Oregon Notice of Right to Lien Sect. 87.023 - Individual

Overview of this form

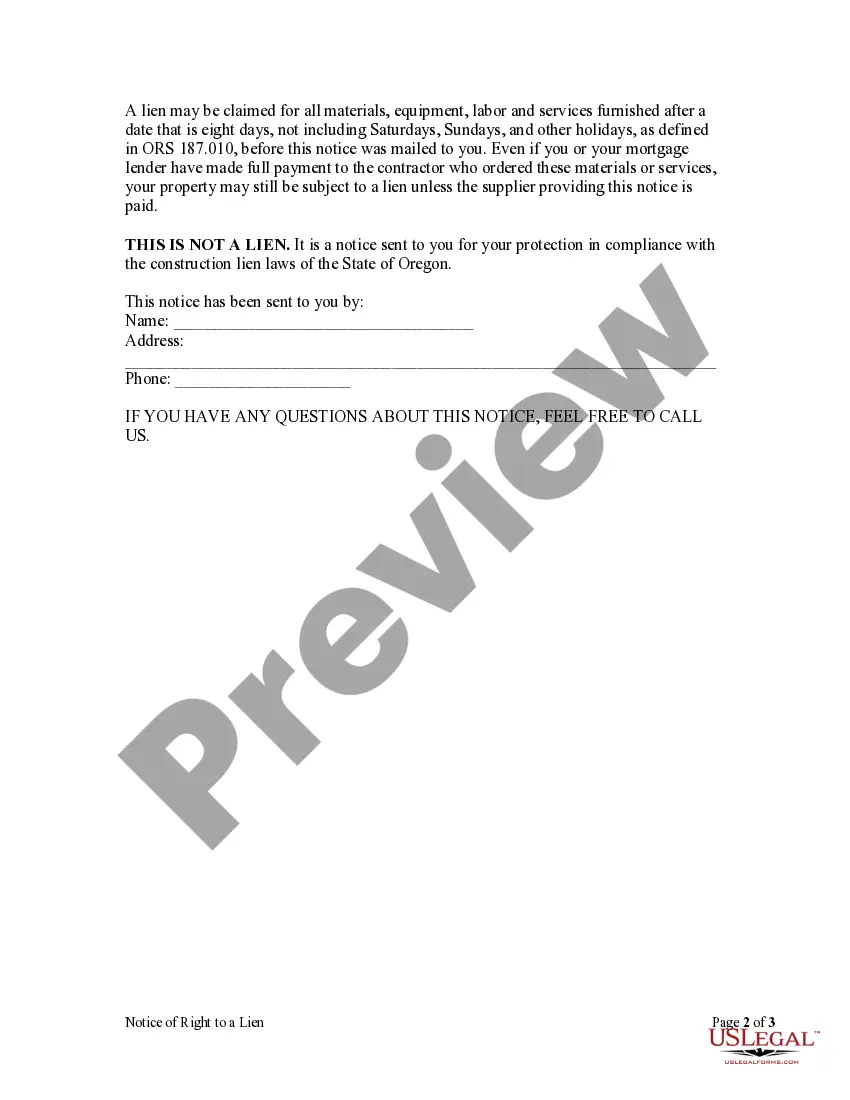

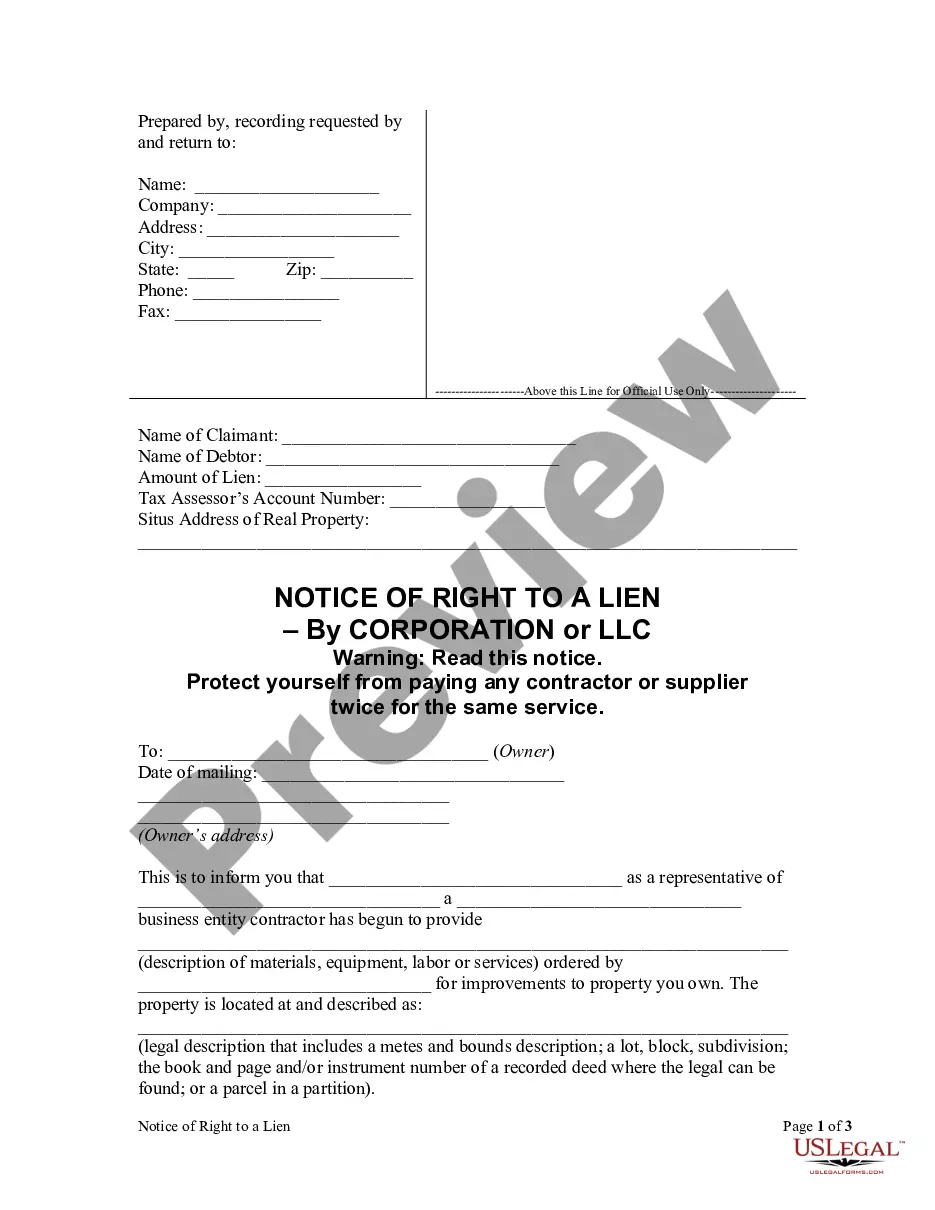

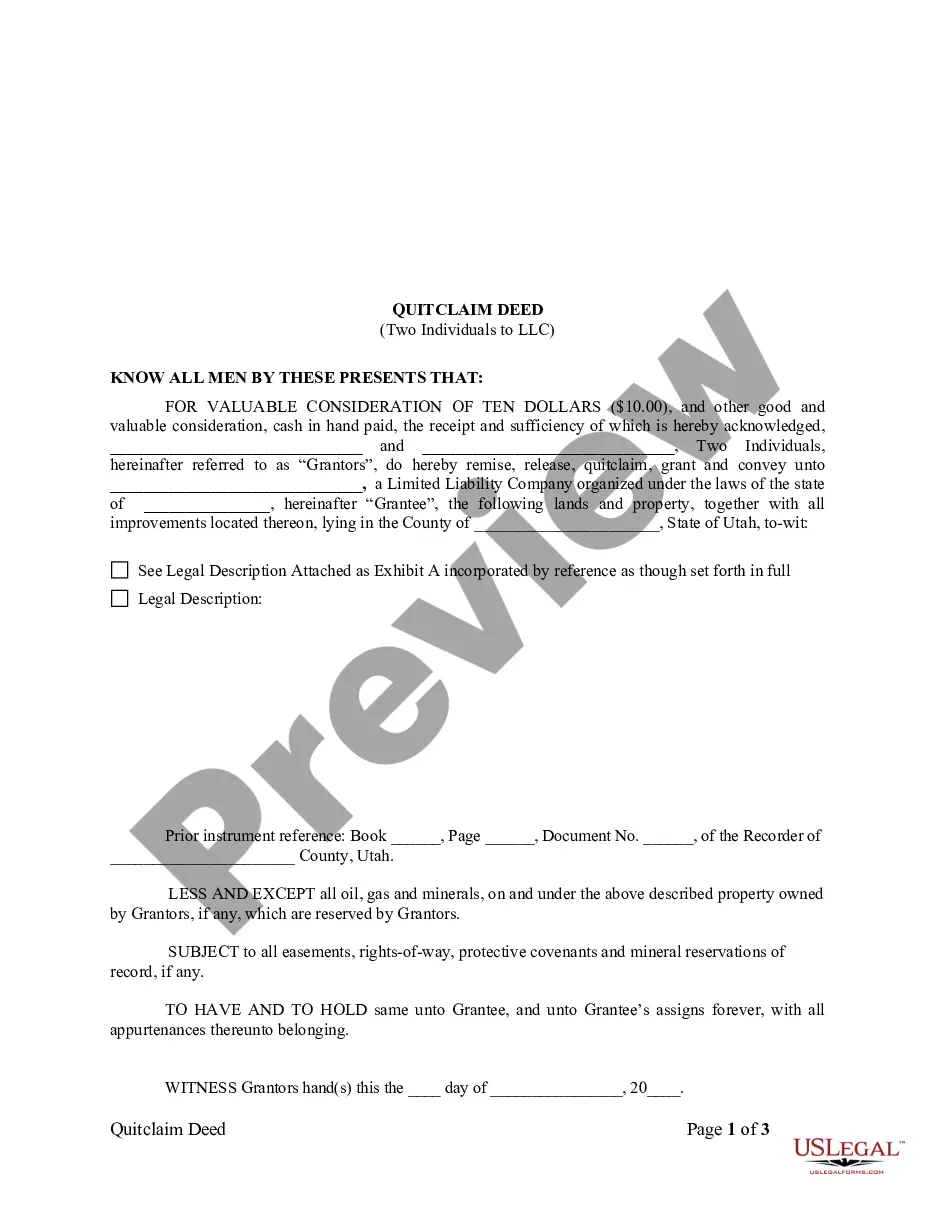

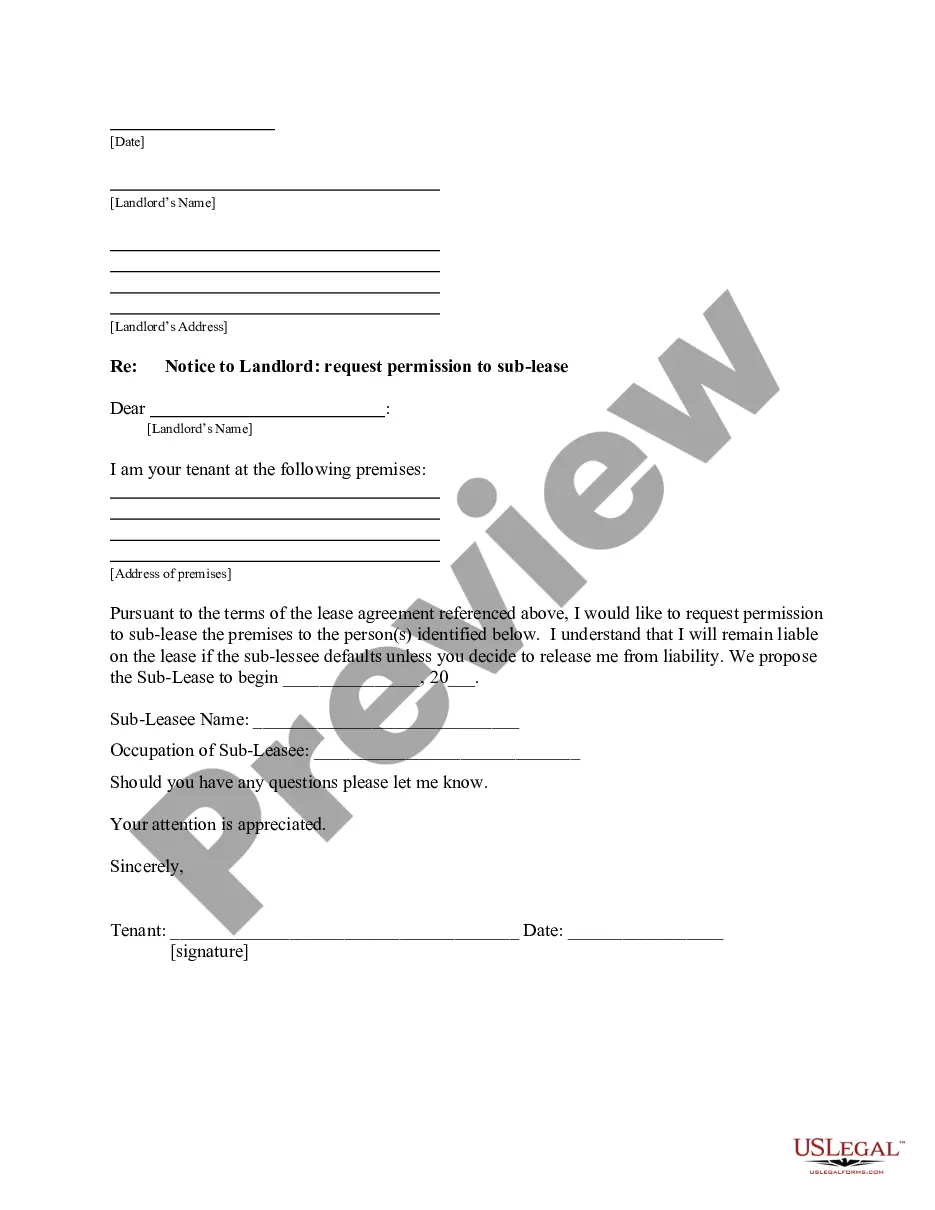

The Notice of Right to Lien Sect. 87.023 - Individual is a legal document that informs property owners of their rights regarding construction liens. It serves as a notice that an individual or company has begun providing materials, equipment, or services on their property. This form is critical for protecting the rights of contractors and suppliers who may seek payment for their services even if the property owner has already paid their contractor. Unlike a lien itself, this notice does not create a lien but rather informs the owner of potential claims against their property related to unpaid services or materials.

When to use this form

This form should be used when a contractor or supplier is providing materials, equipment, or services that could lead to a construction lien against a property. It is best to issue this notice at any point during the ongoing construction project, especially when services or materials have been provided after eight days before the notice is mailed. This ensures that the property owner is aware of potential lien claims and can take necessary actions to protect themselves.

Who should use this form

This form is intended for:

- Contractors providing construction-related services

- Suppliers of materials and equipment

- Individuals performing labor related to property improvements

- Property owners who may be at risk of lien claims

Instructions for completing this form

- Identify the owner of the property and enter their name and address.

- Enter the name and details of the contractor or supplier providing the services.

- Describe the materials, equipment, or services provided in detail.

- Specify the location and provide a legal description of the property involved.

- Fill in the date of mailing and your contact information for any questions.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a full legal description of the property.

- Not mailing the notice within the proper time frame.

- Leaving out the address of the property owner.

- Not including a description of the materials or services provided.

Benefits of using this form online

- Convenient access to complete and customizable form templates.

- Immediate download and printing options for urgent needs.

- Reliability of forms drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt.A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien.

In the state of Oregon, a lien must be filed within 75 days after the last day of performing labor or providing materials or within 75 days after the completion of construction.

A construction lien is a claim made against a property by a contractor or subcontractor who has not been paid for work done on that property. Construction liens are designed to protect professionals from the risk of not being paid for services rendered.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so creditors, such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.

If you owe money to a creditor and don't pay, that party may sue you for the balance. If the court rules against you, the creditor can file a judgment lien against you.In a few states, if a court enters a judgment against a debtor, a lien is automatically created on any real estate the debtor owns in that county.

A security interest or legal right acquired in one's property by a creditor. A lien generally stays in effect until the underlying obligation to the creditor is satisfied.Within these categories, many liens have specific names that usually stem from the type of creditor involved.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

Non-consensual liens arise from statutory or common law. The most notable example is a tax lien, which is imposed by law against the property of a taxpayer. If a taxpayer fails to pay the taxes owed to the government, the tax agency can seize his or her real or personal property for the amount of the lien.