Wyoming Single Member Limited Liability Company LLC Operating Agreement

What is this form?

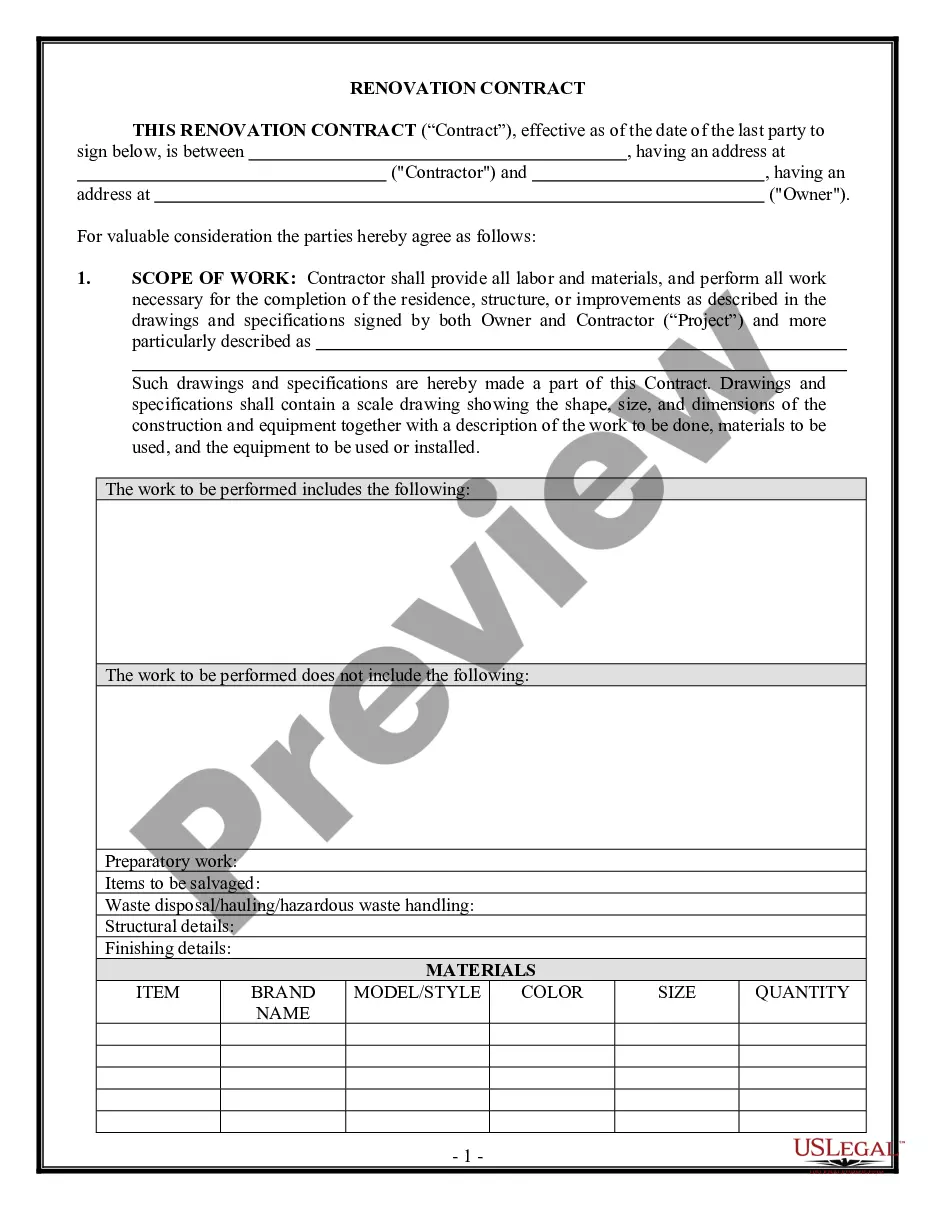

The Single Member Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the operational procedures and ownership structure of a single-member LLC in Wyoming. This form specifically provides guidance for the management, contributions, profits, and other key details pertinent to the formation and operation of the LLC, distinguishing it from multi-member agreements which require additional provisions for multiple stakeholders.

What’s included in this form

- Formation of the LLC: Details on how the LLC is established under Wyoming law.

- Initial Member: Identifies the initial owner and their responsibilities.

- Management Structure: Specifies how the LLC will be managed and who has decision-making authority.

- Financial Contributions: Outlines initial and potential additional contributions of the members.

- Profits and Losses: Defines how profits and losses will be distributed among members.

- Dissolution: Conditions under which the LLC may be dissolved and how assets will be distributed.

Situations where this form applies

This form is essential when an individual wants to establish an LLC in Wyoming and intends to operate it primarily alone. It should be used to clarify the internal operations of the company, especially if the owner anticipates future membership changes, to ensure clarity in management and financial matters.

Who can use this document

- Individuals establishing a single-member LLC in Wyoming.

- Business owners seeking to clearly define operational procedures.

- Entrepreneurs anticipating potential future members in their LLC.

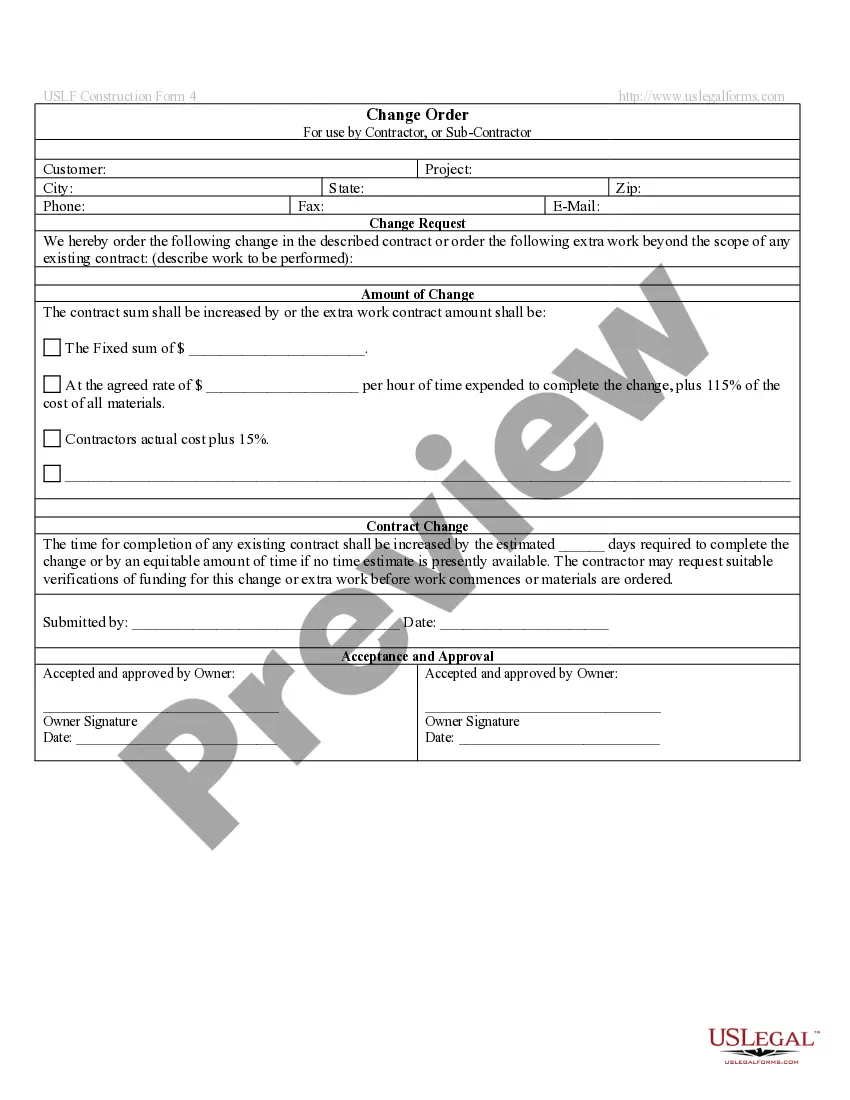

How to prepare this document

- Enter the name of your LLC and the date of the agreement.

- Identify the initial member and provide any additional member names if applicable in the future.

- Specify the business purpose of the LLC.

- Detail the initial capital contributions from the member.

- Outline the management structure and voting rights in case of future members.

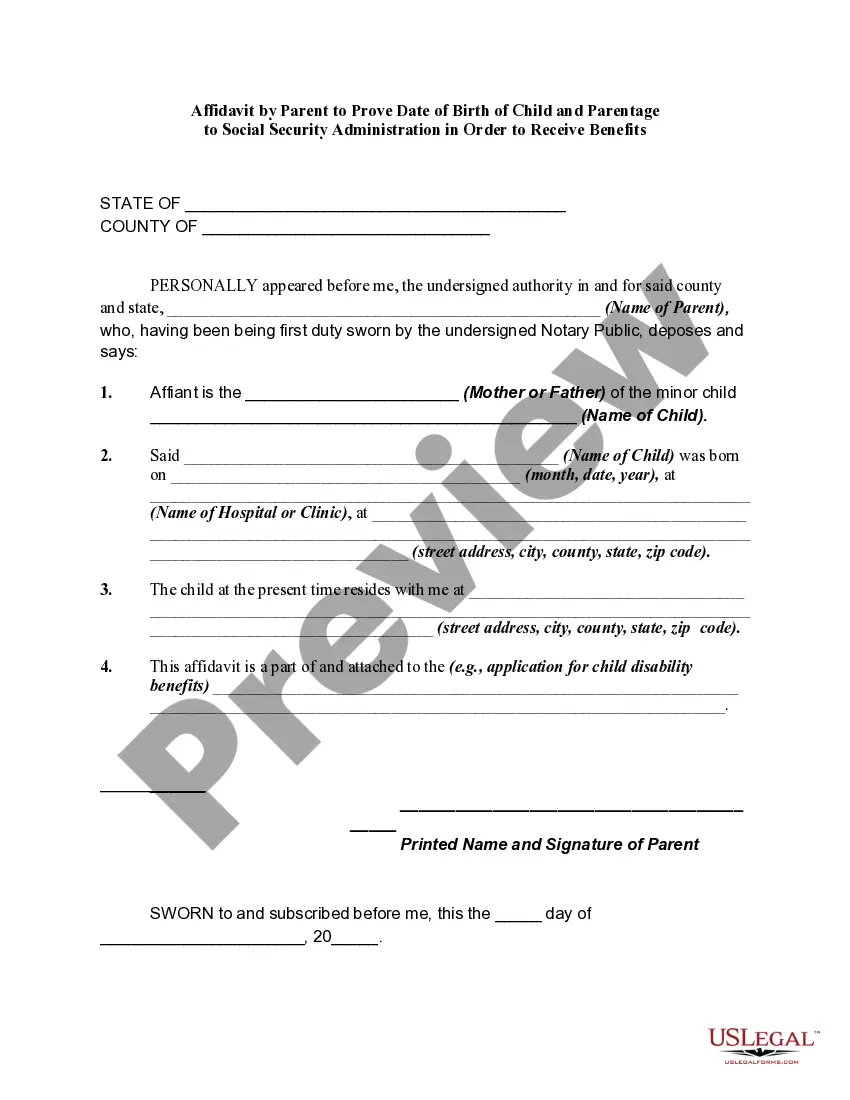

Notarization requirements for this form

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

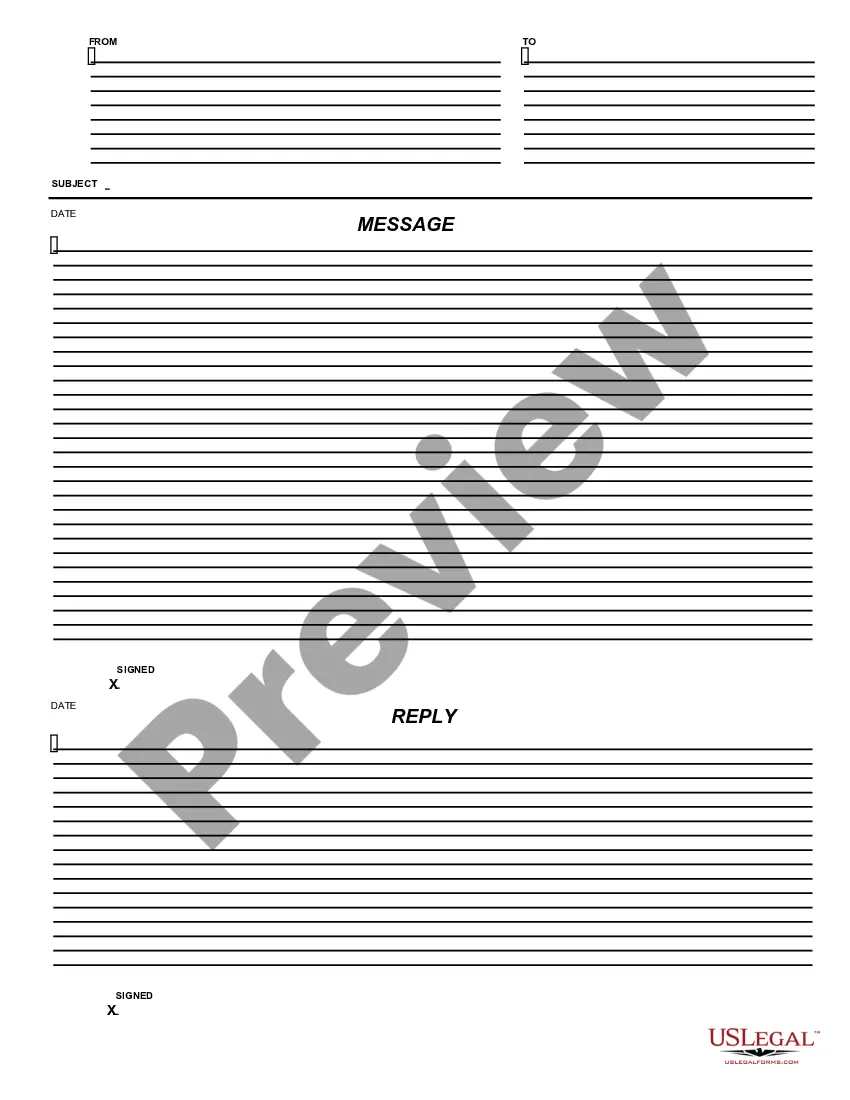

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to fill out all required fields, which can lead to misunderstandings later.

- Not detailing the business purpose, which can cause legal complications.

- Overlooking the need for initial and potential future contributions, leading to financial disputes.

Benefits of completing this form online

- Convenient access to legally compliant documents from anywhere.

- Easy customization for individual business needs.

- Step-by-step instructions simplify the filling process.

Legal use & context

- The document is legally binding once signed by the initial member.

- It helps delineate responsibilities and rights within the LLC to protect both the member and potential future members.

- Helps establish clear protocols for financial contributions and profit distribution.

What to keep in mind

- The Single Member LLC Operating Agreement is essential for structuring your business.

- Clear guidelines help avoid future disputes and facilitate smooth operations.

- Using this form provides a legally sound foundation for your LLC operations in Wyoming.

Glossary of terms

- LLC: Limited Liability Company, a business structure that protects its owner from personal liability.

- Member: An individual or entity that owns an interest in the LLC.

- Articles of Organization: The official document filed with the state to create the LLC.

Looking for another form?

Form popularity

FAQ

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

It can secure your liability protection. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.In order to keep this liability protection, you need to keep your business affairs and personal affairs separate.

An LLC operating agreement is not required in Wyoming, however, drafting this document will allow you establish a suitable operating system for your company.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

The single-member LLC articles of organization is a document that you need to file with the state when forming your LLC. LLC stands for limited liability company, and it is a business structure that state law allows you to form.A single-member LLC has special consideration, however, since it is a one-owner company.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.