Maryland Owner Financing Contract for Home

Description

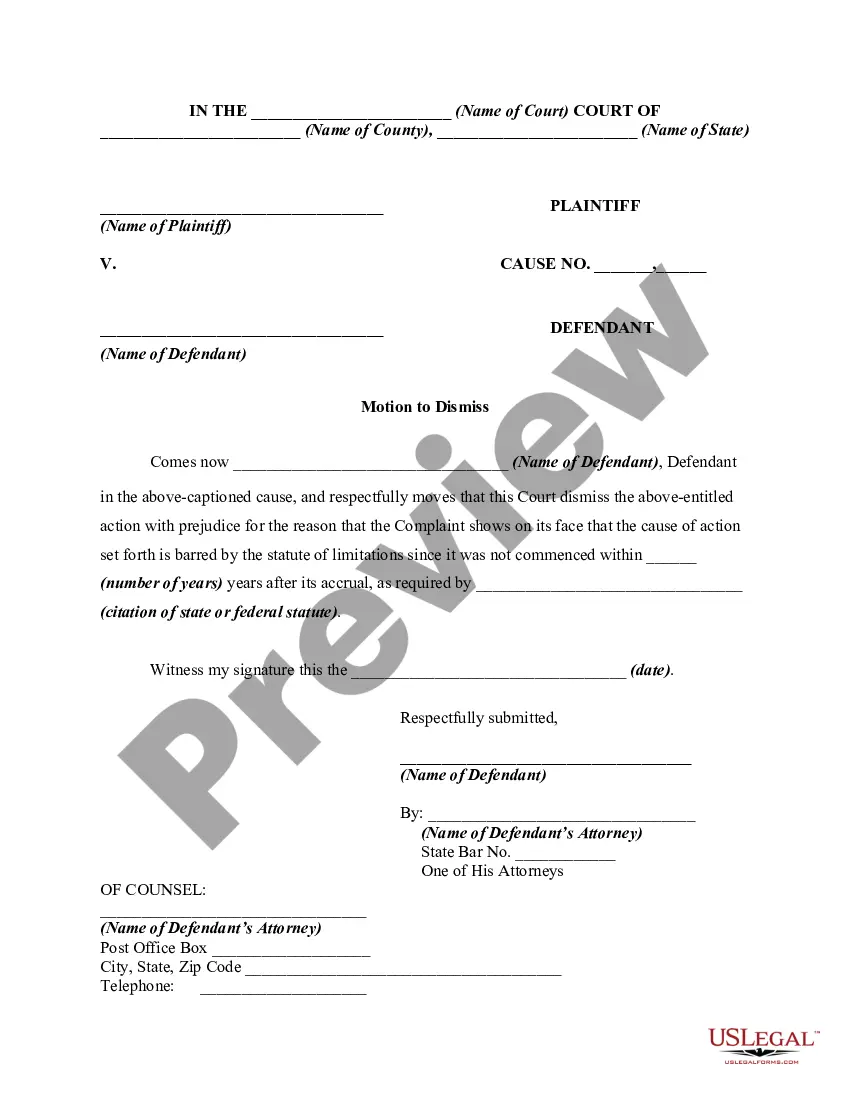

How to fill out Owner Financing Contract For Home?

You can spend multiple hours online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

You can download or print the Maryland Owner Financing Agreement for Home from our services.

To find another version of the form, use the Search box to locate the template that meets your needs and criteria.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or endorse the Maryland Owner Financing Agreement for Home.

- Each valid document template you receive is permanently yours.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for the county/region you select.

- Review the form summary to ensure you have selected the appropriate form.

Form popularity

FAQ

To create a Maryland Owner Financing Contract for Home, start by outlining the key elements, including buyer and seller information, property details, and payment terms. Clearly define the responsibilities of both parties and include any necessary legal disclosures. Utilizing a platform like US Legal Forms can simplify this process by providing customizable templates tailored to your needs.

Writing a Maryland Owner Financing Contract for Home involves outlining the essential components such as buyer and seller information, property details, payment terms, and consequences for default. It’s crucial to use clear language and ensure all parties fully understand the terms. Using platforms like USLegalForms can help streamline the process with templates that simplify this task while ensuring legal compliance.

One downside of owner financing in a Maryland Owner Financing Contract for Home is that sellers may require a higher interest rate than traditional loans, which can increase overall costs for buyers. Additionally, property owners may not fully understand the risks associated with seller financing, including potential default by the buyer. Careful consideration and preparation are essential for both parties.

The average length of seller financing in a Maryland Owner Financing Contract for Home usually ranges from 5 to 30 years. However, the specific term can be negotiated between the buyer and seller, offering flexibility to both parties. Shorter terms might involve higher payments but could save on interest costs overall.

While seller financing can be advantageous, potential pitfalls exist within a Maryland Owner Financing Contract for Home. Buyers may encounter issues if they fail to make payments, leading to possible foreclosure and loss of investment. Sellers may also face risks such as late payments or defaults. It's essential to have clear agreements in place and consider using platforms like uslegalforms to ensure your contract details are comprehensive and legally sound.

Owner financing often benefits both buyers and sellers in a Maryland Owner Financing Contract for Home. Buyers gain access to purchasing opportunities without the need for traditional bank financing, making homeownership achievable. Sellers can sell their property faster, attract a broader pool of potential buyers, and potentially secure a steady income stream through monthly payments. This mutually beneficial arrangement often leads to positive outcomes for both parties.

The IRS provides specific guidelines regarding owner financing, indicating that all income must be reported, including interest earned from installments. Understanding these rules is essential for compliance, especially when managing a Maryland Owner Financing Contract for Home. Consulting a tax professional can help you navigate these regulations effectively.

When reporting owner financing on taxes, you will need to account for the income from the sale and any related interest. Utilize IRS forms to report installment sales and ensure that your Maryland Owner Financing Contract for Home is compliant with tax reporting requirements. This keeps your finances organized and transparent.

Seller-financed interest should be included as interest income on your tax return. Typically, it is reported on Schedule B, where you list any interest earned from loans, including those from a Maryland Owner Financing Contract for Home. Keeping accurate records will help you ensure compliance and transparency in your reporting.

To report owner financing income, you will need to report the full amount received, including principal and interest, on your tax return. Utilize Form 6252 to report any installment sale income or gains on your tax forms. Remember, clarity in your Maryland Owner Financing Contract for Home simplifies this process.