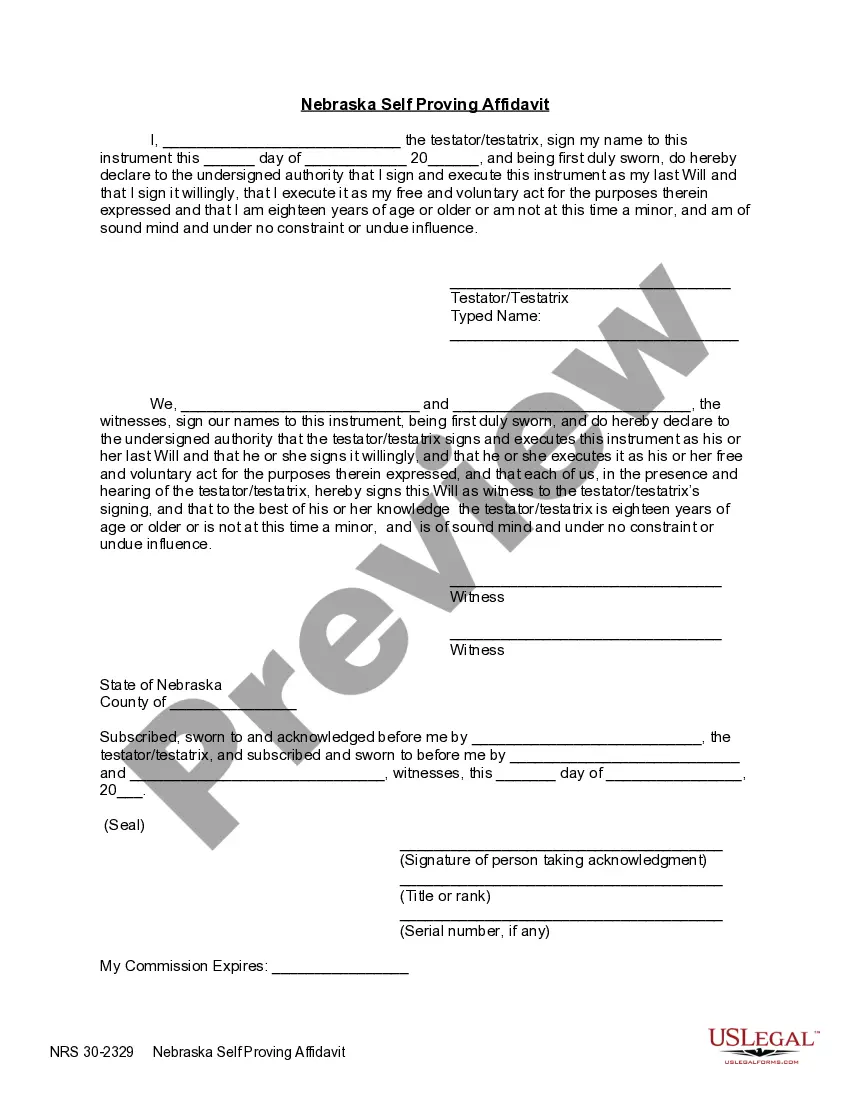

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Nebraska Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Nebraska Last Will And Testament With All Property To Trust Called A Pour Over Will?

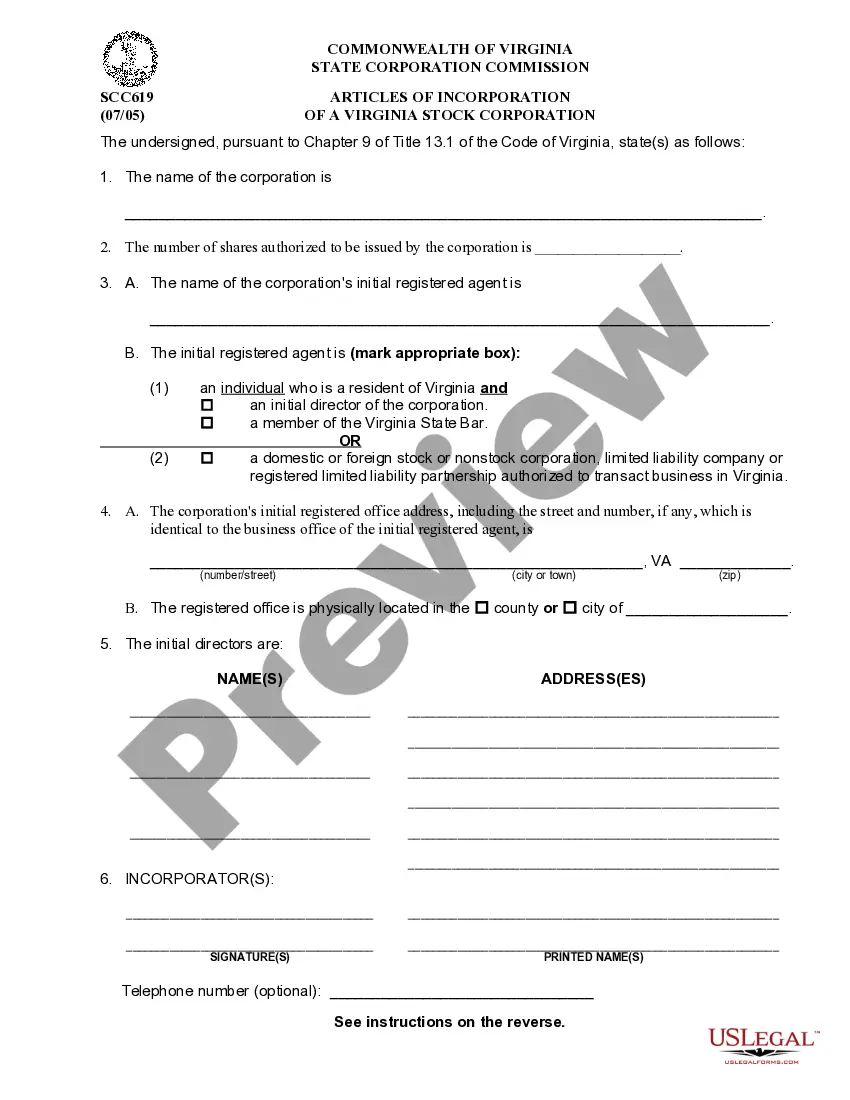

Avoid pricey lawyers and find the Nebraska Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will you need at a affordable price on the US Legal Forms site. Use our simple groups function to search for and download legal and tax files. Read their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to download and complete each form.

US Legal Forms subscribers basically have to log in and obtain the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips listed below:

- Make sure the Nebraska Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you’re sure the template is right for you, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, it is possible to complete the Nebraska Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will by hand or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

The pour over will does not need to be notarized; however, in California it does need to be signed by two disinterested witnesses.

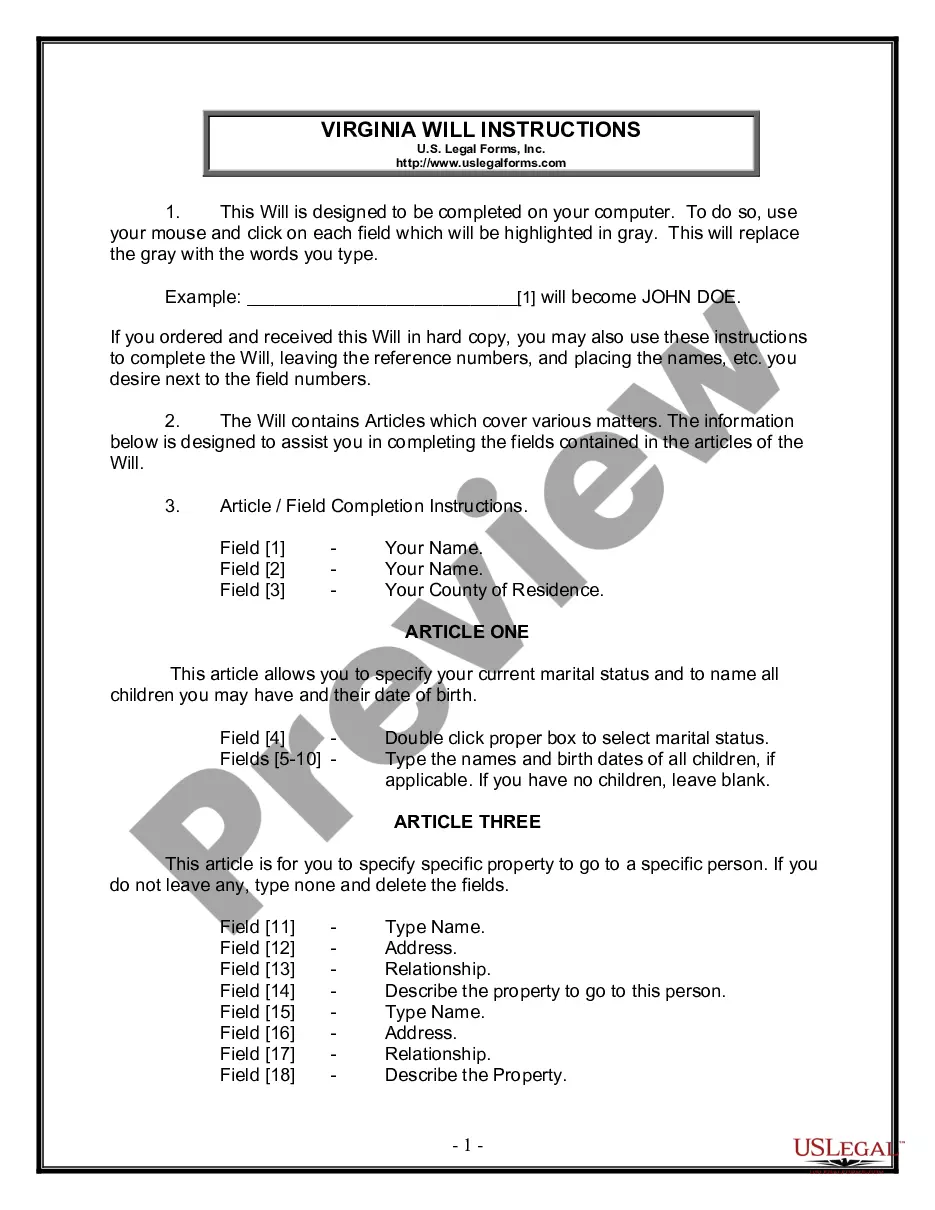

Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

Include personal identifying information. Include a statement about your age and mental status. Designate an executor. Decide who will take care of your children. Choose your beneficiaries. List your funeral details. Sign and date your Last Will and Testament.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

There are certain types of property that legally cannot be included in a person's will. Depending on state laws, these may include: Any Property that is Co-Owned with Someone Else Through Joint-Tenancy: Married couples typically own the marital home in joint tenancy.Property being held in a living trust.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Types Of Property And Assets To Include In A WillCash, including money in checking accounts, savings accounts, and money market accounts, etc. Intangible personal property, such as stocks, bonds, and other forms of business ownership, as well as intellectual property, royalties, patents, and copyrights, etc.

In most situations, a will template is an easy and inexpensive way to make sure your wishes are known and carried out. Most people can get everything they need by using a will template, with little cost or hassle.