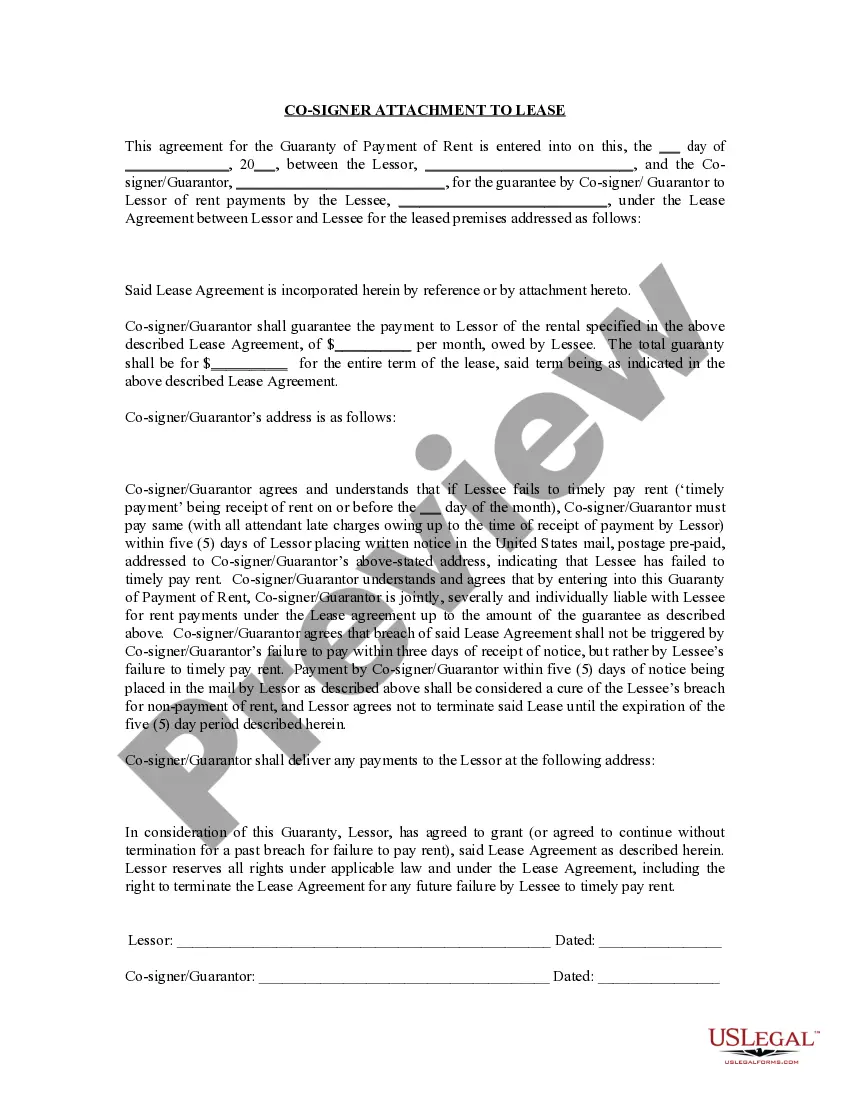

Virginia Landlord Tenant Lease Co-Signer Agreement

About this form

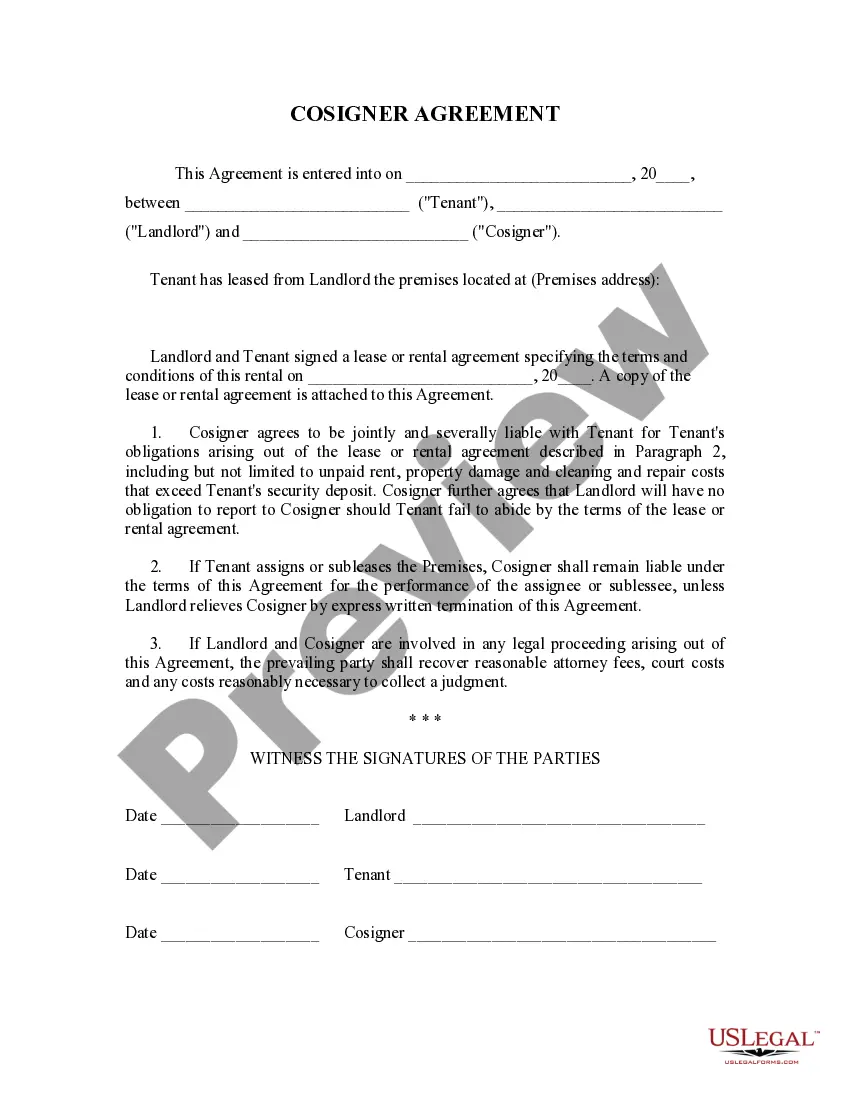

The Landlord Tenant Lease Co-Signer Agreement is a legal document that allows landlords to ensure that a cosigner will take on the financial responsibilities of a tenant if they fail to meet their obligations. This agreement not only makes the cosigner liable for unpaid rent but also for any damages incurred during the lease term. Unlike traditional lease agreements, this form specifically outlines the cosigner's role as a guarantor, providing additional security for landlords in rental transactions.

Key parts of this document

- Date of agreement entry.

- Identification of Tenant, Landlord, and Cosigner.

- Address of the leased premises.

- Conditions under which the cosigner remains liable for future tenants.

- Provision for recovery of attorney fees and costs in case of legal proceedings.

When to use this document

This form is essential when a landlord requires a cosigner to guarantee a tenant's lease. Typical scenarios include tenants with insufficient credit history, those without a stable income, or younger individuals who may not have an established rental background. Using this agreement provides added assurance to landlords that their financial interests are protected if the tenant defaults.

Who this form is for

- Landlords seeking a financial guarantee from a cosigner.

- Cosigners willing to assume financial responsibility for a tenant's lease.

- Tenants who may need a cosigner to secure a lease.

Completing this form step by step

- Identify the parties involved: Tenant, Landlord, and Cosigner.

- Specify the address of the leased premises.

- Enter the date the agreement is being made.

- Ensure all parties sign and date the agreement to validate it.

- Retain a copy of the signed agreement for future reference.

Is notarization required?

This form does not typically require notarization unless specified by local law. It's always best to check with your local regulations to ensure compliance.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all partiesâ names correctly.

- Not specifying the property address clearly.

- Missing signatures from one or more parties.

Benefits of completing this form online

- Convenience of downloading and printing the form immediately.

- Ability to edit the document as necessary before finalizing.

- Access to forms drafted by licensed attorneys, ensuring reliability.

Key takeaways

- The Landlord Tenant Lease Co-Signer Agreement adds a layer of financial security for landlords.

- It clarifies the responsibilities of all parties involved, promoting transparency.

- Accurate completion of this form is essential for legal enforceability.

- Online access to the form streamlines the process of obtaining legal documentation.

Looking for another form?

Form popularity

FAQ

According to Nolo, a cosigner is a person designated to make the rental payments if the tenant does not pay.However, if a lease doesn't have this provision, then the only people who need to sign the lease are the people responsible for paying the rent.

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.You will owe more debt: Your debt could also increase since the consignee's debt will appear on your credit report.

Co-signing a lease means that a third-party individual like a parent, sibling or friend assumes the responsibility of the lease if the primary lessee is unable to do so. As a co-signer, this means that you'll be responsible for ensuring that the rent is paid and fulfilled.

Some landlords agree to consider cosigners as long as they pass a background check, while other landlords don't allow them at all. Since there are no laws that require you to accept a cosigner, according to RentPrep, it's up to you to determine what makes the most sense for your property.

As a general rule, unlike so many things in life, co-signing is pretty much forever. In the case of a lease, this means that the co-signer is responsible for the lease for the duration of the agreement, whether it's a six-month lease, a yearlong lease or for some other period.

As a cosigner on a lease, you're not only helping someone out, you're taking on a ton of risk. For instance, if the lease holder doesn't make their payments on time, it will negatively affect your credit report and credit score.

Co-signers have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the primary signer is unable to make the rental payment.

The cosigner, simply by signing on to the debt, is liable for the debt without the creditor needing to to take any additional actions. The guarantor is only liable for the debt after the creditor has exhausted all other options of collections from the original borrower.

A co-signer is a third party who is responsible if you are unable to pay rent. This person does not typically live in the apartment with you, but he or she is equally liable for your lease.