New Hampshire Financial Account Transfer to Living Trust

Understanding this form

The Financial Account Transfer to Living Trust form is designed to facilitate the transfer of bank and other financial accounts into a living trust. This type of trust is created during a person's lifetime, allowing for more efficient estate planning and management of assets. By using this form, individuals can ensure that their financial accounts are properly assigned to the trustee of the living trust, distinguishing it from other estate planning documents like wills or powers of attorney.

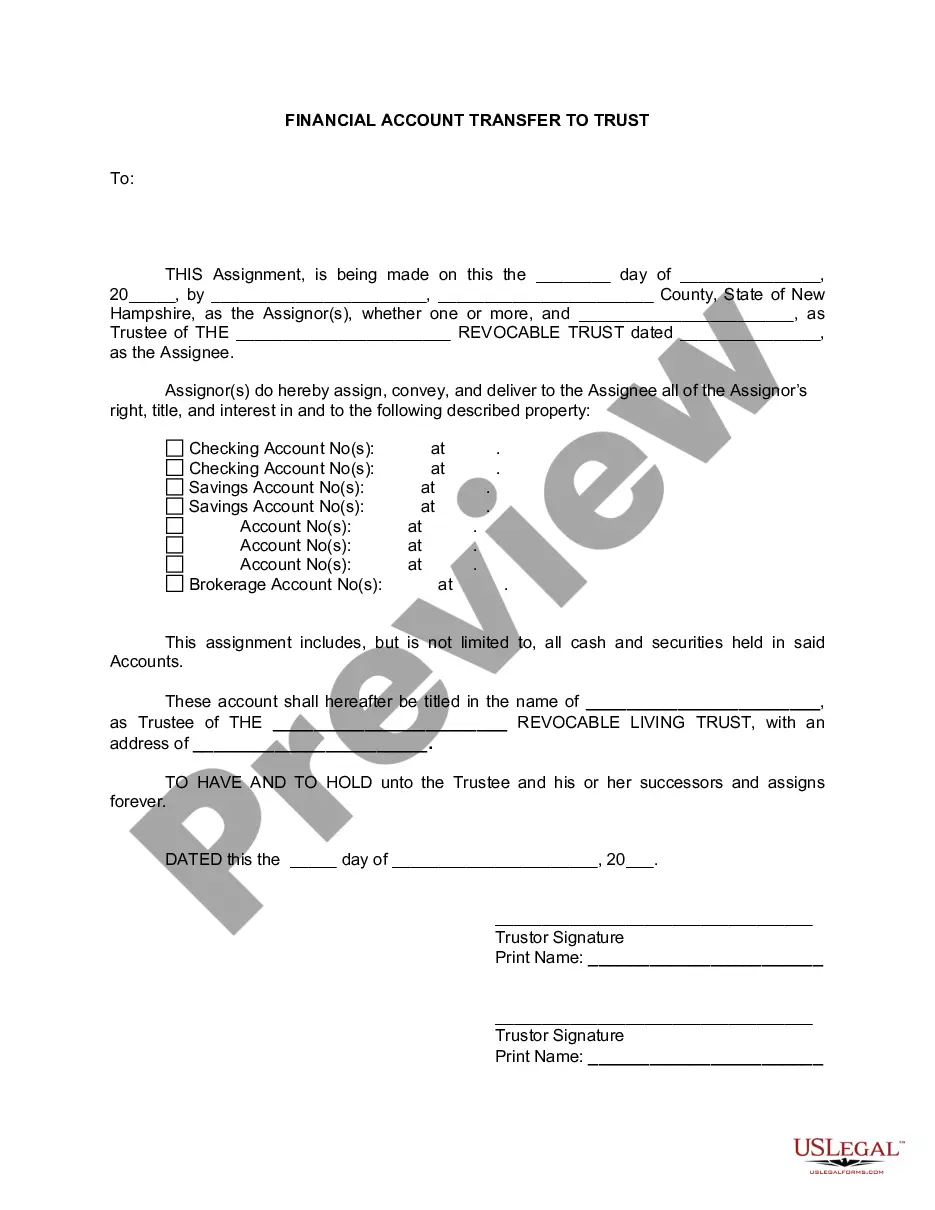

Main sections of this form

- Assignment clause: Assignor(s) assign all right, title, and interest in the financial accounts to the Assignee.

- Trustee designation: Specifies the name and address of the trustee of the living trust.

- Date field: Indicates when the transfer is executed.

- Signatures: Requires signatures from the Assignors to validate the transfer.

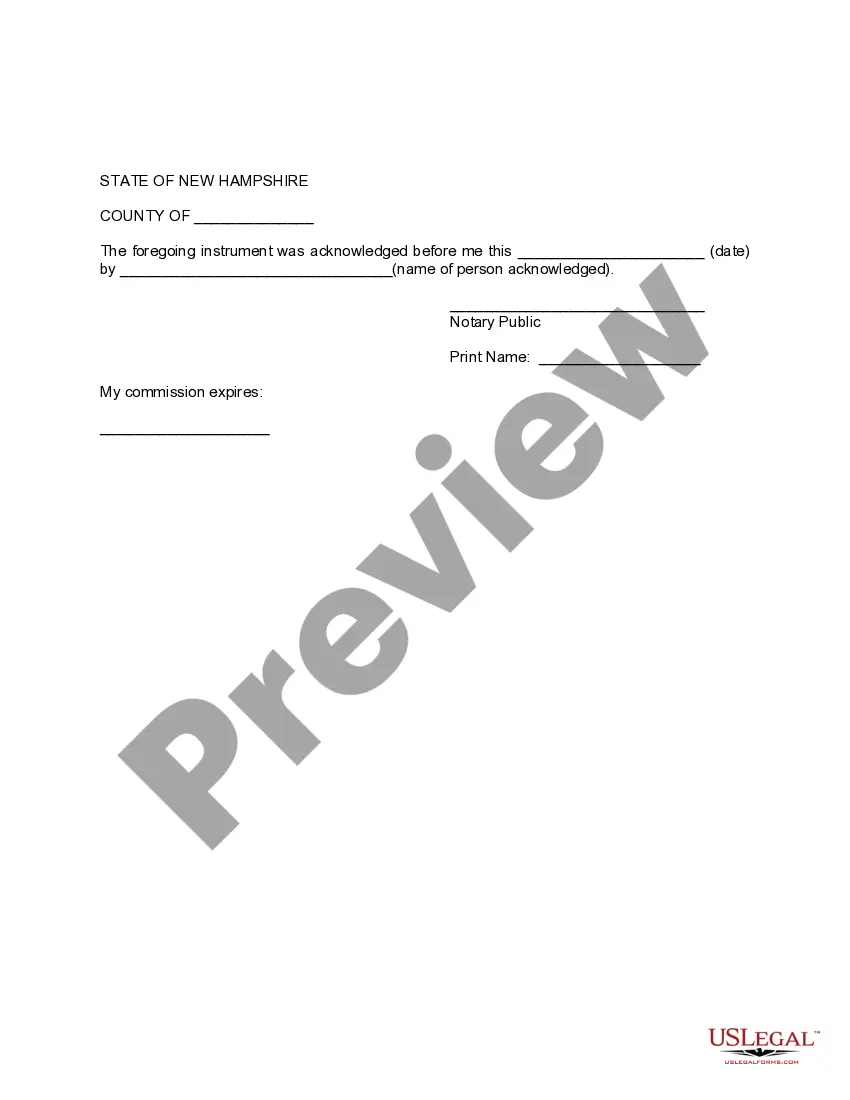

- Notary acknowledgment: Must be formally recognized by a notary public to ensure authenticity.

Situations where this form applies

This form should be used when you want to transfer ownership of your financial accounts, such as bank accounts and investment accounts, to a living trust. This is particularly useful for individuals who are estate planning and wish to avoid probate, streamline asset management, or designate how their assets will be managed after their passing. Using this form can ensure that the accounts are managed according to the terms of the trust.

Who can use this document

- Individuals establishing a living trust as part of their estate planning.

- Trustors who own bank or financial accounts they wish to transfer into their living trust.

- Anyone looking to streamline asset management for their beneficiaries.

Completing this form step by step

- Identify the parties: Fill in the names of the Assignor(s) and Assignee.

- Specify the property: Include details about the financial accounts being transferred.

- Enter the trustee's information: Provide the name and address of the trustee of the living trust.

- Sign and date: Ensure all Assignors sign the document and enter the date of execution.

- Obtain notarization: Have a notary public acknowledge the signatures to finalize the transfer.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes to avoid

- Failing to include complete account details can lead to ambiguity in the transfer.

- Not obtaining notarization, which is crucial for validation in states like New Hampshire.

- Leaving fields blank, especially signature or date sections, can render the form unusable.

Advantages of online completion

- Convenience: Download and complete the form at your own pace, on your schedule.

- Editability: Easily customize the form to fit your specific needs before printing.

- Reliability: Access professionally drafted forms created by licensed attorneys.

Key takeaways

- This form is crucial for seamlessly transferring financial accounts into a living trust.

- It requires signatures from the Assignor(s) and notarization for validity.

- Correctly filling out this form can save time and avoid complications in estate management.

Form popularity

FAQ

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.