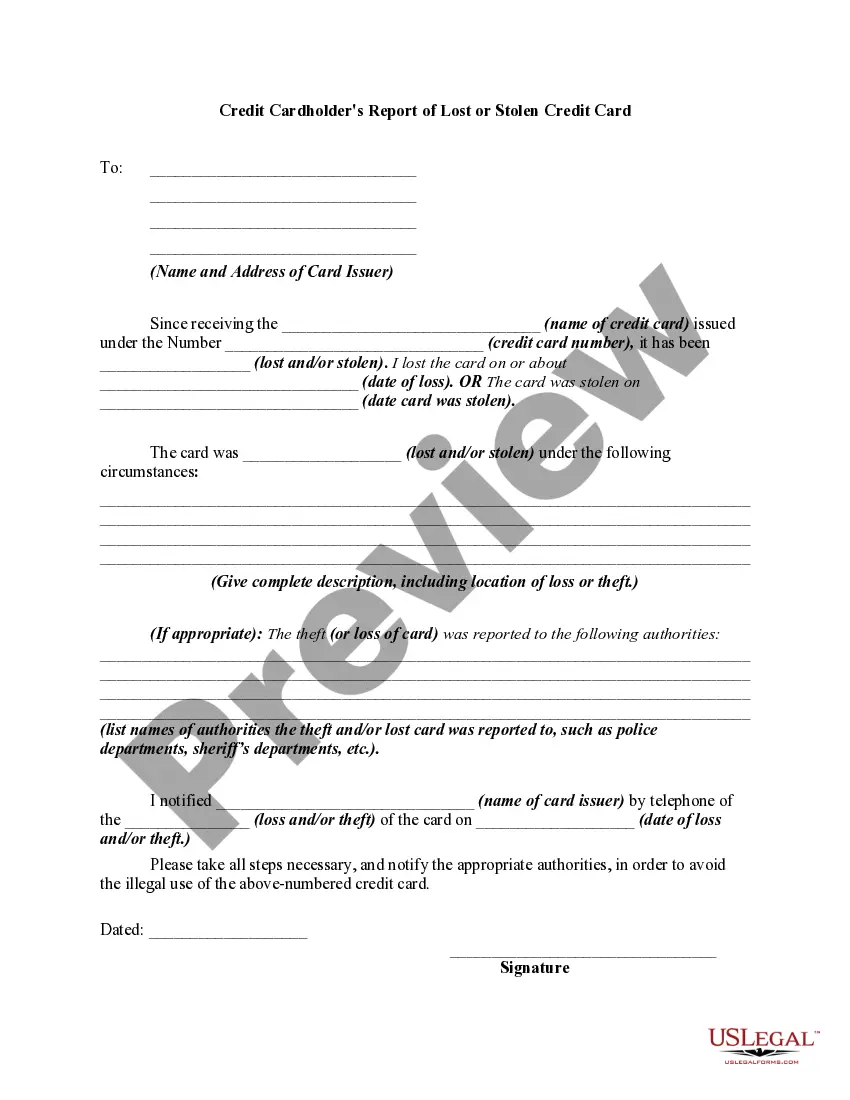

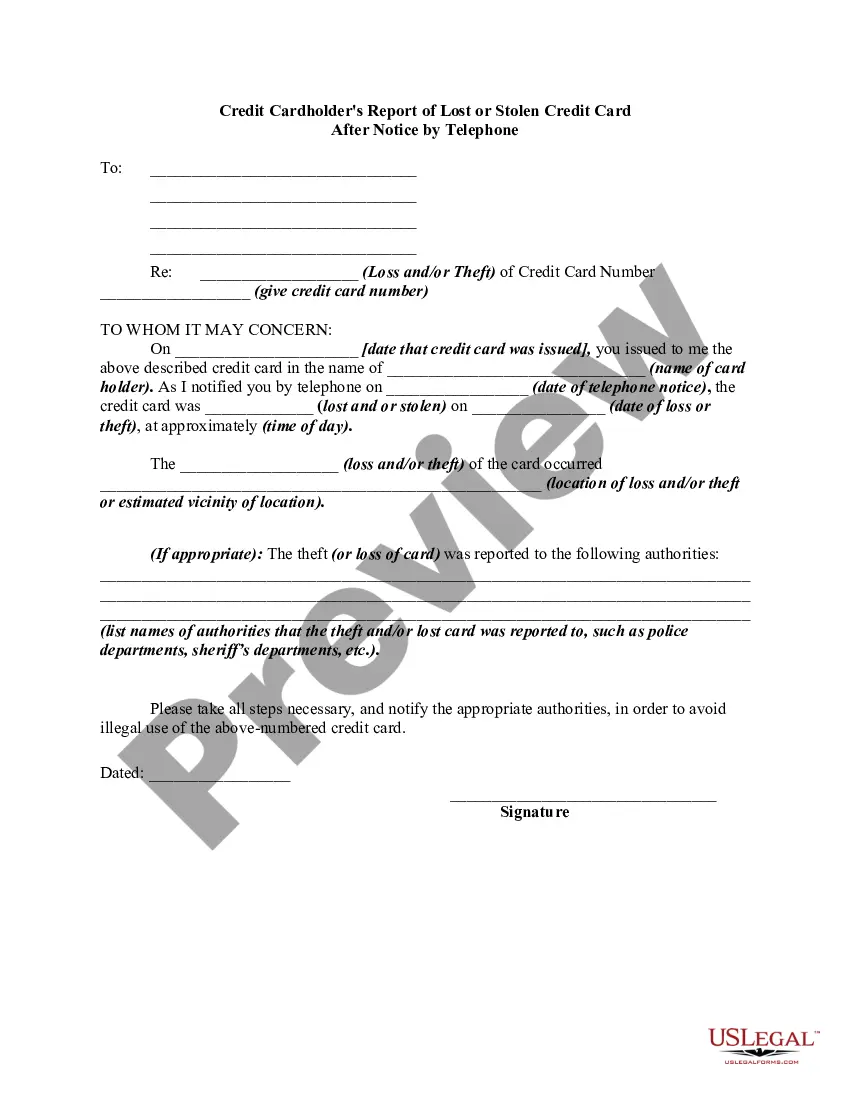

Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

Aren't you sick and tired of choosing from countless samples every time you need to create a Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone? US Legal Forms eliminates the lost time millions of American citizens spend browsing the internet for suitable tax and legal forms. Our skilled group of lawyers is constantly modernizing the state-specific Samples collection, so that it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete simple steps before being able to get access to their Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone:

- Utilize the Preview function and look at the form description (if available) to ensure that it’s the appropriate document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for your state and situation.

- Utilize the Search field on top of the site if you have to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your document in a required format to finish, create a hard copy, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever file you need for whatever state you want it in. With US Legal Forms, finishing Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone samples or other legal documents is not hard. Begin now, and don't forget to recheck your examples with certified lawyers!

Form popularity

FAQ

The police will carry out an investigation into stolen credit cards when they have found a suspect during their initial investigations. One thing about credit card fraud is that the majority of them occur on a wide scale especially overseas. More often than not, such cases are handled by the American secret service.

Credit card companies can track where your stolen credit card was last used, in most cases, only once the card is used by the person who took it. The credit card authorization process helps bank's track this. However, by the time law enforcement arrives, the person may be long gone.

Credit card companies can track where your stolen credit card was last used, in most cases, only once the card is used by the person who took it. The credit card authorization process helps bank's track this. However, by the time law enforcement arrives, the person may be long gone.

If you report a lost or stolen credit card before it is used, the card company cannot hold you responsible for any unauthorized charges. If there is unauthorized use of your card before you report it missing, the most you will owe for unauthorized charges on the card is $50.

1. Call your credit card issuer.Under the Fair Credit Billing Act (FCBA), you cannot be held liable for any transactions that occur once you report your card missing. However, if someone uses your card before you report it, the law limits your liability to $50.

Using a stolen credit card is a serious crime that carries serious penalties. Even if the card was not stolen, per se, but rather found on the sidewalk, using the card is still illegal in all 50 states.Most states however do differentiate between when using a stolen credit card is a misdemeanor or felony.

Reporting an unauthorized transaction notify your bank or credit card issuer immediately. report any transactions you didn't make or approve. check your credit report for any credit you didn't apply for.

In addition to the identity theft itself, criminals can be punished under federal law for using devices that facilitate fraudulent activity, such as skimmers or other counterfeit access devices.Minor offenses can result in fines, jail time, or both, but felony-level credit card theft and fraud can lead to prison.

While police often do not have the jurisdiction to go after credit card fraud, that does not mean that you are without protection. With federal protection from liability and most card issuers offer zero liability protection, you will rarely have to pay anything in cases of fraud.