This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Texas Renunciation And Disclaimer of Property - Community Property Interest

Description

Key Concepts & Definitions

Renunciation and Disclaimer of Property refers to the legal act of voluntarily giving up or disclaiming rights to an inheritance, including property, assets, or an estate. This commonly occurs when the beneficiary wants to avoid taking ownership for reasons such as high liabilities associated with the property, tax implications, or personal beliefs.

Step-by-Step Guide to Renunciate Property

- Understand the Implications: Research and understand the potential financial and legal consequences of renouncing an inheritance.

- Obtain Legal Advice: Consulting a lawyer experienced in estate planning is crucial to navigate the complexities.

- Prepare the Disclaimer: Draft a renunciation or disclaimer form, which must state clearly that the decision is irrevocable and complete.

- Timing: Submit the disclaimer form within nine months of receiving the inheritance, as required by U.S. federal law.

- File Appropriately: File the disclaimer with the relevant court or legal entity handling the estate.

- Notify Affected Parties: Inform the executor of the estate and any other relevant parties about the disclaimer.

Risk Analysis in Property Renunciation

Renouncing property or an estate includes risks like loss of asset value that could be beneficial, potential legal disputes from other beneficiaries, and irreversible decisions affecting future financial health. Alternatively, it helps avoid assuming responsibility for debts or other liabilities associated with the property.

Key Takeaways

- Renunciation of property needs careful consideration and legal advice.

- Follow legal timelines and procedures strictly to avoid unintentional acceptance of an inheritance.

- Understanding the financial and legal implications can prevent future complications.

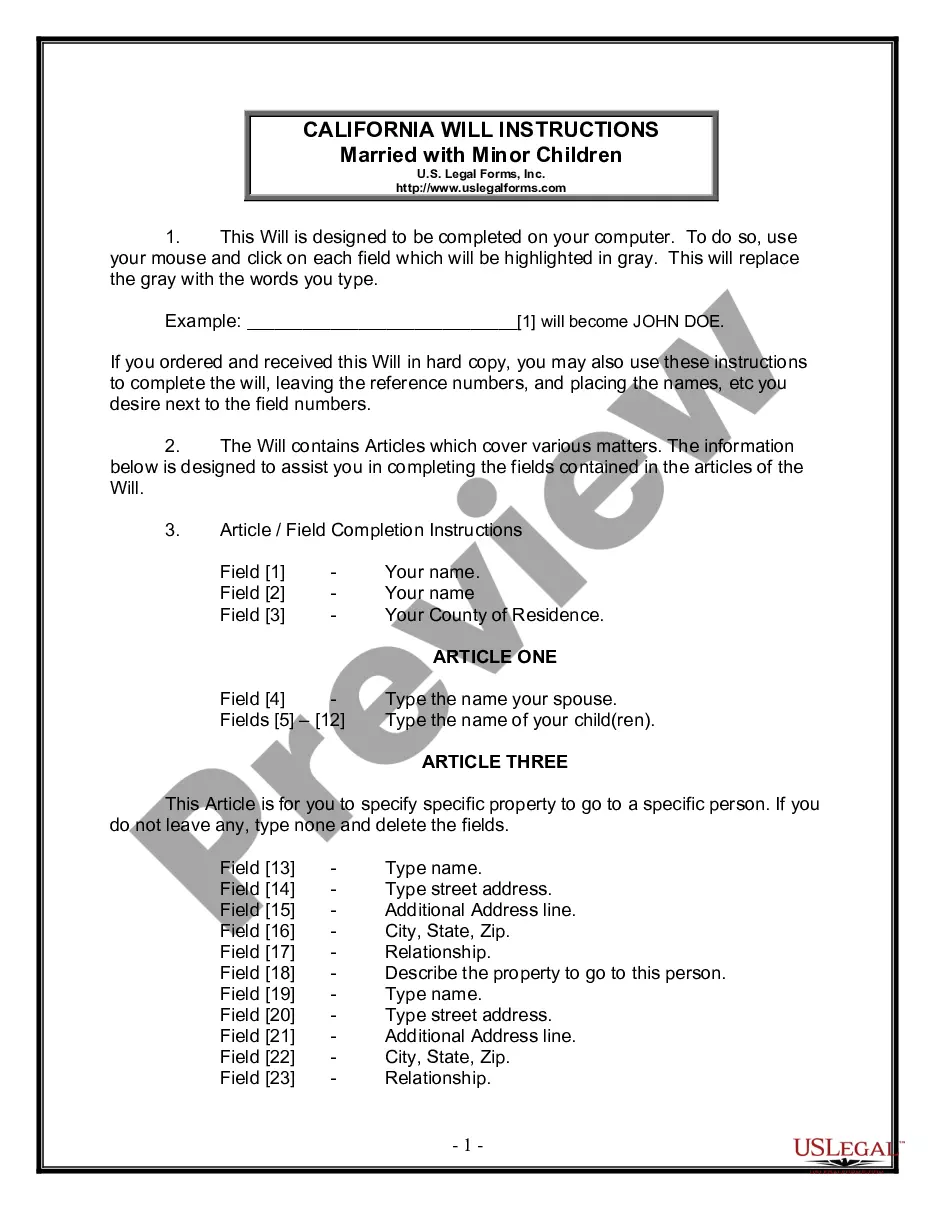

How to fill out Texas Renunciation And Disclaimer Of Property - Community Property Interest?

Access to high quality Texas Renunciation And Disclaimer of Property - Community Property Interest samples online with US Legal Forms. Avoid hours of lost time looking the internet and dropped money on files that aren’t updated. US Legal Forms gives you a solution to just that. Find more than 85,000 state-specific legal and tax templates that you could download and submit in clicks in the Forms library.

To find the example, log in to your account and click Download. The document will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Texas Renunciation And Disclaimer of Property - Community Property Interest you’re considering is suitable for your state.

- Look at the form making use of the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by card or PayPal to finish making an account.

- Choose a preferred file format to download the document (.pdf or .docx).

Now you can open up the Texas Renunciation And Disclaimer of Property - Community Property Interest template and fill it out online or print it out and get it done by hand. Consider mailing the document to your legal counsel to ensure everything is filled in properly. If you make a error, print out and fill application again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access far more templates.

Form popularity

FAQ

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Be in writing; Declare the refusal to accept an interest in or power over the property; Describe the interest or power disclaimed; Be signed by the person making a disclaimer;

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Note that inheritances from a trust typically cannot be assigned to someone else.That means it could go to the next person in the line of succession, such as the children of the person who disclaims the inheritance. There are legal restrictions on disclaiming an inheritance. There are time constraints, for example.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,