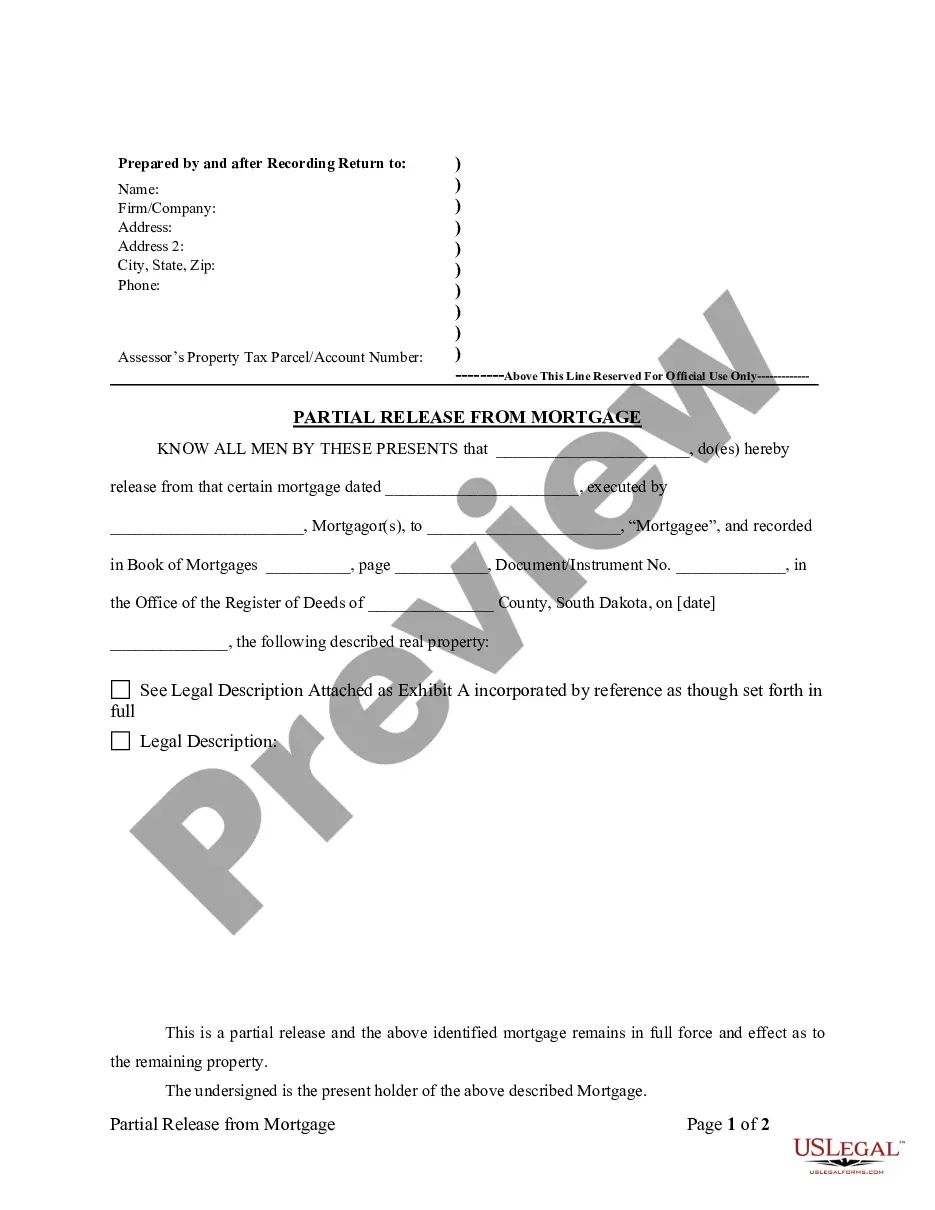

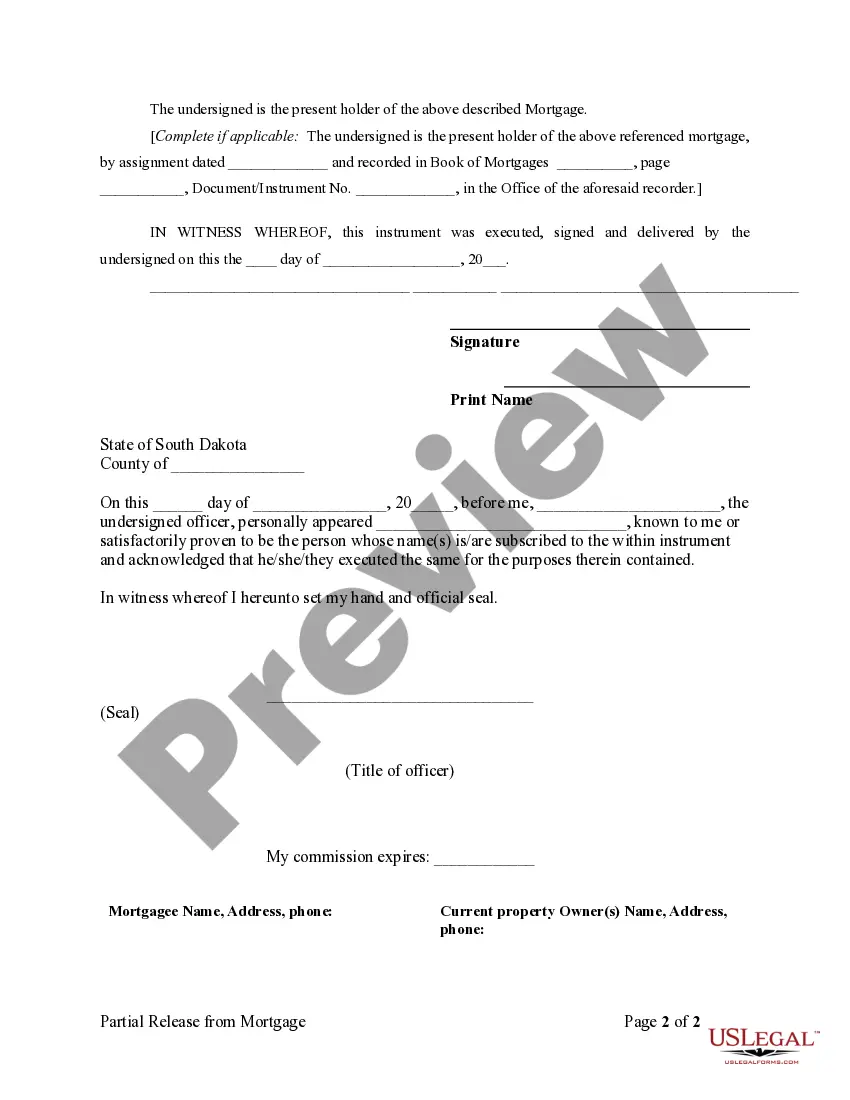

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

South Dakota Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out South Dakota Partial Release Of Property From Mortgage By Individual Holder?

Get access to high quality South Dakota Partial Release of Property From Mortgage by Individual Holder forms online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific authorized and tax forms that you could save and fill out in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the South Dakota Partial Release of Property From Mortgage by Individual Holder you’re looking at is suitable for your state.

- See the sample making use of the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by credit card or PayPal to complete creating an account.

- Choose a preferred format to save the document (.pdf or .docx).

Now you can open up the South Dakota Partial Release of Property From Mortgage by Individual Holder template and fill it out online or print it out and do it yourself. Think about giving the file to your legal counsel to ensure everything is filled in correctly. If you make a mistake, print and complete application again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

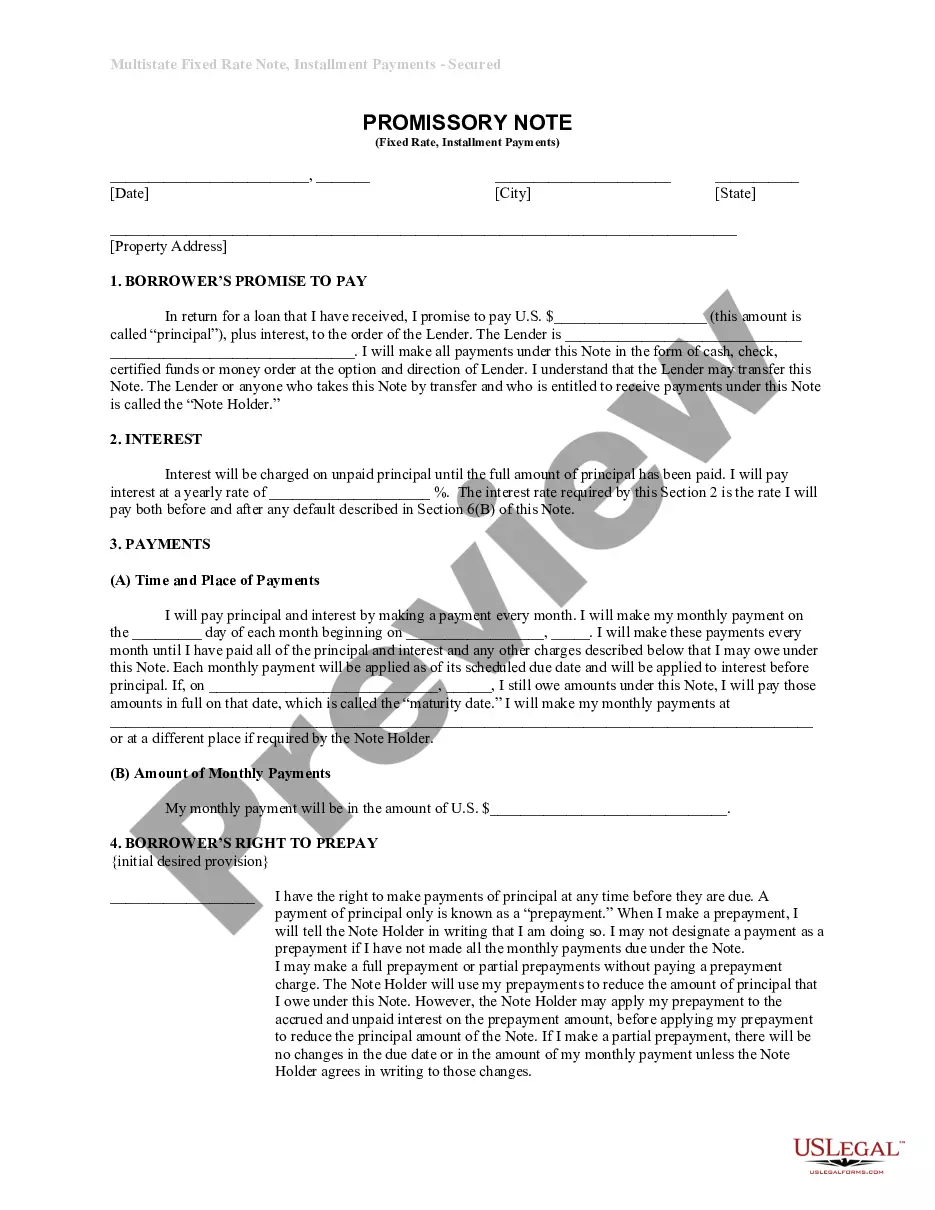

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A deed of release is a legal document that removes a previous claim on an asset.A deed of release might be included when a lender transfers the title of real estate to the homeowner upon satisfaction of the mortgage. A deed of release literally releases the parties from previous obligations.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A partial discharge is when you have more than one property that is secured by a loan, and you would like to release one of those properties as security, without repaying the full loan.

A release clause is a term that refers to a provision within a mortgage contract. The release clause allows for the freeing of all or part of a property from a claim by the creditor after a proportional amount of the mortgage has been paid.