New York Prenuptial Premarital Agreement with Financial Statements

What is this form?

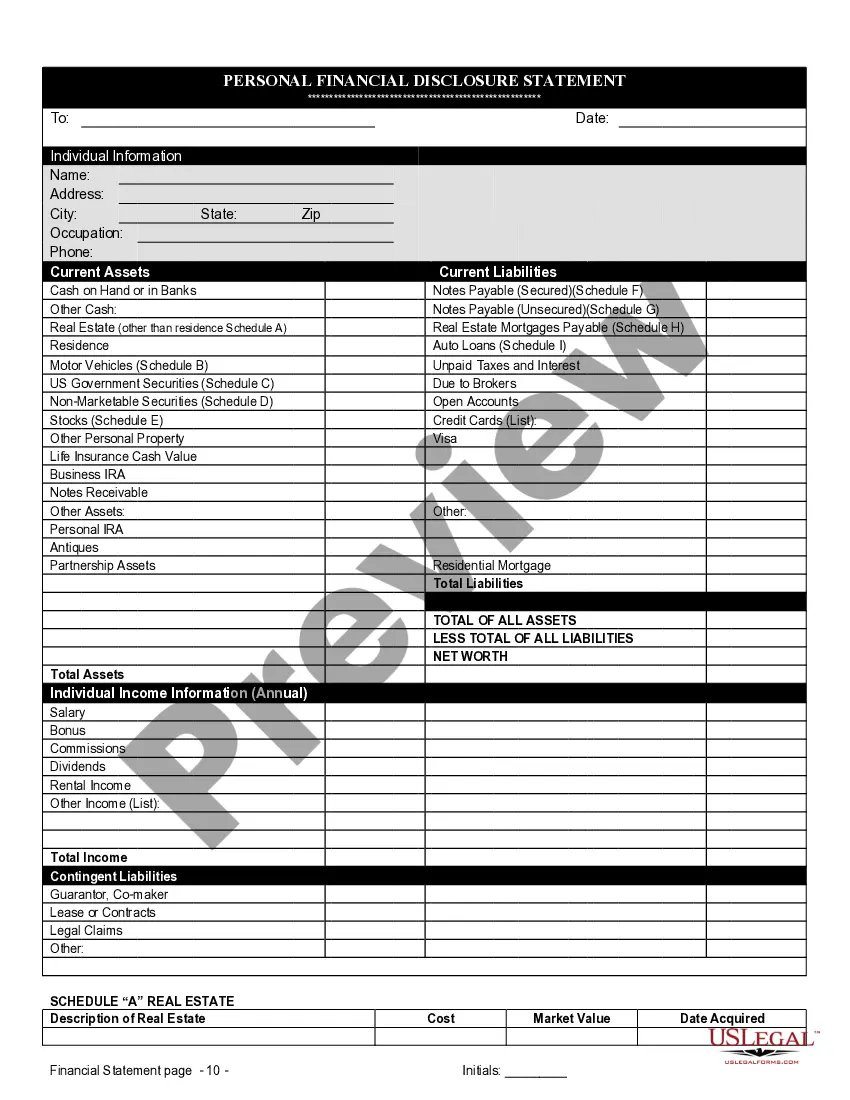

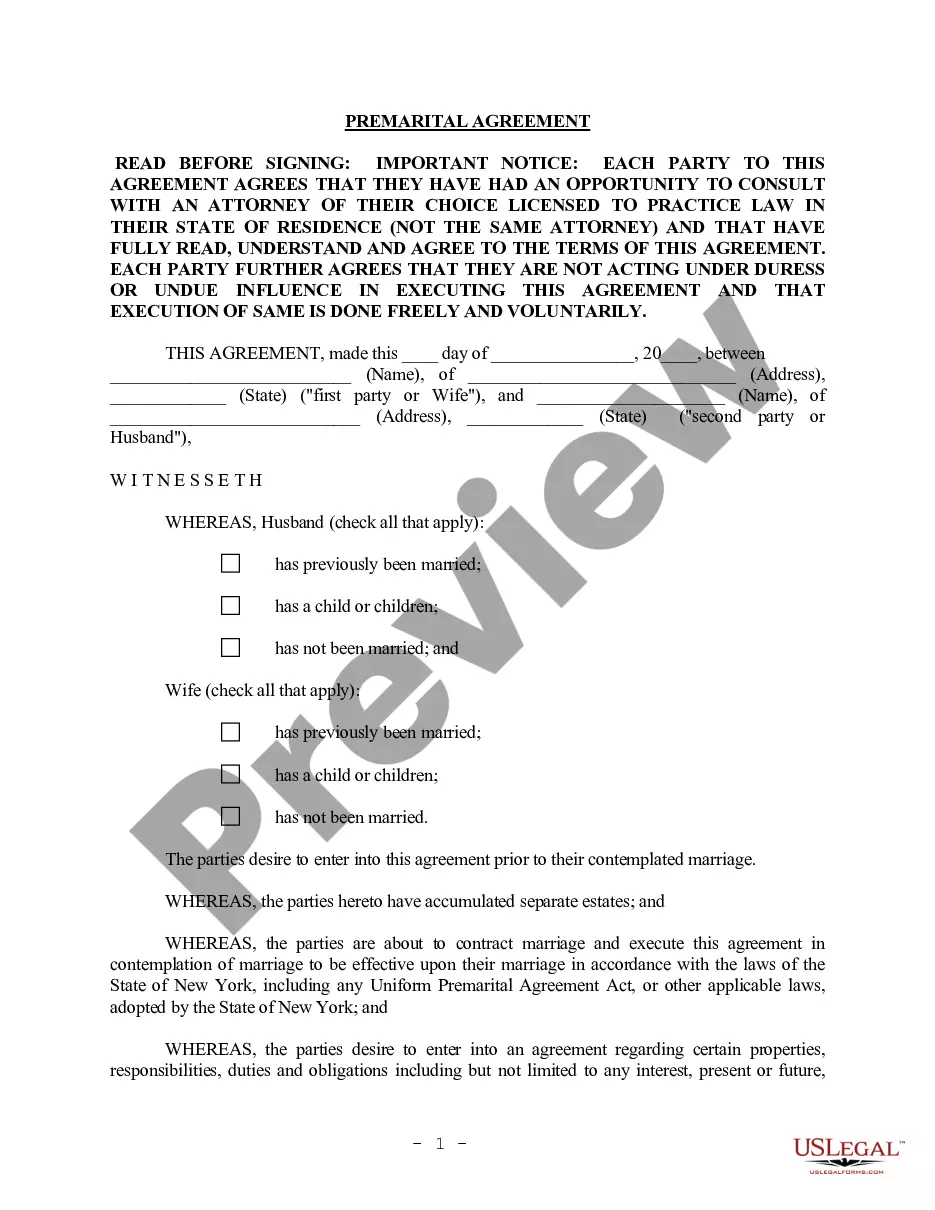

The New York Prenuptial Premarital Agreement with Financial Statements is a legal document that outlines the financial responsibilities and rights of two individuals who are planning to marry. This form allows both parties to disclose their assets and debts, thus providing clarity and protection regarding their individual financial interests during the marriage and in the event of divorce or death. Unlike simple agreements, this comprehensive form is specifically tailored to New York law and includes detailed provisions to safeguard individual properties and assets.

Key components of this form

- Full disclosure of all assets and debts by each party.

- Clarification of each party's separate property rights during and after the marriage.

- Provisions regarding the management of debts and property, ensuring both parties retain control over their assets.

- Terms addressing property rights upon death or divorce, avoiding costly litigation.

- Examples of additional provisions that may apply in case of divorce.

When this form is needed

This form is useful when individuals wish to protect their financial interests before entering into marriage. It is particularly relevant for those who have previously been married, have children, own significant assets, or want to clarify property rights. Utilizing this agreement can prevent misunderstandings and legal conflicts should the marriage end in divorce or upon the death of one spouse.

Who can use this document

- Individuals planning to marry who wish to protect their individual properties.

- Persons who have been previously married and want to clarify asset distribution.

- Couples with significant debts or assets that may complicate financial matters during the marriage.

- Those with children from previous relationships who want to protect inheritance rights.

Instructions for completing this form

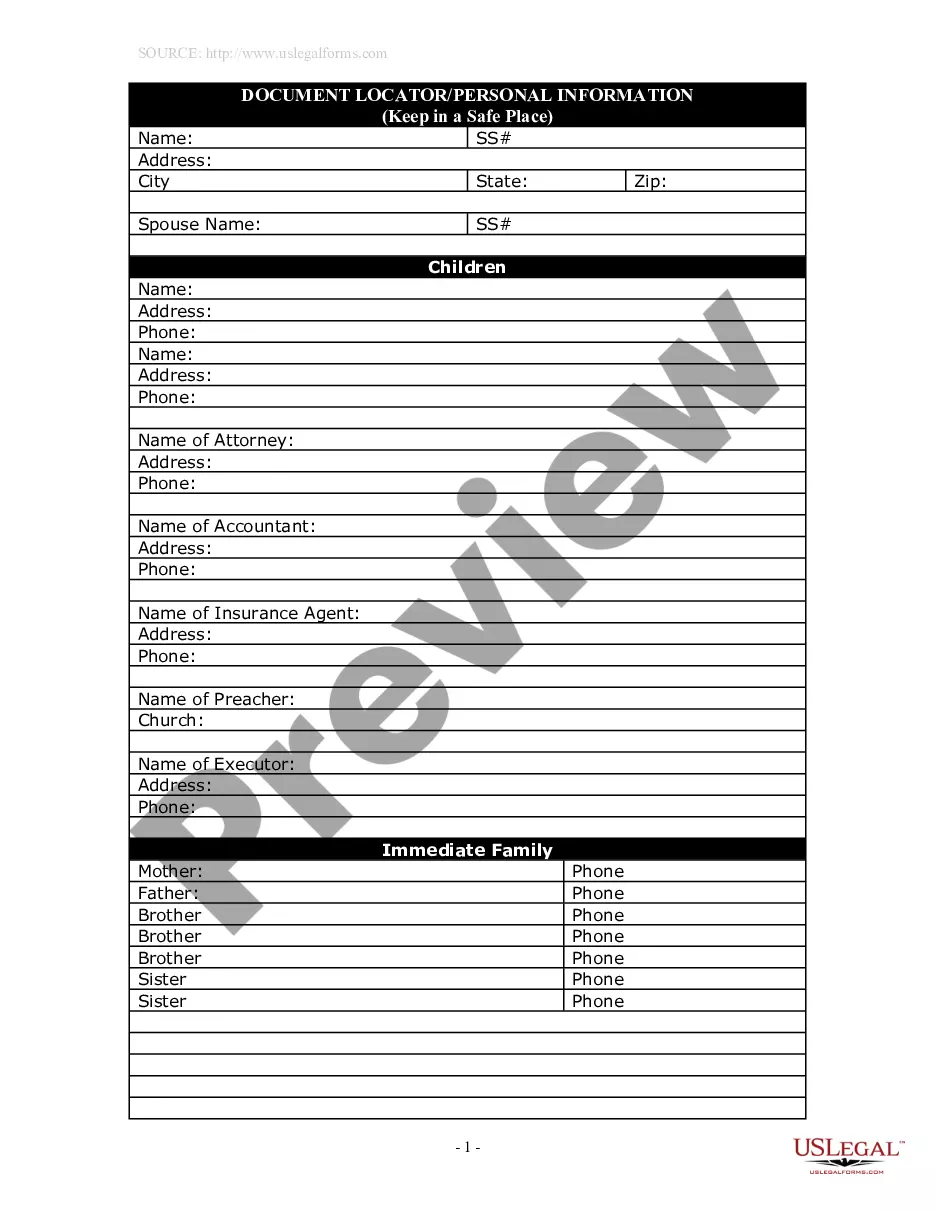

- Identify both parties by entering their names, addresses, and states of residence.

- Check relevant boxes to indicate whether each party has been previously married or has children.

- Complete the financial statements accurately, detailing all assets and liabilities.

- Review the agreement terms carefully, ensuring both parties understand their rights and obligations.

- Sign the agreement in the presence of a notary public to validate it.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not disclosing all assets and debts fully, which can lead to disputes later.

- Failing to consult independent legal counsel to ensure both parties understand the agreement.

- Not completing or signing the financial disclosure statements correctly.

- Neglecting the notarization requirement, which is crucial for legal validity.

Benefits of completing this form online

- Convenience of completing the form at your own pace, with easy edits.

- Access to reliable templates drafted by licensed attorneys.

- Time-saving by eliminating the need to start from scratch.

- Security in storing and retrieving your legal documents online.

Looking for another form?

Form popularity

FAQ

However, if you decide not to sign a prenup and ultimately get divorced, you may not be able to protect certain assets. It is likely that your marital assets and properties will simply be divided between you and your ex 50/50, in accordance with California community property laws.

While prenups usually aren't bad ideas, they aren't always necessary. For couples with significant financial assets on either or both sides, a prenup might be a good idea. If not, in the event of divorce one part could lose out on what was theirs to begin with.

These documents need to be revised, refreshed, updated and reaffirmed through a post-nuptial agreement on a regular basis. This is advised every five years, but at the very least, couples should re-affirm their agreements every 10 years. Failing to do so could cause a prenup to appear stale and outdated to the court.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

If one party refuses to sign a prenup and the parties still get divorced, then the standard laws regarding alimony and equitable distribution would be applicable.If your future spouse does not want to sign a prenup, many things could happen. It may be wise for you to get in touch with an attorney.

Prenups Ruin the Specialness of a Marriage It's a fact of life that money can create huge conflict. Many families witness this during inheritance disputes, which can lead to unfixable grudges.In fact, prenups themselves can cause such confrontation that they can even lead to separation before the marriage.

A prenuptial agreement, commonly referred to as a prenup, is a written contract you and your spouse enter into before getting legally married. It details exactly what happens to finances and assets during your marriage and, of course, in the event of divorce.

Prenups last, usually by their terms, for the entire length of the marriage. However, prenups sometimes include provisions that expire. The most common one might be an agreement that there's going to be no spousal support unless they are married for at least 10 years.

A marriage contract is an agreement signed before or after a wedding that provides a private and custom-made set of rules for dividing the couple's property should they separate and divorce or die.