Virginia Unsecured Installment Payment Promissory Note for Fixed Rate

About this form

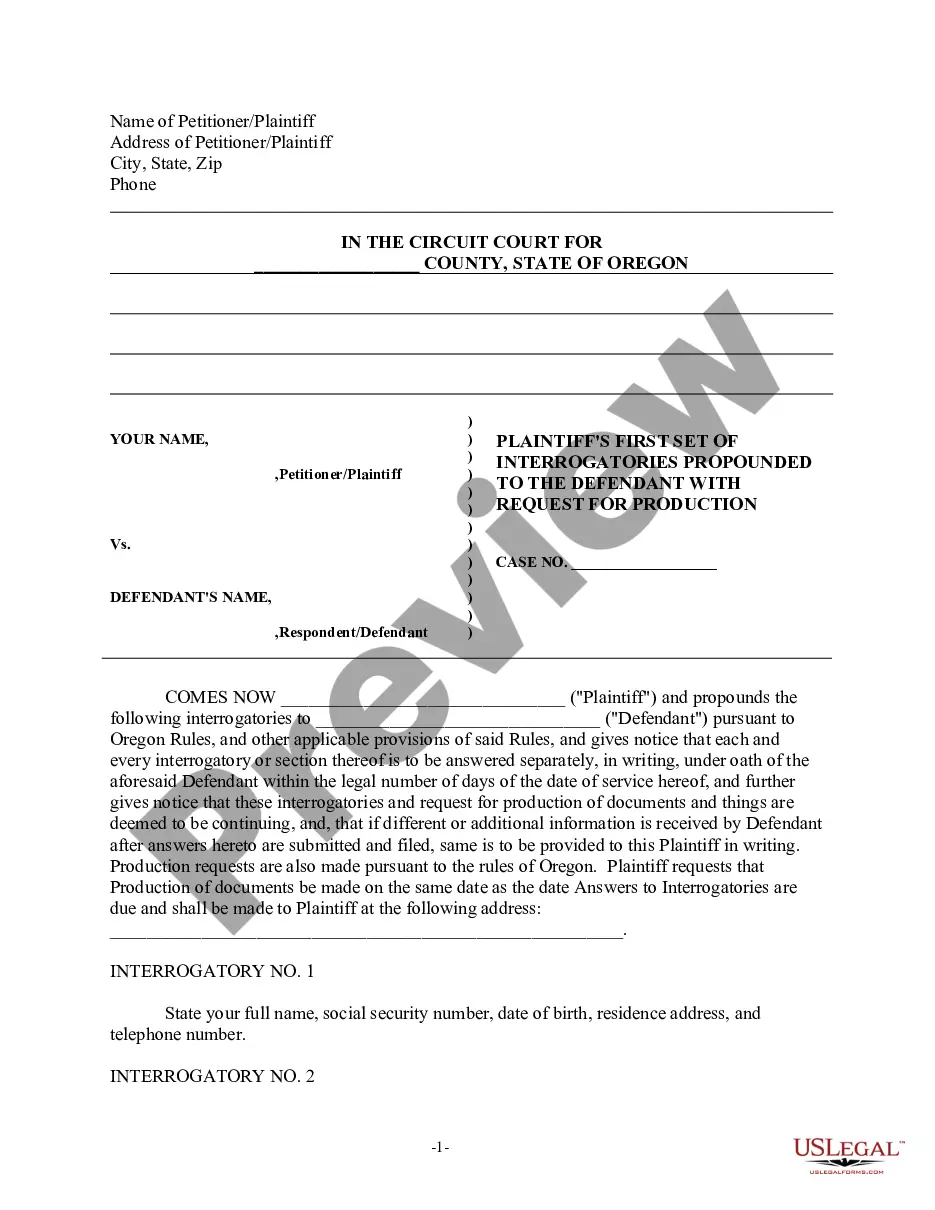

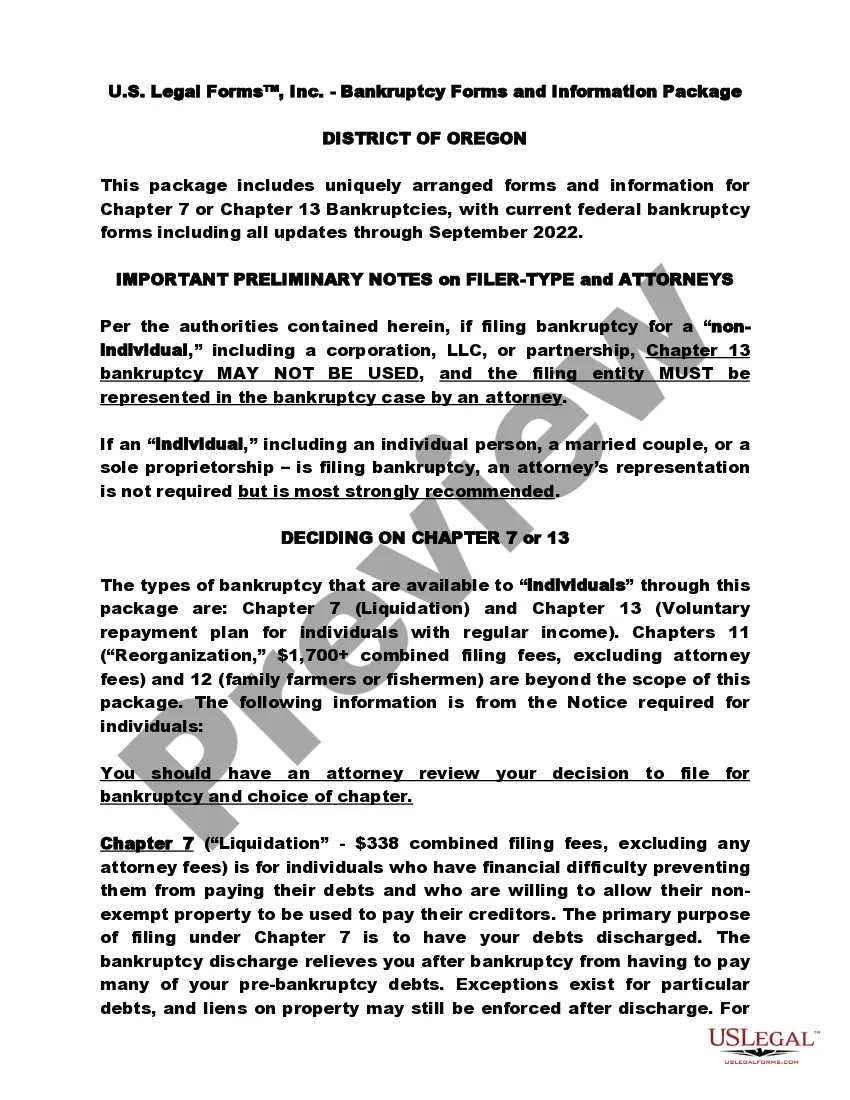

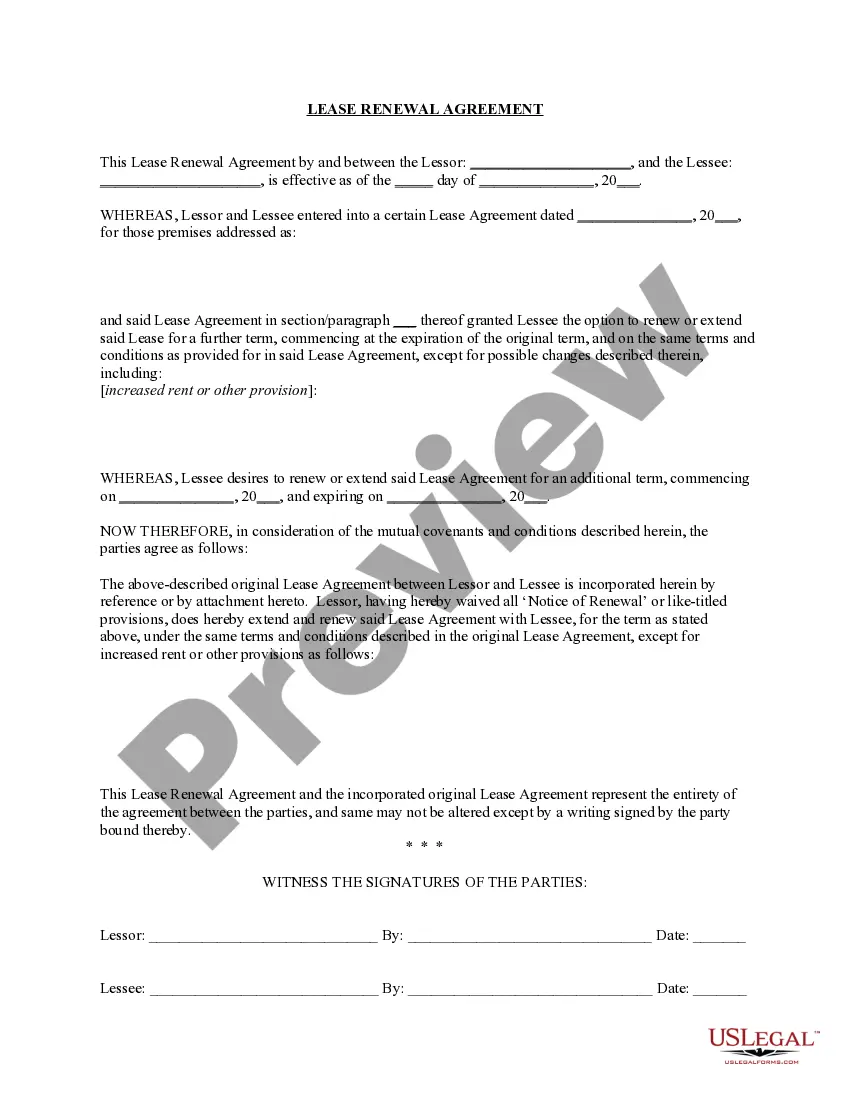

The Virginia Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines a borrower's promise to repay a loan with fixed interest in installments. This note is unsecured, meaning no collateral is required. It is essential for any loan agreement where the lender and borrower wish to define the terms of repayment in a formal and legally enforceable manner.

Main sections of this form

- Borrower's promise to pay a specified principal amount with interest.

- Details about the interest rate and how it will be applied to the unpaid principal.

- Schedule of monthly payments including the amount and due dates.

- Borrower's right to prepay the loan without a penalty.

- Consequences of late payments and default provisions.

- Methods for delivering notices between the borrower and the lender.

Situations where this form applies

This form is utilized when a borrower needs to formalize a loan agreement with a lender without the need for collateral. Common scenarios include personal loans, family loans, or informal agreements where both parties agree to the terms of repayment with fixed interest rates. It provides clarity and legal backing to both parties regarding the installment payments to be made.

Intended users of this form

- Individuals or businesses borrowing funds from a lender or private party.

- Lenders who want a formal agreement for unsecured loans.

- Anyone wishing to document the repayment terms clearly and legally.

- Borrowers who need to ensure their repayment terms are enforceable under Virginia law.

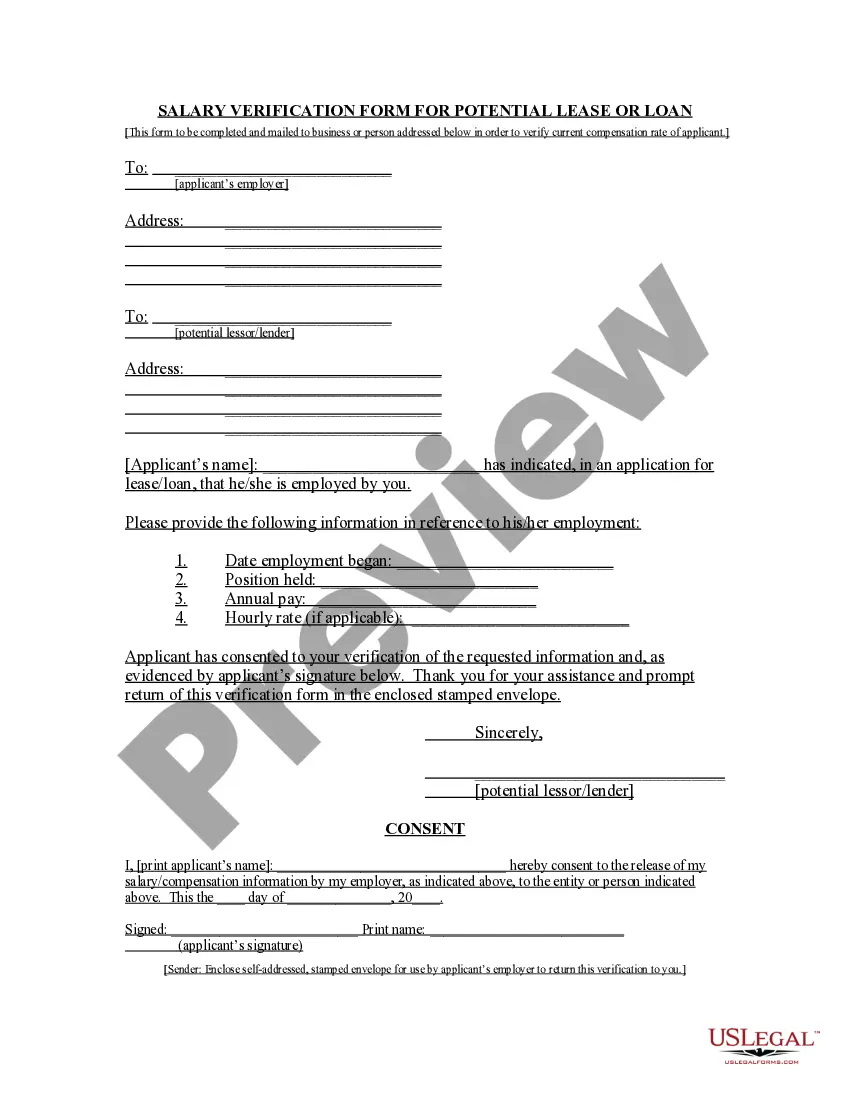

How to complete this form

- Enter the names and addresses of the borrower and lender at the top of the note.

- Specify the total principal amount of the loan and the fixed interest rate.

- Indicate the monthly payment amount and the payment start date.

- Include any late payment charges and terms for default.

- Have all parties sign the document to make it legally binding.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the interest rate clearly, leading to potential disputes.

- Not including the payment schedule or start date, which can create confusion.

- Omitting the borrower's right to prepay, which can affect repayment flexibility.

- Neglecting to sign the document, making it non-enforceable.

Benefits of using this form online

- Convenience of immediate access to the template for customization.

- Ease of editing to match specific terms agreed upon by both parties.

- Reliable format that adheres to legal standards for Virginia.

Looking for another form?

Form popularity

FAQ

What Is an Unsecured Credit Card? With an unsecured credit card, the issuer doesn't have a security deposit they can take if you don't pay your credit card balance. Instead, the creditor's options are to take further collection efforts.

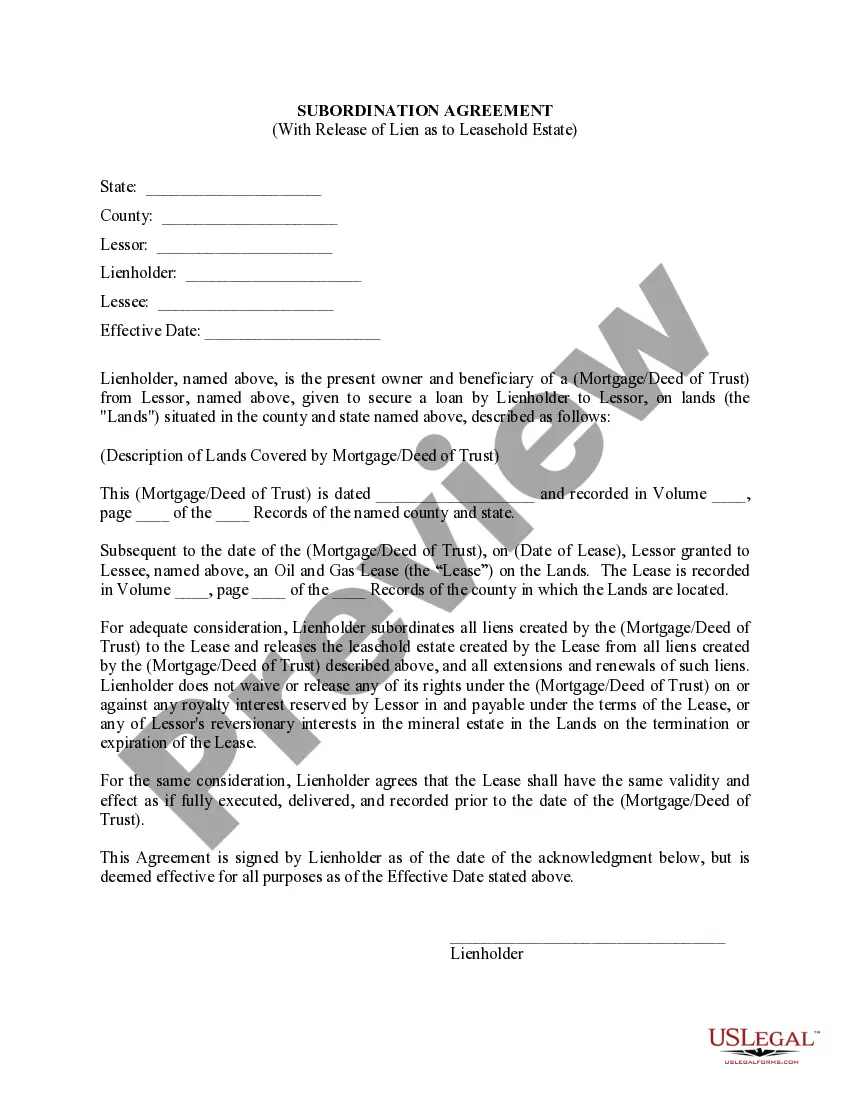

An "unsecured debt" is an obligation or debt that doesn't have specific property, like your house or car, serving as collateral for payment of the debt.A "secured debt," on the other hand, has a piece of property serving as collateral for the debt. If you fail to make payments, the creditor can take the property.

Insecure means lacking in security. Unsecured means not secured, not fastened, or not guaranteed.In your example the correct usage is insecure, meaning that the security of the system was found to be lacking.

Unsecure websites display the Not Secure warning which appears on all pages using the HTTP protocol, because it is incapable of providing a secure connection. Historically, this had been the primary protocol used for internet communication.

: not protected or free from danger or risk of loss : not secured unsecured cargo unsecured funds an unsecured loan. Synonyms & Antonyms More Example Sentences Learn More about unsecured.

Secure means safe, protected. Your money is secure in a bank. Supportive friends and family make you feel secure. Secure can also be used as a verb. You secure the sails before you take out the sailboat, which means you tie them down.

As nouns the difference between insecurity and security is that insecurity is a lack of security, uncertainty while security is (uncountable) the condition of not being threatened, especially physically, psychologically, emotionally, or financially.

Insecure means lacking in security. Unsecured means not secured, not fastened, or not guaranteed. Unsecure is not a word as far as I can tell. In your example the correct usage is insecure, meaning that the security of the system was found to be lacking.

What's the difference between secured and unsecured credit? Secured credit generally refers to credit that requires you to pledge something of value in order to secure the loan.On the other hand, an unsecured loan or line of credit doesn't require any collateral.