Annual Minutes for a Virginia Professional Corporation

Understanding this form

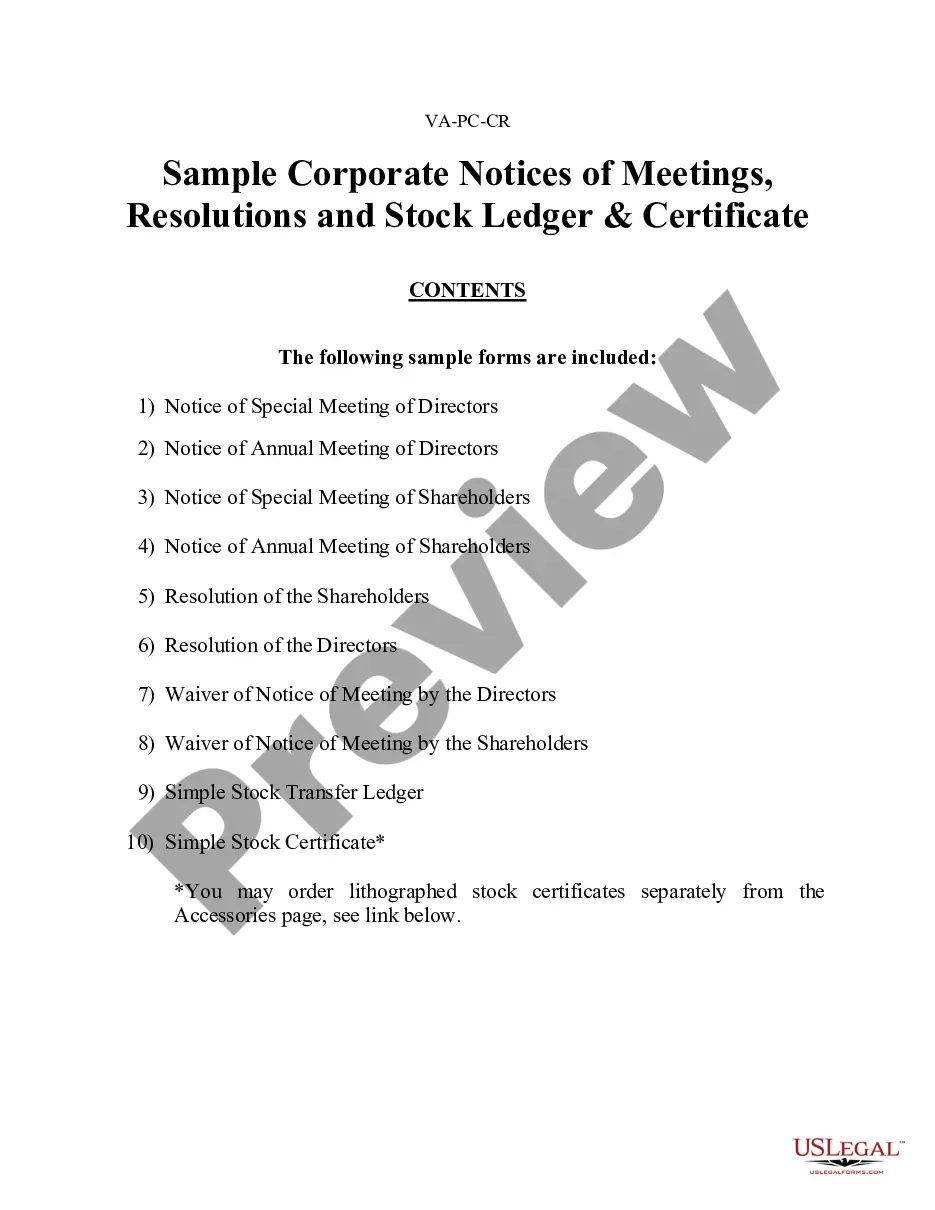

The Annual Minutes for a Virginia Professional Corporation is a legal document that records the actions and decisions made by the shareholders and board of directors of a professional corporation over the course of a year. This form is essential for maintaining compliance with Virginia state law and serves as an official record of corporate activities, distinguishing it from other types of corporate documentation such as general minutes that may not focus on annual reviews or decisions.

Main sections of this form

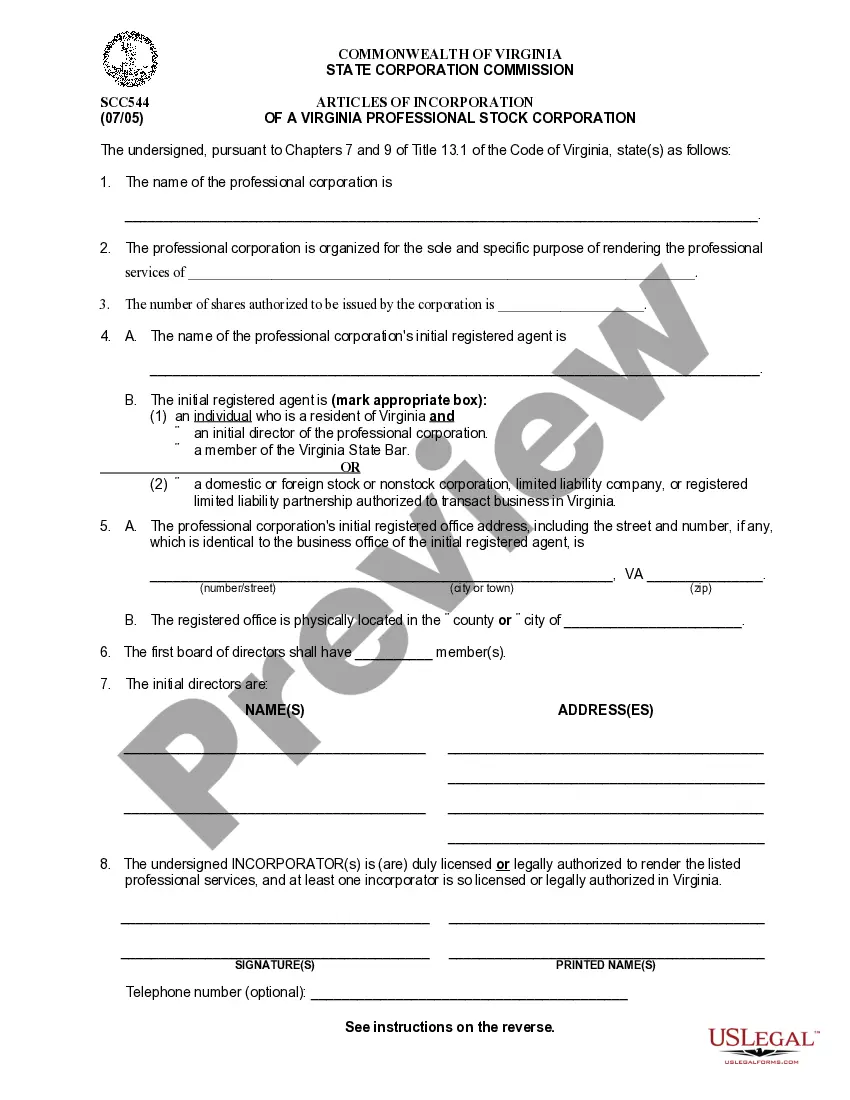

- Name of the corporation

- Names and addresses of directors

- Names of officers elected

- Date of the meeting or consent

- Signatures of shareholders and directors

- Secretary's signature

When to use this form

This form is used annually by professional corporations in Virginia to document significant corporate actions, such as the election of directors and officers, approval of corporate actions, and ratification of previous decisions. It is essential for ensuring that all procedural requirements are met under Virginia law.

Who can use this document

- Shareholders of a Virginia professional corporation

- Members of the board of directors

- Corporate secretaries responsible for maintaining official records

- Legal advisors assisting corporations with compliance

Instructions for completing this form

- Enter the name of the corporation at the top of the document.

- List the names and addresses of all directors.

- Specify the officers elected and their respective positions.

- Document the meeting date or date of consensus reached.

- Collect and include signatures from all shareholders and directors.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all required signatures.

- Using incorrect names or addresses for directors and officers.

- Not documenting previous actions taken in the corporate year.

Why use this form online

- Immediate access to downloadable templates drafted by licensed attorneys.

- Customizable format to suit specific needs of your corporation.

- Convenient and reliable method for maintaining compliance with Virginia law.

Looking for another form?

Form popularity

FAQ

Use a template. Check off attendees as they arrive. Do introductions or circulate an attendance list. Record motions, actions, and decisions as they occur. Ask for clarification as necessary. Write clear, brief notes-not full sentences or verbatim wording.

Taking Meeting Notes. Type Meeting Notes - Type up a full version of the meeting minutes. Circulate a Draft - Follow your corporation's policy about who must review the draft notes. Distribute Minutes to Board - Usually in advance of the next meeting.

Prepare corporate minutes. Notes kept at each shareholder and board meeting held by a corporation provide a written record of what occurred at the meeting. Approve corporate minutes. File the minutes with internal corporate records. In limited circumstances, file the corporate minutes with the state.

Corporate annual meeting minutes serve as a record of a business's annual meeting.Meeting agenda items with a brief description of each. Details about what was discussed during the meeting. Results of any voting actions taken. The time when the meeting adjourned.

Date, time, and location. Minutes should include this basic information about when and where the meeting was held and how long it lasted. Creator. List of persons present. Topics list. Voting record. Review and approval.

Minutes are important details that you can't ignore if you want to keep your business in line with state laws, and to back up your tax returns. Minutes represent the actions of the Board and company leadership, and are considered legal documents by auditors, the IRS, and the courts.

An annual report may be filed online through CIS. To request a paper copy of the annual report form, access the Online Forms Request page or contact the Clerk's Office at (804) 371-9733 or toll free in Virginia, 1-866-722-2551.

What Are Corporate Meeting Minutes? Corporate meeting minutes are a record that's taken at formal meetings of managers of corporations. The minutes describe the actions and decisions that managers take at company meetings.

Meeting Requirements for Corporations. State laws and a corporation's bylaws will dictate specific meeting requirements for corporations. In general, however, most corporations are required to have at least one shareholders' meeting per year. Corporations are also required to prepare and retain minutes of these meeting