Pennsylvania Foreign Judgment Enrollment

Understanding this form

The Pennsylvania Foreign Judgment Enrollment form is designed to help individuals or businesses enroll a foreign judgment in the state of Pennsylvania. A foreign judgment refers to a decision from a court in another state that is being recognized and enforced in Pennsylvania. This process ensures that the judgment creditor can legally enforce the judgment in Pennsylvania, creating a lien against the judgment debtor's property.

Key components of this form

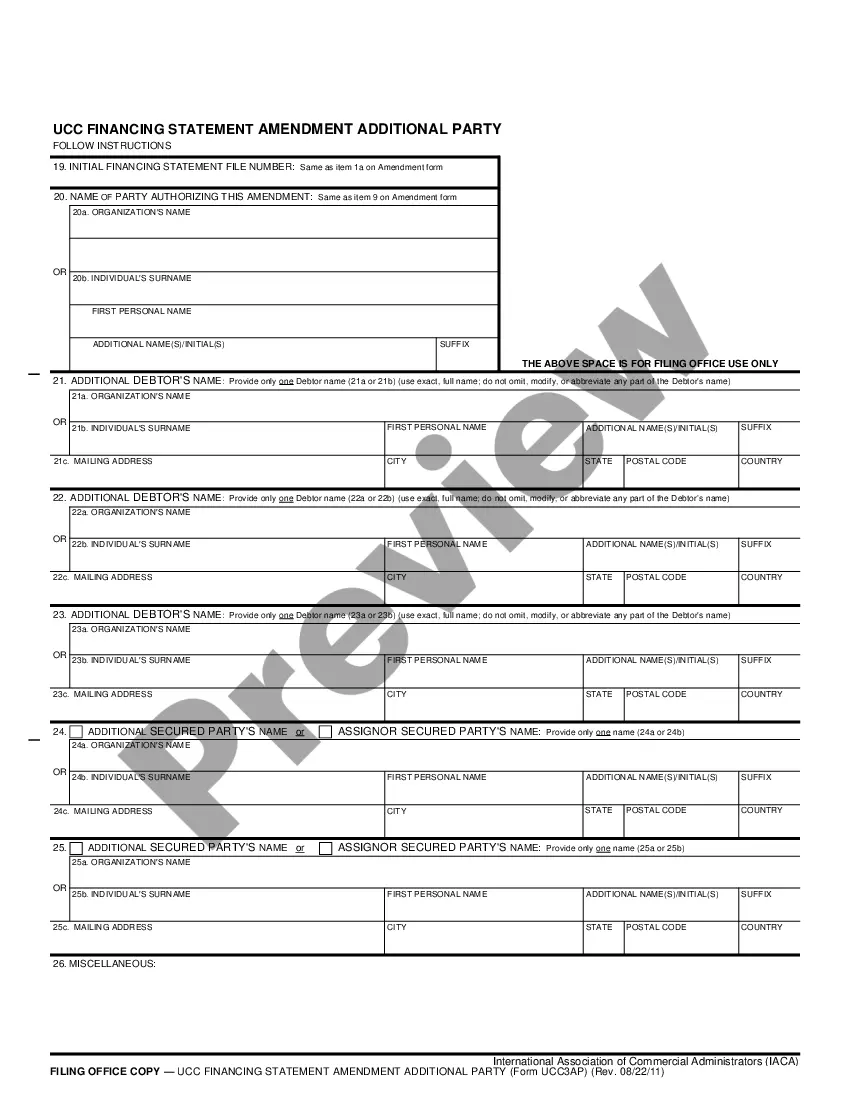

- Instructions for completing the enrollment process.

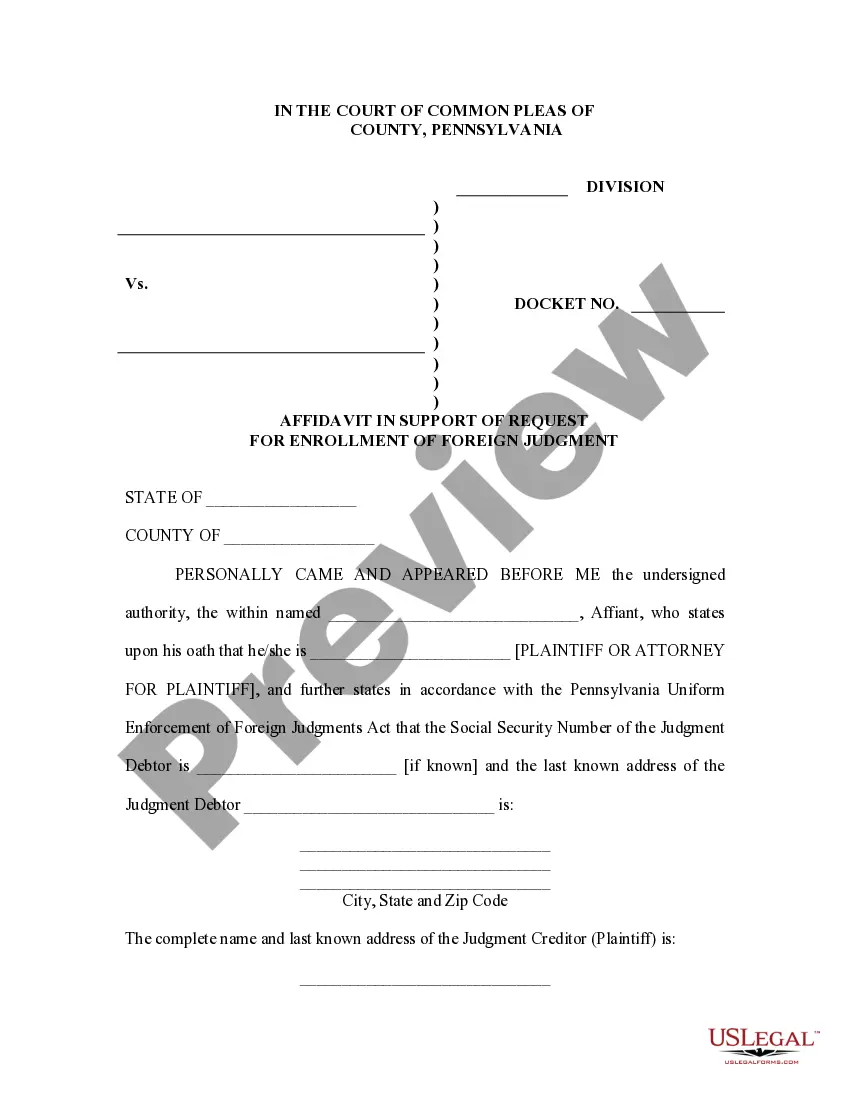

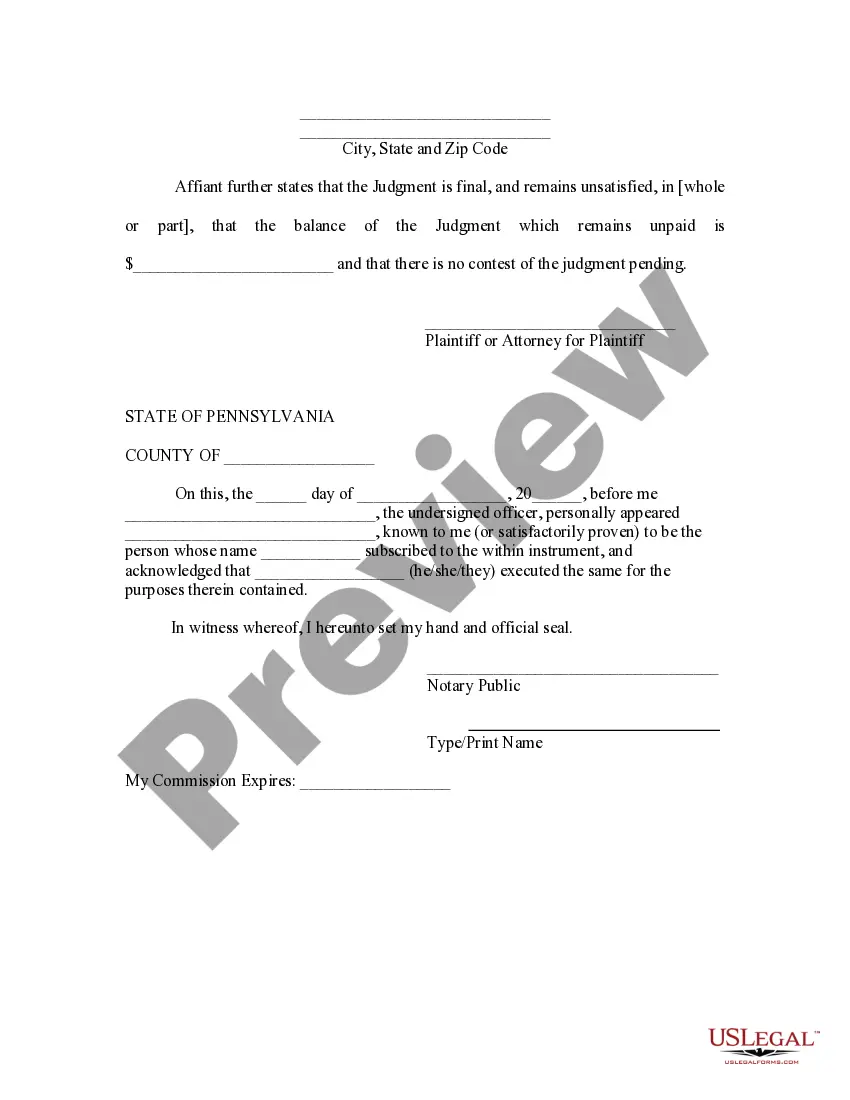

- Affidavit in support of the request to enroll the foreign judgment.

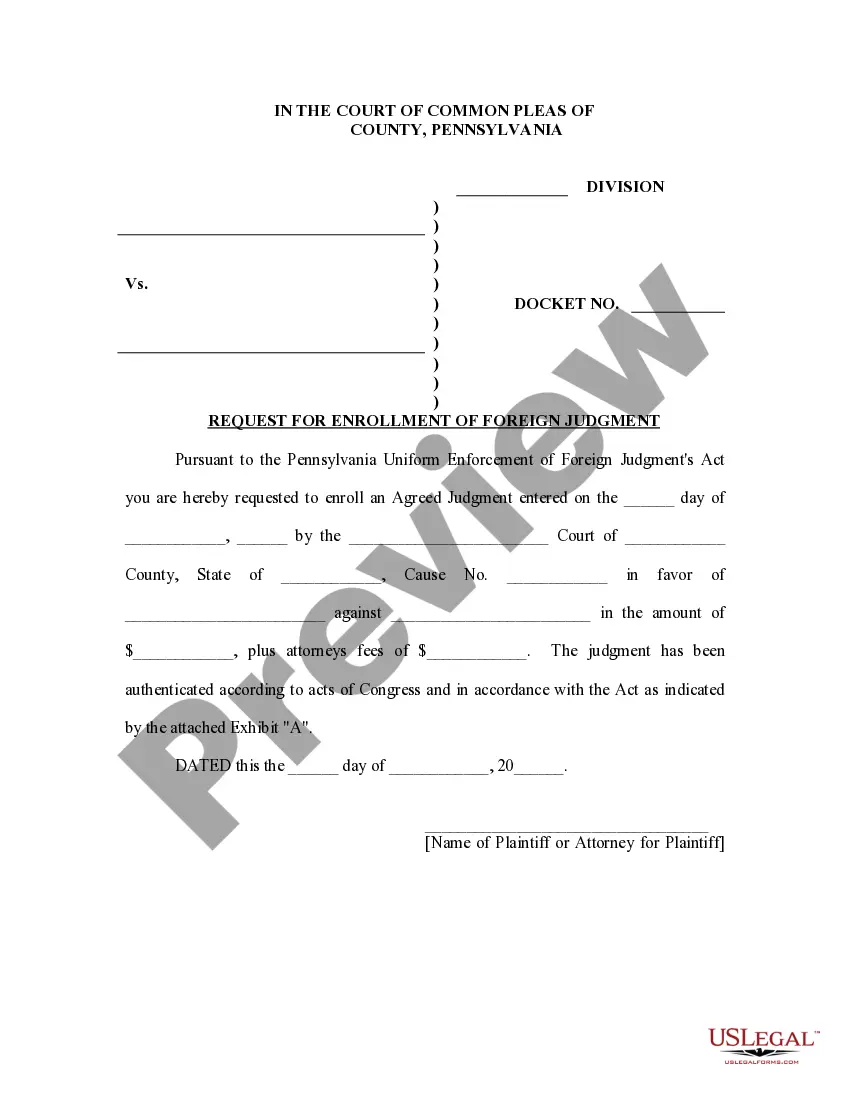

- Request for enrollment form that includes the attached judgment.

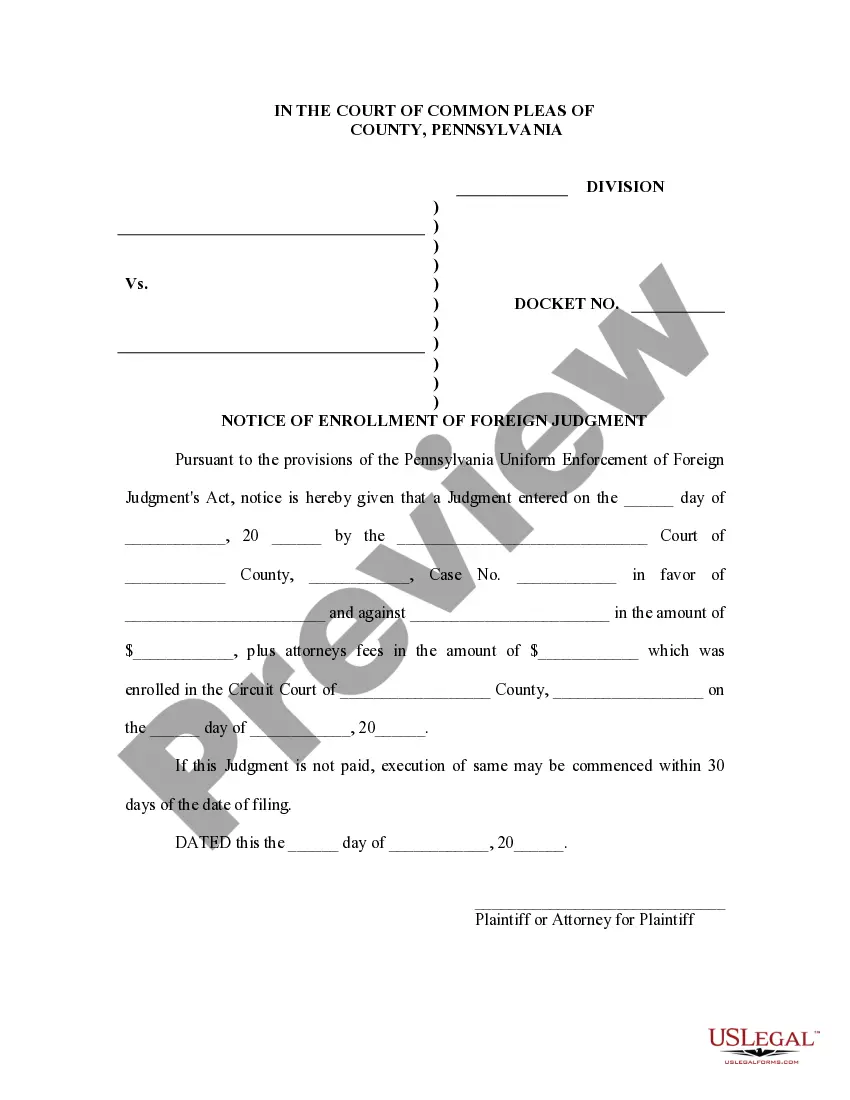

- Notice of enrollment, which must be sent to the judgment debtor.

- Law summary that outlines relevant legal requirements and context.

When this form is needed

You should use the Pennsylvania Foreign Judgment Enrollment form when you have a judgment from another state that you wish to enforce in Pennsylvania. This is particularly necessary if you need to collect any outstanding debts from the judgment debtor or if you want to establish a judgment lien against their property in Pennsylvania.

Who needs this form

- Individuals or businesses that hold a foreign judgment against a debtor.

- Judgment creditors seeking to enforce a judgment in Pennsylvania.

- Attorneys representing clients in need of enrolling a judgment from another state.

Completing this form step by step

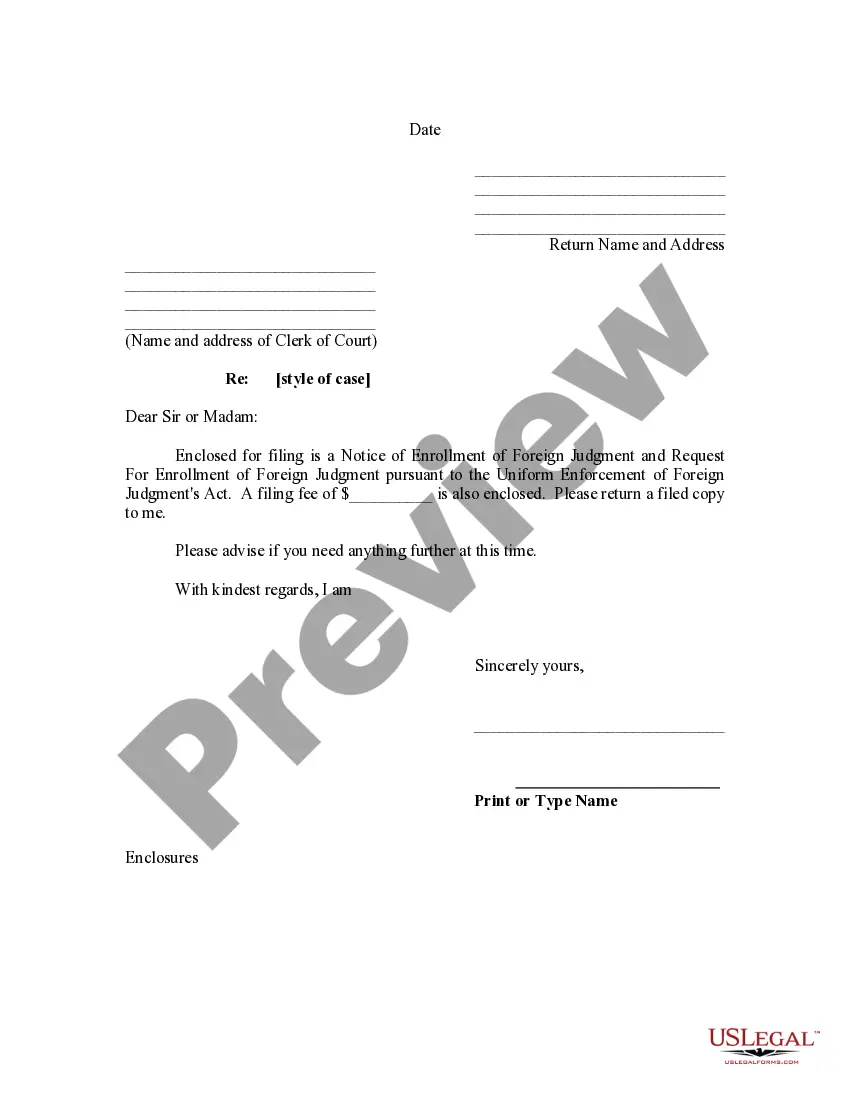

- Obtain and review the instructions provided in the enrollment package.

- Fill out the affidavit in support of the request for enrollment, ensuring accuracy.

- Complete the request for enrollment form, attaching the original judgment as Exhibit A.

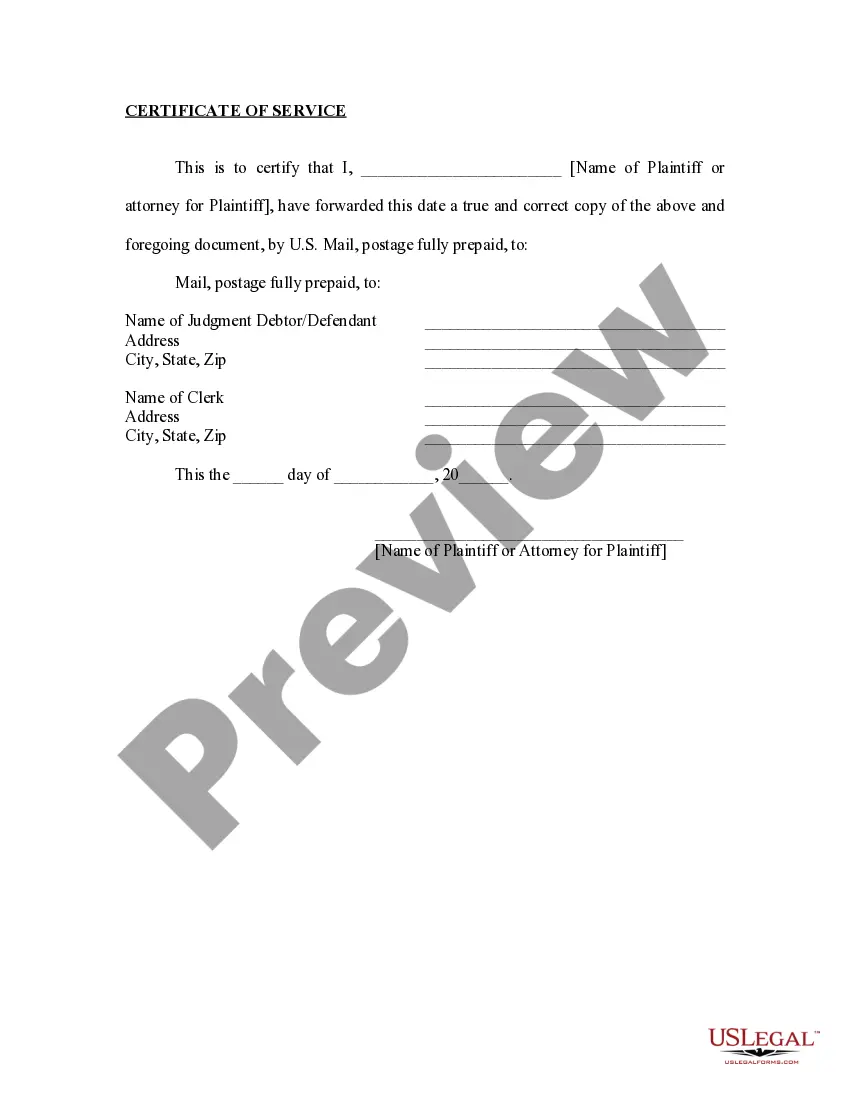

- Prepare the notice of enrollment to inform the judgment debtor of the action.

- File the completed forms with the clerk of the court in the appropriate Pennsylvania jurisdiction.

- Send a copy of the notice of enrollment to the judgment debtor via mail.

Does this form need to be notarized?

Yes, this form must be notarized to be legally valid. The document requires a notary's acknowledgment to ensure that the affidavit and associated filing forms are properly executed. US Legal Forms provides integrated online notarization services for your convenience, allowing you to obtain notarization securely and efficiently from home.

Mistakes to watch out for

- Failing to authenticate the foreign judgment correctly.

- Not including all required forms when filing with the court.

- Neglecting to send a copy of the notice to the judgment debtor.

- Missing filing deadlines or fees associated with the enrollment.

Why use this form online

- Easy access to the necessary forms and legal instructions from home.

- Ability to fill out and edit the forms digitally for accuracy.

- Convenient filing process without the need to visit a physical location.

Legal use & context

- The enrolled foreign judgment gains full legal standing in Pennsylvania.

- It creates a judgment lien on the judgment debtor's property, enhancing enforcement capabilities.

- The enrollment is governed by specific legal statutes which must be adhered to for successful enforcement.

Quick recap

- The Pennsylvania Foreign Judgment Enrollment form is essential for enforcing foreign judgments within the state.

- Strict adherence to legal requirements and proper documentation is crucial for successful enrollment.

- Consider utilizing online resources for convenience and efficiency.

Form popularity

FAQ

Generally, U.S. judgments cannot be enforced in a foreign country without first being recognized by a court in that foreign country.It can generally be said that non-default judgments not involving tort claims or punitive damages are more likely to be enforced.

The only U.S. states which have not adopted the Uniform Enforcement of Foreign Judgments Act are California and Vermont.

Hence, a decree passed by a superior court of a foreign country cannot be enforced in India if it contravenes an earlier conclusive judgment passed by a competent court in a suit between the same parties, as it is enforced as a domestic decree.

In Pennsylvania, auto loan, credit card, mortgage and medical debt all have a statute of limitations of four years. However, state tax debt has no statute of limitations. Before you pay on an old debt, even if it's just $1, be sure that the statute of limitations on that debt hasn't expired first.

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years. Judgments also act as a lien against real property for up to 20 years or longer if properly revived.

Potentially, a judgment can effectively become permanent; many states allow creditors to renew their judgments. So, if a creditor gets a court order or files an affidavit or other document, it can renew the judgment for another cycle. In some states, creditors are allowed to renew a judgment once or twice.

Is there a statute of limitations on my judgment? While there are time limits for collecting debts, once a court judgment is obtained, that limit does not apply. In California a judgment is valid for 10 years; however, if renewed prior to 10 years, it is extended for another decade.

The process requires registering a certified copy of the foreign judgment with the clerk of the court in the jurisdiction where you want to enforce the judgment. You will also need to file an affidavit attesting to certain facts, as specified in the court's procedural rules.

In Pennsylvania, a judgment lien is fully effective for five years, and is governed by the five year statute of limitations.