UCC1 - Financing Statement - Vermont -For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Vermont UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Vermont UCC1 Financing Statement?

Looking for a Vermont UCC1 Financing Statement online might be stressful. All too often, you see documents that you believe are fine to use, but find out later they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Get any form you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will automatically be added in to your My Forms section. If you do not have an account, you should register and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont UCC1 Financing Statement from our website:

- See the form description and press Preview (if available) to check if the form meets your expectations or not.

- If the form is not what you need, get others using the Search field or the listed recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. In addition to professionally drafted samples, users will also be supported with step-by-step guidelines concerning how to find, download, and complete templates.

Form popularity

FAQ

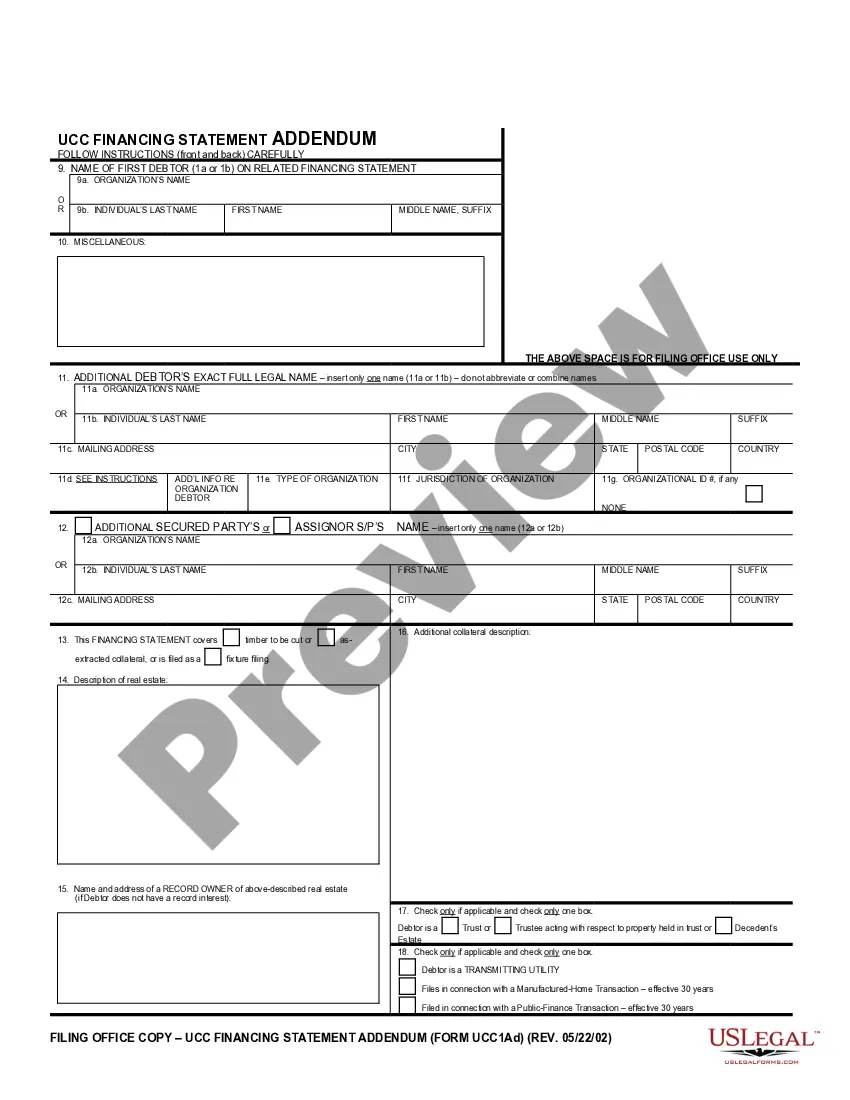

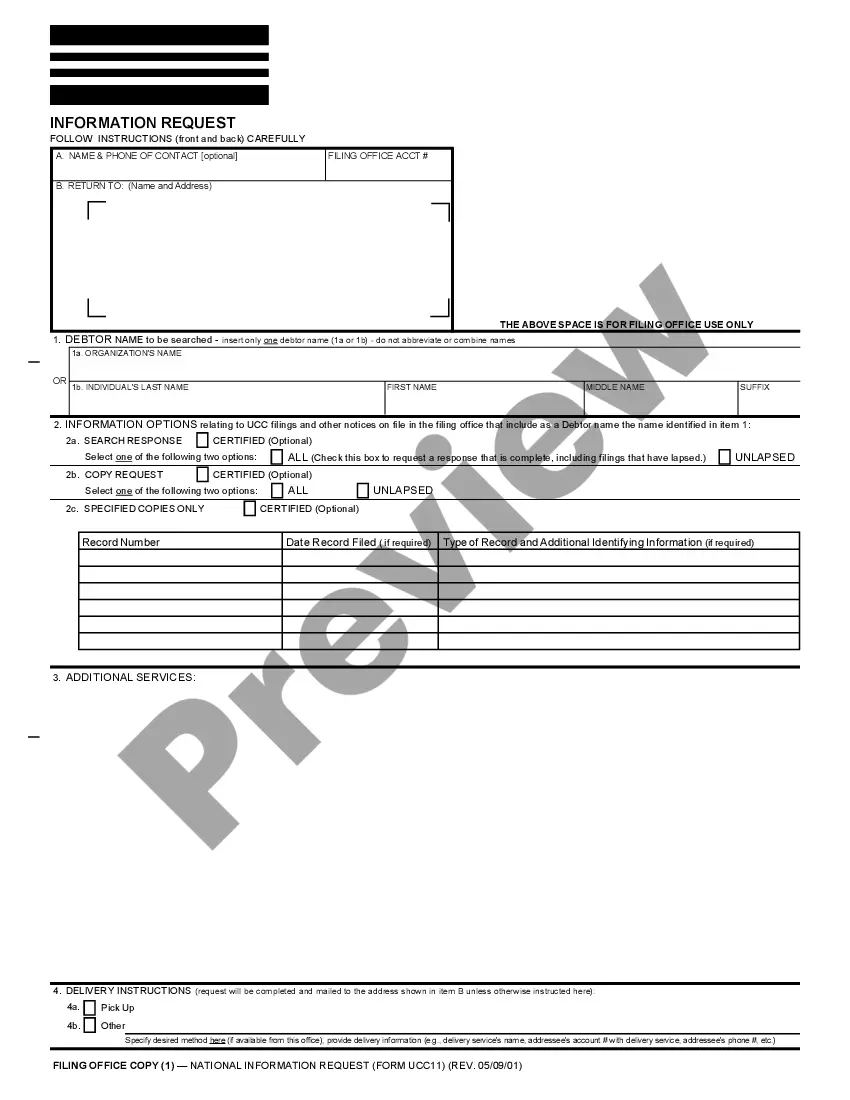

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

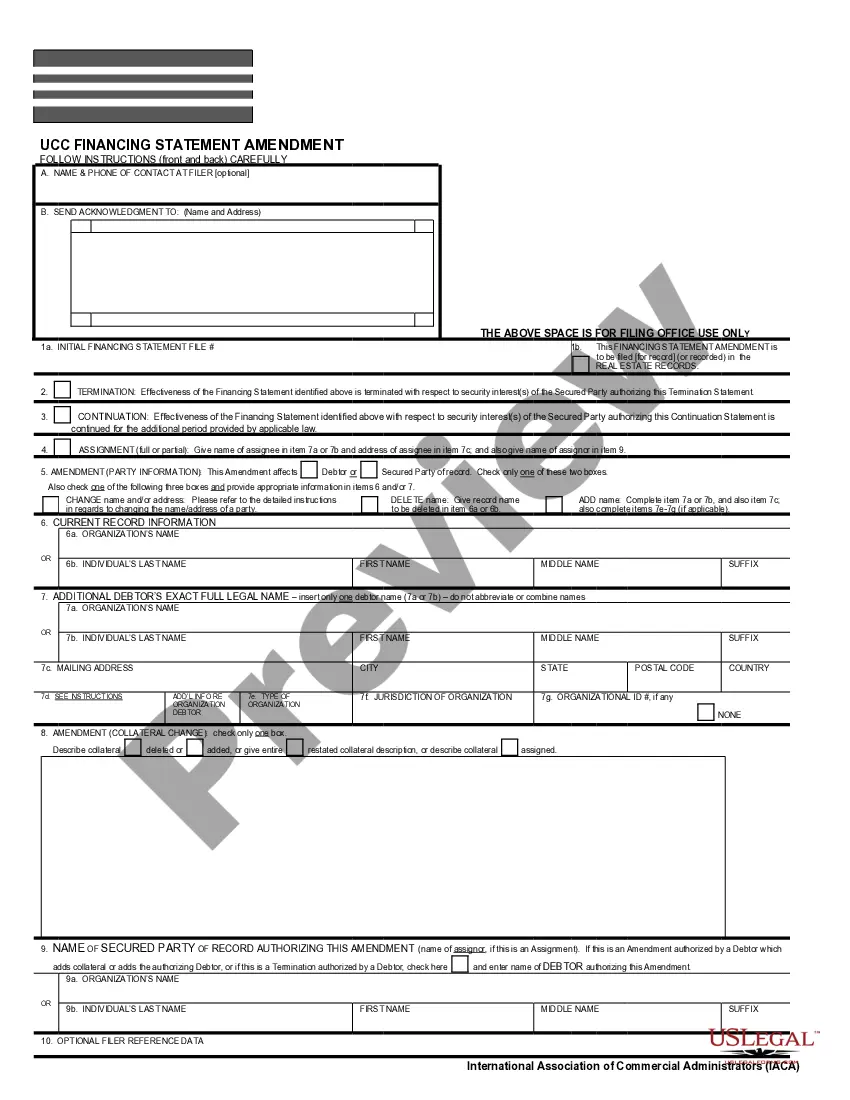

Documents Filed in the Offices of the County Clerks All other types of amendment filings would require the filing of a financing statement in the Office of the Secretary of State. Documents pertaining to real estate records are to be filed in the Office of the County Clerk.

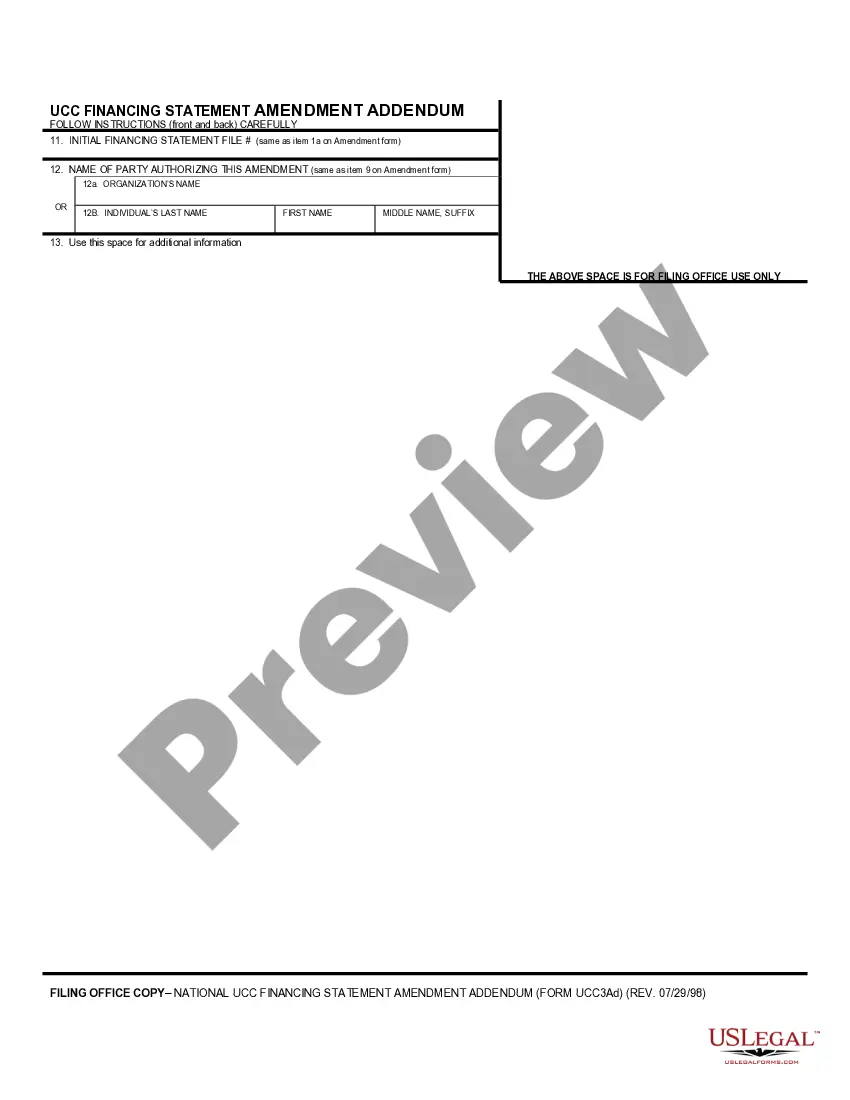

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.