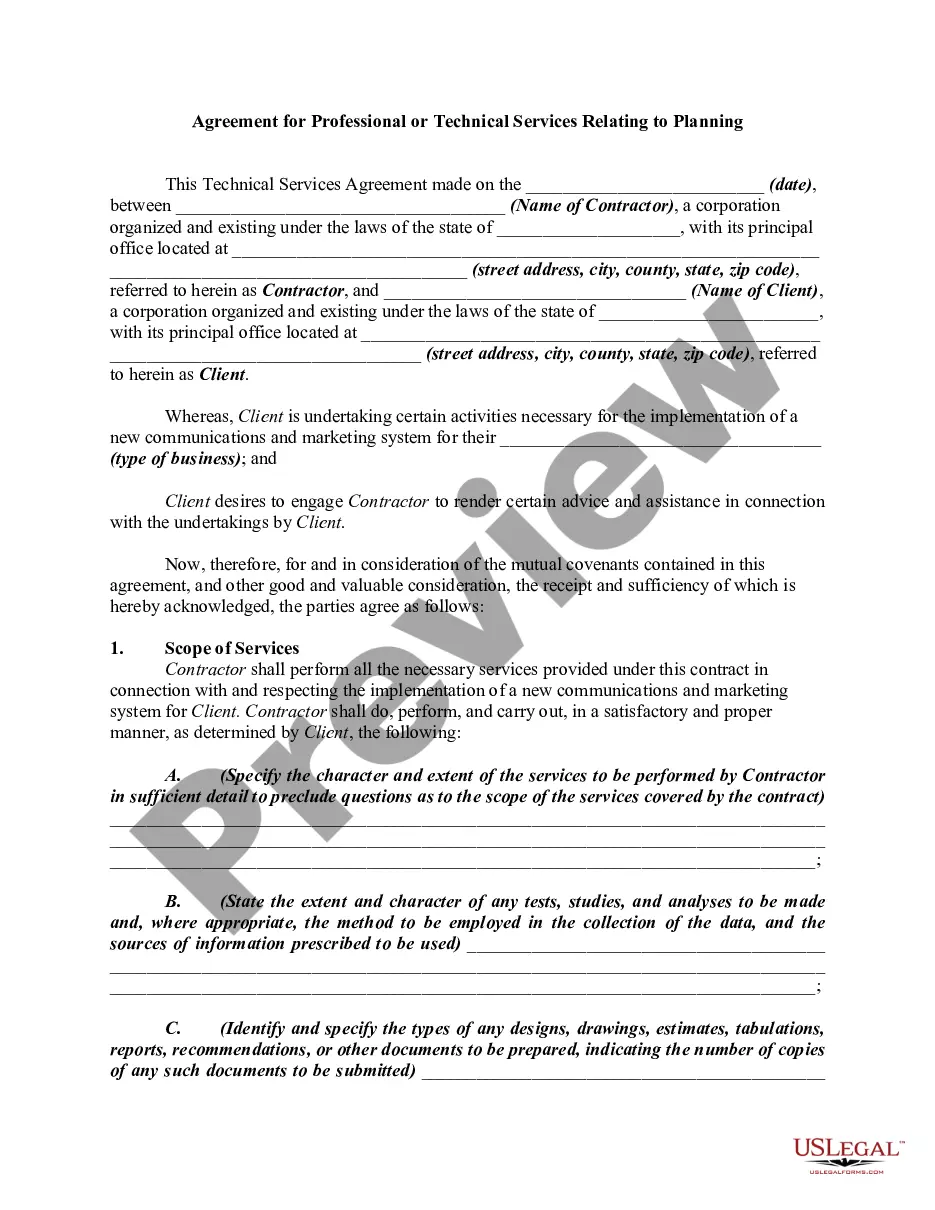

- Initial, be sure you have selected the correct kind for your personal town/state. You can check out the form utilizing the Review button and browse the form information to make sure it is the right one for you.

- If the kind is not going to satisfy your needs, take advantage of the Seach field to get the right kind.

- Once you are certain the form is acceptable, go through the Acquire now button to have the kind.

- Choose the costs program you want and type in the necessary details. Make your profile and pay money for your order making use of your PayPal profile or credit card.

- Opt for the document formatting and down load the legitimate file design for your gadget.

- Complete, modify and produce and signal the acquired Alaska Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

US Legal Forms will be the biggest library of legitimate types where you can discover different file web templates. Make use of the service to down load skillfully-created documents that follow state specifications.

Form popularity

FAQ

It's likely because Delaware is widely considered the best state to start a nonprofit. In fact, many nonprofits choose to incorporate in Delaware even if they plan to operate in a different state.

Alaska Statute AS 43.70. 020 requires you to obtain an Alaska Business License before you engage in business activity. For more information please go to the Business Licensing Section.

How Much Does It Cost to Incorporate an Alaska Nonprofit? Nonprofits pay a $50 state fee to file articles of incorporation with the Alaska Division of Corporations, Business and Professional Licensing (the fee is the same for articles filed online or on paper).

The State of Alaska does not grant tax-exempt status. Tax-exempt designation comes from the U.S. Department of Treasury, Internal Revenue Service. IMPORTANT: The IRS has specific filing time frames and language expectations for obtaining tax exempt status from the IRS.

How To Start A Nonprofit In Alaska Choose your AK nonprofit filing option. Complete the AK Articles of Incorporation. Get a Federal EIN from the IRS. Adopt your AK nonprofit's bylaws. Obtain federal and/or state tax exemptions. Register for AK state tax accounts and licenses. Open a bank account for your AK nonprofit.

The operational test for exemption under Section 501(c)(3) consists of four broad categories: Requirement to operate exclusively for exempt purposes. Prohibition against inurement. Prohibition against becoming an action organization; and. Prohibition against substantial private benefit.

How to start a nonprofit in 9 easy steps Incorporate your nonprofit. ... Secure an Employer Identification Number (EIN) ... Elect a board of directors. ... Create your bylaws. ... Develop a conflict of interest policy. ... Apply for federal tax-exempt status. ... File for state tax exemptions. ... Register to fundraise where required.