Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors

What this document covers

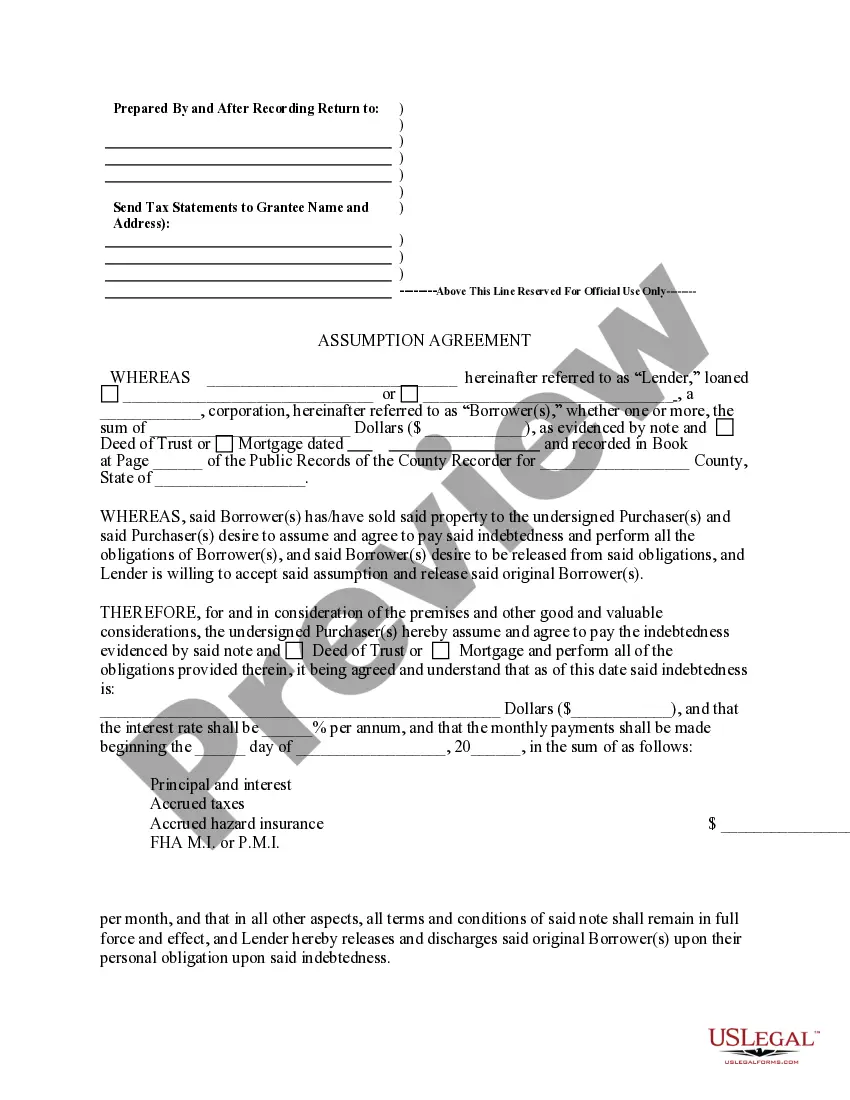

The Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that allows new property purchasers to assume the existing mortgage. By signing this agreement, the new purchasers agree to take over the mortgage debt, while the lender releases the original mortgagors from any future liability regarding the loan. This form is important because it clearly defines the obligations of all parties involved, thereby protecting the interests of the lender and relieving the original borrowers from financial responsibility.

What’s included in this form

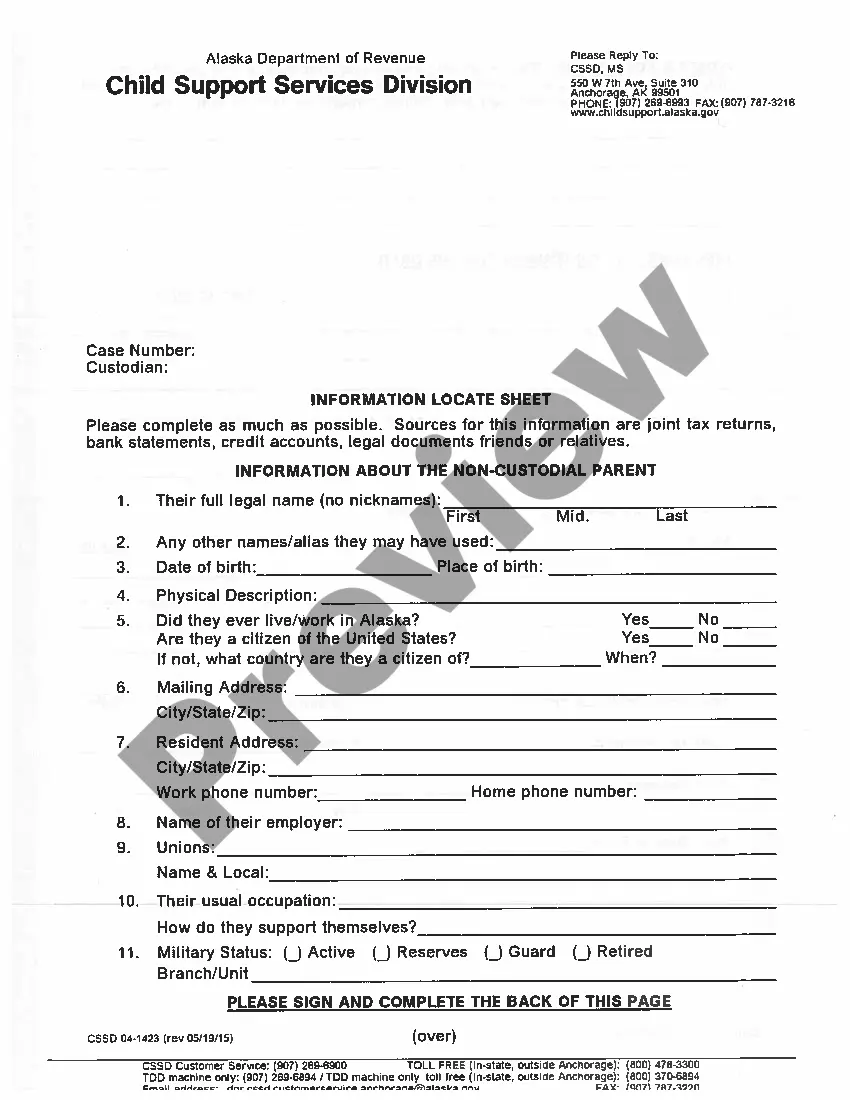

- Identification of parties: Names of the original mortgagors, lenders, and new purchasers.

- Assumption clause: New purchasers agree to assume responsibility for the mortgage debt.

- Release clause: Lender releases original mortgagors from future liabilities on the loan.

- Financial details: Specific figures regarding the indebtedness, interest rates, and payment obligations.

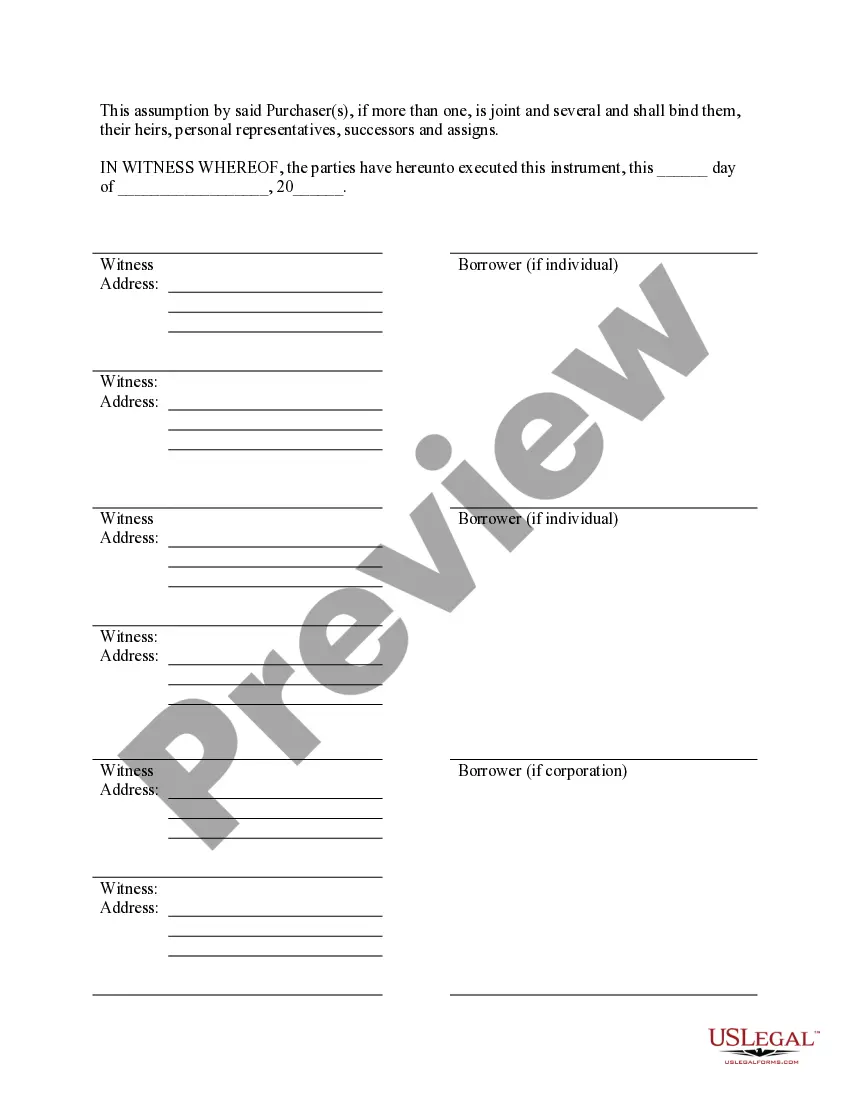

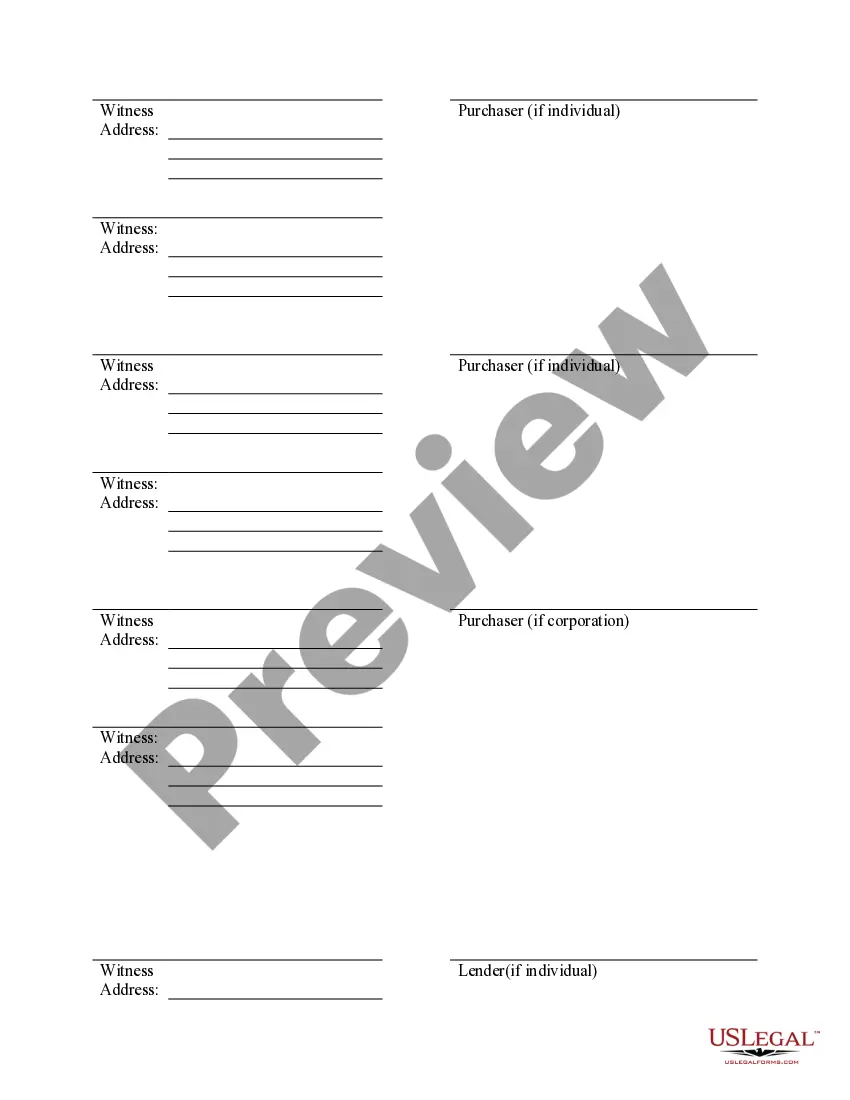

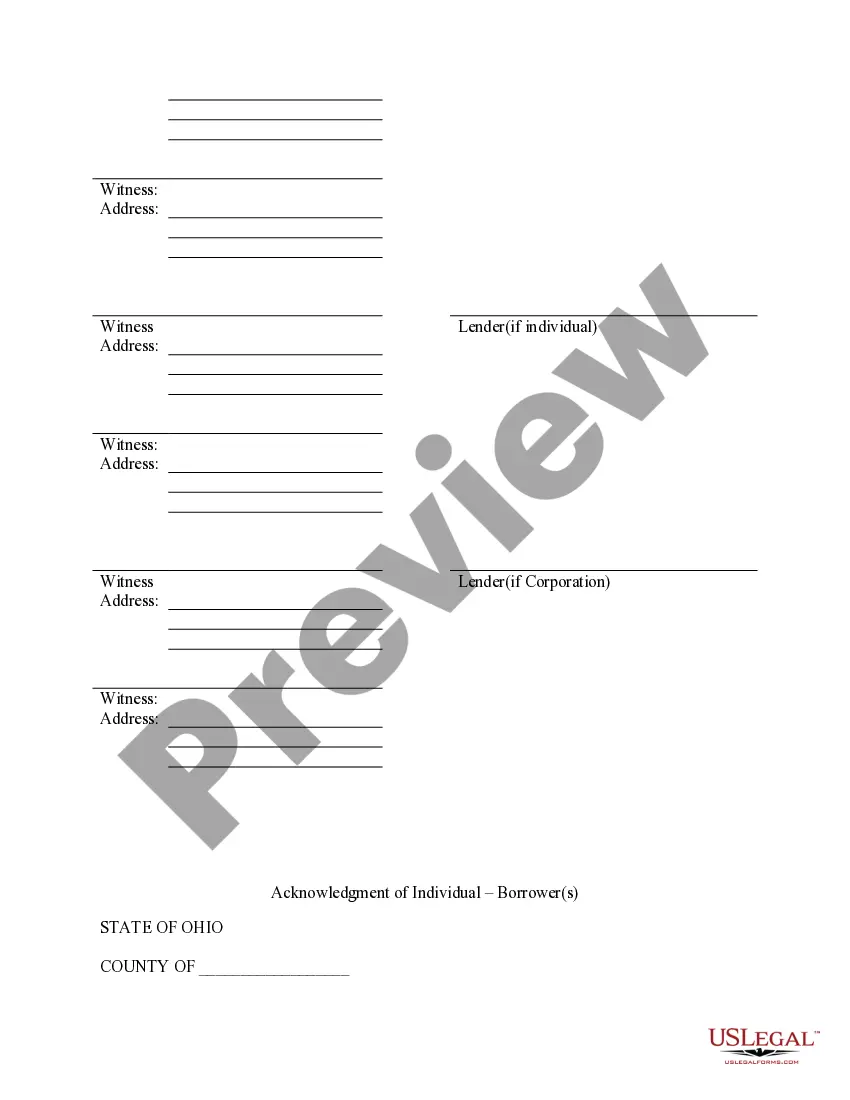

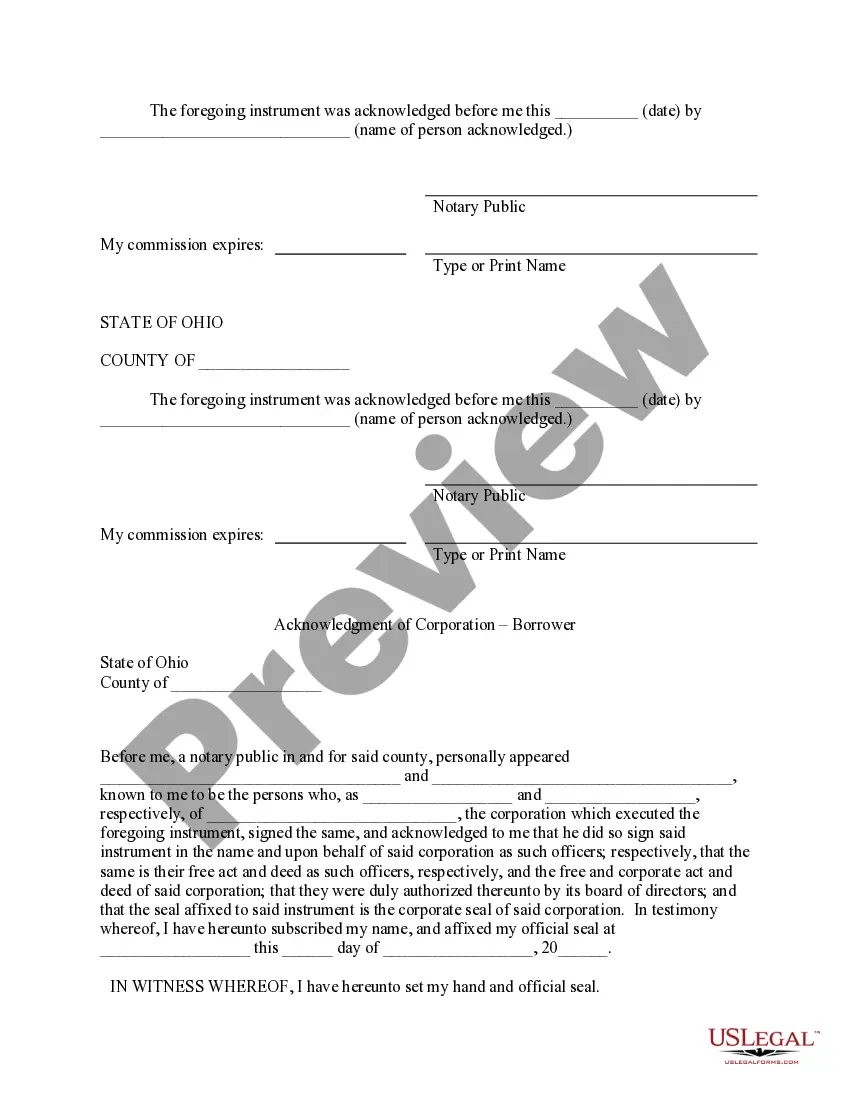

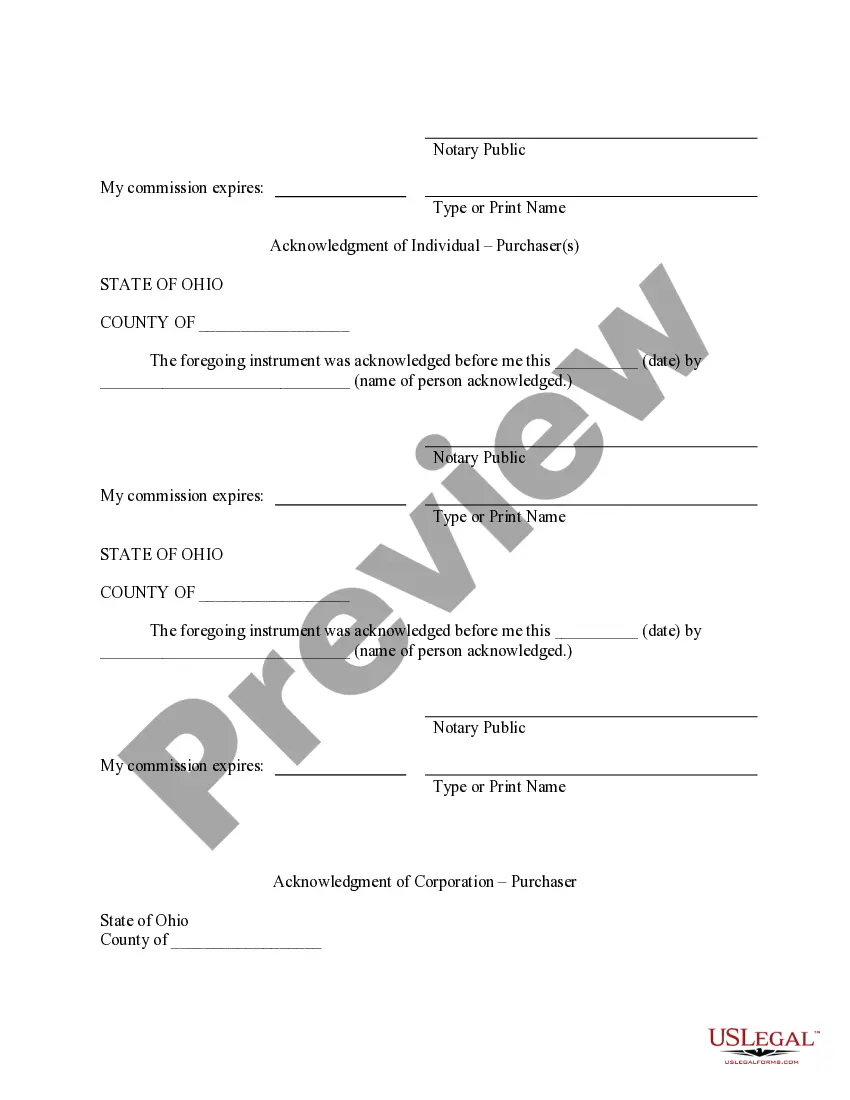

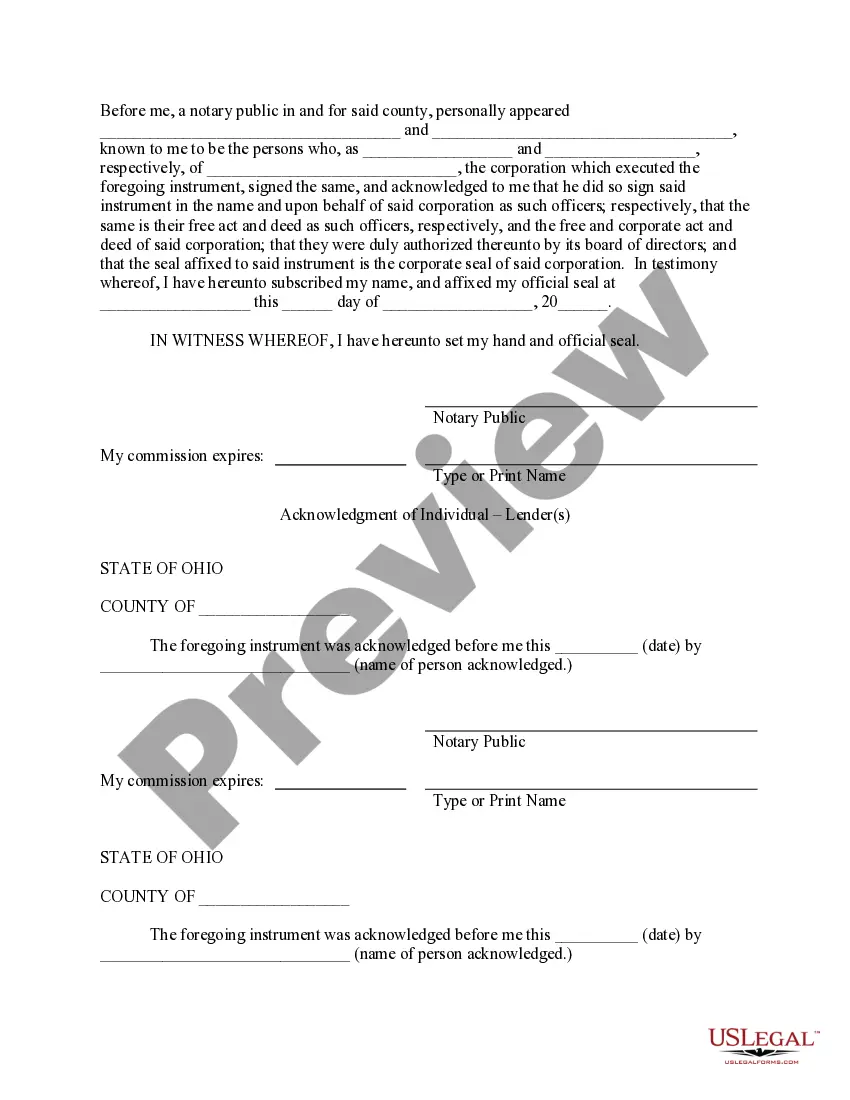

- Signatures and acknowledgments: Required signatures from all parties involved, including a notary acknowledgment for validity.

When to use this form

This form is typically used during the sale of a property when the buyer agrees to take over the existing mortgage from the seller. It is essential in situations where the seller needs to be released from the mortgage liabilities, often occurring in real estate transactions involving assumptions or transfers of ownership. This agreement helps facilitate smooth transitions in property ownership while respecting the legal agreements with lenders.

Who can use this document

- New purchasers who are assuming an existing mortgage and want to clarify their financial responsibilities.

- Original mortgagors wishing to be released from their loan obligations upon selling their property.

- Lenders who need a formal record of the assumption and release of liability for their mortgage agreement.

How to complete this form

- Identify the parties involved by entering the names of the original mortgagors, lender, and new purchasers.

- Clearly state the details of the mortgage, including the total indebtedness and interest rate.

- Specify the terms of the monthly payments and any related costs such as taxes or insurance.

- Ensure all parties sign the agreement, including obtaining a notary acknowledgment to validate the document.

- Review all entered information for accuracy before finalizing the document.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all relevant parties' names can lead to disputes later.

- Not providing accurate financial details may lead to misunderstandings regarding payment obligations.

- Forgetting to have the document notarized can make it difficult to enforce the agreement.

- Neglecting to read the terms of the original mortgage thoroughly can result in overlooking key obligations.

Advantages of online completion

- Convenient access from anywhere, allowing users to complete the form at their own pace.

- Editability ensures that users can make necessary adjustments before finalizing the document.

- Reliable templates drafted by licensed attorneys minimize the risk of legal errors.

What to keep in mind

- The Assumption Agreement of Mortgage allows new purchasers to legally take over a mortgage.

- This document releases original mortgagors from future liabilities concerning the loan.

- It is essential to ensure all parties sign and that the form is notarized for legal enforceability.

Looking for another form?

Form popularity

FAQ

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

It is a legal contract that effectuates an agreement between two parties, whereby one party agrees to assume the responsibilities, interests, rights, and obligations of another party in respect to a separate agreement made between the latter and a third party.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

An assumable mortgage is an arrangement in where an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

The loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.