New Mexico Limited Liability Company LLC Operating Agreement

What is this form?

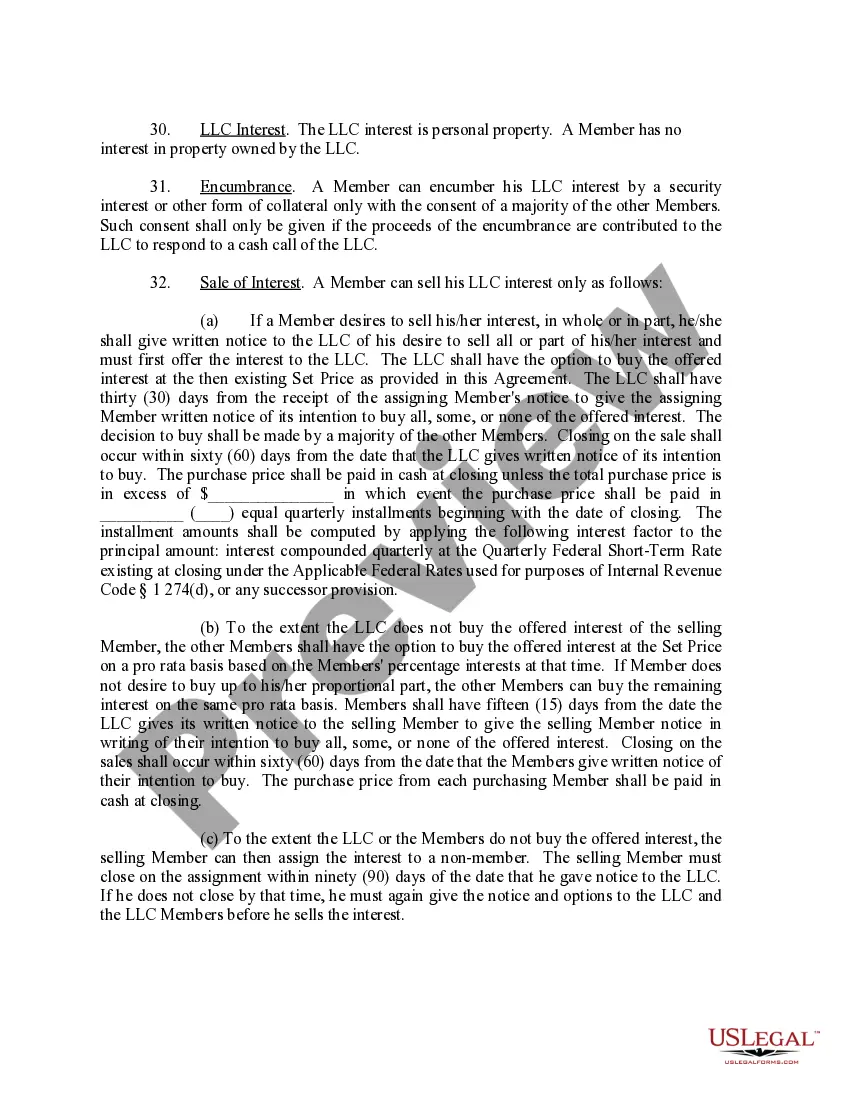

The Limited Liability Company (LLC) Operating Agreement is a crucial document when establishing an LLC. It outlines the operational procedures of the company and the relationships and responsibilities of its members. Unlike other business structures, an LLC provides liability protection and flexible tax options. This form is tailored for LLCs in New Mexico and allows customization to fit your specific business needs, making it essential for managing your LLC effectively.

Key parts of this document

- Formation details of the LLC, including the name and registered agent.

- Member contributions, ownership percentages, and rules for adding new members.

- Management structure, specifying whether managed by members or appointed managers.

- Voting rights and procedures for making major decisions within the LLC.

- Distribution of profits and losses among members based on percentage interests.

- Indemnification clauses protecting members against liability claims.

When to use this form

This form is essential when forming an LLC in New Mexico or when there are changes to the LLCâs structure or operations. It should be used during the initial setup of the LLC, when adding new members, and whenever any significant operational changes occur that require internal guidelines and legal clarity regarding the roles and responsibilities of all parties involved.

Who should use this form

- Entrepreneurs forming a new LLC in New Mexico.

- Existing LLC members updating their operating agreement.

- Business partners who wish to clarify the management structure and profit distribution.

- Individuals seeking a clear understanding of member responsibilities and obligations within the LLC.

How to prepare this document

- Identify and list the members of the LLC directly in the agreement.

- Specify the name and purpose of the LLC as well as the registered office address.

- Outline the management structure by deciding between member management and manager appointments.

- Determine and document each memberâs initial capital contributions and ownership percentage.

- Include provisions for profit sharing, decision-making, and the admission of new members as required.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all members in the formation process.

- Not specifying the management structure leading to potential conflicts.

- Neglecting to outline clear procedures for adding new members.

- Forgetting to review state-specific laws regarding LLC operations.

Why use this form online

- Easy access to legal templates tailored for your state.

- Customizable fields to reflect your specific business needs.

- Convenient download options for quick use and filing.

- Legal guidance integrated to ensure compliance and correctness.

Looking for another form?

Form popularity

FAQ

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its owners. It also outlines the financial and functional decision-making in a structured manner.

Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

In essence, state law provides a standard operating agreement if you don't create your own.In the absence of an operating agreement, LLC owners could be subject to personal liability if it looks like they are operating a sole proprietorship or a partnership.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.