Washington Dissolution Package to Dissolve Corporation

Understanding this form

The Washington Dissolution Package to Dissolve Corporation provides all necessary forms and instructions to legally dissolve a corporation in Washington State. This package streamlines the voluntary dissolution process, allowing incorporators or directors to terminate corporate existence efficiently. It is specifically designed for corporations that have not issued shares or commenced business activities, distinct from administrative and judicial dissolution methods.

Key components of this form

- Articles of Dissolution: The primary document needed for initiating dissolution.

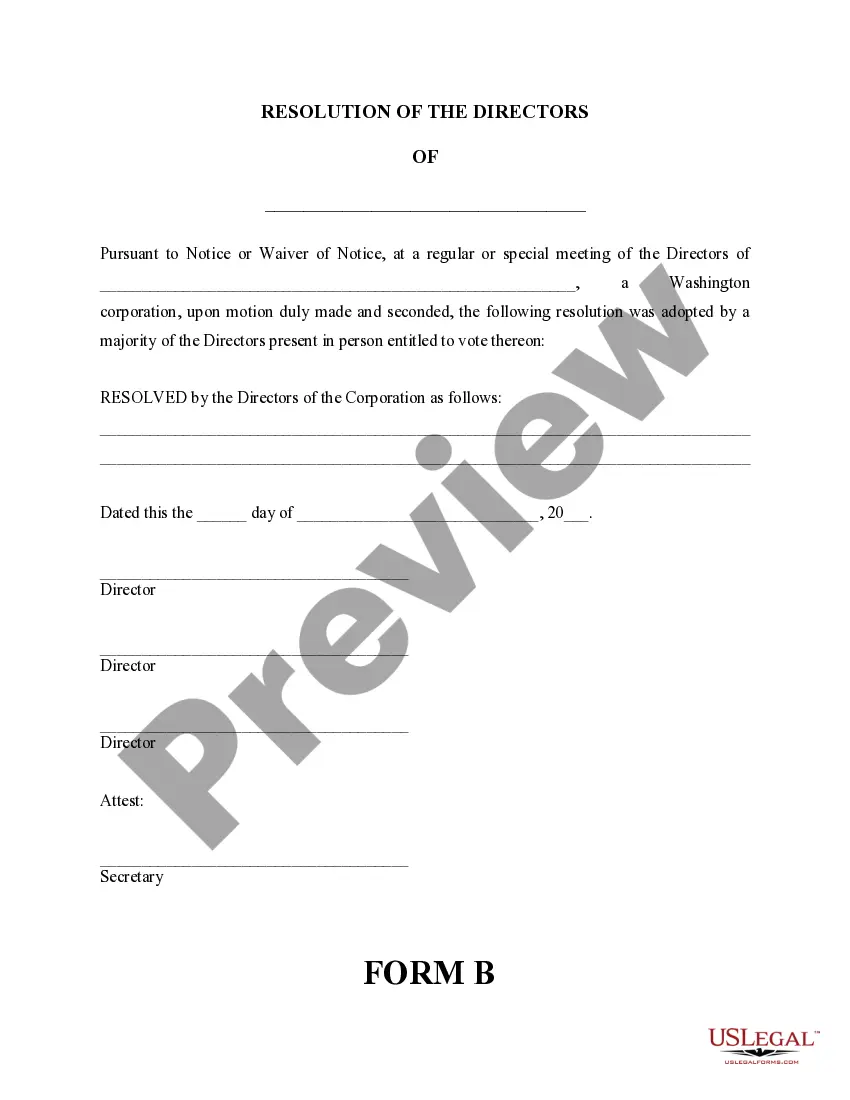

- Resolution of Directors: Required if the corporation has issued stock; documents board recommendation.

- Notice of Special Meeting: Notifies shareholders about the vote on dissolution.

- Written Consent: Allows shareholders to agree to the dissolution without a meeting.

- Notice of Dissolution and Request for Claims: Informs claimants about the dissolution process.

- Revenue Clearance Certificate: Confirms no outstanding taxes, required for filing dissolution.

Common use cases

This form package is necessary when the owners of a corporation in Washington decide to voluntarily dissolve the business. Situations may include: corporate restructuring, cessation of operations, or when it is no longer economically viable to continue business. This package ensures compliance with state laws during the dissolution process.

Who this form is for

Eligibility for using the Washington Dissolution Package includes:

- Corporation owners or initial directors desiring to dissolve a corporation.

- Corporations that have not issued shares or commenced business operations.

- Legal representatives acting on behalf of the corporation in dissolution matters.

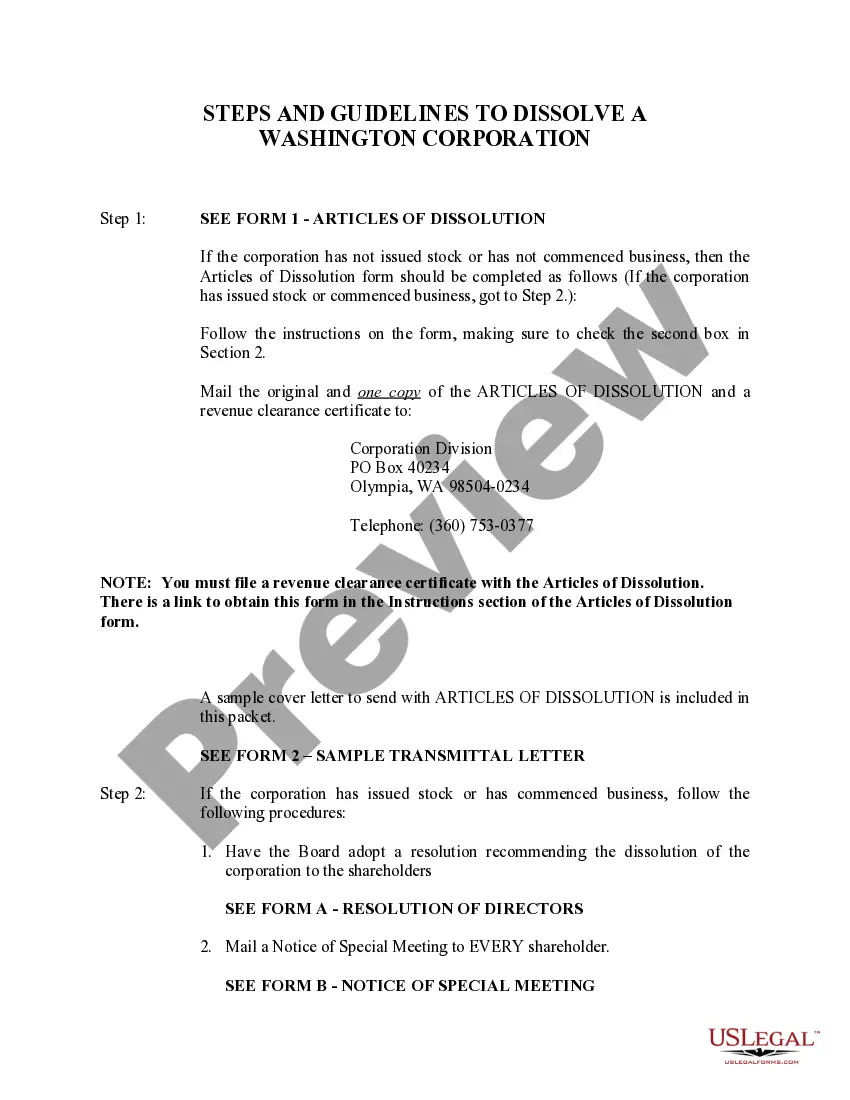

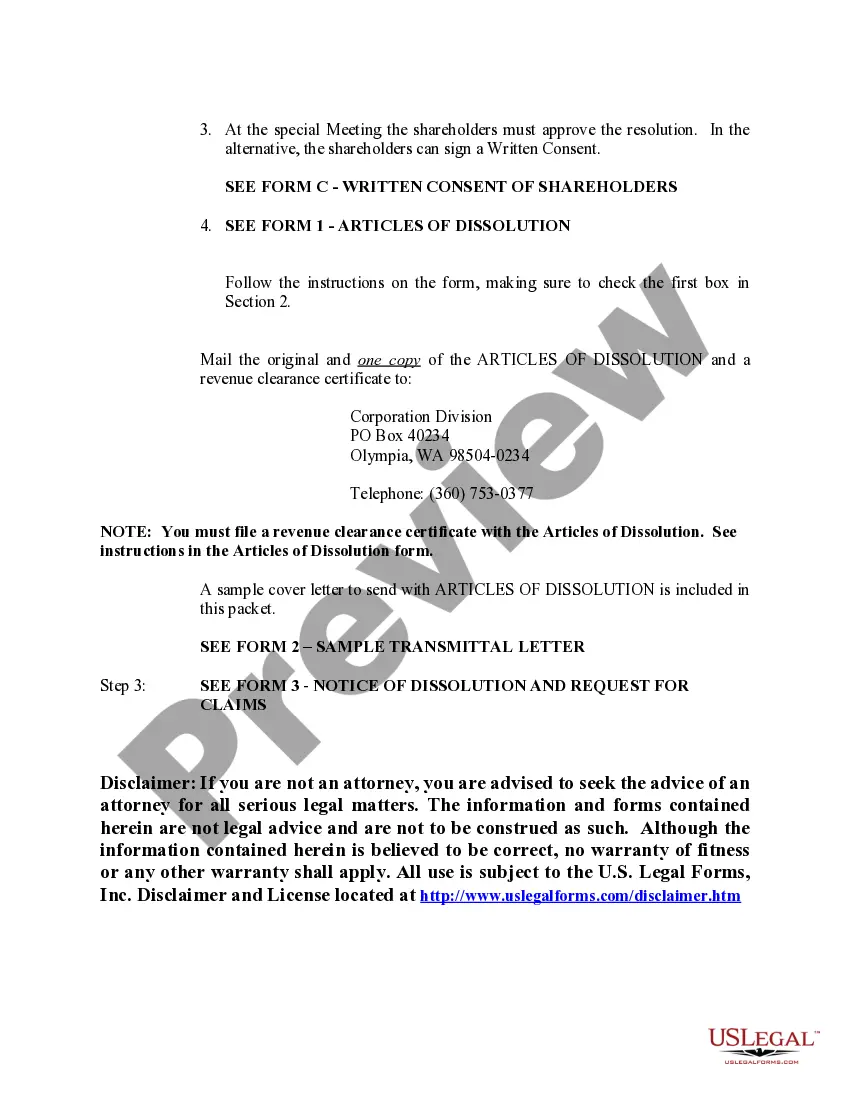

How to prepare this document

- Identify whether your corporation has issued stock or commenced business.

- If no stock has been issued, complete the Articles of Dissolution and include a revenue clearance certificate.

- If stock has been issued, adopt a resolution from the board of directors recommending dissolution.

- Notify all shareholders of a special meeting to vote on the dissolution, or obtain their written consent.

- Submit completed Articles of Dissolution along with required attachments to the Secretary of State.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to obtain a revenue clearance certificate before filing.

- Not properly notifying all shareholders about the dissolution plan.

- Missing deadlines for submitting claims or notices after dissolution.

- Not following the correct voting requirements for shareholders when dissolving.

Why use this form online

- Convenient access to all required documents and instructions in one package.

- Editable forms that allow for quick personalization to your corporationâs information.

- Reliable legal language drafted by licensed attorneys for accuracy and compliance.

- Instant downloads and easy-to-follow steps facilitate a smooth dissolution process.

Legal use & context

- This form package complies with Washington State laws regarding voluntary dissolution of corporations.

- Proper completion and submission ensure that the dissolution process is legally recognized.

- Failure to adhere to guidelines may result in delays or complications in the dissolution process.

Key takeaways

- The Washington Dissolution Package facilitates the voluntary dissolution of corporations.

- It includes critical forms and instructions to ensure compliance with state law.

- Understanding the necessary steps is crucial for a smooth dissolution process.

Looking for another form?

Form popularity

FAQ

Involuntary dissolution is a judicial process where the court separates the warring partners by forcing a sale of ownership from one to the other, or by forcing a sale of the entire business. You use this process when all else has failed for a dispute between owners of a corporation or an LLC in California.

A state may bring an action to dissolve a corporation on one of five grounds: failure to file an annual report or pay taxes, fraud in procuring incorporation, exceeding or abusing authority conferred, failure for thirty days to appoint and maintain a registered agent, and failure to notify the state of a change of

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Administrative dissolution is the process by which the state administrator overseeing business entities takes away the rights, powers and authority of a corporation, LLC or other business entity, due to the entity's failure to comply with certain obligations of the business entity statute.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.