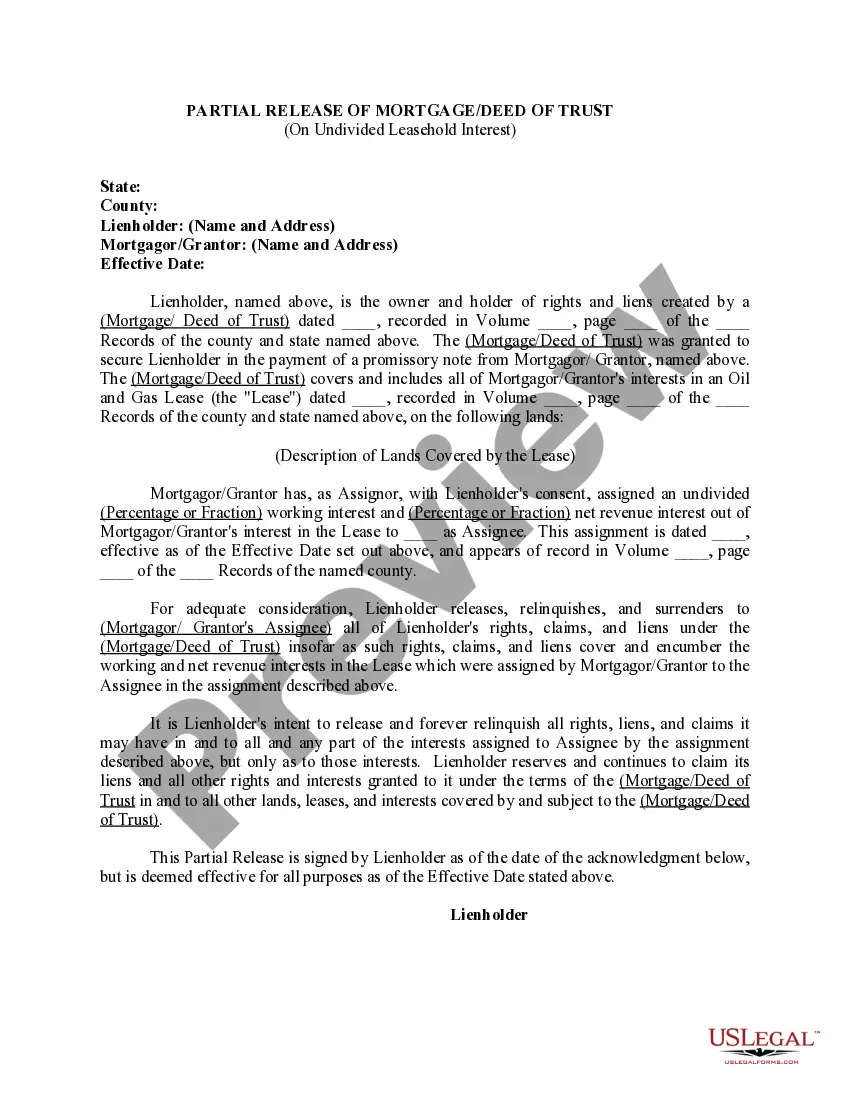

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

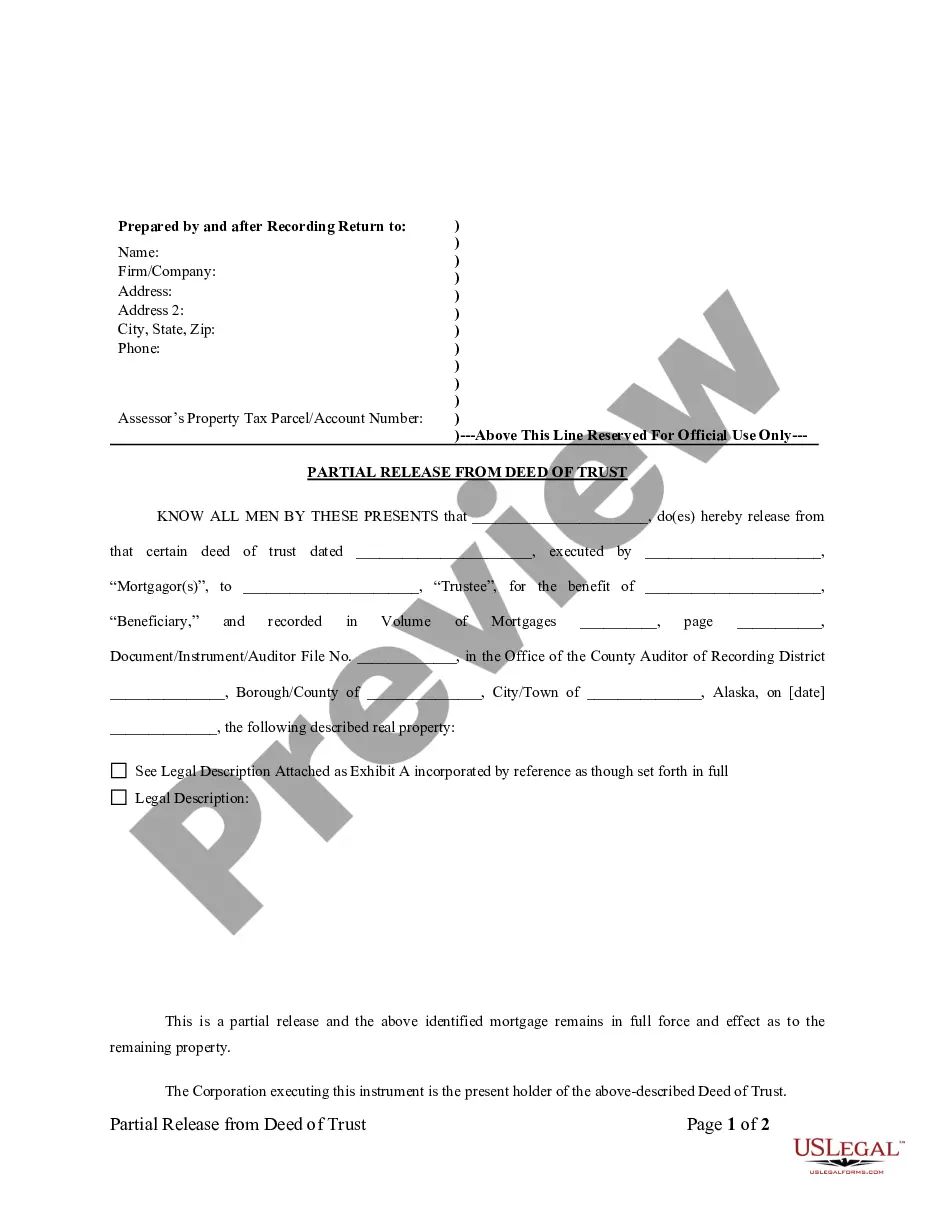

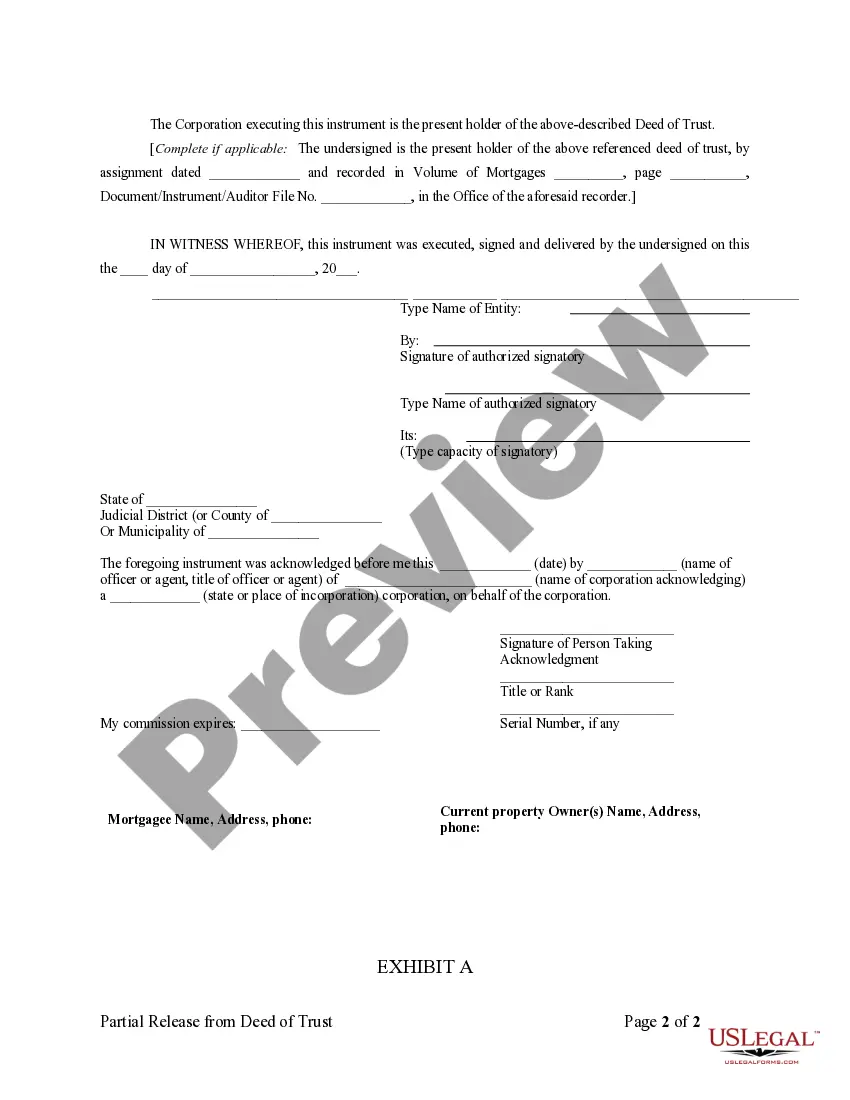

Alaska Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Alaska Partial Release Of Property From Deed Of Trust For Corporation?

Utilizing Alaska Partial Release of Property From Deed of Trust for Corporation templates crafted by skilled attorneys helps you steer clear of complications while filling out forms.

Simply retrieve the document from our site, complete it, and have a lawyer verify it for you.

Doing so can assist you in conserving significantly more time and effort than asking a legal expert to create a document from the ground up for you would.

Once you have completed all of the above steps, you will be able to fill out, print, and sign the Alaska Partial Release of Property From Deed of Trust for Corporation template. Remember to verify all entered information for accuracy before sending it or mailing it. Reduce the time spent on document creation with US Legal Forms!

- If you currently have a US Legal Forms subscription, just Log In to your account and return to the form webpage.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a template, you can find your saved documents in the My documents section.

- If you do not have a subscription, no worries.

- Just follow the instructions below to register for your account online, obtain, and fill out your Alaska Partial Release of Property From Deed of Trust for Corporation template.

- Double-check to ensure you are downloading the correct state-specific form.

Form popularity

FAQ

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

A Deed of Trustis a document where a borrower transfers the legal title for its property to a trustee who holds the property in trust as security for the payment of the debt to the lender. If the borrower pays the debt as agreed, the deed of trust becomes void and the lender executes a Deed of Reconveyance.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.