Florida Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Florida Living Trust For Husband And Wife With Minor And Or Adult Children?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms serves as a resource to locate any state-specific form in just a few clicks, including examples of Florida Living Trust for Married Couples with Minor and/or Adult Children.

No need to waste your time searching for a court-acceptable template. Our certified specialists guarantee that you receive the most current forms each time.

After selecting a pricing plan, create an account. Make your payment via card or PayPal. Download the template to your computer by clicking on the Download button. That's all! You need to submit the Florida Living Trust for Married Couples with Minor and/or Adult Children form and proceed with the checkout. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful templates.

- To access the document library, select a subscription and set up your account.

- If you've completed this, simply Log In and then click Download.

- The Florida Living Trust for Married Couples with Minor and/or Adult Children document will be automatically stored in the My documents section (a section for all documents you save on US Legal Forms).

- To establish a new account, follow the brief instructions provided below.

- When using a state-specific document, make sure to select the correct state.

- If possible, review the description to understand all of the details of the form.

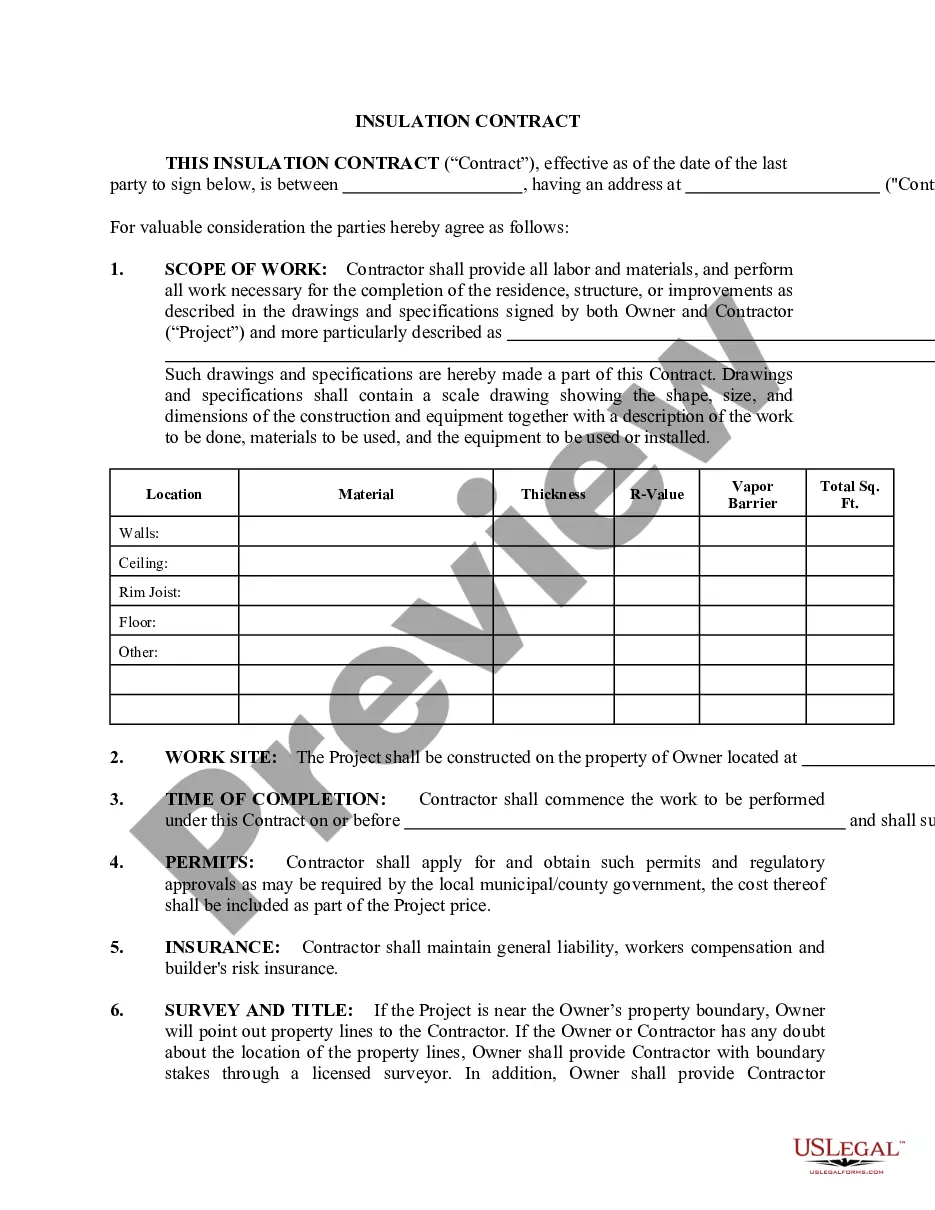

- Use the Preview feature if available to examine the document's content.

- If everything looks correct, click the Buy Now button.

Form popularity

FAQ

One disadvantage of a Florida Living Trust for Husband and Wife with Minor and or Adult Children is the potential for higher upfront costs. Establishing a trust involves drafting legal documents, which may require the assistance of an attorney. Additionally, if not managed properly, a trust can complicate the distribution of assets and create confusion among beneficiaries. Furthermore, family trusts may not provide the same level of asset protection from creditors as other legal tools.

Whether a husband and wife should have separate living trusts depends on their specific financial and family circumstances. A Florida Living Trust for Husband and Wife with Minor and or Adult Children can consolidate assets efficiently, but separate trusts might offer more control over individual assets and distributions. Consulting with legal experts can provide clarity on the best approach for your unique situation.

One significant mistake parents often make when establishing a Florida Living Trust for Husband and Wife with Minor and or Adult Children is failing to communicate their intentions clearly with their children. Without open discussions, beneficiaries may not understand the trust's purpose or rules, leading to confusion and disputes later on. Furthermore, not updating the trust as circumstances change can also create problems. Regular reviews are essential to keep the trust relevant.

One downside of putting assets in a Florida Living Trust for Husband and Wife with Minor and or Adult Children is the effort required to transfer ownership properly. Failing to fund the trust fully can leave out key assets, which may lead to complications down the road. Additionally, assets in a trust might still face complex legal challenges, so understanding these risks is vital. Careful planning can help mitigate these issues.

Yes, you can prepare your own Florida Living Trust for Husband and Wife with Minor and or Adult Children, especially with accessible resources available today. However, navigating the legal requirements can be complex, so it's essential to ensure all paperwork complies with state laws. Using platforms like uslegalforms can provide templates and guidance that simplify the process, ensuring your trust meets legal standards.

While a Florida Living Trust for Husband and Wife with Minor and or Adult Children offers many benefits, there are some potential downsides. Establishing a trust can involve upfront costs, and maintaining it requires ongoing management. Additionally, assets in a trust are not immune to creditor claims, so understanding the limitations is important. Always weigh these factors carefully.

Setting up a Florida Living Trust for Husband and Wife with Minor and or Adult Children can help your parents manage their assets more effectively. A trust can offer protection from probate, providing a smoother transition of wealth to heirs. Additionally, it allows for more control over how and when assets are distributed, which can be particularly useful for families with minor children. Consider using uslegalforms to create a trust tailored to their specific needs.