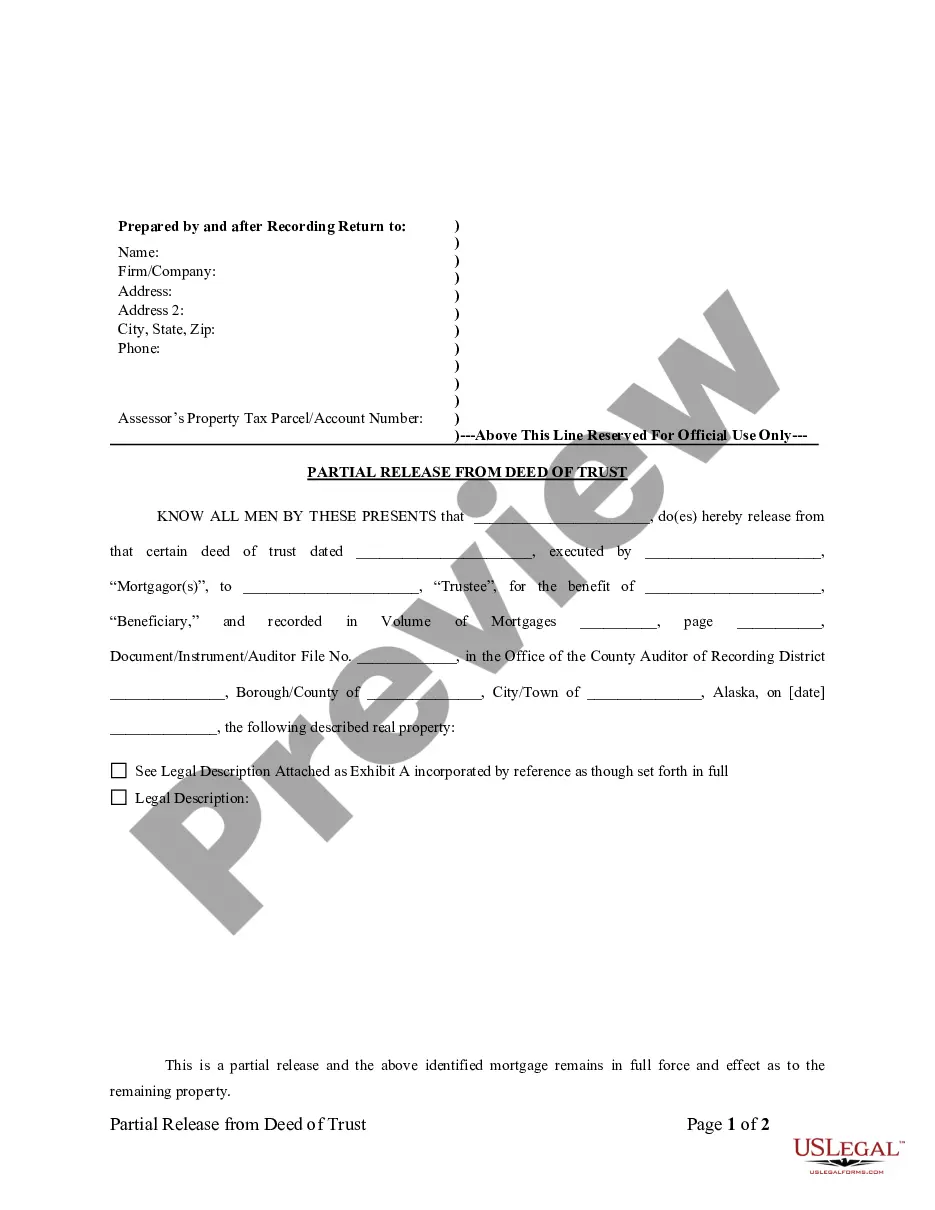

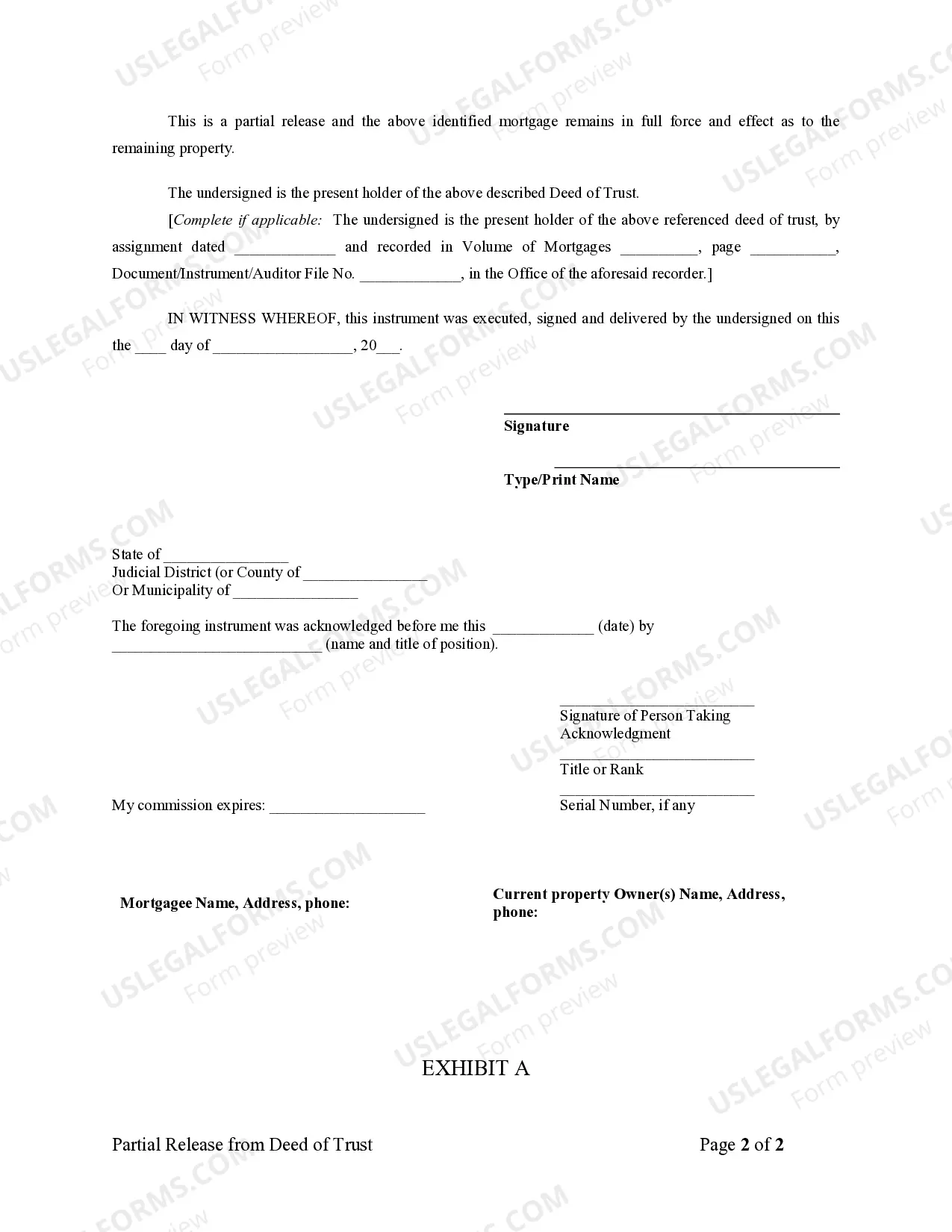

This Partial Release from Deed of Trust form is for a holder of a deed of trust or mortgage to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Alaska Partial Release of Property From Deed of Trust for Individual

Description

How to fill out Alaska Partial Release Of Property From Deed Of Trust For Individual?

Employing Alaska Partial Release of Property From Deed of Trust for Individual templates designed by proficient lawyers provides you the chance to evade complications when finalizing documents.

Merely save the template from our site, complete it, and request a legal expert to validate it. Doing so will conserve you significantly more time and expenses than asking an attorney to create a file tailored to your requirements.

If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the sample webpage. Locate the Download button near the templates you are reviewing.

After you have completed all the aforementioned steps, you'll be able to finalize, print, and sign the Alaska Partial Release of Property From Deed of Trust for Individual template. Remember to double-check all entered information for accuracy before submitting or sending it out. Minimize the time spent on document creation with US Legal Forms!

- After downloading a document, you will find all your preserved samples under the My documents tab.

- If you do not have a subscription, there is no issue. Just adhere to the steps below to create an account online, acquire, and complete your Alaska Partial Release of Property From Deed of Trust for Individual template.

- Double-check and ensure that you are downloading the correct state-specific form.

- Utilize the Preview feature and read the description (if available) to ascertain if you need this particular template and if so, just click Buy Now.

- Search for another template using the Search field if necessary.

- Select a subscription that aligns with your needs.

- Proceed to use your credit card or PayPal.

Form popularity

FAQ

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

They serve different purposes and are signed by different parties. The warranty deed transfers the property's ownership from the current owner to the new buyer, while the deed of trust ensures the lender has interest in the property in the event a buyer defaults on the loan.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A Deed of Trust is a type of secured real-estate transaction that some states use instead of mortgages.A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

A Deed of Trust is a type of secured real-estate transaction that some states use instead of mortgages.A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

A deed conveys ownership; a deed of trust secures a loan.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.