Utah Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements

Understanding this form

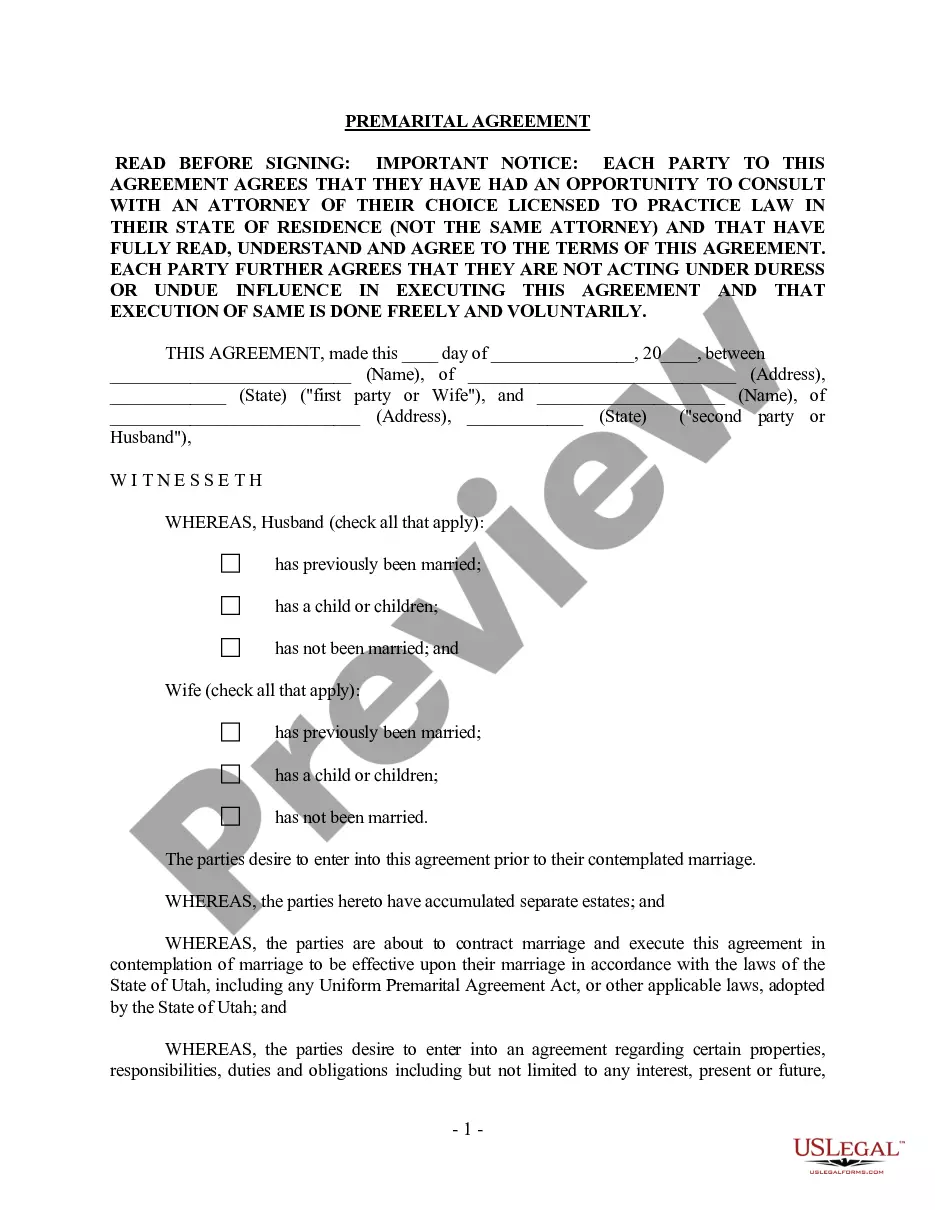

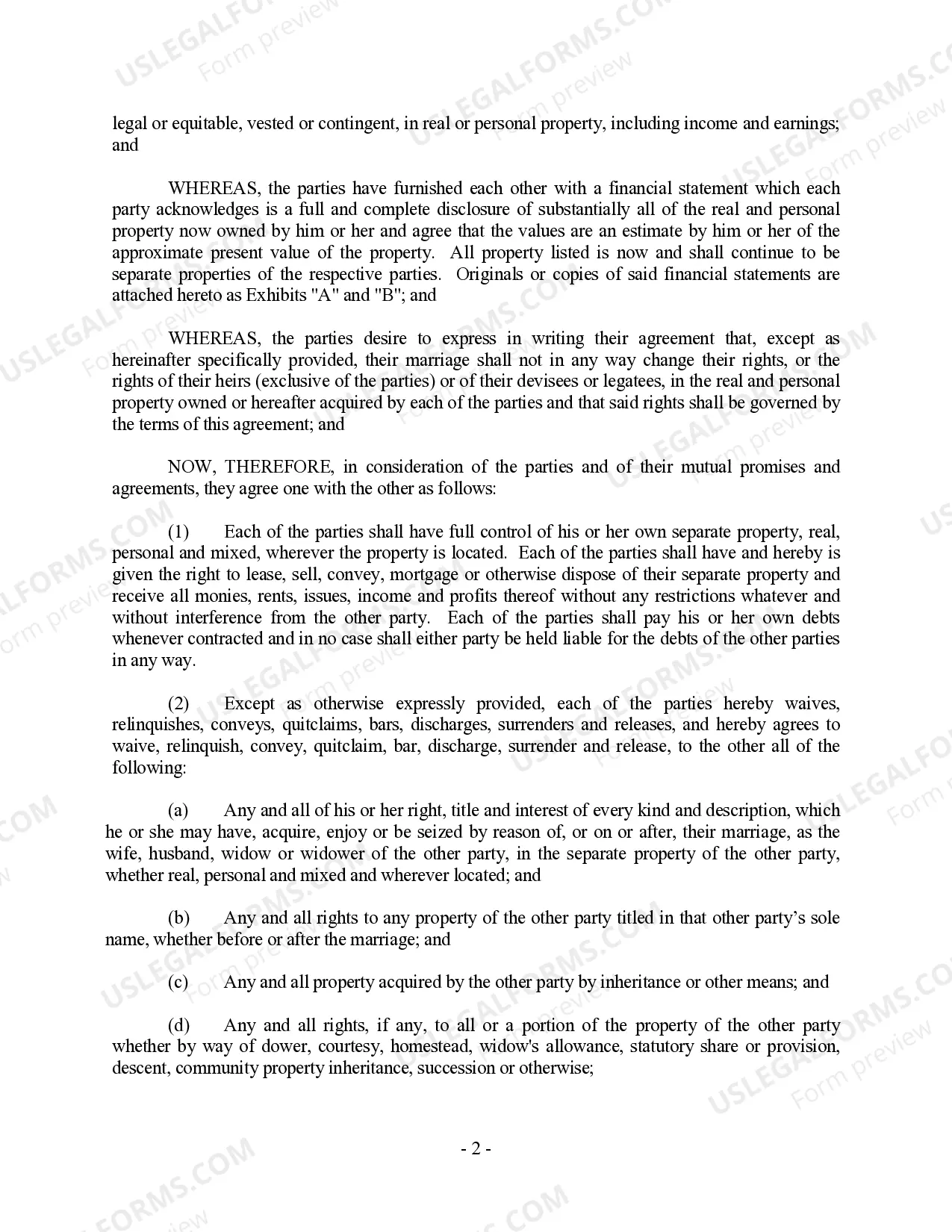

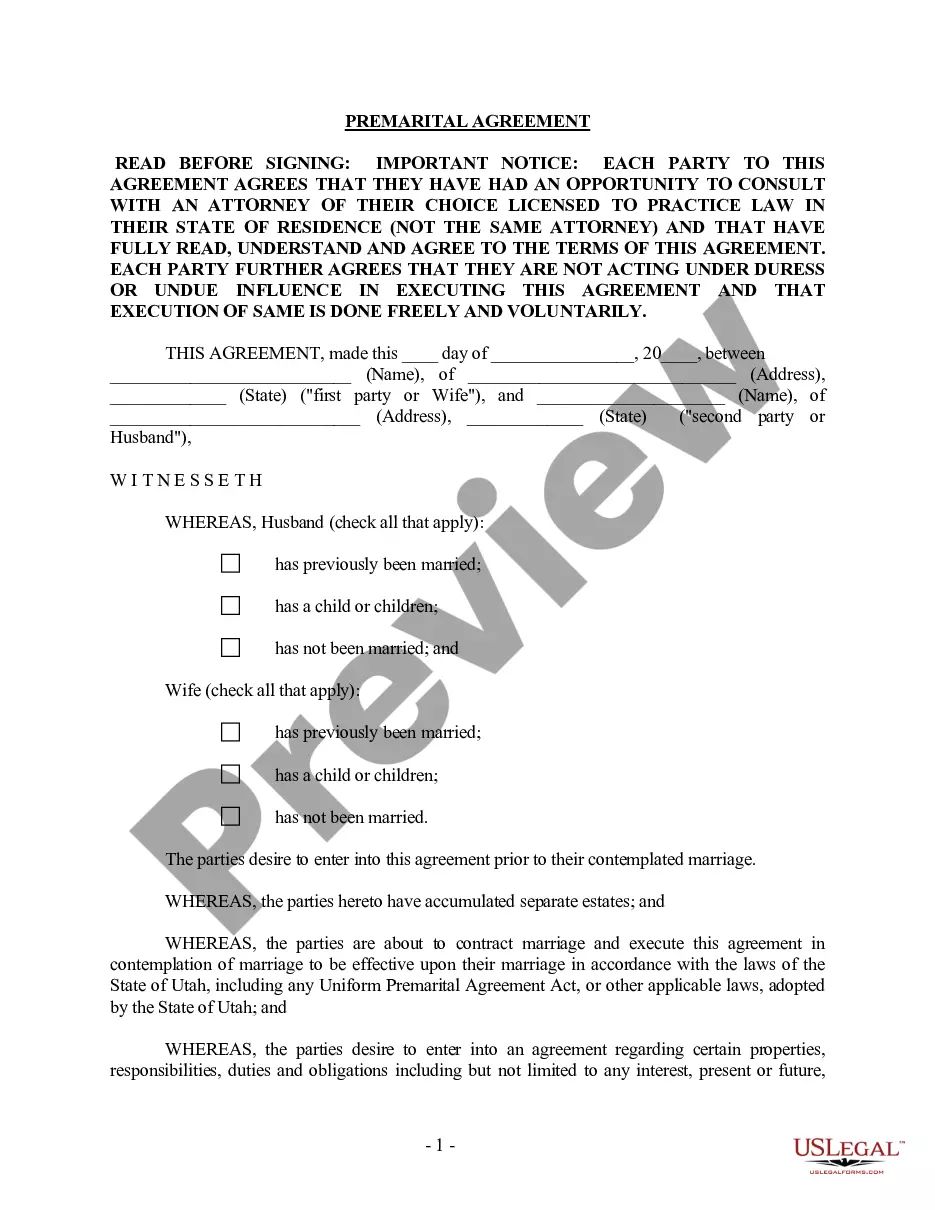

The Utah Prenuptial Premarital Agreement is a legal document designed to outline the financial rights and responsibilities of each partner before marriage. This form, compliant with the Uniform Premarital Agreement Act, differs from standard agreements by including financial statements that provide transparency regarding each party's assets and liabilities. It serves to protect individual property rights in the event of divorce or death, ensuring that both parties are aware of their financial standings and how assets will be managed during and after the marriage.

Key parts of this document

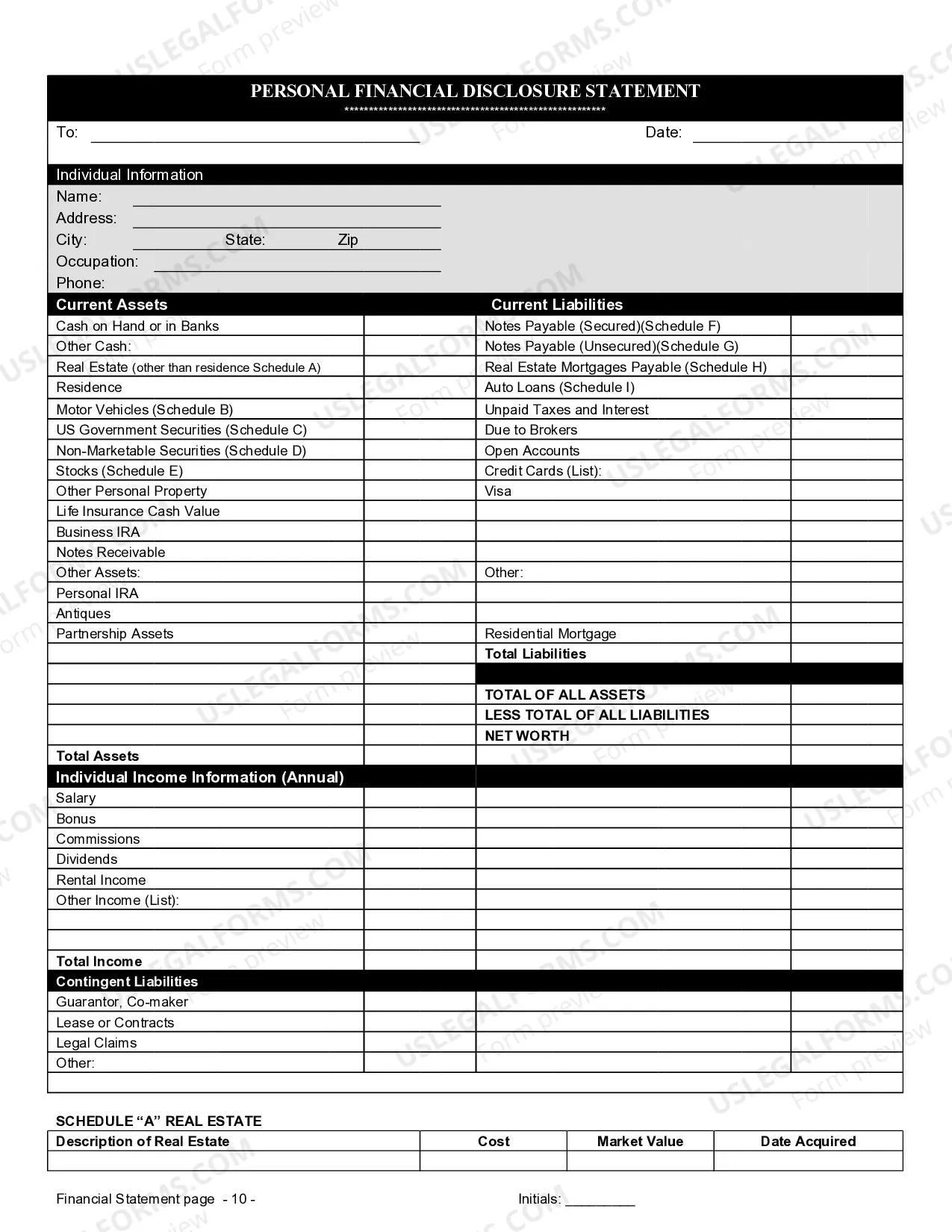

- Disclosure of assets and debts through the attached financial statements.

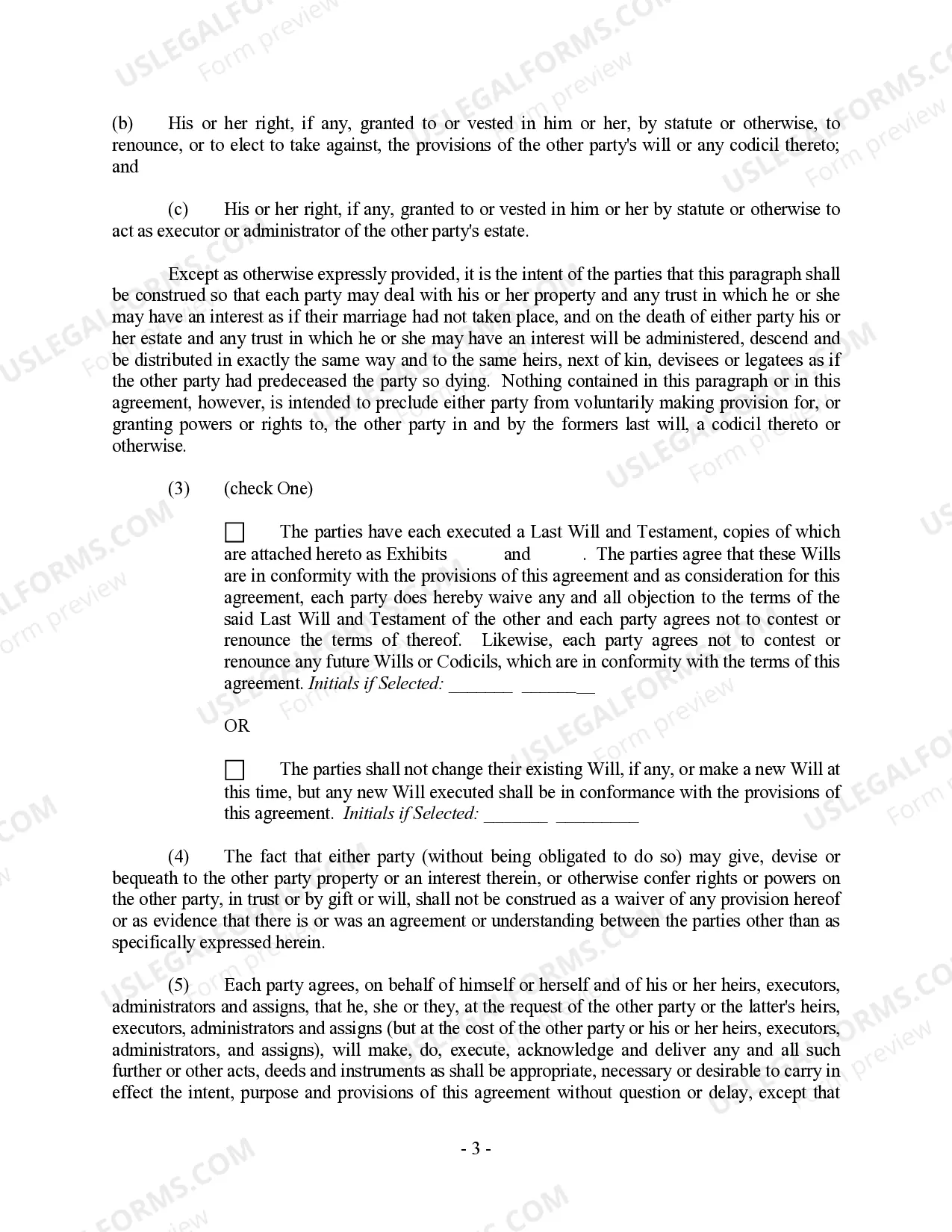

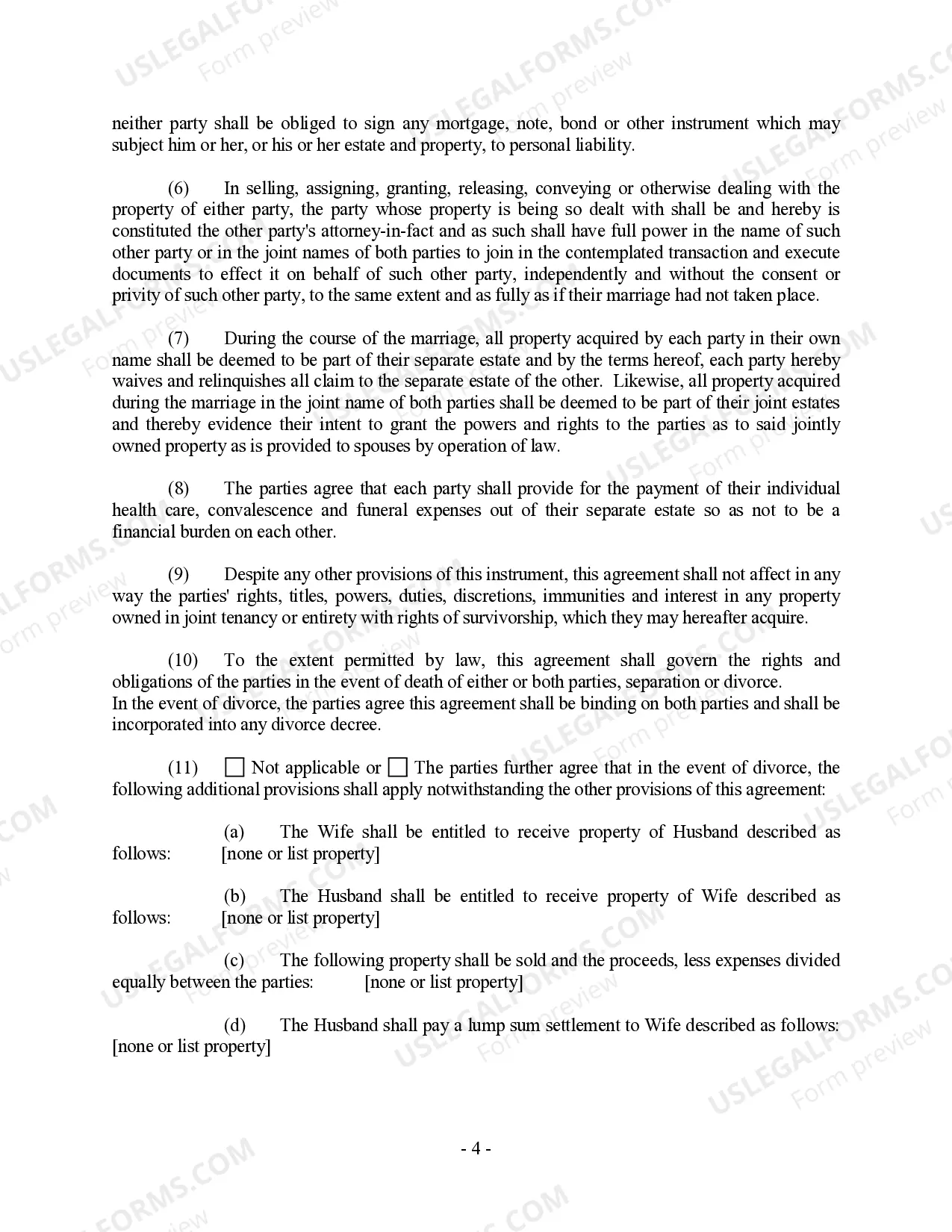

- Provisions specifying the control and ownership of separate and jointly acquired property.

- Rights and responsibilities of each party during the marriage and in the event of divorce.

- Clauses that address financial obligations relating to healthcare and funeral expenses.

- Conditions under which the agreement can be amended or revoked.

When to use this document

This form is beneficial when couples wish to clarify and protect their financial interests prior to marriage. It is particularly useful for individuals who have been previously married, those with considerable assets or debts, or couples who want to avoid financial disputes should the marriage dissolve. It ensures that both parties understand their rights and obligations, giving them peace of mind as they enter into their marriage.

Intended users of this form

- Couples planning to marry who want to define their financial rights and obligations.

- Individuals who have significant assets or children from previous relationships.

- Partners wishing to protect family businesses or inheritances.

- Any couple wanting transparency about their financial situations before marriage.

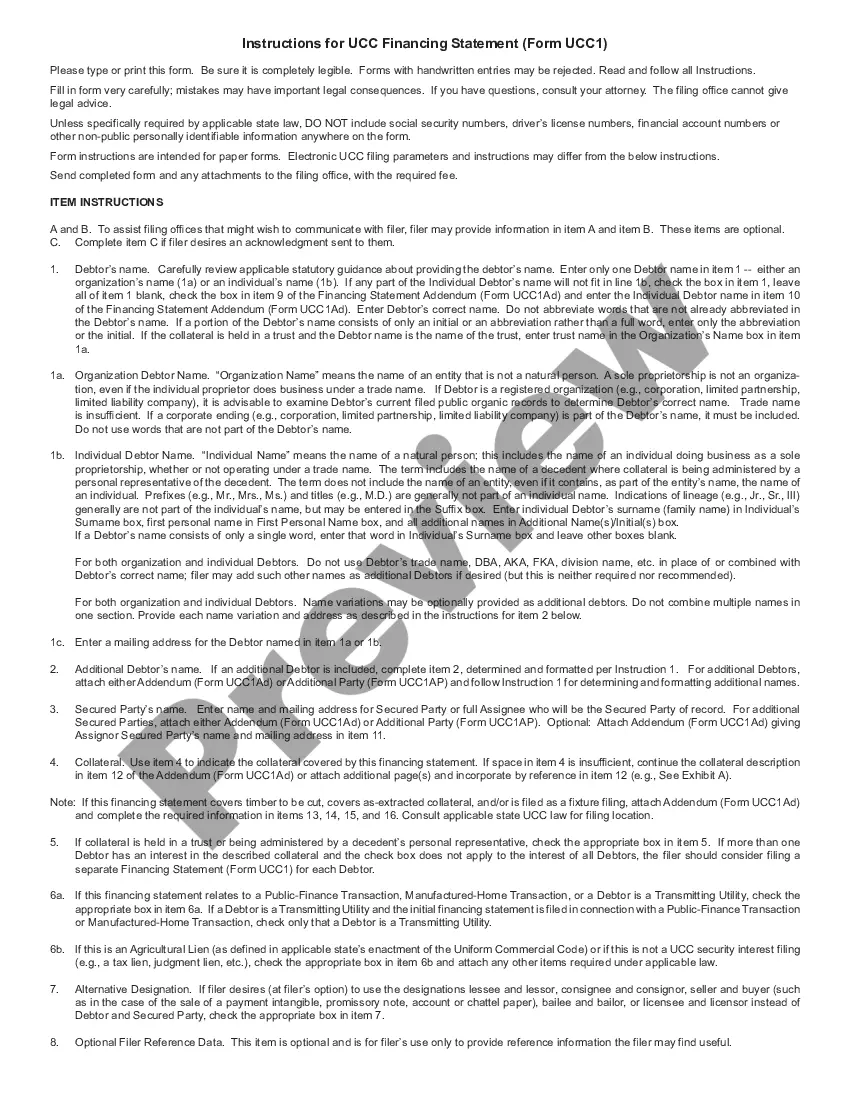

Completing this form step by step

- Identify the parties involved by filling in their names and addresses at the beginning of the form.

- Each party should check off applicable boxes regarding previous marriages or children.

- Complete the attached financial statements, disclosing all assets and debts accurately.

- Both parties must review the agreement thoroughly and consult with separate legal counsel, if desired.

- Sign and date the agreement in the presence of a notary public to ensure its validity.

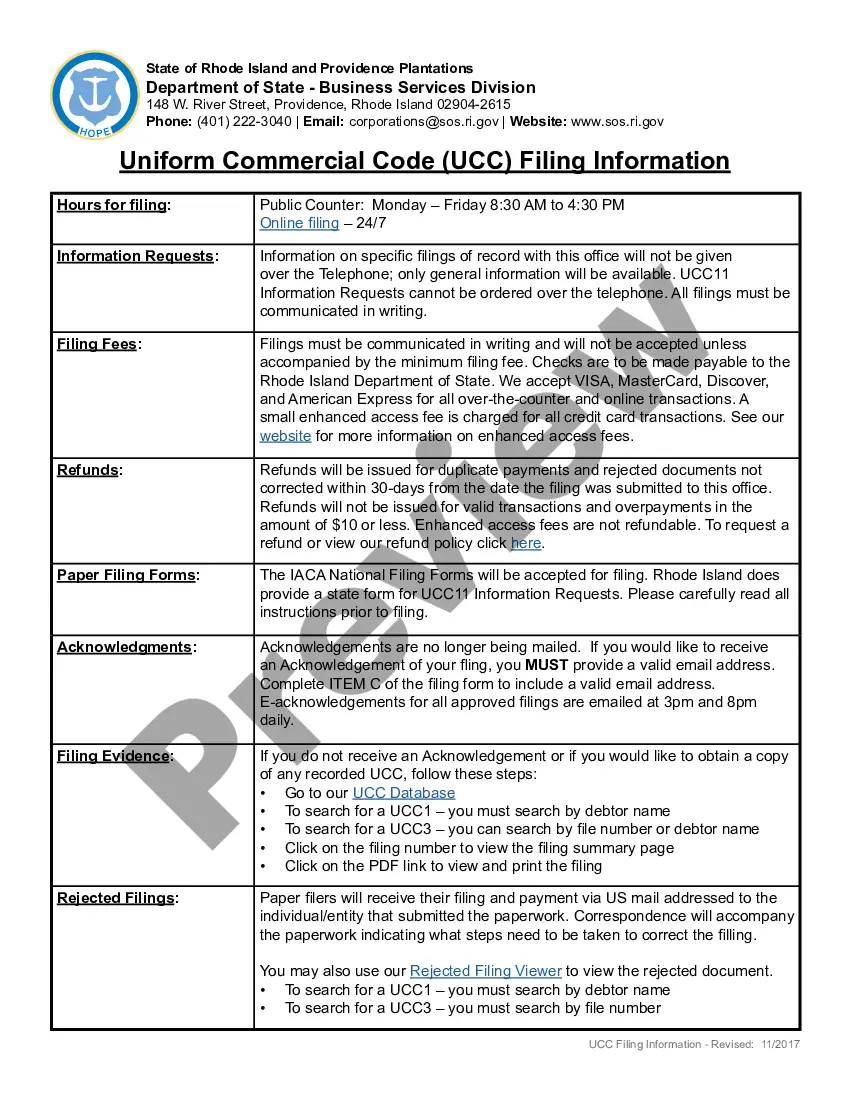

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to fully disclose all assets and debts on the financial statements.

- Not consulting with separate legal counsel, which could lead to disputes on enforceability.

- Overlooking the notarization requirement, which can invalidate the agreement.

- Signatures not being witnessed or acknowledged properly.â

Why complete this form online

- Easy access to legal templates drafted by licensed attorneys, saving time and reducing legal costs.

- Ability to customize the agreement to meet individual needs and circumstances.

- Secure online notarization services available for added convenience.

- Immediate downloads, allowing for quick completion and execution of the form.

Looking for another form?

Form popularity

FAQ

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

A prenup cannot include child support or child custody issues.A court would never uphold a provision of a prenuptial agreement that dealt with child support, child custody, or visitation, because these are issues of public policy.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

A prenuptial agreement ("prenup" for short) is a written contract created by two people before they are married. A prenup typically lists all of the property each person owns (as well as any debts) and specifies what each person's property rights will be after the marriage.

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

The three most common grounds for nullifying a prenup are unconscionability, failure to disclose, or duress and coercion.Duress and coercion can also invalidate a prenup. If the prenup was signed the day before your wedding, it may appear that the parties didn't have much time to fully review the agreement.