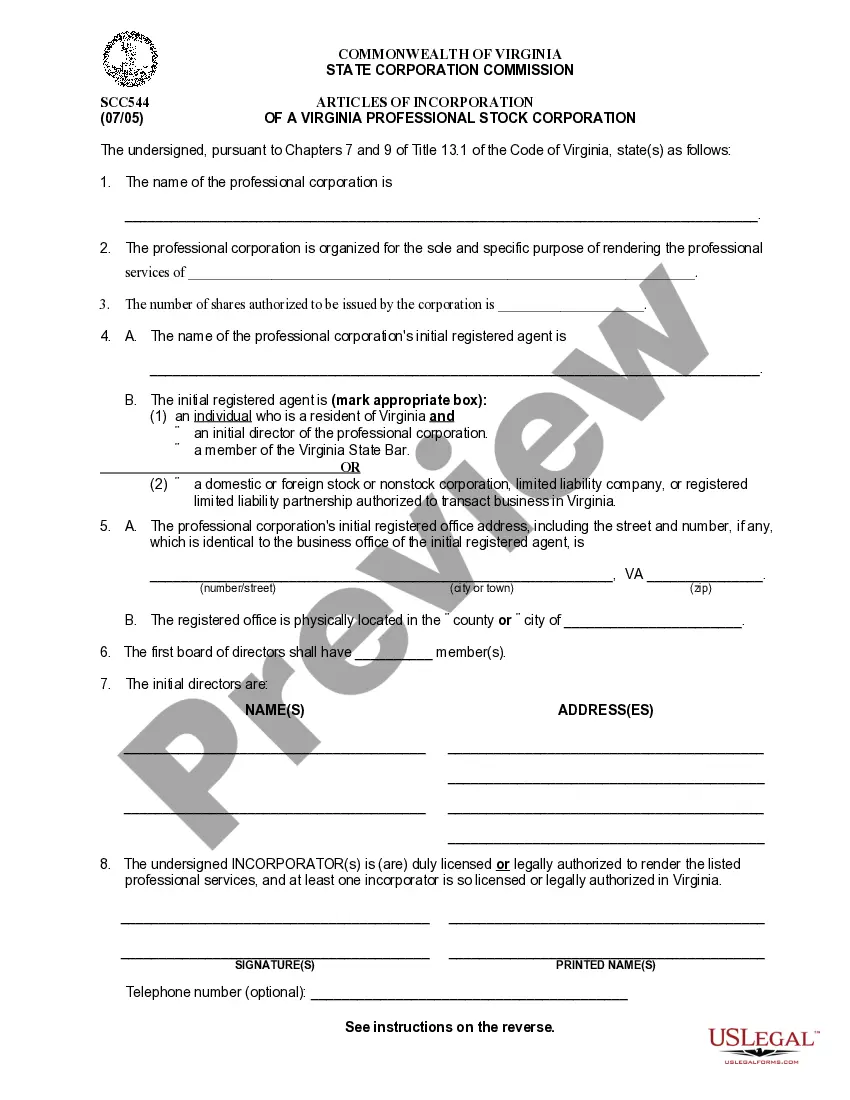

Sample Corporate Records for a Virginia Professional Corporation

Overview of this form

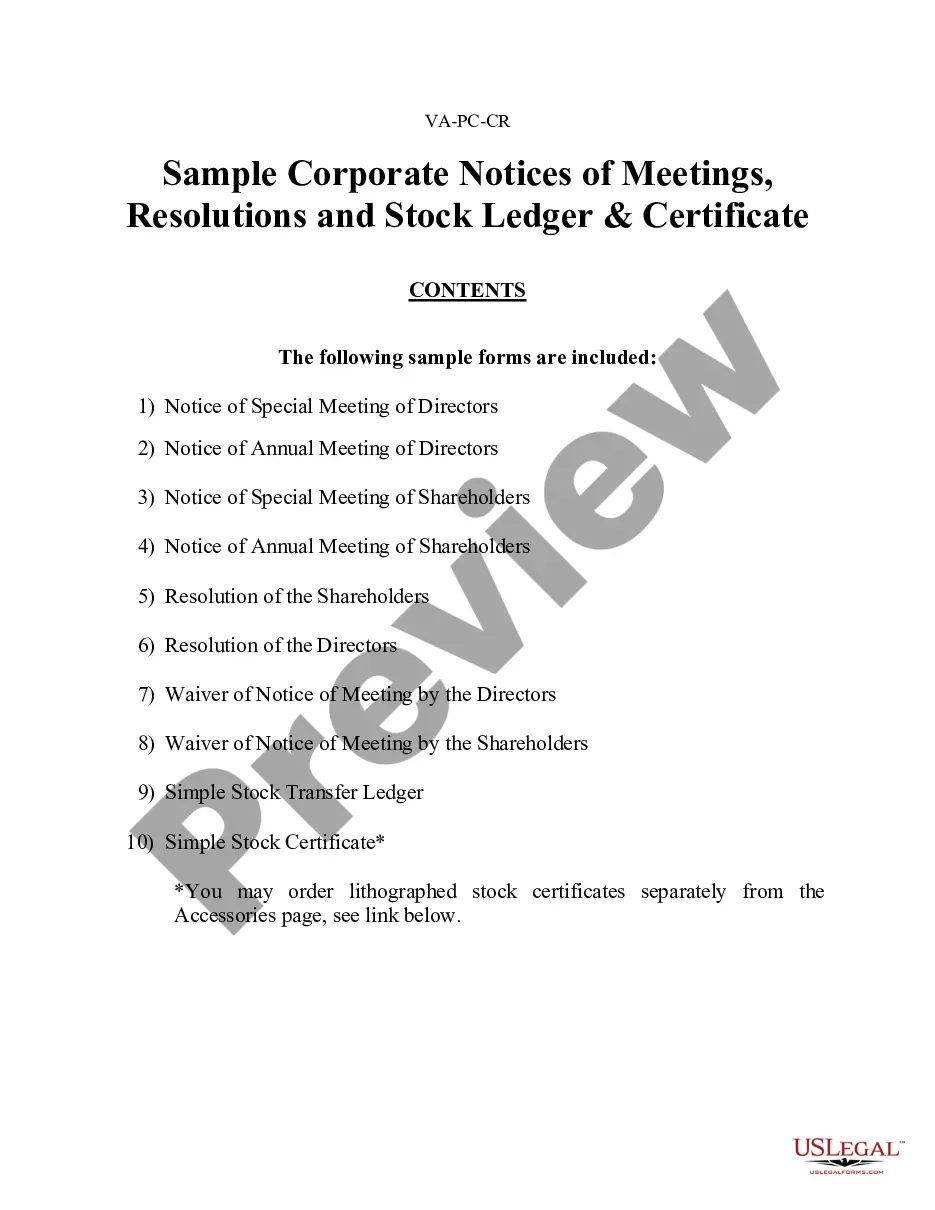

The Sample Corporate Records for a Virginia Professional Corporation is a comprehensive document that includes essential corporate notices and records. It serves to formalize actions and decisions made by the corporation's directors and shareholders, ensuring compliance with Virginia state laws. This form is particularly useful for maintaining accurate records of meetings and stock transactions, setting it apart from other general corporate forms that may not cover stock-related documentation.

Key parts of this document

- Notice of Special Meeting of Directors

- Notice of Annual Meeting of Directors

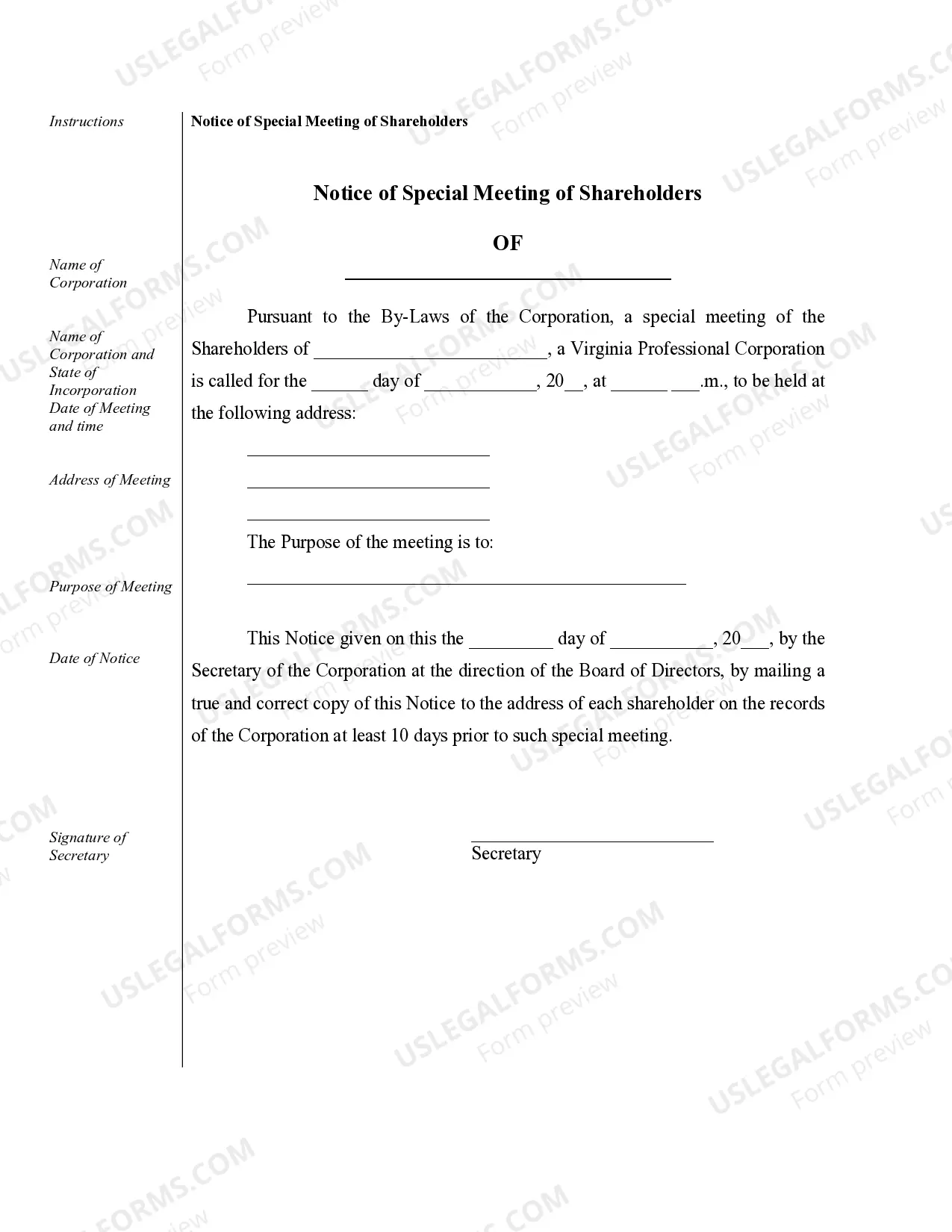

- Notice of Special Meeting of Shareholders

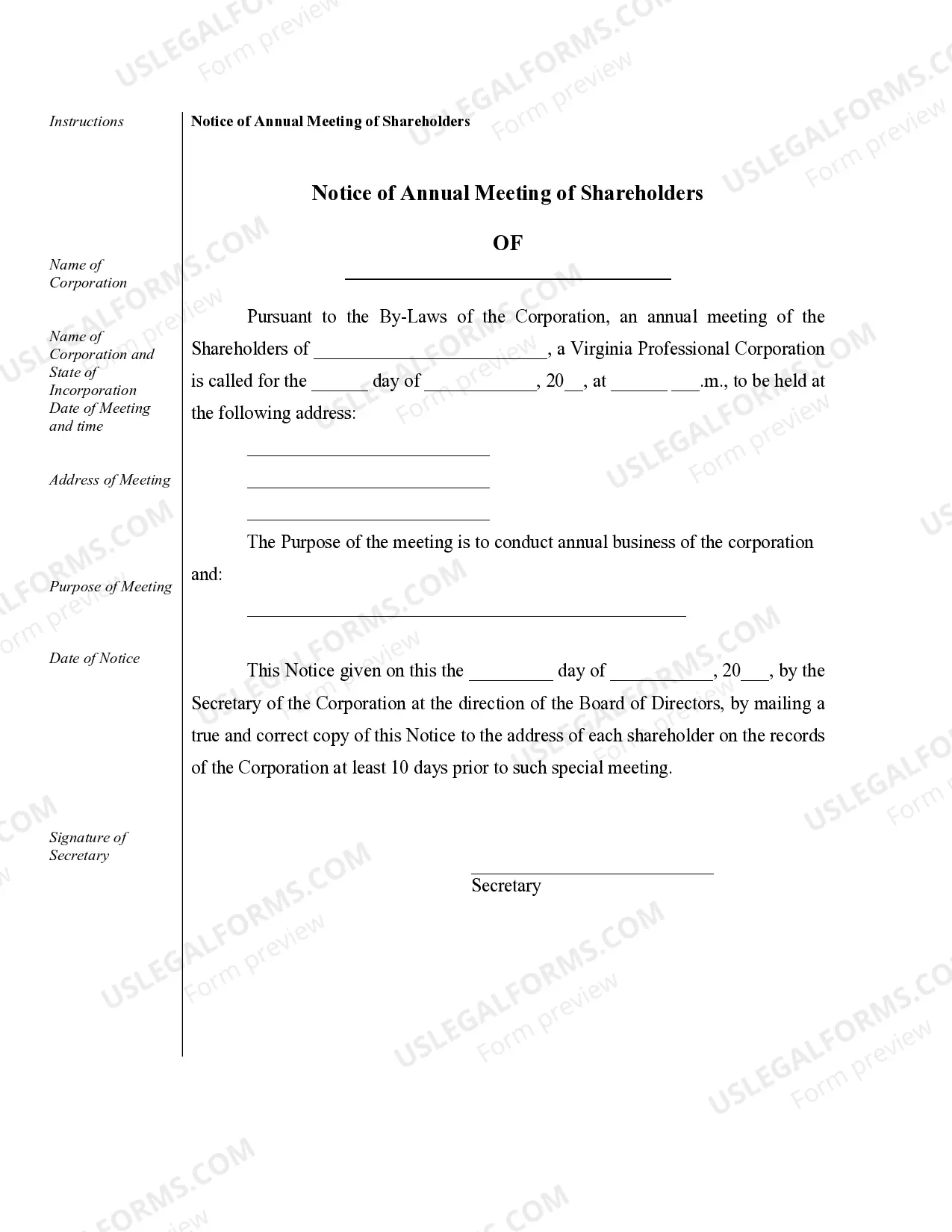

- Notice of Annual Meeting of Shareholders

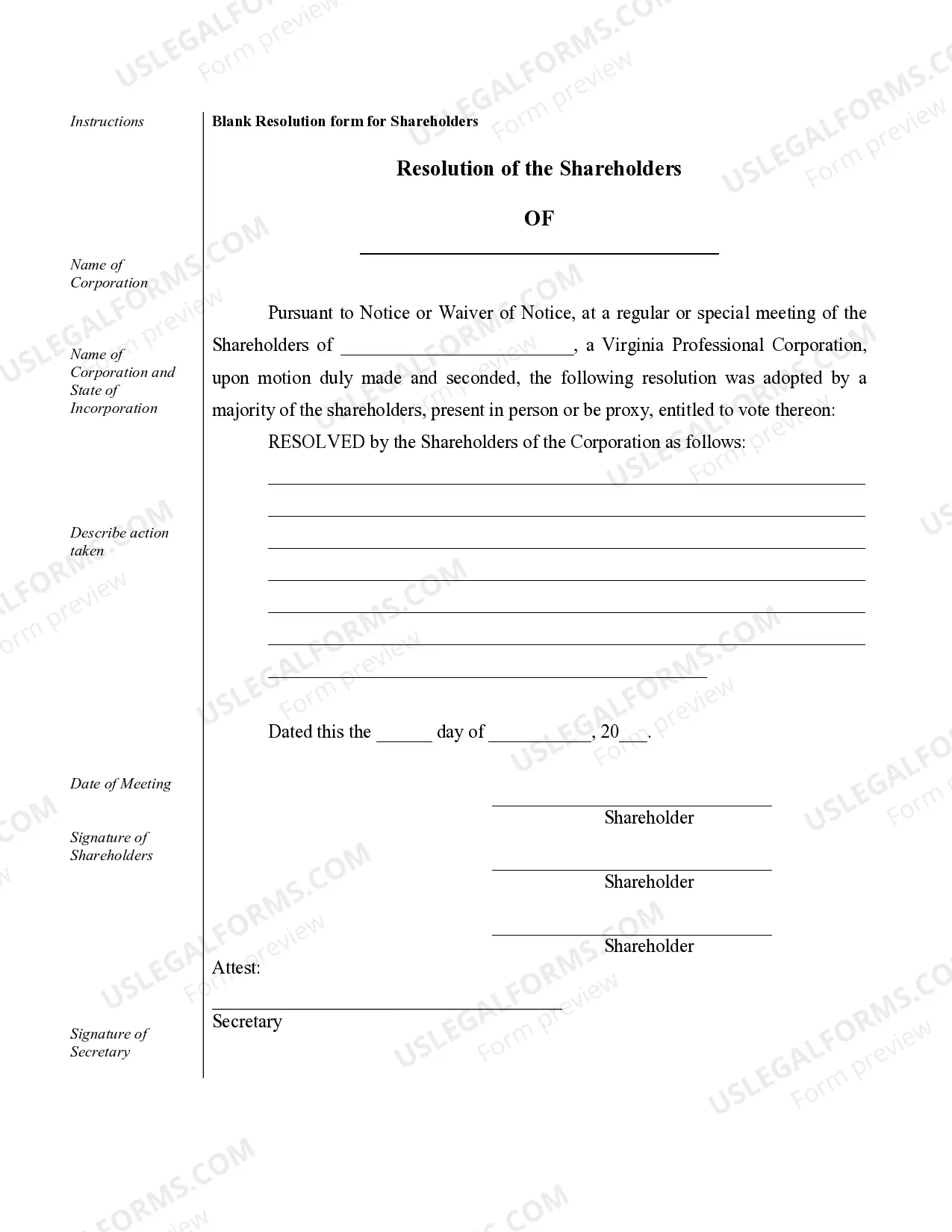

- Resolution of the Shareholders

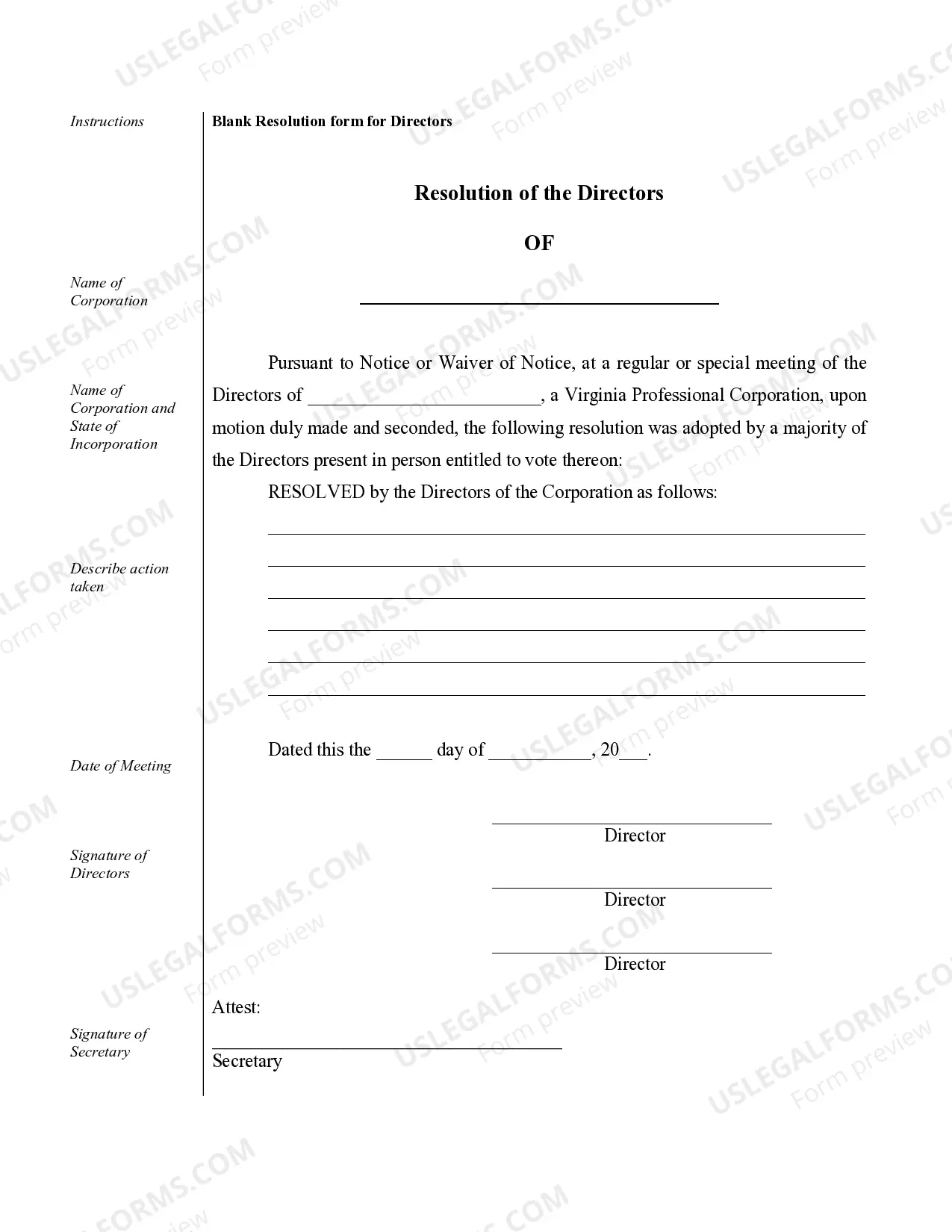

- Resolution of the Directors

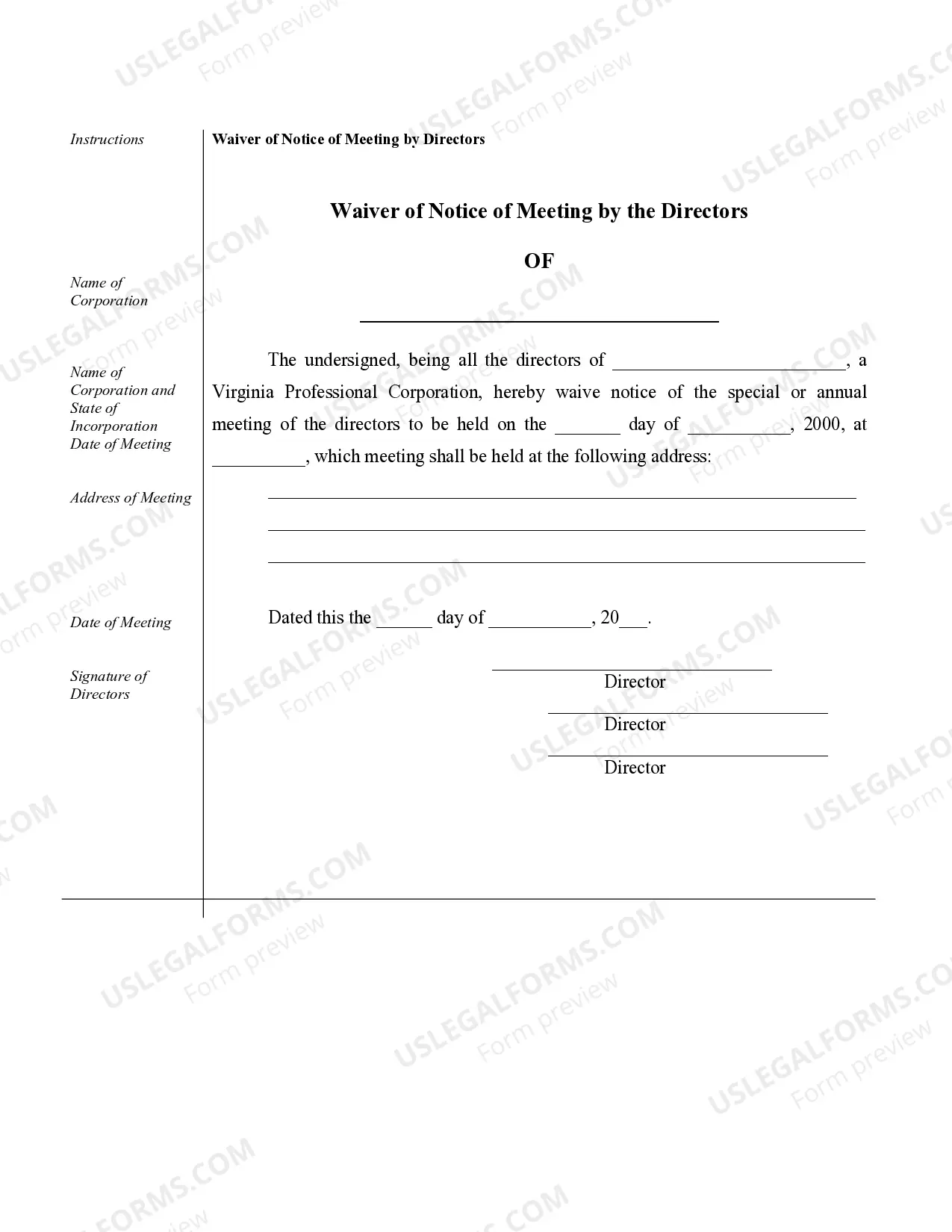

- Waiver of Notice of Meeting by the Directors

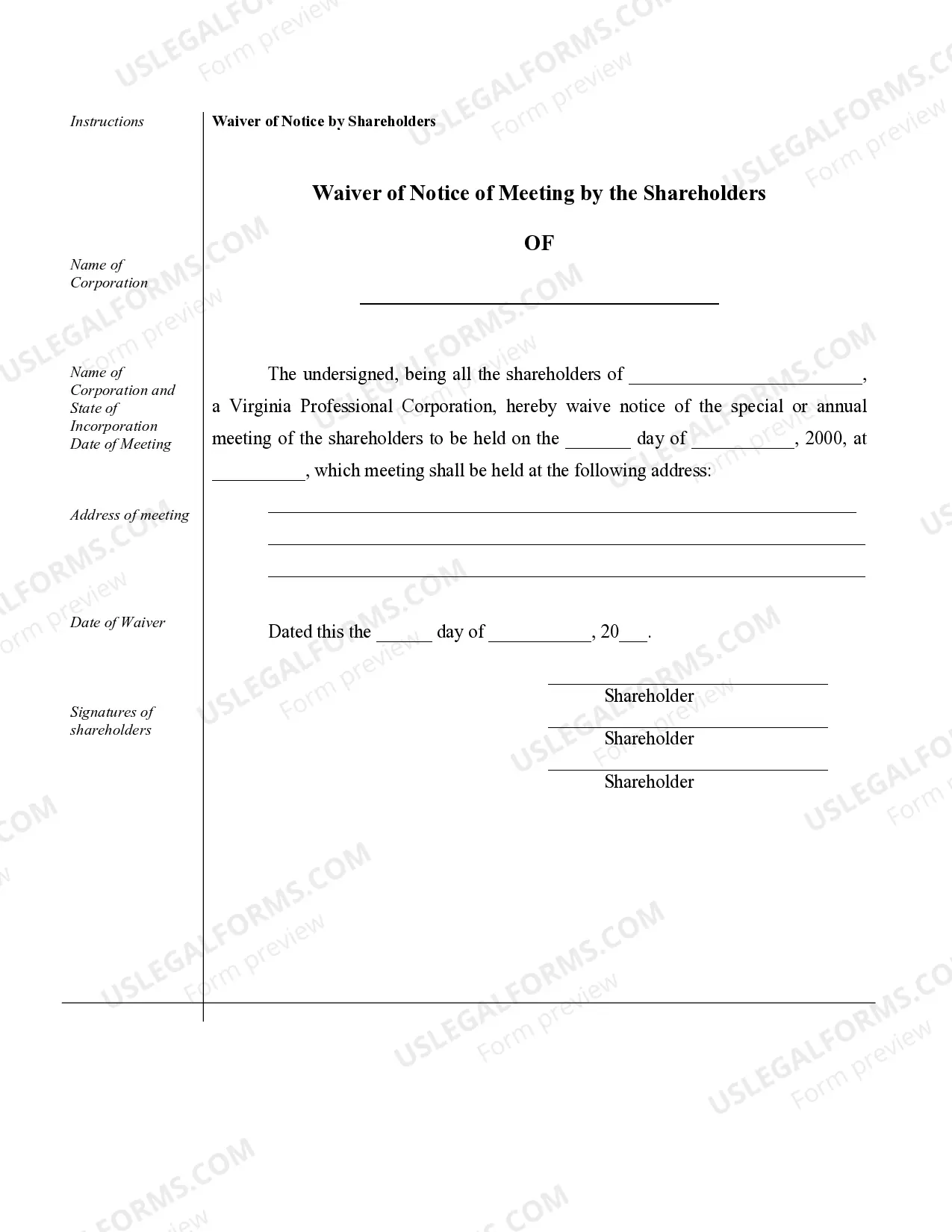

- Waiver of Notice of Meeting by the Shareholders

- Simple Stock Transfer Ledger

- Simple Stock Certificate

Common use cases

This form should be used when a Virginia professional corporation needs to document corporate meetings, decisions, and stock transactions. It is essential for annual business meetings, special meetings, and when shareholder or director resolutions are required. Additionally, it is valuable in maintaining a proper stock transfer ledger and issuing stock certificates, making it crucial for legal compliance and organizational transparency.

Who needs this form

- Professional corporations in Virginia

- Corporate secretaries and directors

- Shareholders participating in corporate governance

- Business owners seeking to maintain official records

How to complete this form

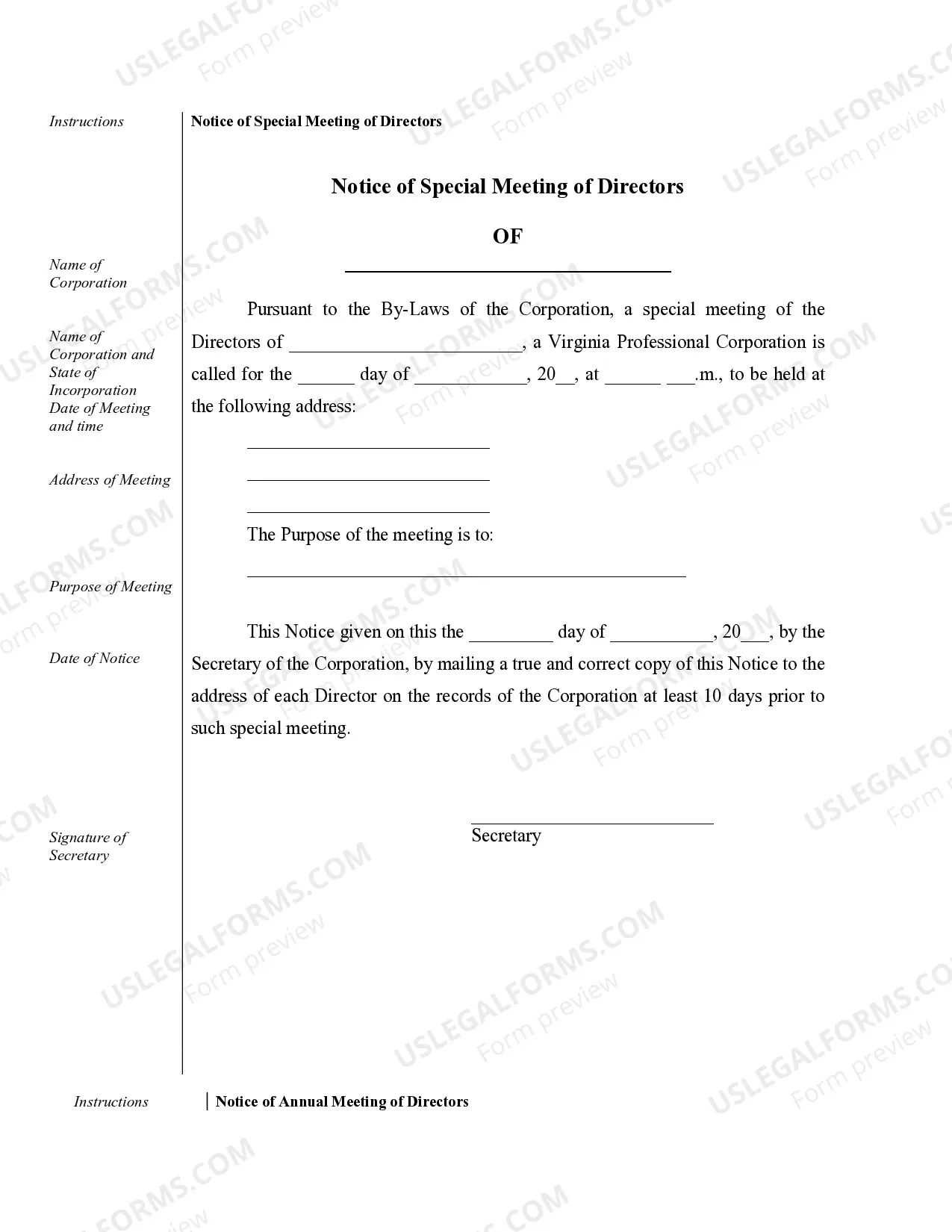

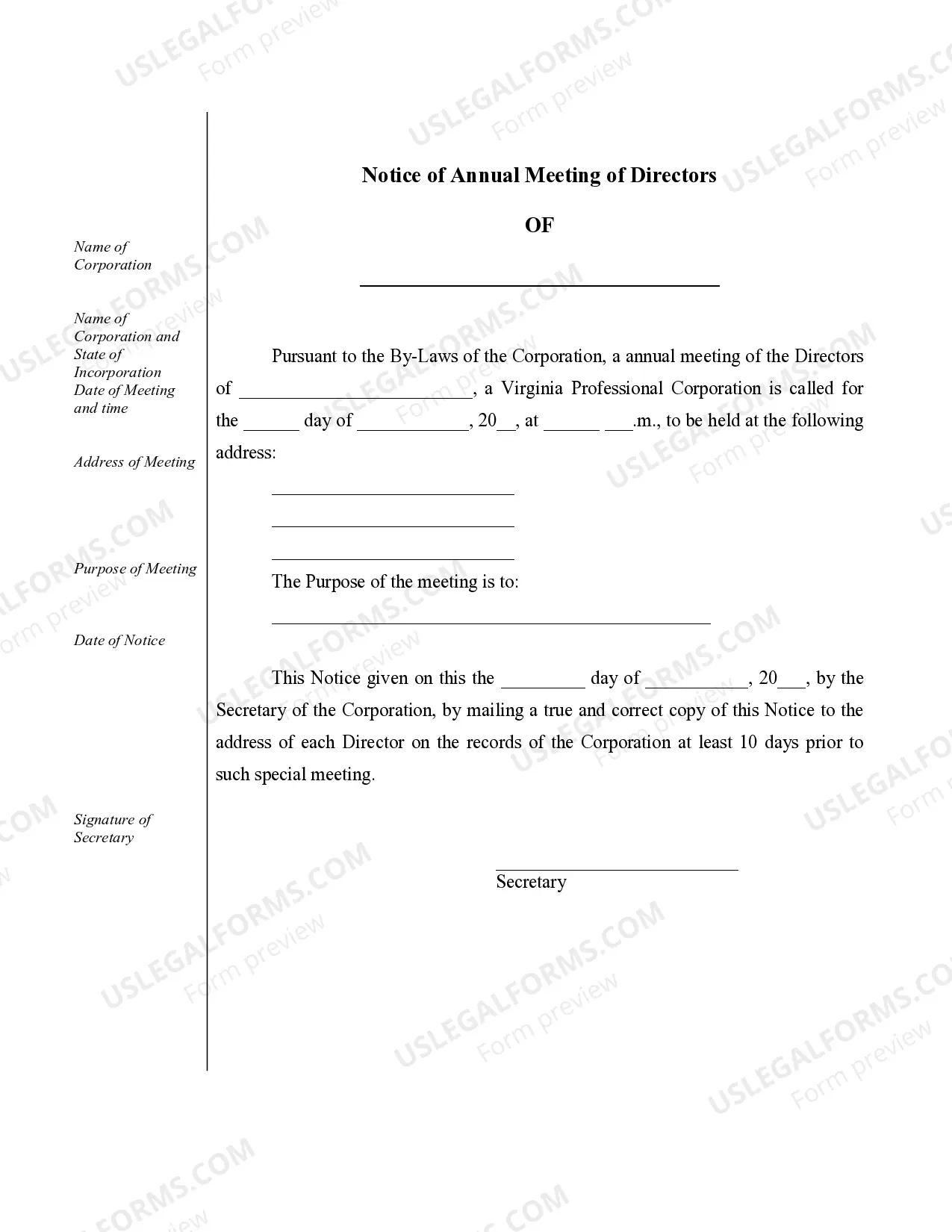

- Enter the name of the corporation and the state of incorporation.

- Fill in the date, time, and address of the meeting.

- State the purpose of the meeting clearly.

- Ensure the notice is signed by the Secretary of the corporation.

- Record any resolutions or waivers in the appropriate sections.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to send out notices at least 10 days prior to meetings.

- Not including all necessary signatures on resolutions.

- Incomplete or incorrect information about the meeting details.

Why complete this form online

- Convenience of downloading and filling out forms at any time.

- Editability allows for customization based on specific corporate needs.

- Access to templates drafted by licensed attorneys ensures reliability.

Looking for another form?

Form popularity

FAQ

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

A Virginia PLLC is a limited liability company (LLC) formed specifically by people who will provide Virginia licensed professional services.Like other LLCs, PLLCs protect their individual members from people with claims for many (but not all) types of financial debts or personal injuries.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

LLC owners must pay self-employment taxes for all income. S-corp owners may pay less on this tax, provided they pay themselves a "reasonable salary." LLCs can have an unlimited number of members, while S-corps are limited to 100 shareholders.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

Professional corporationslike traditional corporationscan take two forms: S Corps or C Corps.However, owners typically have the option to elect for S Corp status by completing and submitting IRS form 2553: Election by a Small Business Corporation.

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized according to the laws of the state where the professional is licensed to practice.