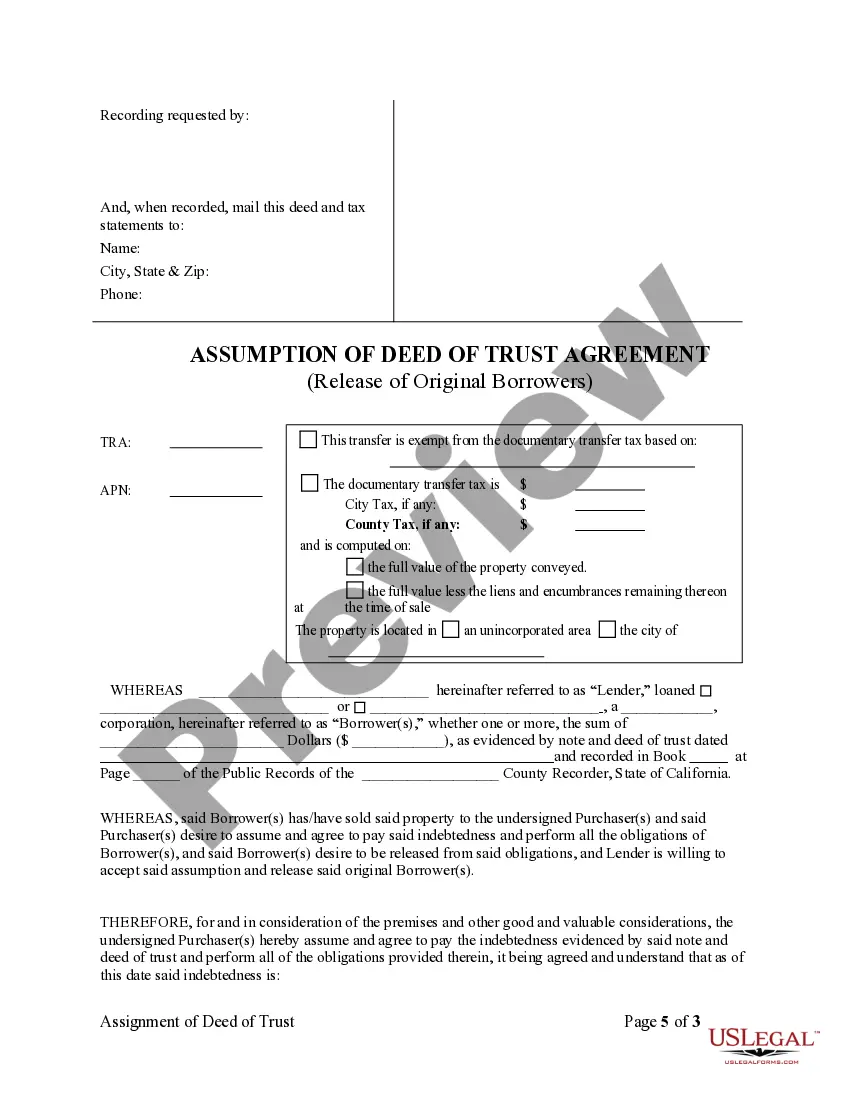

California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you are seeking accurate California Assumption Agreement of Deed of Trust and Release of Original Mortgagors formats, US Legal Forms is what you require; access documents provided and verified by state-certified legal professionals.

Using US Legal Forms not only prevents you from troubles related to legal documentation; additionally, you save effort, time, and money! Downloading, printing, and filling out a professional document is significantly less expensive than asking a lawyer to do it for you.

And that’s it. With just a few simple clicks, you obtain an editable California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Once your account is created, all future requests will be processed even more easily. When you have a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form’s page. After that, whenever you need to access this template again, you will always find it in the My documents section. Don’t waste your time and energy sifting through numerous forms on different online sources. Order professional templates from a single reliable service!

- To begin, complete your registration by entering your email and creating a password.

- Follow the steps below to set up your account and locate the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors example to address your needs.

- Use the Preview option or review the document details (if available) to ensure that the sample is the one you desire.

- Verify its legality in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing option.

- Create an account and pay with a credit card or PayPal.

Form popularity

FAQ

To obtain a copy of your deed of trust in California, you can visit your county recorder's office. They maintain records of all deeds, including the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Additionally, you can access some records online through the county’s official website. If you prefer convenience, consider using services like uslegalforms, which simplifies the search for legal documents.

Choosing whether to be on the mortgage or the deed largely depends on your financial situation and investment strategy. Being on the mortgage means you bear the financial responsibility, while being on the deed grants you ownership rights. Consider your long-term goals and risk tolerance when making this decision. If you're involved in agreements like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, having clear insights will aid in making an informed choice.

Using a deed of trust can provide several advantages over a mortgage. For instance, it typically allows for faster foreclosure in case of default, which can be beneficial for lenders and can lead to lower costs. This structure also allows more flexibility in terms of financing options. If you're considering a transaction involving a California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, recognizing the benefits can help guide your decision.

To file a deed of trust in California, you need to prepare the necessary documents, including the deed of trust itself, and gather the required signatures. Following that, file the documents with the county recorder’s office where the property is located. It's essential to ensure everything is filled out correctly to avoid delays. The California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can assist in managing these steps effectively.

Lenders often prefer deeds of trust because they provide a faster and less expensive route to foreclosure. This minimizes their risk, as they can reclaim the property more efficiently in case of default. Additionally, deeds of trust can lead to lower financial losses for lenders, making them more appealing than traditional mortgages. Exploring the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can further enlighten you on these benefits.

A disadvantage of a deed of trust lies in the non-judicial foreclosure process it enables. This means that lenders can foreclose without court involvement, often making the process quicker and less transparent. As a borrower, this shift in power can leave you with limited options if you face financial difficulties. Understanding details like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can help you navigate these challenges.

Releasing a trust typically requires the formal termination of the trust agreement by the trustee. This may involve distributing the trust's assets to the beneficiaries and ensuring all legal obligations are met. If the trust includes a deed of trust, the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can be a useful tool during the release process.

California primarily uses deeds of trust instead of traditional mortgages for real estate transactions. A deed of trust involves three parties: the borrower, the lender, and a trustee, which can simplify foreclosure processes. Understanding this structure is essential when dealing with the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

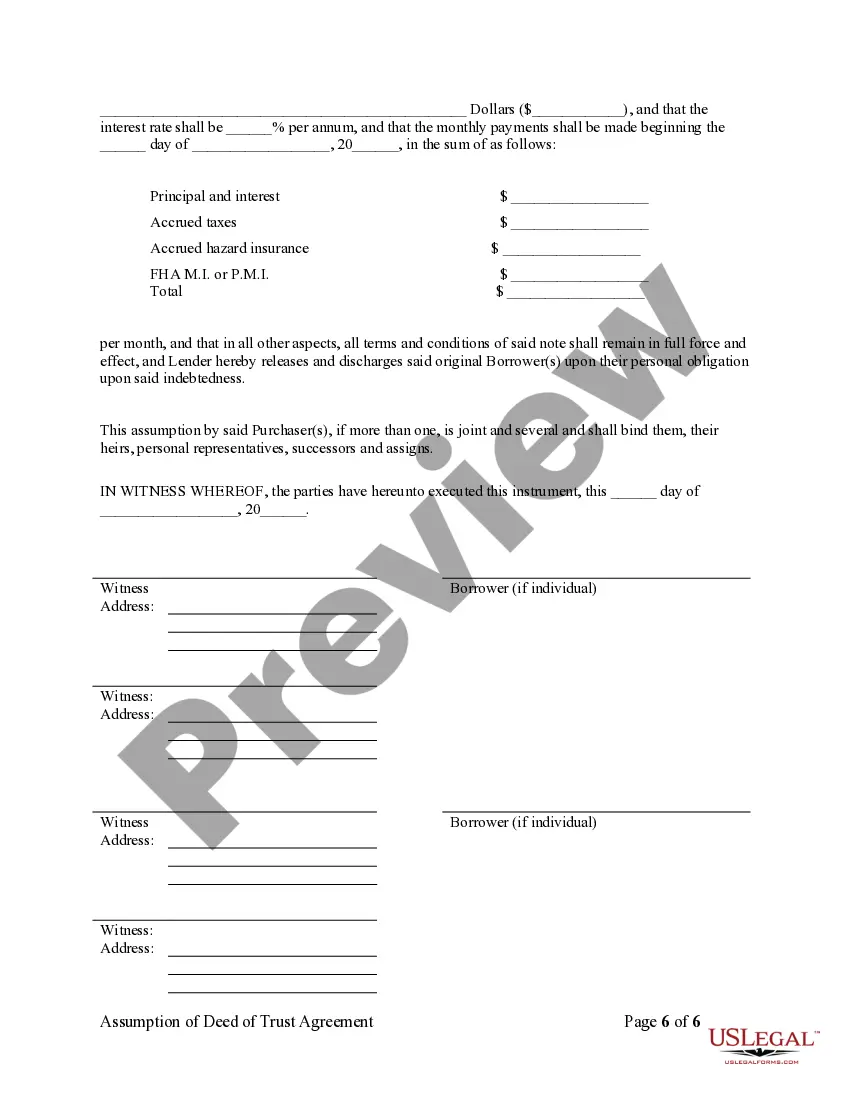

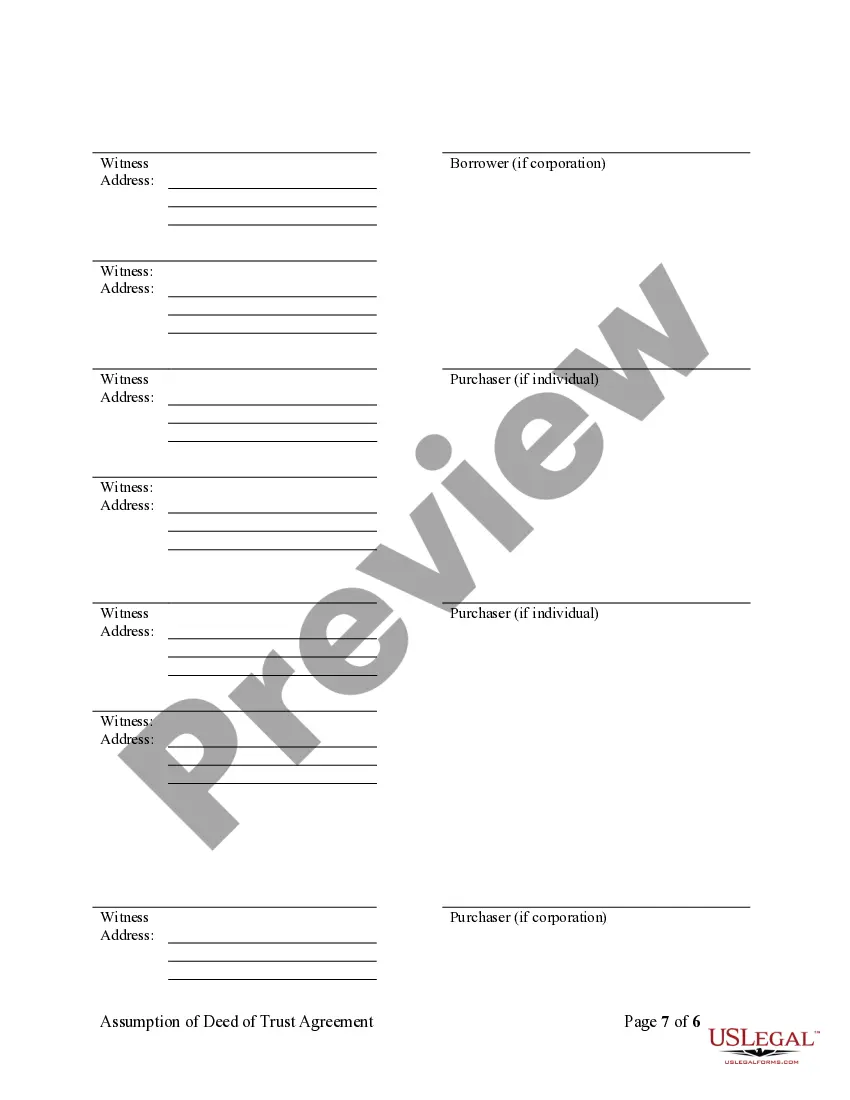

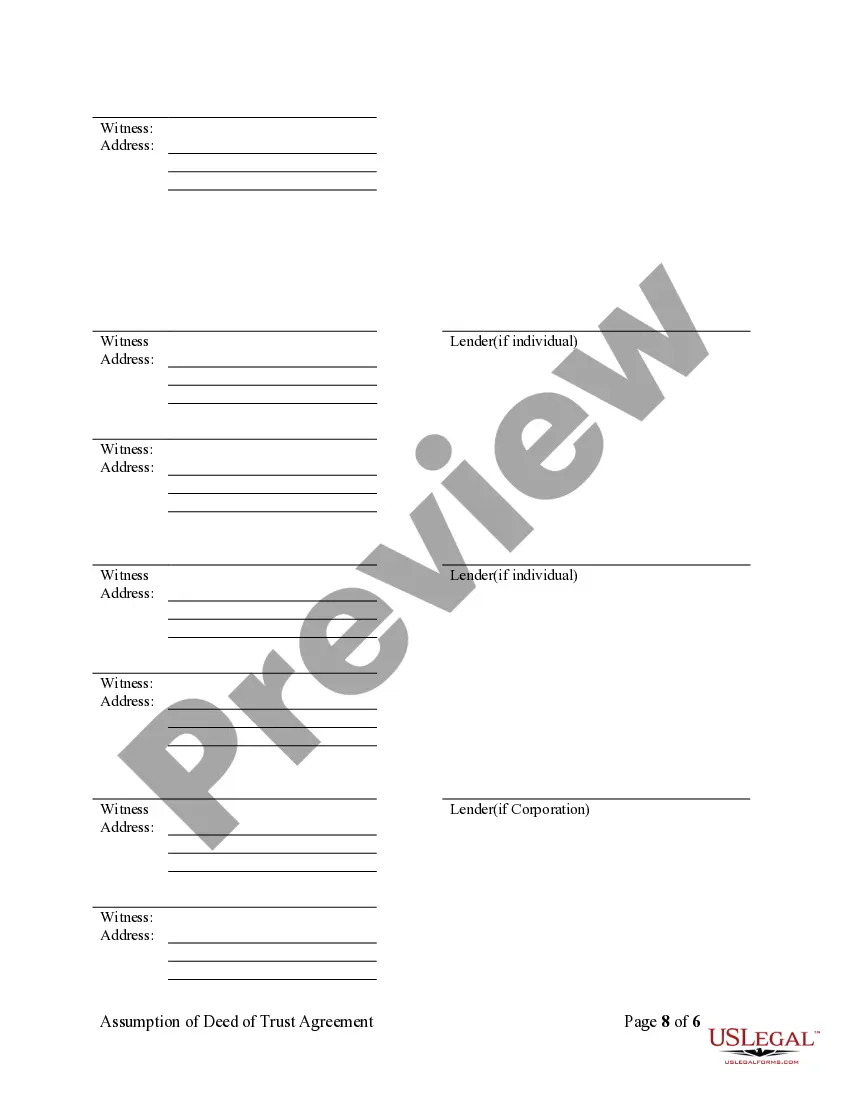

An assumption and release agreement for a mortgage in California allows one borrower to take over another’s mortgage responsibilities while releasing the original mortgagors from liability. This can be an essential part of the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. By utilizing such an agreement, all parties can clarify their obligations and ensure a smooth transition.

Yes, you can sell a house with a deed of trust, but there are specific steps to follow. The sale typically involves the buyer assuming the current mortgage obligations, which requires formal agreements like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. This process helps ensure that both the seller and buyer are protected during the transaction.