Arizona Subcontractor's Agreement

What this document covers

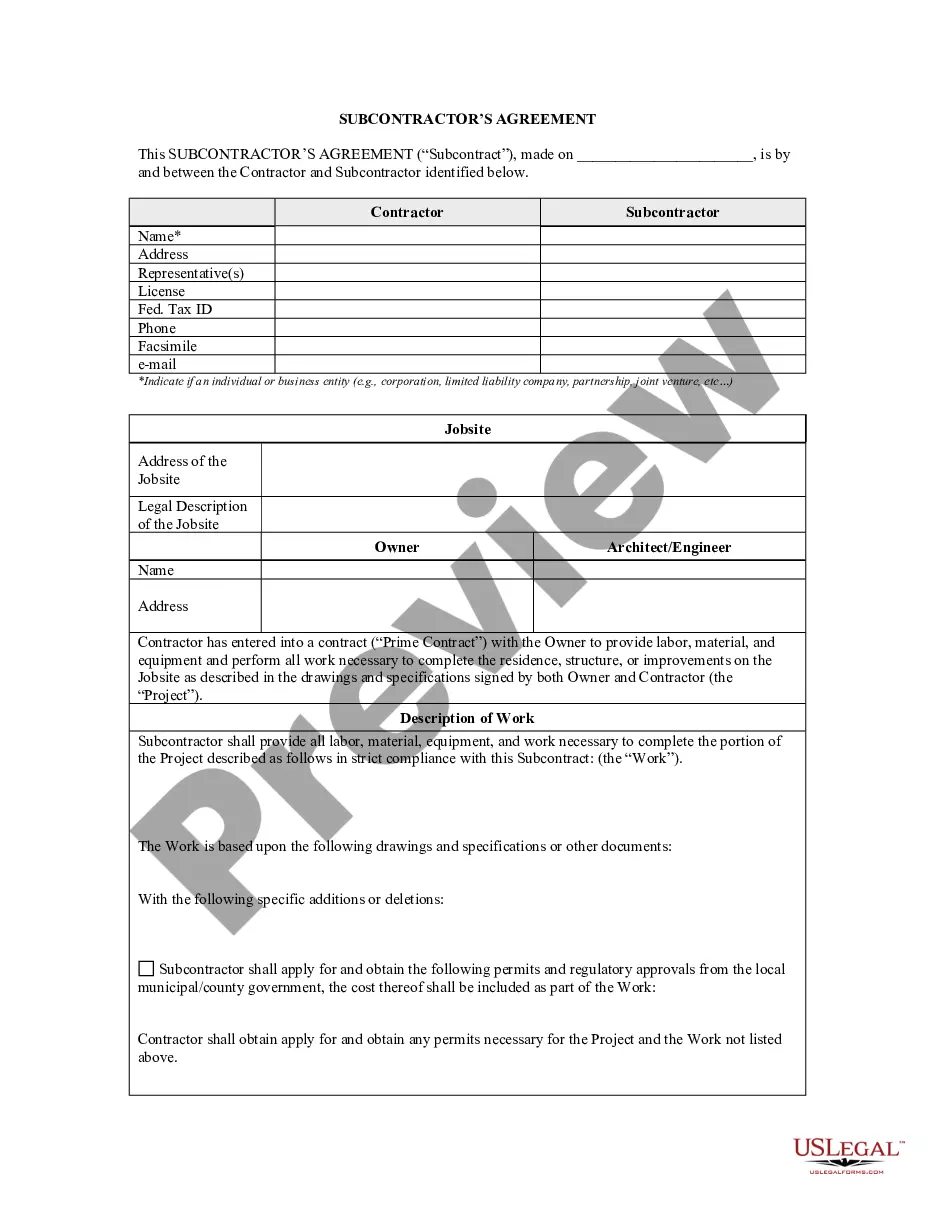

The Subcontractor's Agreement is a legally binding document that outlines the terms and conditions of work between a contractor and a subcontractor. It is specifically designed to address various aspects of subcontracted work, such as job descriptions, payment schedules, and dispute resolution. This agreement helps ensure clarity and protection for both parties, making it distinct from general construction contracts or employment agreements.

Main sections of this form

- Identification of parties involved and the jobsite.

- Description of work to be performed by the subcontractor.

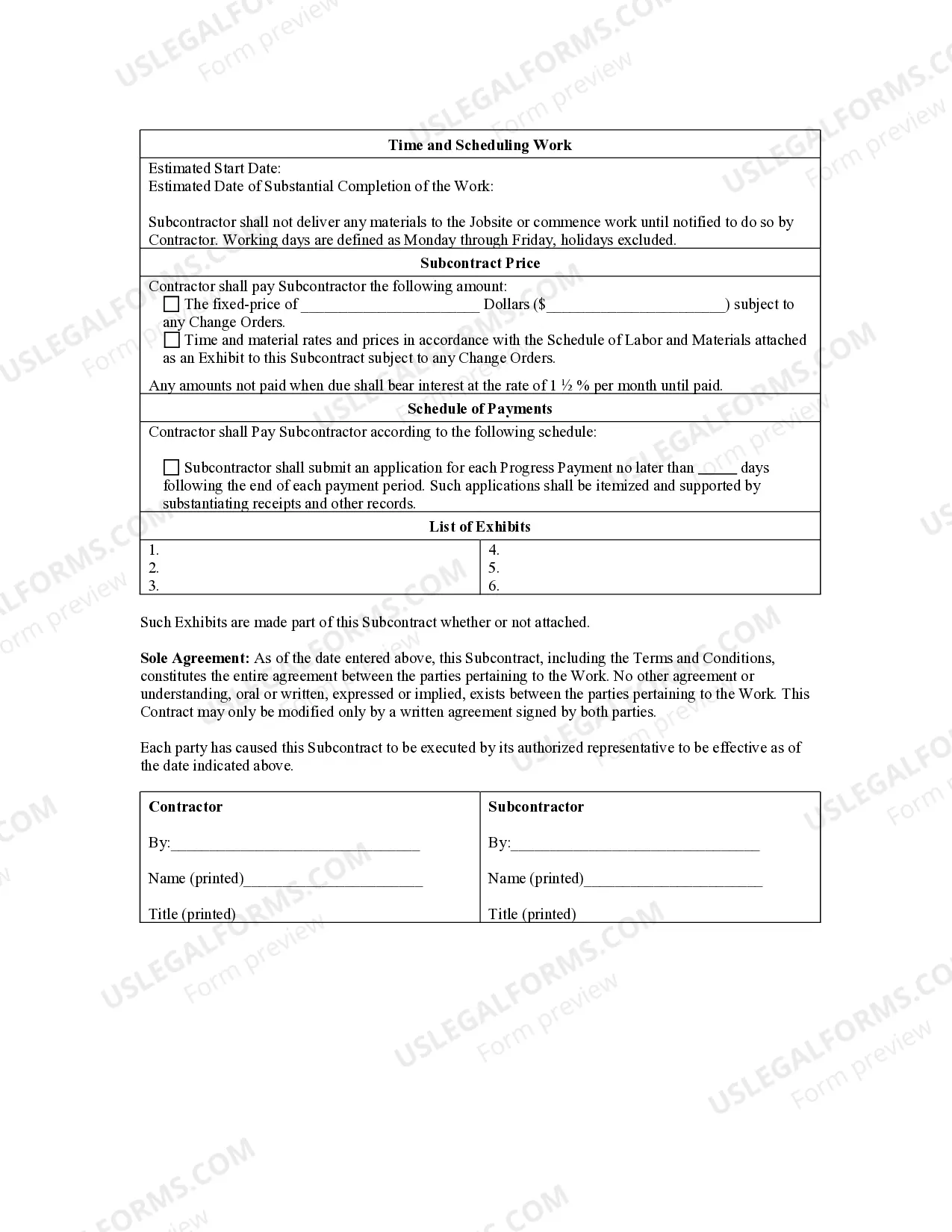

- Fixed price and payment schedule, including change orders.

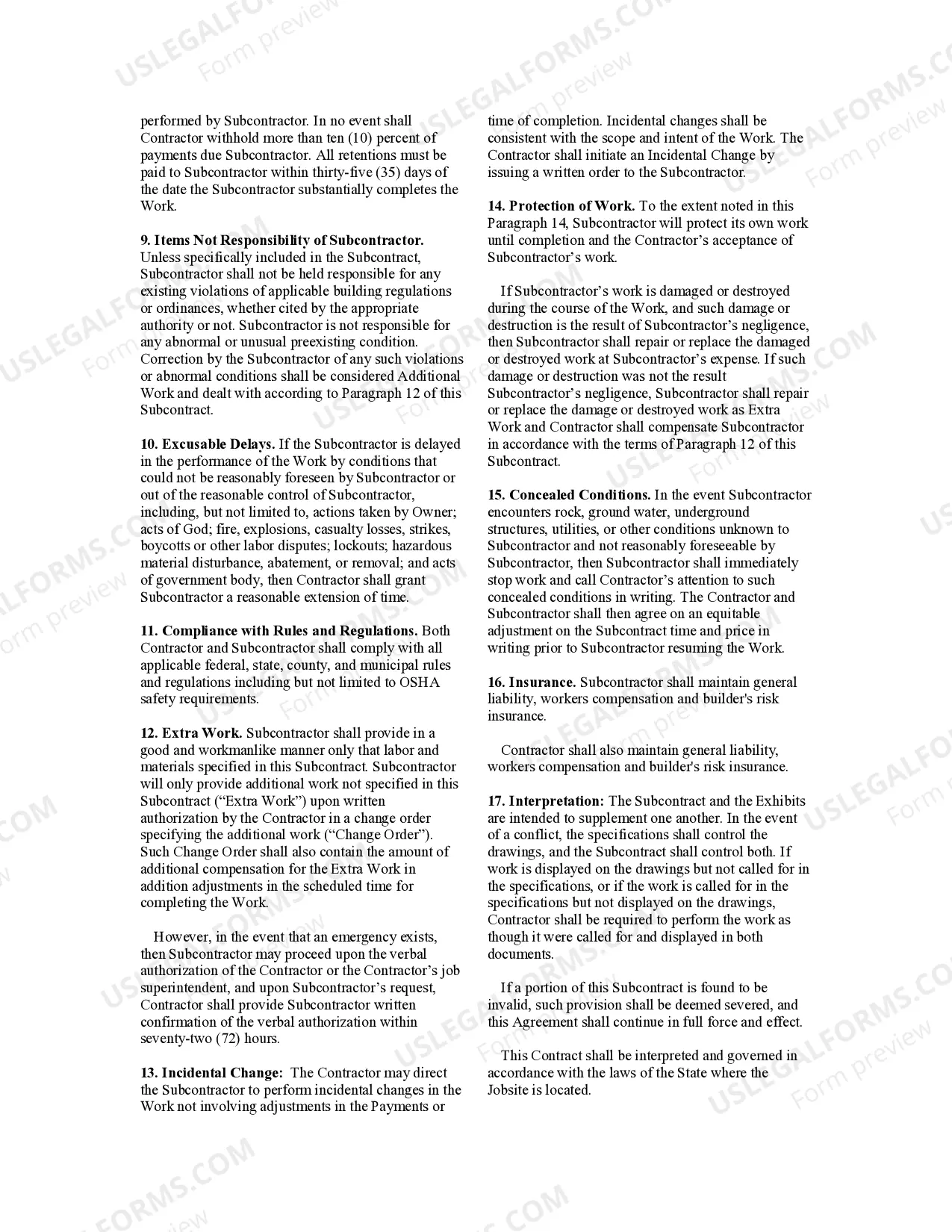

- Clauses addressing delays, disputes, and conditions of work.

- Requirements for compliance with regulations and insurance obligations.

Common use cases

This form is needed when a contractor hires a subcontractor for specific tasks on a project. It can be used in various situations, including construction projects, renovation works, and other services requiring subcontracted labor. Installing the agreement at the onset of the subcontractor relationship helps establish clear expectations and responsibilities.

Who should use this form

This agreement is suitable for:

- Contractors who need to formalize arrangements with subcontractors.

- Subcontractors looking to understand their rights and obligations.

- Project managers overseeing subcontractor relationships.

Steps to complete this form

- Identify the parties involved by filling in the contractor and subcontractor details.

- Specify the jobsite location where the work will be performed.

- Clearly describe the scope of work to be done by the subcontractor.

- Enter the agreed fixed price and outline the payment schedule.

- Obtain signatures from both the contractor and subcontractor to finalize the agreement.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include specific descriptions of the work to be performed.

- Not specifying the payment terms in detail.

- Overlooking the need for both parties to sign the agreement.

Why complete this form online

- Convenient access to templates that can be customized to meet specific needs.

- Real-time editing allows for quick adjustments and updates.

- Safe and reliable format that ensures compliance with legal standards.

Legal use & context

- This agreement offers a clear framework for subcontracting, which helps prevent misunderstandings.

- Enforceable by law, it provides protection for both parties involved.

- Always advisable to review state-specific laws for any additional requirements.

Main things to remember

- The Subcontractor's Agreement is essential for defining the terms of engagement between contractors and subcontractors.

- It covers vital areas such as payment terms, work descriptions, and dispute resolution.

- Properly completing and executing the agreement helps prevent disputes and ensures clarity between both parties.

Glossary of terms

- Change Order: A document that modifies the original terms of the subcontract, typically adding scope or cost adjustments.

- Excusable Delay: A delay in performance that is not caused by the subcontractor's negligence, allowing for reasonable time extensions.

- Incidental Change: Minor alterations to the work that do not affect the cost or completion time.

Looking for another form?

Form popularity

FAQ

In Arizona, subcontractors may need a license depending on the nature and scope of the work they perform. It's essential to check local regulations, as failing to obtain a required license can lead to penalties or disputes. By ensuring compliance with licensing rules, you can draft a more effective Arizona Subcontractor's Agreement that safeguards your interests. Always research your specific situation to stay informed.

Arizona form 5000 is typically used for reporting general tax obligations, while form 5000A serves as an amendment or additional information form. It's important to understand these distinctions when filing tax documents to avoid confusion. For subcontractors, choosing the correct form can directly impact your financial documentation related to the Arizona Subcontractor's Agreement. Always verify with the Arizona Department of Revenue to ensure accurate submissions.

To create a subcontractor agreement, start by specifying the project details and scope of work. Clearly outline payment terms, deadlines, and responsibilities to ensure both parties have a mutual understanding. Utilizing an online platform, such as USLegalForms, can provide ready-to-use templates and guidance, simplifying the drafting of your Arizona Subcontractor's Agreement. Remember to review the agreement for compliance with Arizona law before finalizing it.

Arizona form 5005 is a tax form primarily used for reporting specific income types. This form is essential for subcontractors as it helps accurately reflect earnings and ensures correct tax calculations. Filling out Arizona form 5005 correctly can support a smooth process when preparing your Arizona Subcontractor's Agreement, aligning financial reporting with contractual obligations. Always consider consulting with a tax professional for assistance.

The Arizona tax form is a document used to report income and calculate taxes owed to the state. It is crucial for individuals and businesses operating in Arizona to complete the appropriate tax forms, including those specifically related to contractor activities. Using the right forms can help streamline your financial management and ensure compliance with state requirements. For subcontractors, understanding these forms can be beneficial when drafting your Arizona Subcontractor's Agreement.

Writing a subcontract letter involves outlining the intent to enter into a subcontractor agreement. You may start with a formal greeting, then clearly state your business intent and project details. When referring to an Arizona Subcontractor's Agreement, specify the work scope, expected outcomes, and your contact information for further discussion.

Filling out a contract agreement requires attention to detail. Start by entering the names and contact information of both parties. For an Arizona Subcontractor's Agreement, ensure you clearly specify the scope of work, payment terms, and deadlines. This clarity helps prevent misunderstandings later in the project.

To write a subcontract agreement, begin by outlining the primary parties and their duties. In an Arizona Subcontractor's Agreement, it is crucial to include details about the work to be performed, timelines, and financial arrangements. This ensures all parties have a clear understanding of their roles and responsibilities.

An effective subcontractor agreement should include essential elements like project descriptions, deadlines, and payment schedules. When creating your Arizona Subcontractor's Agreement, also consider adding clauses for insurance, liability, and dispute resolution. This comprehensive approach safeguards both parties and clarifies expectations.

Writing a subcontractor agreement involves several key steps. First, specify the parties and their roles. Next, detail the project scope, payment terms, and deadlines, ensuring clarity in the Arizona Subcontractor's Agreement. Finally, incorporate clauses for dispute resolution and confidentiality to protect both parties' interests.