New York Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out New York Financial Statements Only In Connection With Prenuptial Premarital Agreement?

US Legal Forms is a special system where you can find any legal or tax form for completing, including New York Financial Statements only in Connection with Prenuptial Premarital Agreement. If you’re tired with wasting time searching for perfect examples and spending money on document preparation/attorney service fees, then US Legal Forms is exactly what you’re searching for.

To reap all the service’s benefits, you don't need to install any application but simply select a subscription plan and sign up your account. If you have one, just log in and find an appropriate template, save it, and fill it out. Saved files are stored in the My Forms folder.

If you don't have a subscription but need to have New York Financial Statements only in Connection with Prenuptial Premarital Agreement, take a look at the instructions listed below:

- Double-check that the form you’re checking out applies in the state you want it in.

- Preview the example its description.

- Simply click Buy Now to reach the register webpage.

- Select a pricing plan and keep on signing up by entering some info.

- Pick a payment method to finish the registration.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel unsure concerning your New York Financial Statements only in Connection with Prenuptial Premarital Agreement form, speak to a legal professional to check it before you decide to send out or file it. Get started without hassles!

Form popularity

FAQ

Despite the fact that a prenup is arranged before a marriage, you can still sign one after exchanging "I do's." This contract, known as a post-nuptial agreement, is drafted after marriage by those who are still married and either are contemplating separation or divorce or simply want to protect themselves from the

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

A prenuptial agreement is a legally binding contract that dictates the division of premarital assets, but it can also include other agreements between the parties. A will, on the other hand, dictates the distribution of an individual's assets to their heirs when they pass away.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

Prenups aren't just for the rich or famous more millennials are signing them before getting married, and you probably should too.Prenups set expectations for a division of assets and finances in the event of divorce. They may not be romantic to bring up, but most couples will benefit from having one.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

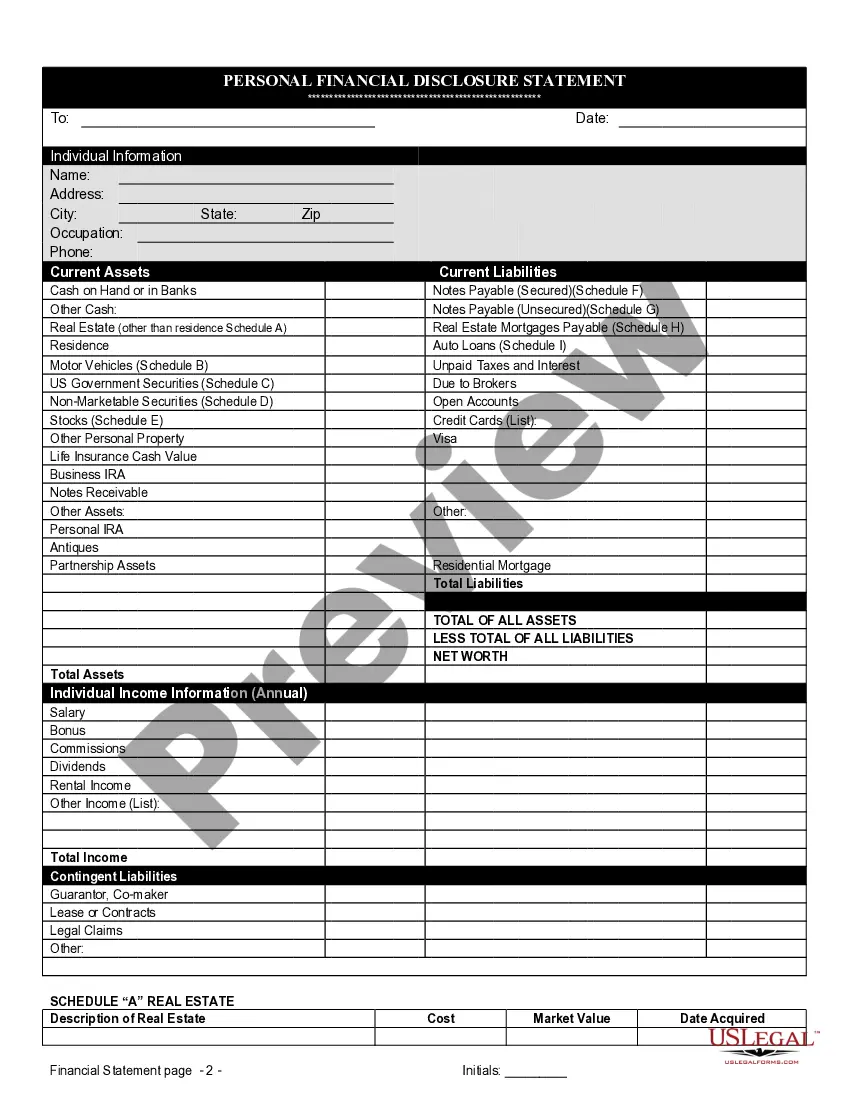

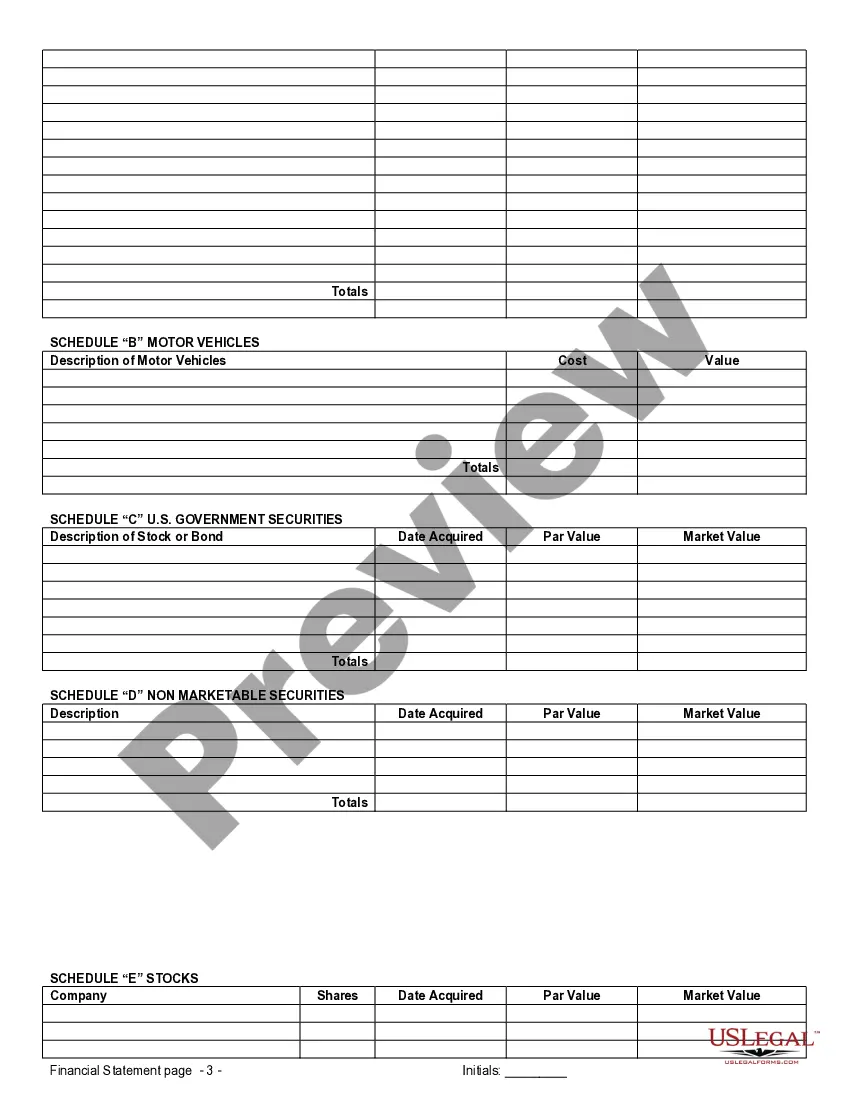

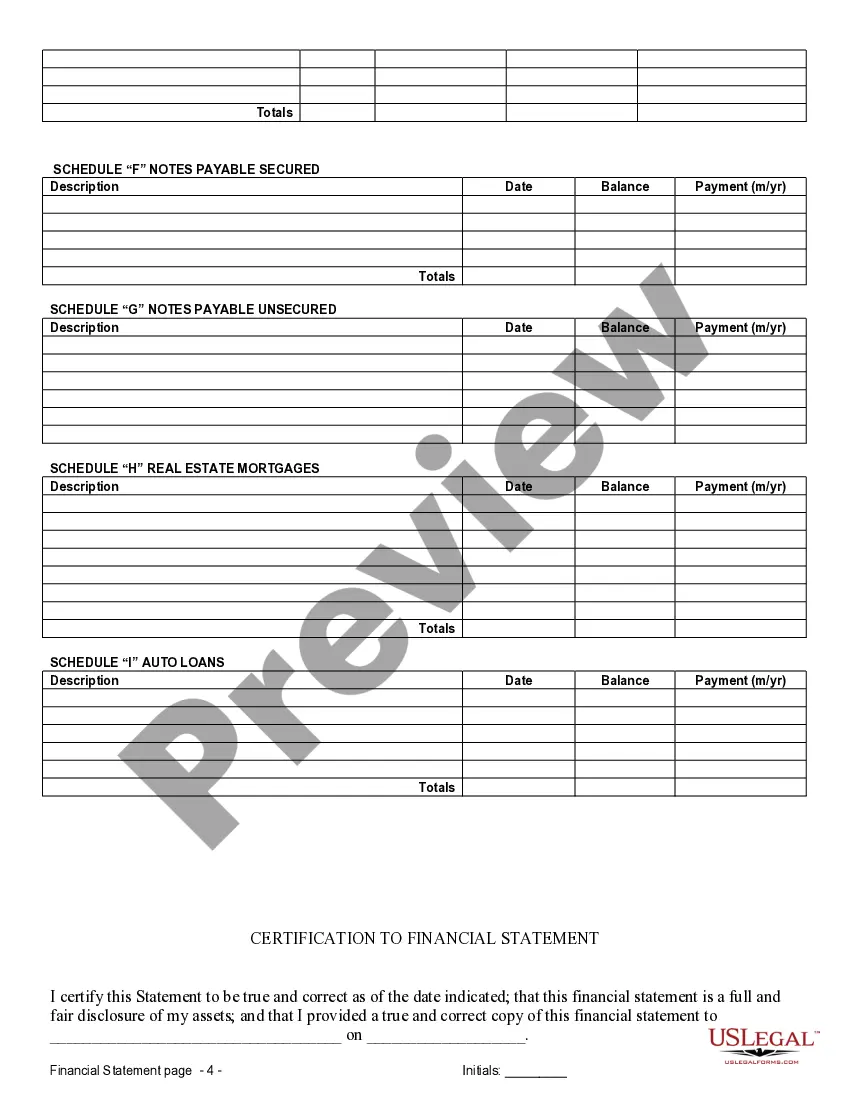

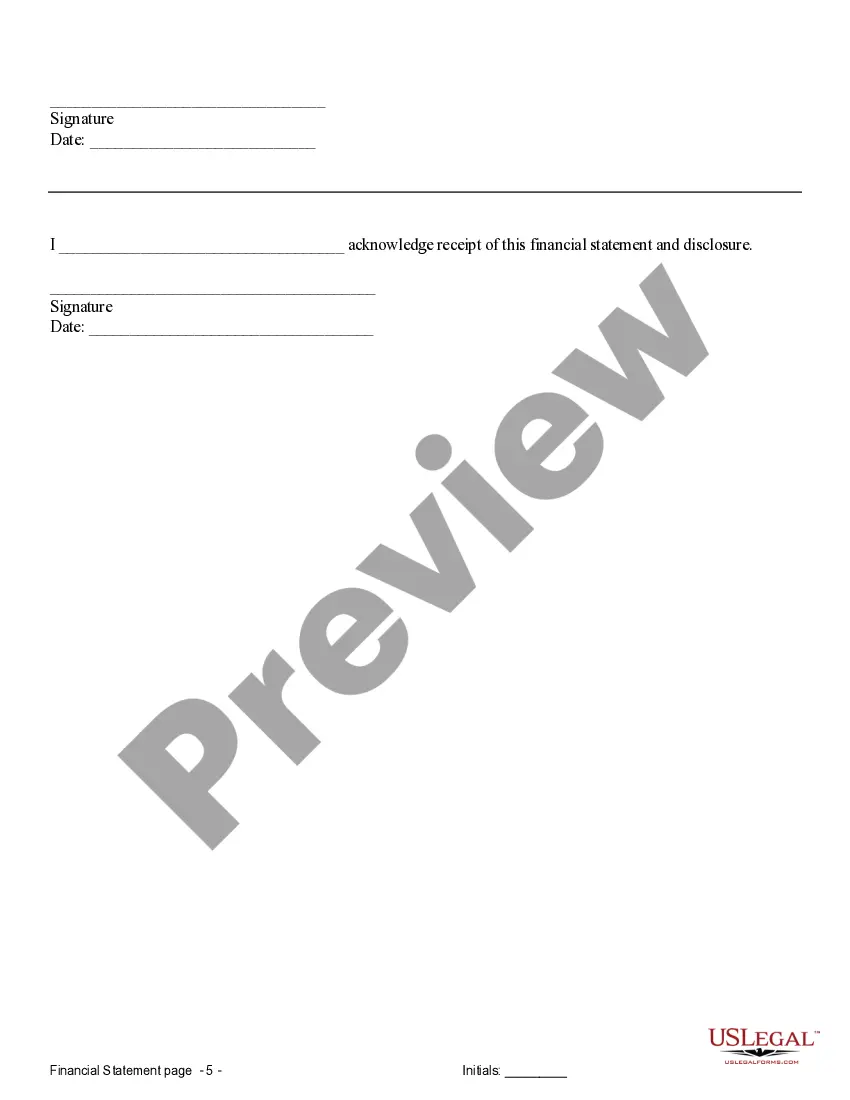

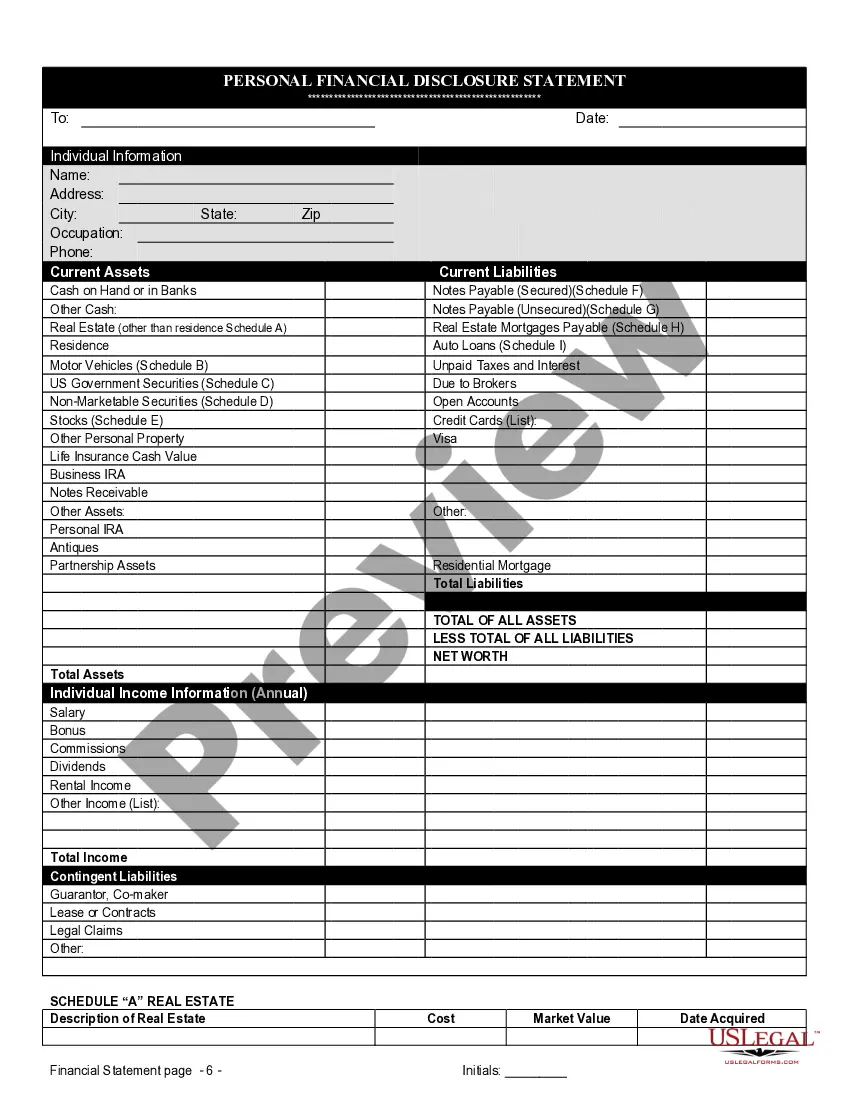

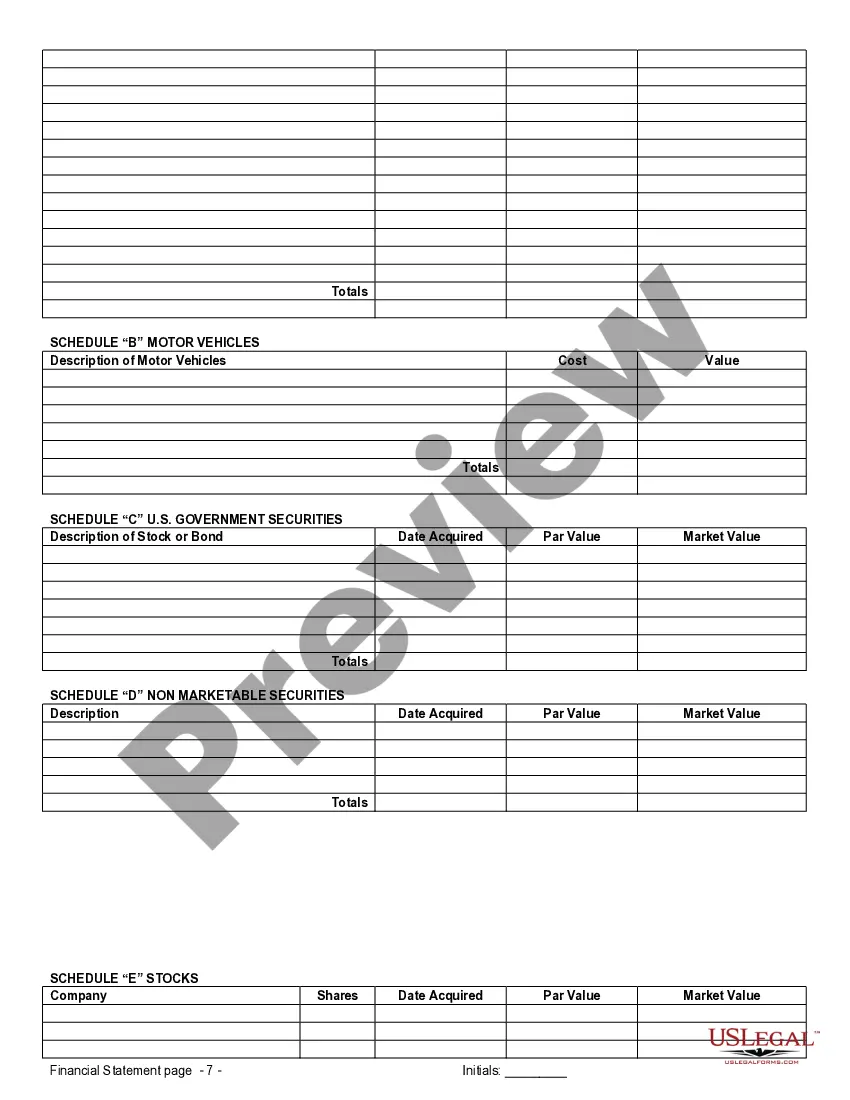

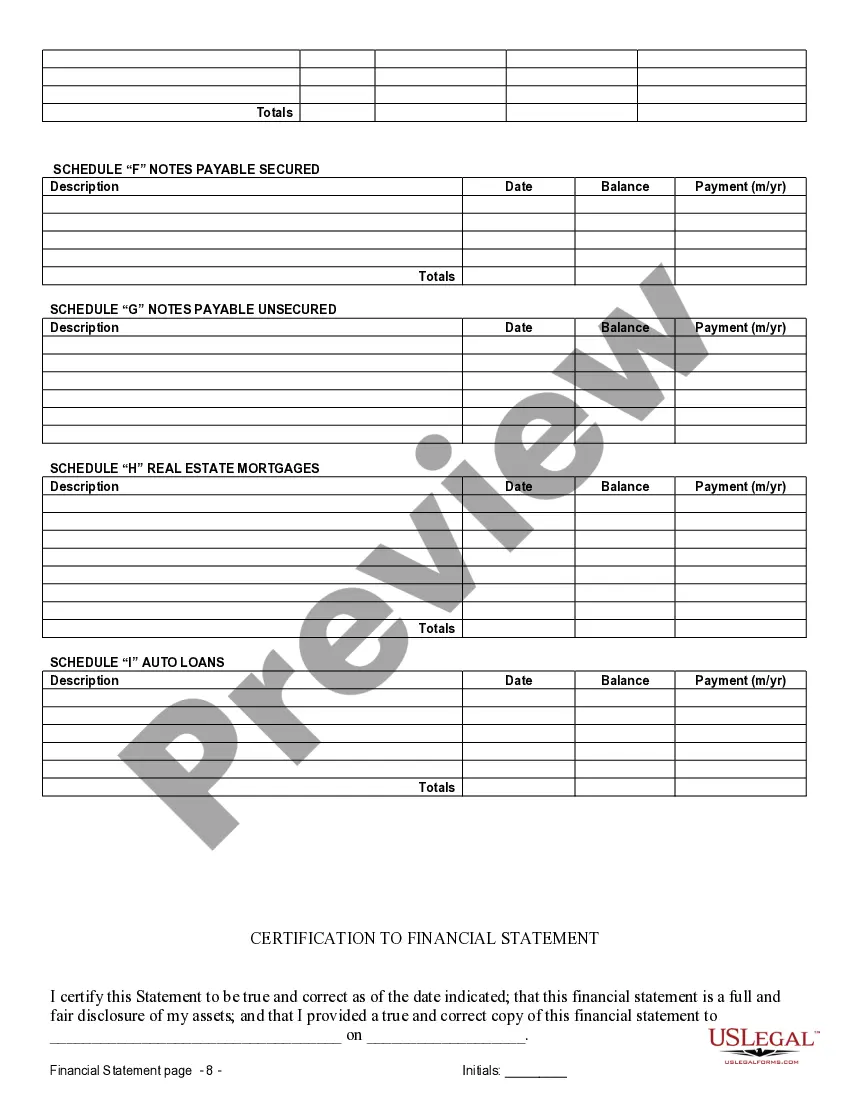

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.