1. Summary of Rights and Obligations under COBRA

2. Termination Letter (General)

3. Checklist for Termination Action

4. Employment Termination Agreement

5. Consent to Release of Employment Information and Release

6. Exit Interview

Oklahoma Employment or Job Termination Package

Description

How to fill out Oklahoma Employment Or Job Termination Package?

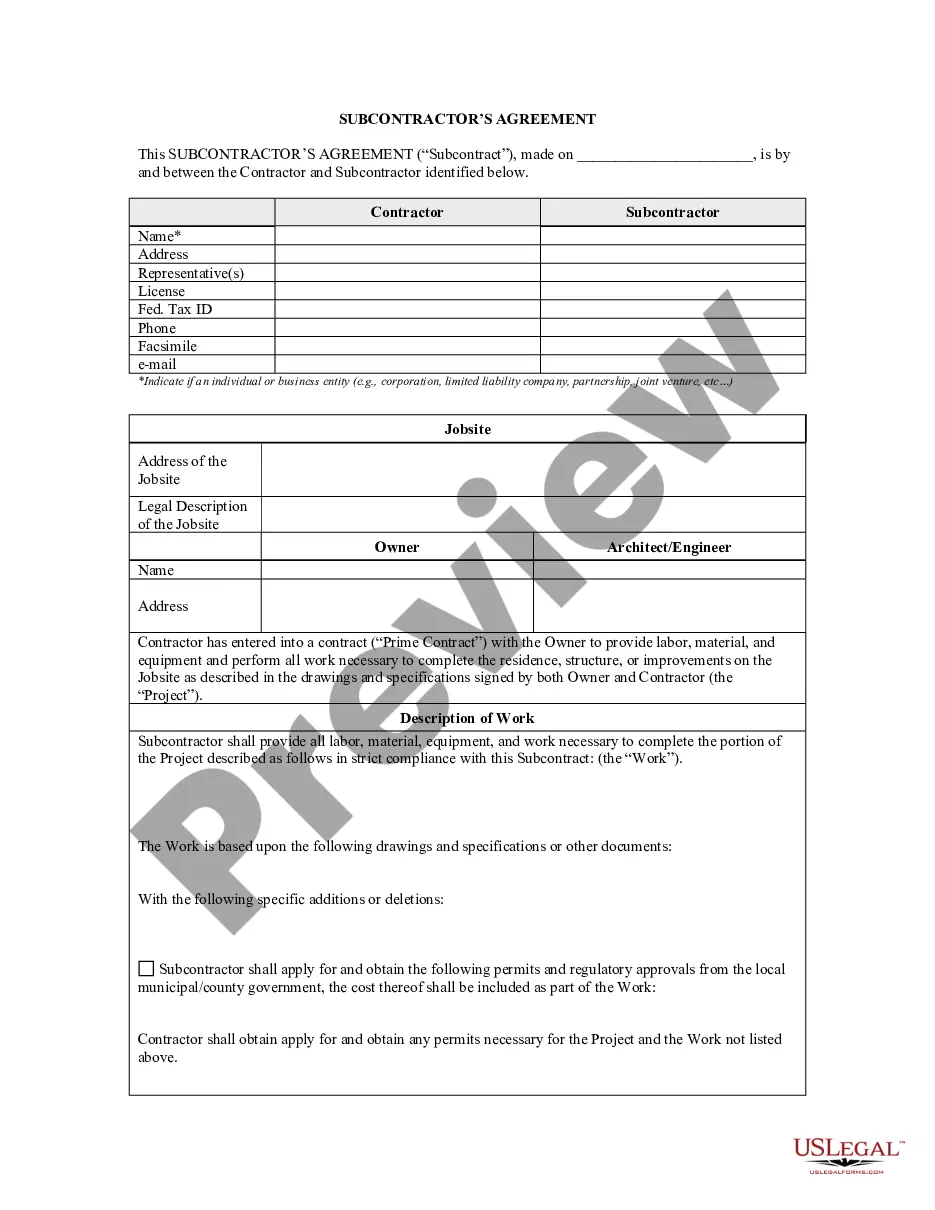

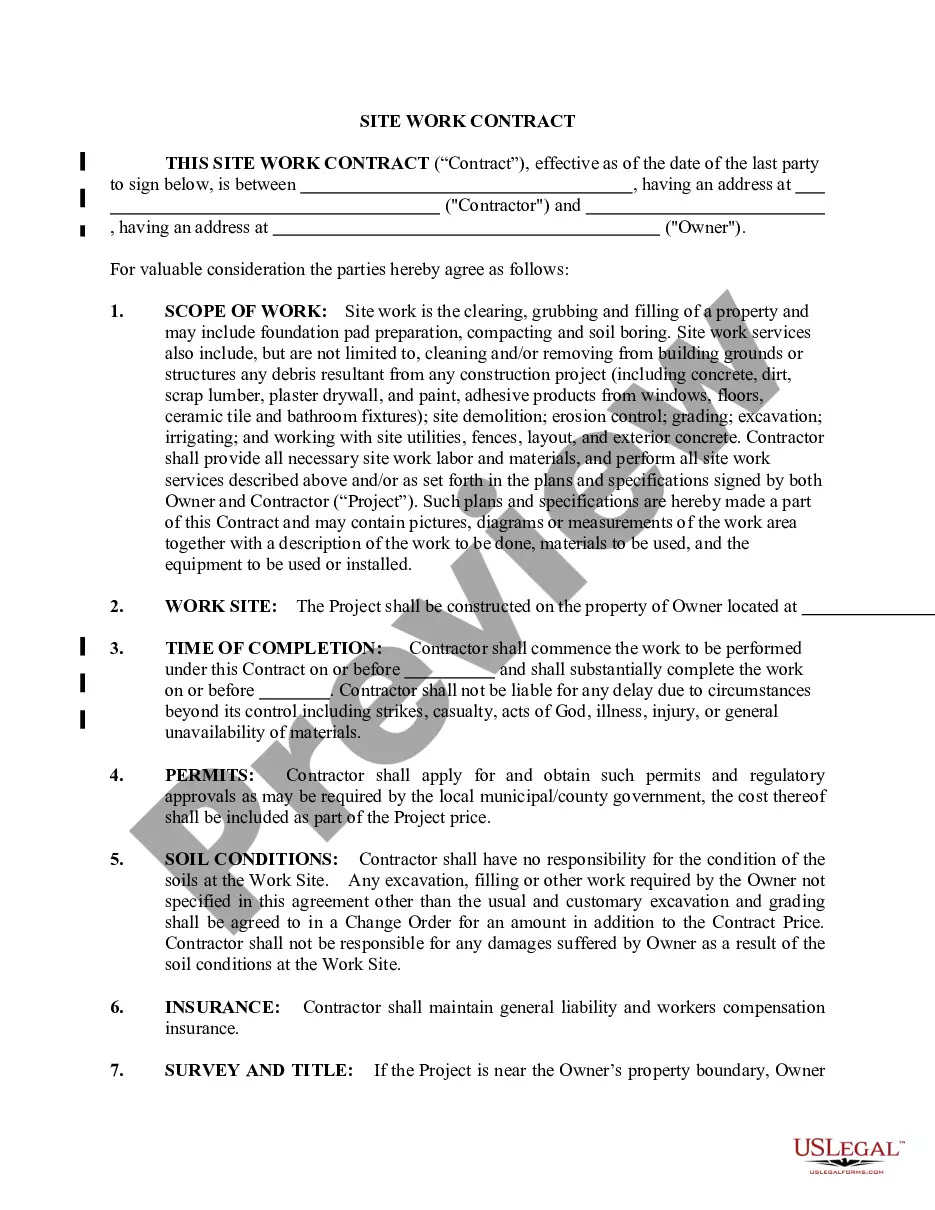

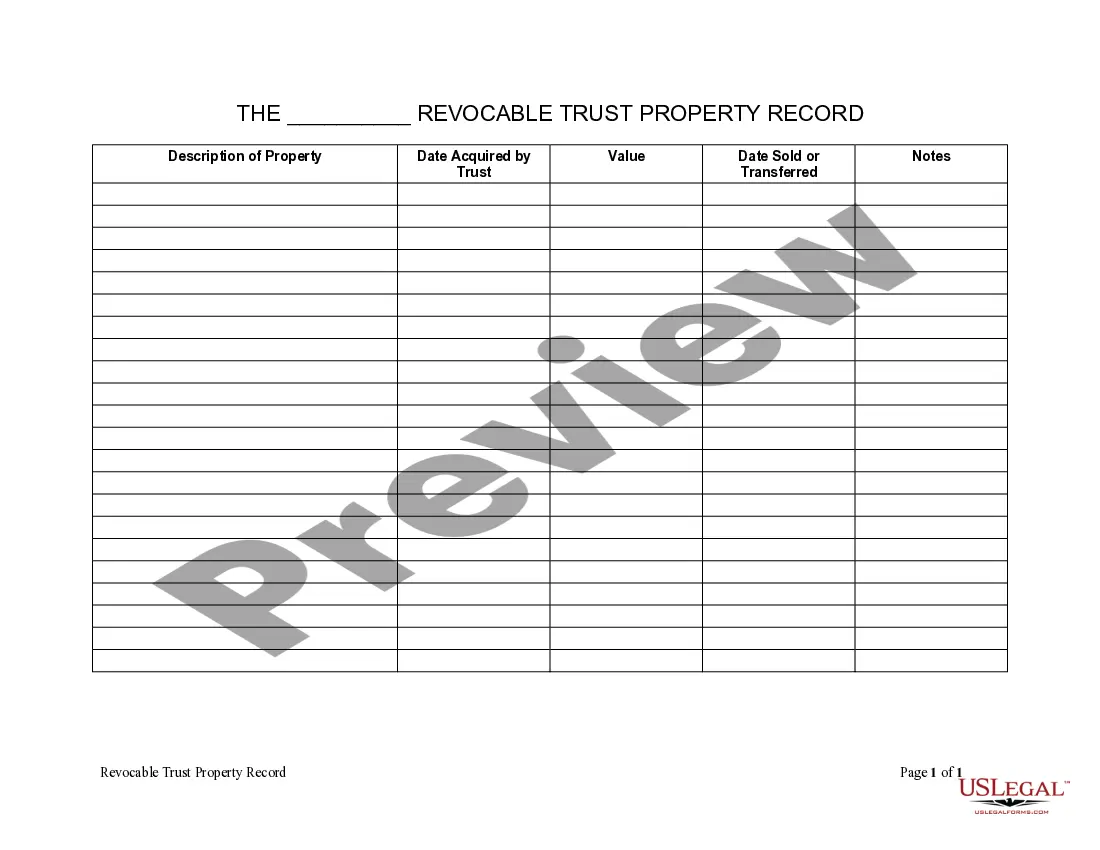

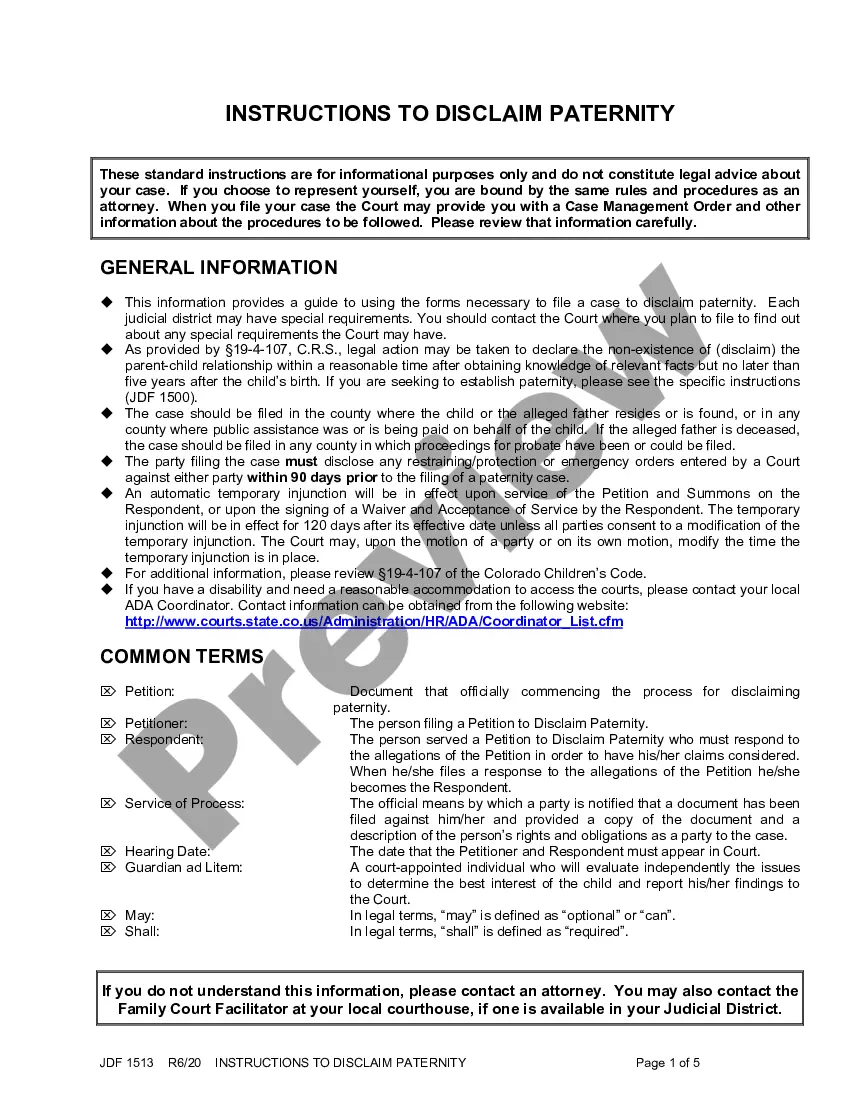

In terms of completing Oklahoma Employment or Job Termination Package, you probably visualize a long procedure that requires choosing a ideal sample among countless very similar ones and then having to pay an attorney to fill it out to suit your needs. Generally, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific form in a matter of clicks.

For those who have a subscription, just log in and click Download to get the Oklahoma Employment or Job Termination Package template.

If you don’t have an account yet but want one, follow the step-by-step guide below:

- Make sure the file you’re getting is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by clicking on the Preview function (if readily available) to find out the form’s information.

- Simply click Buy Now.

- Find the proper plan for your budget.

- Sign up for an account and choose how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Skilled attorneys work on creating our samples so that after saving, you don't have to bother about enhancing content outside of your personal info or your business’s info. Be a part of US Legal Forms and get your Oklahoma Employment or Job Termination Package sample now.

Form popularity

FAQ

Weekly Claims: If you are experiencing any technical difficulties filing your weekly claim, please call the unemployment claims Interactive Voice Response system at 405.525. 1500 or 1.800. 555.1554. You will be able to complete your weekly claim at anytime.

Be prepared with documentation. Write a termination letter. Schedule a meeting. Keep the meeting short. Don't be tempted to apologize, give a second chance, or discuss personal traits.

If an employer makes a lump sum severance payment at the time the worker is separated from a job but allocates the severance payment to a week or weeks other than the week in which the payment is made, then the worker's weekly unemployment benefits will be reduced in each claimed week to which the severance payment is

Employee name. Company name. Name of the manager overseeing the termination. Date of letter. Date of termination. Reason for termination. List of verbal and written warnings.

Getting severance pay does not disqualify an employee from receiving unemployment benefits, and the question turns on whether the employee would be disqualified from receiving unemployment compensation on the basis of either misconduct or voluntary termination (a voluntary quit), just like any other case.

If severance pay does extend the employment relationship, however, unemployment benefits may not be available until the severance ends. For example, if you receive a lump sum amount of severance on your last day of work, you may apply for unemployment.

Some of the most common reasons for disqualification from receipt of benefits are: Quitting a job voluntarily without good cause connected with work. Being discharged/fired from work for just cause. Refusing an offer of suitable work for which the claimant is reasonably suited.

Under California law, severance pay is not considered wages for unemployment purposes. Instead, it is considered a payment in recognition of your past service. Even if it is paid out in installments, as yours will be, it doesn't count against your unemployment.

The file should have an employee termination checklist form to be followed and basic details of the employee such as name, department, position as well as important details such as the reason for termination, last day of work and the name of the person handling their file.