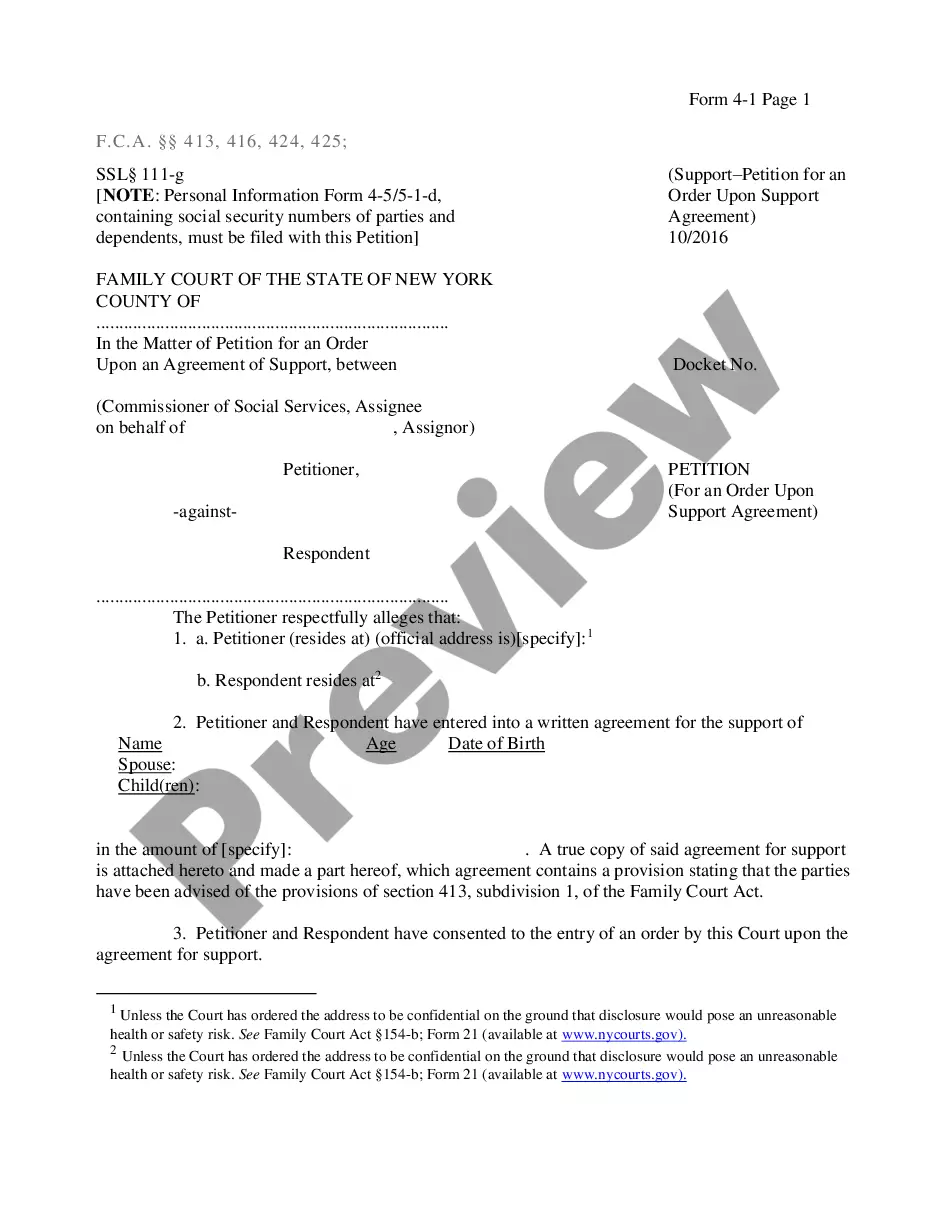

This form is an official State of New York Family Court sample form, a detailed Stipulation for Child Support.

New York Stipulation For Child Support

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Stipulation for Child Support: A legal agreement or order specifying the amount and terms under which one parent will provide financial support to the other parent for the care of their children after a separation or divorce. This stipulation is typically formalized through court approval and ensures that child support arrangements are adhered to legally.

Step-by-Step Guide

- Understand the Basics: Both parents should first understand their states guidelines regarding child support. This involves knowing how payments are calculated based on income, custody arrangements, and other factors.

- Agreement Preparation: Parents can mutually agree on child support terms or seek mediation to come to an agreement. Its advisable to collaborate with legal professionals to ensure that all aspects are legally sound.

- Filing the Stipulation: Once an agreement is reached, the stipulation document should be drafted, which outlines all agreed terms. This document is then submitted to a family court for approval.

- Court Review and Approval: The court will review the stipulation to ensure it complies with legal standards and state guidelines. If acceptable, it will be approved and become a legally binding order.

- Implementation and Compliance: After approval, both parties are required to adhere to the stipulation. Regular monitoring and modifications might be necessary to accommodate changes in financial circumstances or living arrangements.

Risk Analysis

- Non-Compliance Risk: One significant risk involves a parent failing to comply with the stipulation, which can lead to legal consequences such as wage garnishment or license suspensions.

- Insufficient Support Risk: If the stipulation does not accurately reflect ones financial situation, it may result in insufficient support, affecting the childs well-being.

- Overestimation of Income: Overestimating income can lead to unfairly high child support payments, placing a financial strain on the paying parent.

Common Mistakes & How to Avoid Them

- Not Consulting a Lawyer: Skipping professional legal advice can lead to a poorly constructed stipulation that may not be enforceable or fair. Always consult a lawyer who specializes in family law.

- Failing to Update the Agreement: As circumstances change, such as income levels or cost of living, the stipulation should be updated. Periodic reviews every few years or after significant financial changes are advisable.

- Lack of Detailed Documentation: All income and financial statements should be comprehensively documented and included in the agreement discussions to avoid disputes and ensure fairness.

Best Practices

- Ensure Flexibility: Include terms that make allowances for future changes in financial circumstances of either parent, ensuring that the child support remains fair and relevant.

- Be Comprehensive: Cover all necessary expenses related to the childs upbringing, including education, healthcare, and extracurricular activities, when drafting the stipulation.

- Encourage Cooperation: Maintaining a cooperative and respectful relationship between the parents can facilitate smoother adjustments and compliance with the agreement.

Key Takeaways

A stipulation for child support is crucial in ensuring stable financial arrangements for the upbringing of a child after the parents' separation. It must be legally compliant, considerate of both parents financial situations, and flexible to adapt to future changes. Avoiding common pitfalls by seeking appropriate legal counsel and regularly revising the terms are best practices for maintaining an effective stipulation.

How to fill out New York Stipulation For Child Support?

US Legal Forms is a special system to find any legal or tax form for submitting, such as New York Stipulation for Child Support. If you’re sick and tired of wasting time looking for suitable samples and spending money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s advantages, you don't have to download any application but just choose a subscription plan and create an account. If you have one, just log in and get an appropriate template, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New York Stipulation for Child Support, have a look at the recommendations listed below:

- Double-check that the form you’re checking out is valid in the state you need it in.

- Preview the form its description.

- Click on Buy Now button to reach the register webpage.

- Pick a pricing plan and carry on registering by entering some information.

- Decide on a payment method to complete the registration.

- Download the file by choosing your preferred format (.docx or .pdf)

Now, submit the document online or print it. If you feel uncertain concerning your New York Stipulation for Child Support sample, contact a legal professional to analyze it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

Under New York State law, both parents must financially support their child until the child turns 21 years old. If the child is under 21 and married, self-supporting, or in the military then the child is emancipated and the parents don't have to support the child.

In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

Use the correct percentage of total income CSSA says should be devoted to child support: 17% for one child. 25% for two children. 29% for three children.

Minimum basic child support obligation is $100 per month.

Figure out what guideline child support amount is. Agree on an amount and other issues. Write up your agreement. Sign your Stipulation (agreement) Turn in your Stipulation to the court for the judge to sign. File your Stipulation after the judge signs it.

Under the CSSA, non-custodial parents will be ordered to pay a percentage of their gross income, minus certain deductions, until the child reaches the age of 21.The percentages are 17% for one child, 25% for two children, 29% for three children, 31% for four children, and at least 35% for five or more children.

17% of the combined parental income for one child. 25% of the combined parental income for two children. 29% of the combined parental income for three children. 31% of the combined parental income for four children, and.

17% for one child. 25% for two children. 29% for three children. 31% for four children. at least 35% for five or more children.