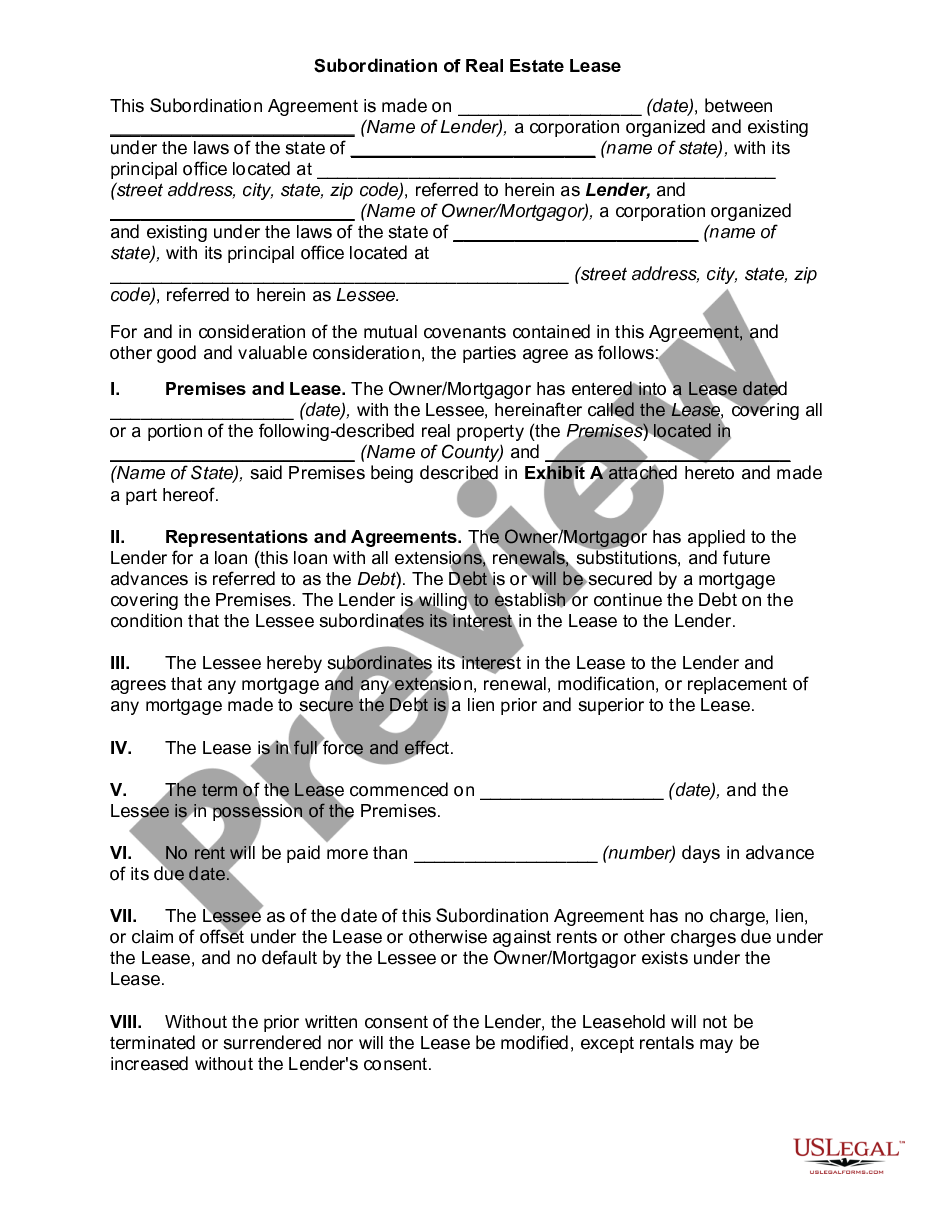

Alaska Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alaska Subordination Agreement?

Utilize US Legal Forms to acquire a downloadable Alaska Subordination Agreement.

Our court-recognized forms are crafted and frequently updated by experienced attorneys.

Ours is the most comprehensive Forms library available online and offers reasonably priced and precise templates for individuals and legal practitioners, as well as small and medium businesses.

Select Buy Now if it’s the template you require, create your account, and complete the payment through PayPal or credit card. Download the document to your device and feel free to reuse it multiple times. Use the Search engine if you need to find another document template. US Legal Forms offers a vast array of legal and tax documents and packages for both business and personal requirements, including the Alaska Subordination Agreement. Over three million users have successfully used our service. Choose your subscription plan and obtain high-quality documents with just a few clicks.

- The templates are sorted into state-specific categories, with some available for preview before downloading.

- To acquire samples, users must possess a subscription and Log In to their account.

- Click Download beside any template you wish to use and access it in My documents.

- For those without a subscription, follow the instructions below to swiftly locate and download the Alaska Subordination Agreement.

- Ensure you have the correct template pertinent to the required state.

- Examine the form by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

: placement in a lower class, rank, or position : the act or process of subordinating someone or something or the state of being subordinated As a prescriptive text, moreover, the Bible has been interpreted as justifying the subordination of women to men.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

A written contract in which a lender who has secured a loan by a mortgage or deed of trust agrees with the property owner to subordinate its loan (accept a lower priority for the collection of its debt), thus giving the new loan priority in any foreclosure or payoff.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.