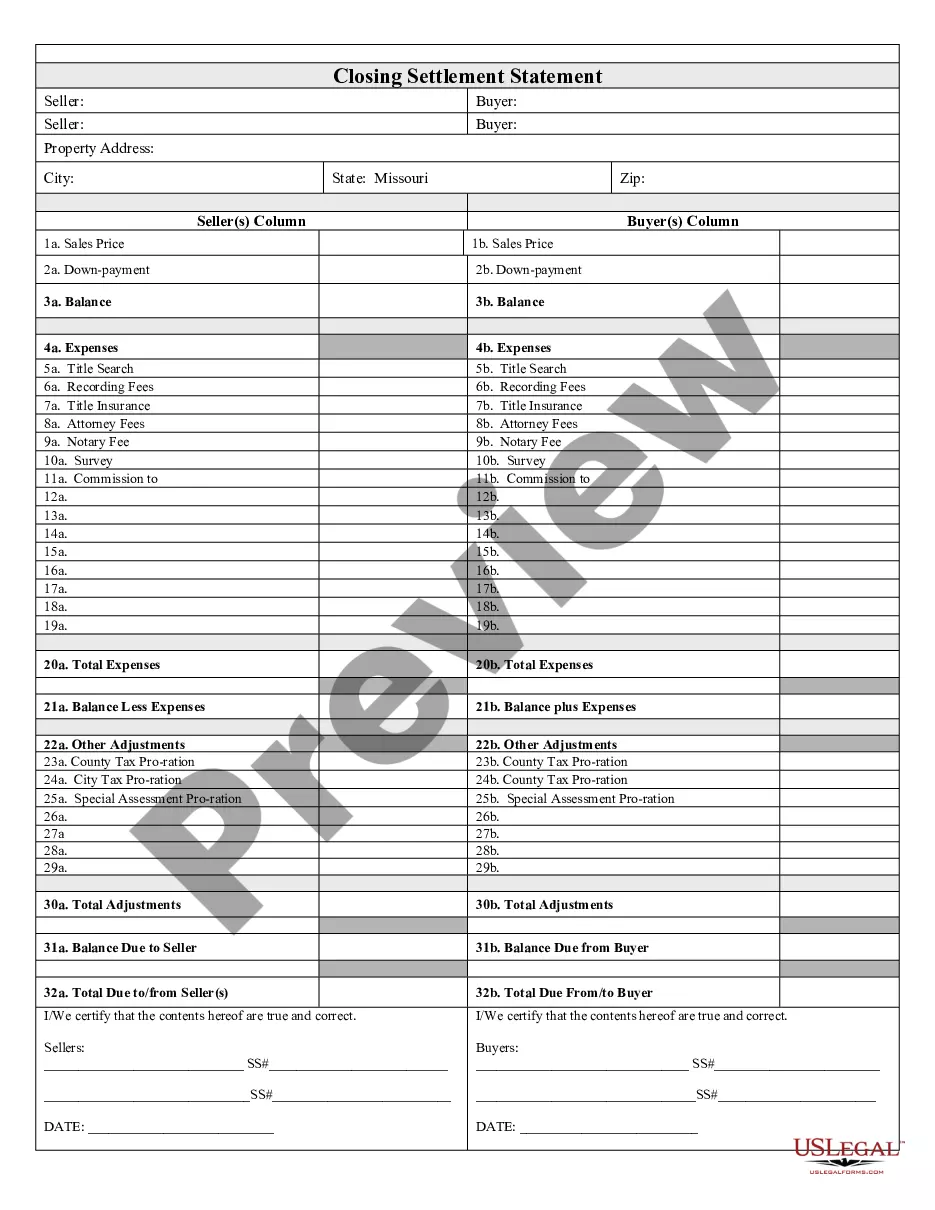

Missouri Closing Statement

About this form

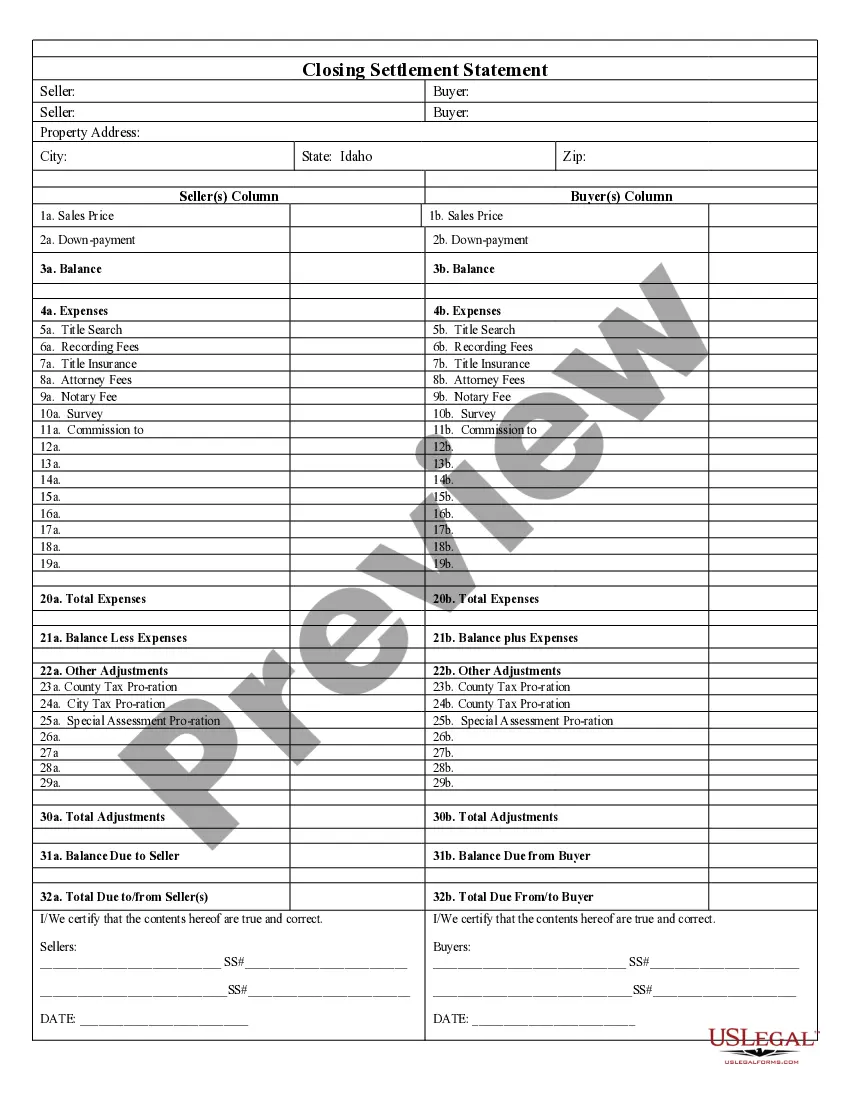

This Closing Statement is a crucial document used in real estate transactions involving either cash sales or owner financing. Unlike other forms, the Closing Statement details all financial transactions between the buyer and seller, ensuring transparency and accountability. It serves as a verified summary of all costs involved and must be signed by both parties to confirm accuracy.

What’s included in this form

- Balance: The net amount due after all expenses are deducted.

- Expenses: Detailed listing of all transaction costs including title search, recording fees, title insurance, attorney fees, and notary fees.

- Commissions: Any applicable real estate commissions paid to agents.

- Adjustments: Pro-rations for county and city taxes, special assessments, and other adjustments impacting the final amounts.

- Signatures: Certification from both seller and buyer affirming the completeness and accuracy of the statement.

When this form is needed

This form should be used during the final stages of a real estate transaction, particularly when a property is sold outright for cash, or when the buyer is seeking owner financing. It helps to clarify the financial obligations between the buyer and seller, including any fees or expenses that must be accounted for at closing.

Who this form is for

This Closing Statement is suitable for:

- Home buyers undertaking a cash purchase or using owner financing.

- Home sellers finalizing the sale of their property.

- Real estate agents involved in facilitating the transaction.

- Attorneys or legal representation for either party who need a summary of the expenses involved.

Steps to complete this form

- Identify the parties involved: Clearly state the names of the buyer and seller.

- List the property details: Include a description of the property being sold.

- Detail all expenses: Fill in each expense item, such as title search and recording fees, ensuring accurate amounts.

- Calculate total adjustments: Sum any adjustments related to taxes or credits due to either party.

- Obtain signatures: Have both buyer and seller sign and date the form to certify its accuracy.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately list all expenses, leading to potential disputes later.

- Not obtaining signatures from both parties, which can render the form invalid.

- Inaccurate calculations of totals and adjustments, resulting in financial discrepancies.

- Not keeping a copy for personal records after signing.

Benefits of using this form online

- Instant access to professionally drafted legal templates.

- Easy editing capabilities to tailor the form to your specific transaction.

- Reliability, with content drafted by licensed attorneys for legal compliance.

- Convenience of downloading the form immediately after completion.

Looking for another form?

Form popularity

FAQ

To obtain a copy of your house deed in Missouri, you should first contact the county recorder of deeds where your property is located. They maintain public records, including the Missouri Closing Statement for your property. You can request a copy in person or online, depending on the resources available in your county. If you prefer a more straightforward process, consider using US Legal Forms, which provides access to essential legal documents and guidance.

In Missouri, a licensed real estate salesperson can assist in the closing process, but they cannot conduct the closing themselves. Typically, a title company or an attorney manages the closing and prepares the Missouri Closing Statement. This ensures that all legalities are properly handled. If you're unsure about the closing process, consider using US Legal Forms for clear guidance and necessary documents.

Yes, a seller can back out of a real estate contract in Missouri, but certain conditions apply. If there are contingencies outlined in the contract, such as inspection or financing, the seller may have valid reasons to withdraw. However, doing so without a lawful reason may lead to legal consequences. Always refer to the Missouri Closing Statement for any obligations regarding the contract.

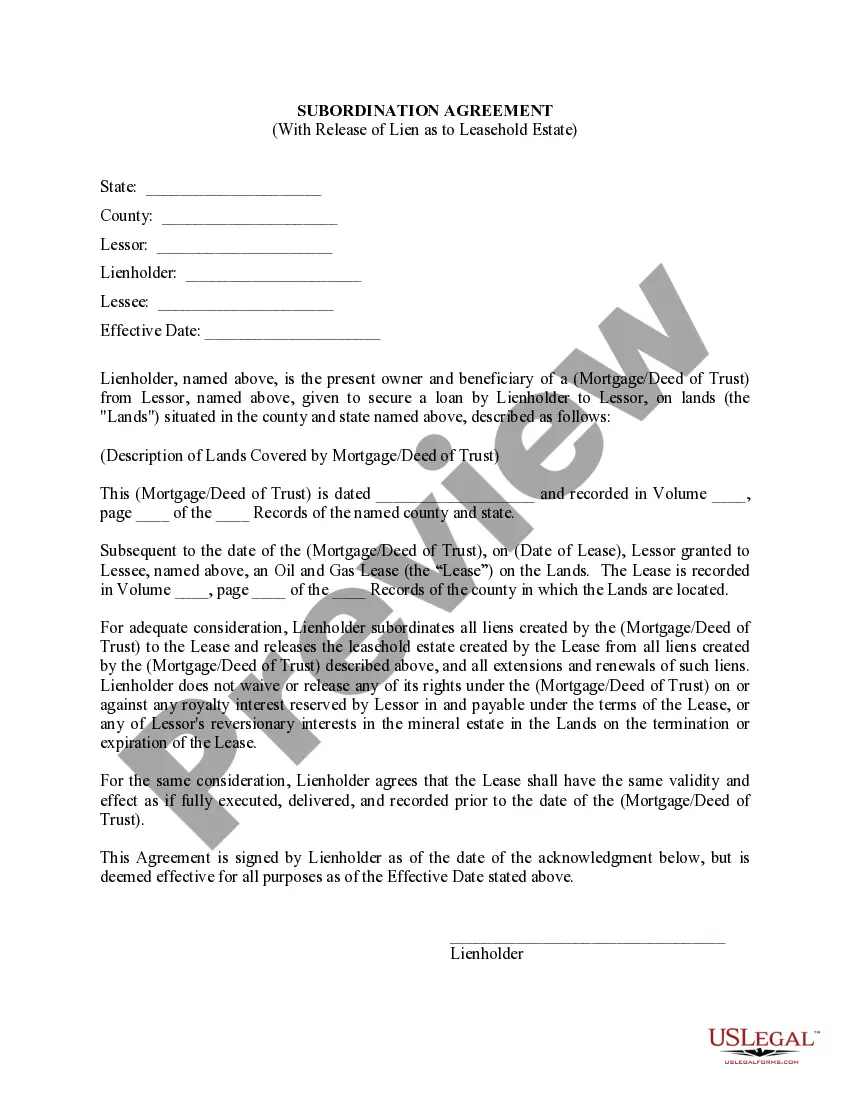

To file a lien on a property in Missouri, you must complete the necessary paperwork and submit it to the appropriate county recorder's office. The Missouri Closing Statement will often outline any existing liens, making it crucial for understanding your position before filing. Ensure you include all required information to avoid delays. If you need assistance with forms, US Legal Forms provides resources to help streamline the process.

Missouri is not a non-disclosure state when it comes to real estate transactions. This means that property sales prices are public information, which you can find in the Missouri Closing Statement. The transparency helps buyers and sellers understand market trends and property values. If you're navigating real estate in Missouri, knowing these details can empower your decisions.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents.

In the United States, a seller disclosure statement is a form disclosing the seller's knowledge of the condition of the property. The seller disclosure notice or statement is anecdotal and does not serve as a substitute for any inspections of warranties the purchaser may wish to obtain.

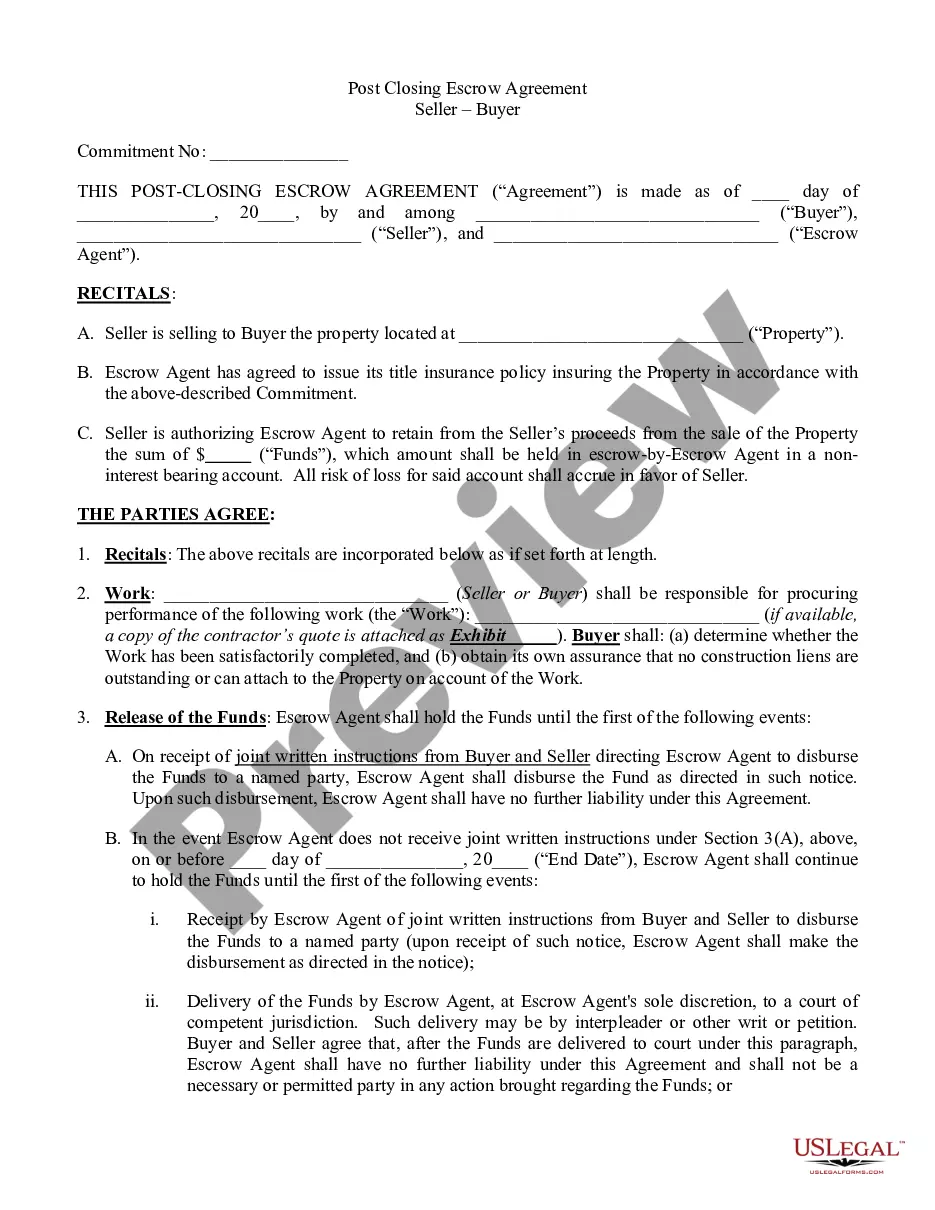

For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents. You may even give your attorney a power of attorney to sign any incidental documents for the escrowee.