Minnesota Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

If you require to complete, acquire, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

A range of templates for corporate and personal purposes are categorized by classes and jurisdictions, or keywords.

Step 4. Once you find the form you need, select the Get now button. Choose your preferred pricing plan and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Minnesota Owner Financing Contract for Home with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Acquire button to obtain the Minnesota Owner Financing Contract for Home.

- You can also access the forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

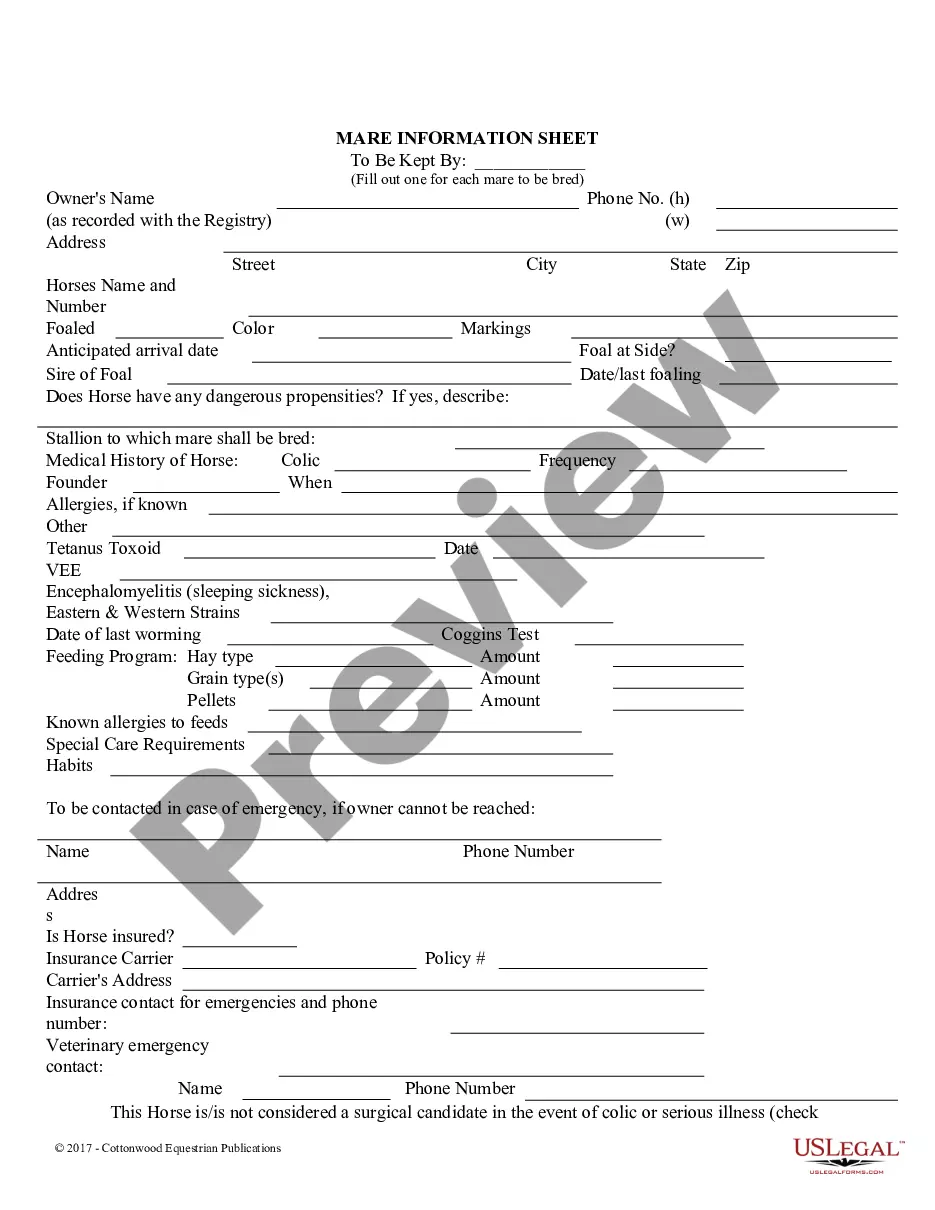

- Step 2. Utilize the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of your legal form template.

Form popularity

FAQ

When reporting a contract for deed on your taxes, you need to account for income received from the property. Typically, any profit from the sale should be reported as capital gains on your tax return. It is wise to consult with a tax professional to navigate the specifics, ensuring you fully comply with tax regulations related to your Minnesota Owner Financing Contract for Home.

Land contracts, which are similar to the Minnesota Owner Financing Contract for Home, do not have a legal requirement for recording. However, recording your land contract is advisable as it helps protect your interest in the property. Keeping it on public record can enhance clarity of ownership and reduce potential legal complications down the road.

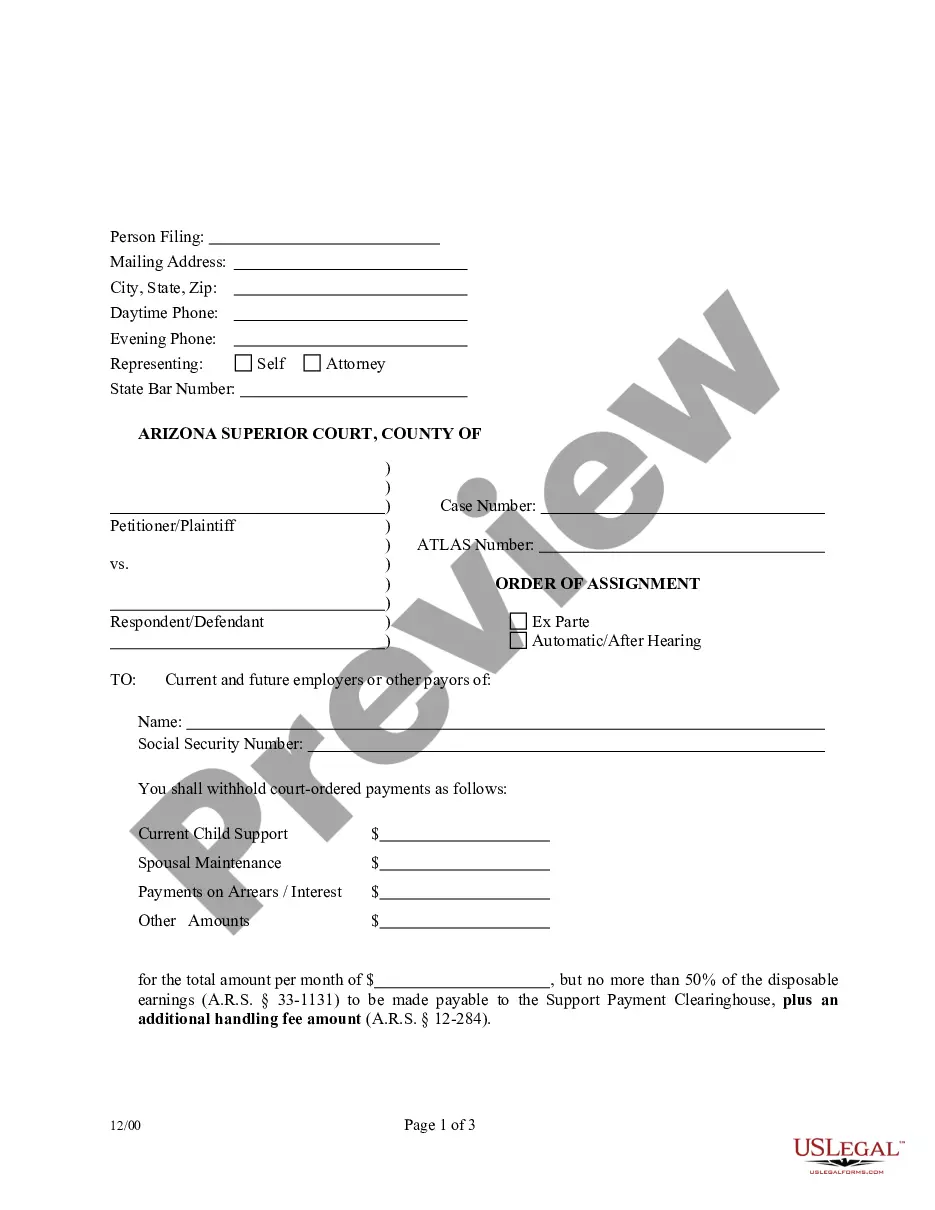

To record a contract for deed in Minnesota, you need to fill out the appropriate form and submit it to your county's Recorder's Office. This process typically involves providing information about the transaction, including both parties' names and property details related to your Minnesota Owner Financing Contract for Home. After submission, ensure you obtain a copy of the recorded contract for your records.

In Minnesota, it is not legally required to record a contract for deed, but doing so offers important protections for both parties. Recording your Minnesota Owner Financing Contract for Home ensures that your interest in the property is public and can help prevent disputes with future buyers or creditors. You will gain a stronger legal standing if any issues arise, making it a wise choice.

Typically, either the seller or a qualified real estate agent initiates the Minnesota Owner Financing Contract for Home. The seller decides if they want to offer owner financing as a selling option, while real estate professionals can assist in structuring the details. Using platforms like uslegalforms can simplify the process for both sellers and buyers by providing templates and legal assistance. Ultimately, both parties should agree on the terms before finalizing the arrangement.

The interest rate on a contract for deed in Minnesota typically reflects market conditions, but it should also align with state laws to avoid penalties. Rates can vary based on individual agreements between buyers and sellers. For a Minnesota Owner Financing Contract for Home, terms should be clearly defined to protect both parties. Consulting with a legal expert can provide insights into fair rates that comply with local regulations.

A contract for deed is a specific type of seller financing where the buyer obtains possession of the property immediately but does not receive the title until all payments are made. In contrast, seller financing can take various forms, including mortgages, where the buyer receives the title upfront. Understanding these distinctions involved in a Minnesota Owner Financing Contract for Home allows both parties to make informed decisions. Seeking professional assistance can help clarify these differences further.

The new contract for deed law in Minnesota introduces changes aimed at improving the transparency and security of these transactions. This law enhances buyer protection and requires clear disclosure of terms to prevent misunderstandings. Under the Minnesota Owner Financing Contract for Home, buyers and sellers are encouraged to understand their rights and responsibilities under this updated framework. It’s advisable to consult professionals to ensure you are fully aware of these recent changes.

In Minnesota, a 25% interest rate in a Minnesota Owner Financing Contract for Home is considered excessive and can be deemed illegal under state law. Minnesota has laws governing maximum interest rates to protect consumers from predatory lending practices. However, interest rates can vary based on the specifics of the agreement and other factors. It’s important to consult a legal expert to ensure compliance with state regulations.

In Minnesota, the maximum interest rate for a contract for deed, often referred to as an owner financing contract for home, is capped at 8 percent for residential properties. This limit ensures fair lending practices while protecting both buyers and sellers. It is essential to verify current regulations, as they can change over time. Knowing these limits helps you secure a favorable agreement.