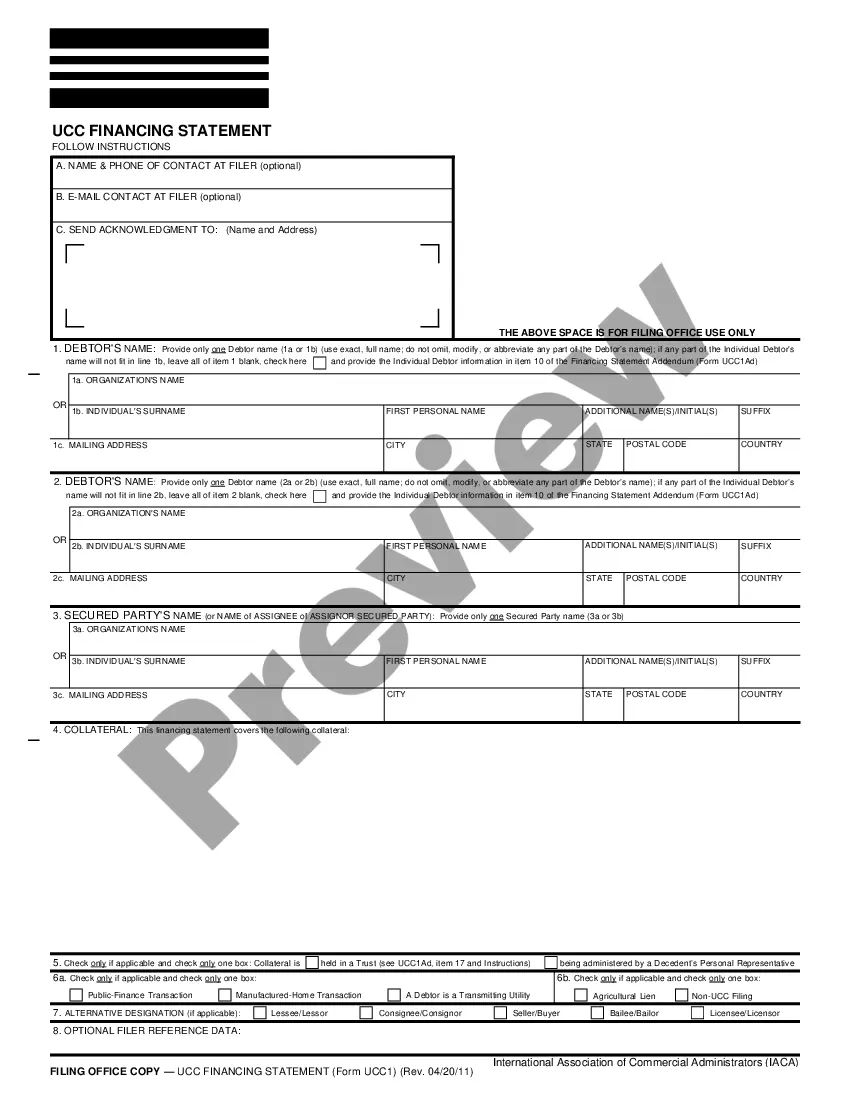

Nevada UCC1 Financing Statement Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada UCC1 Financing Statement Addendum?

US Legal Forms is a unique system where you can find any legal or tax template for submitting, including Nevada UCC1 Financing Statement Addendum. If you’re tired of wasting time looking for ideal examples and spending money on document preparation/lawyer service fees, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s benefits, you don't have to download any application but simply select a subscription plan and register an account. If you already have one, just log in and get a suitable sample, save it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have Nevada UCC1 Financing Statement Addendum, have a look at the guidelines below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to get to the register webpage.

- Select a pricing plan and keep on registering by entering some information.

- Pick a payment method to complete the registration.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel uncertain concerning your Nevada UCC1 Financing Statement Addendum form, contact a lawyer to review it before you decide to send out or file it. Get started without hassles!

Form popularity

FAQ

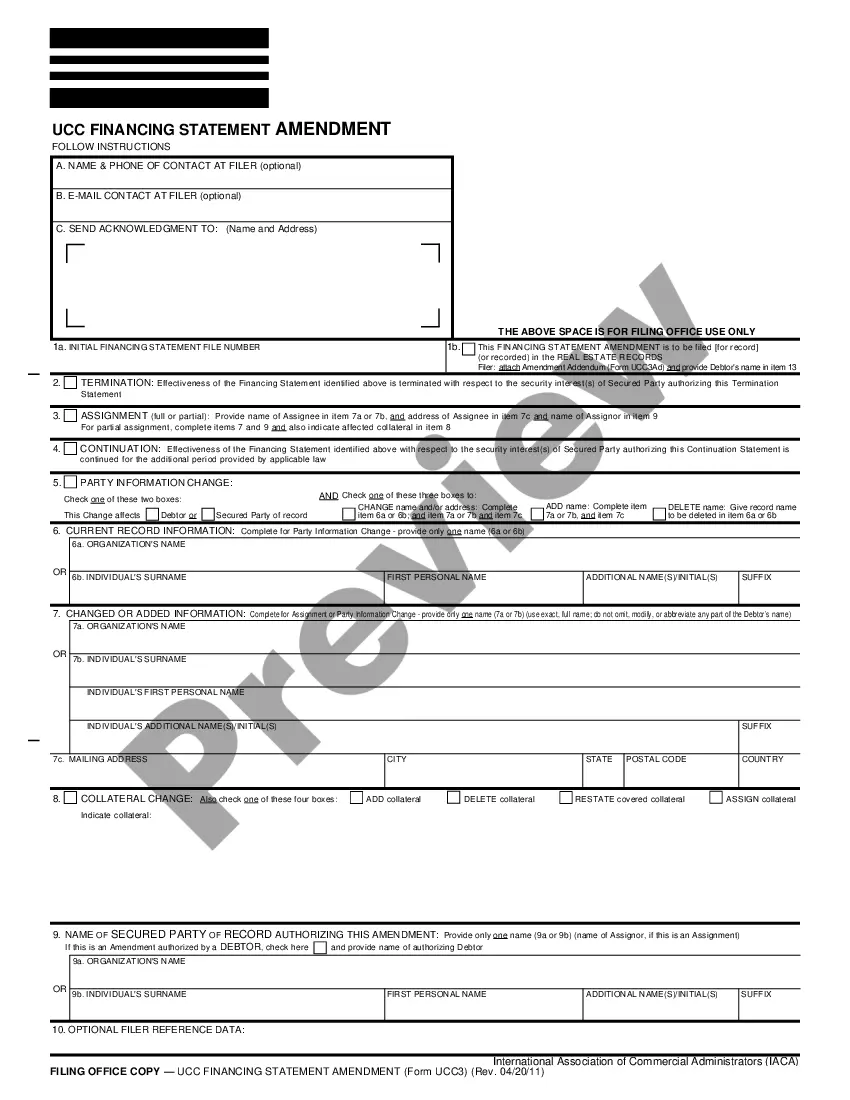

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

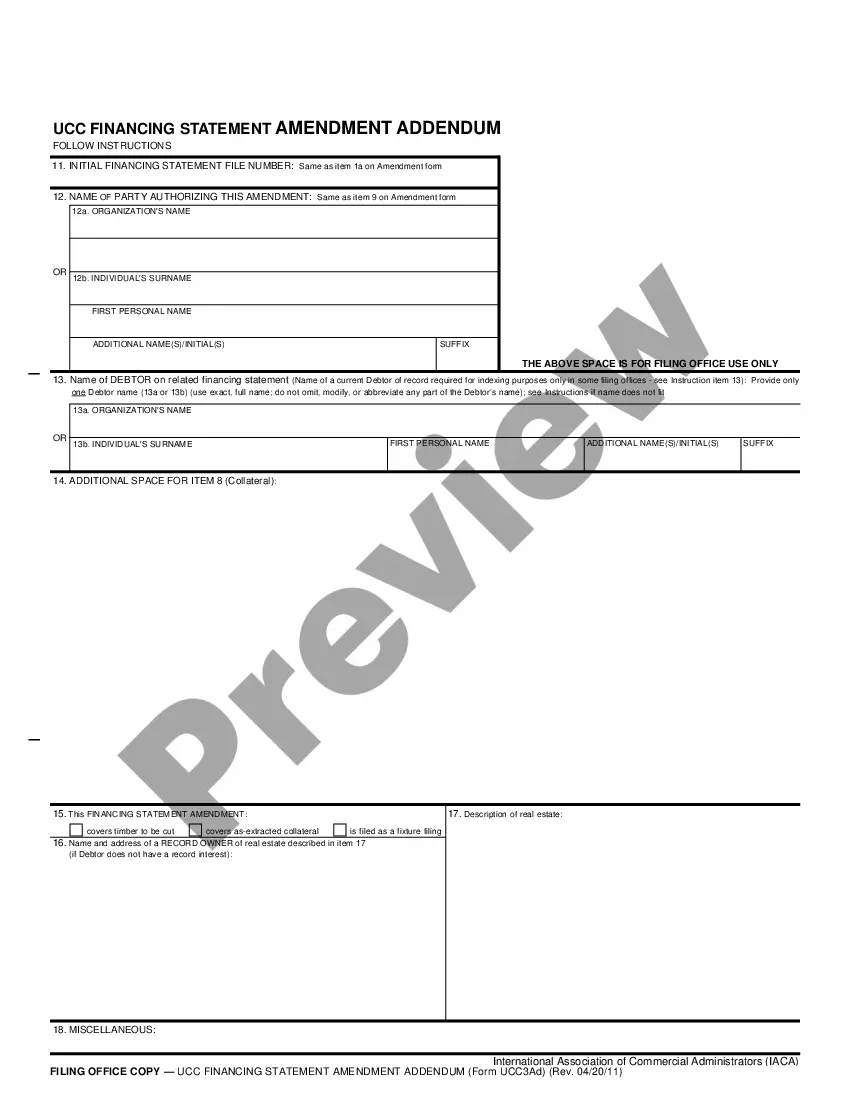

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.