Nebraska Heirship Affidavit - Descent

About this form

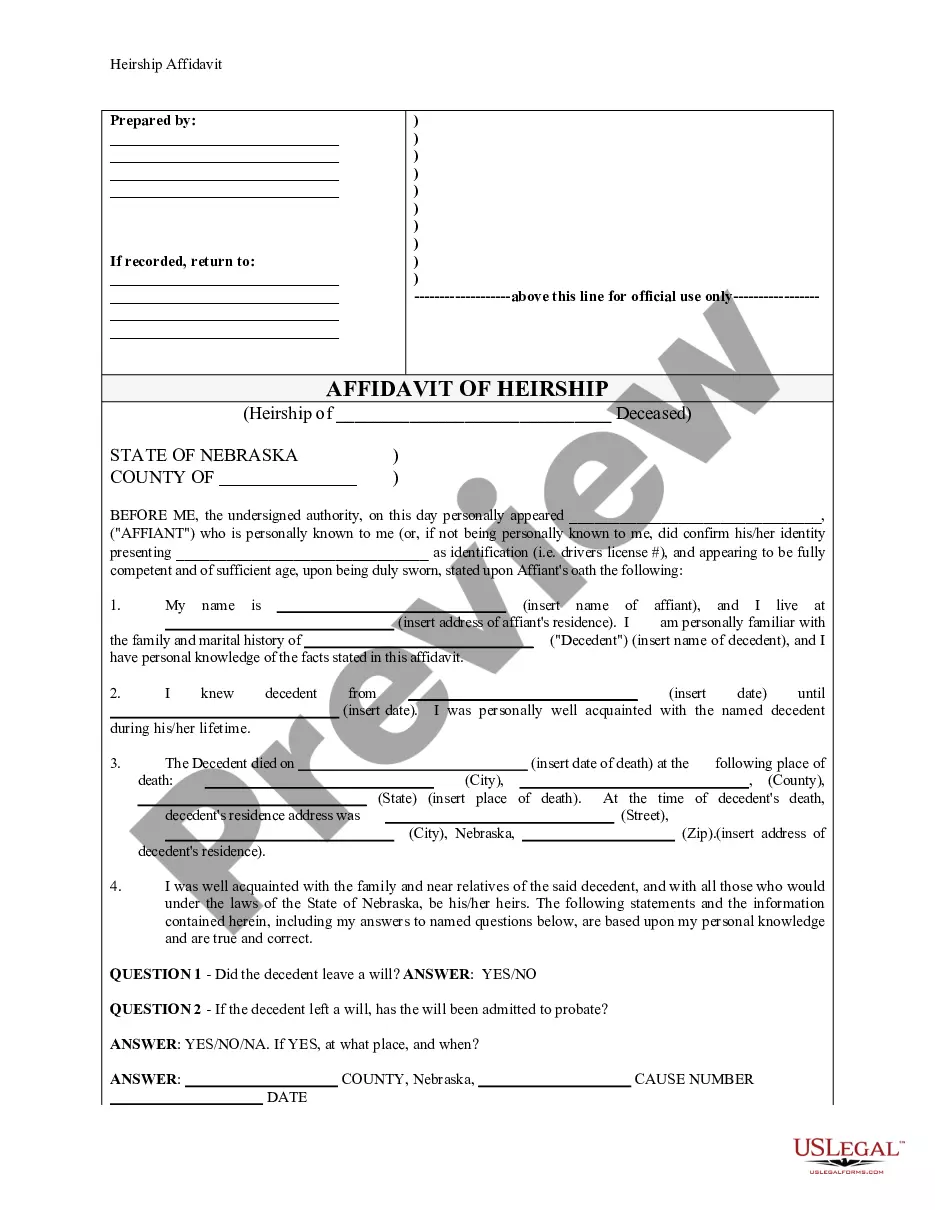

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased person. It serves to establish the rightful successors to personal and real property when there is no will in place. This affidavit is particularly important when the heirs need to prove their rights to inherit property, making it distinct from other probate documents. It is typically executed by someone who is not an heir to avoid conflicts of interest.

What’s included in this form

- Name and address of the affiant (the person completing the affidavit).

- Details about the decedent, including their name, date of death, and place of residence.

- Questions to ascertain the existence of a will and appointment of an estate administrator.

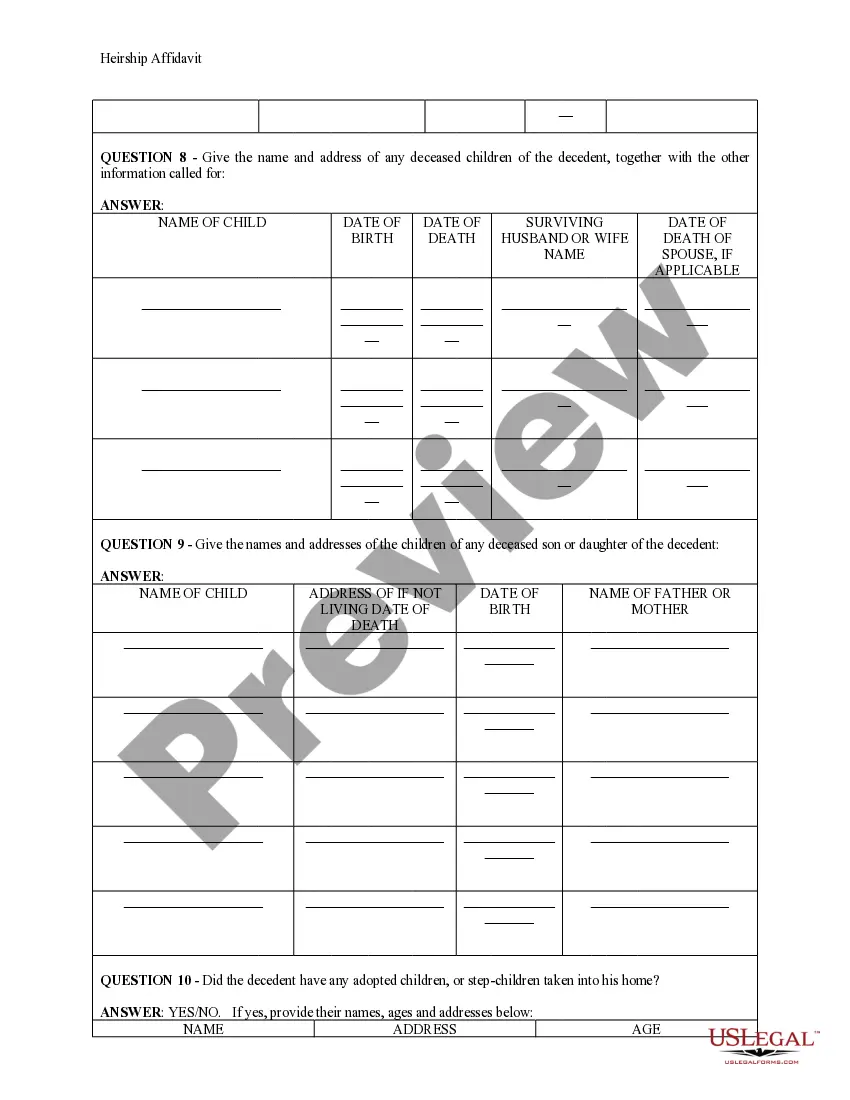

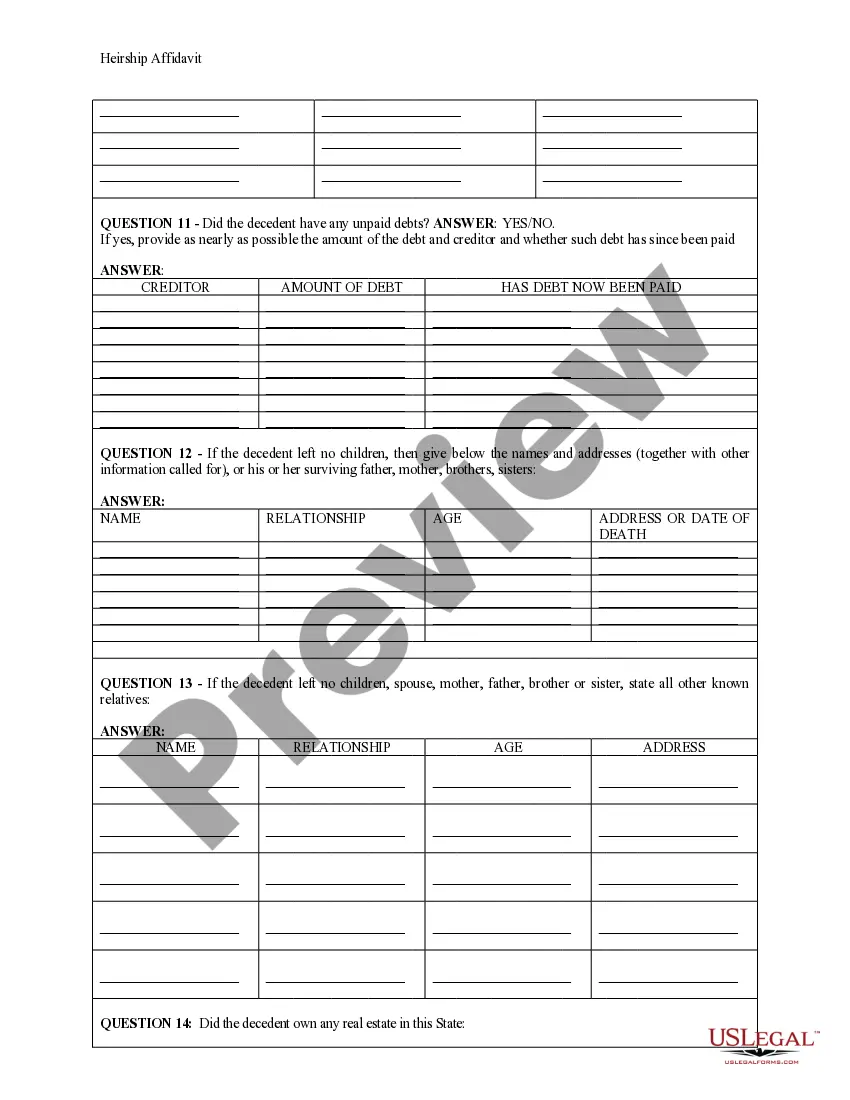

- Information on the decedentâs family, including surviving spouse and children.

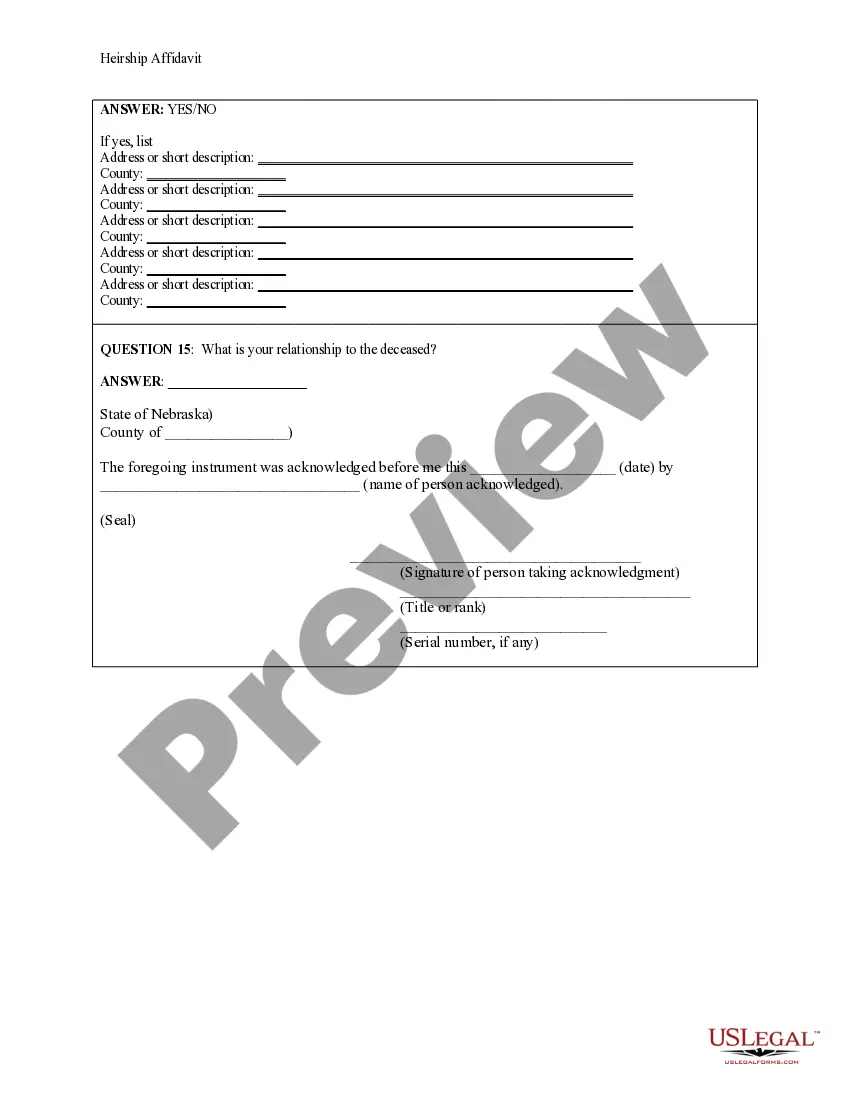

- Property information detailing real estate owned by the decedent.

- Affiant's statement confirming personal knowledge of the decedent and their heirs.

When to use this form

This form is used when a person has died without leaving a will and there is a need to determine and establish the rightful heirs. Common scenarios include selling property owned by the deceased when no estate has been opened, or when heirs need to prove their relationship to the decedent for other legal purposes.

Who should use this form

- Individuals seeking to establish heirship after the death of a loved one without a will.

- Family members or relatives who need to provide evidence of their relationship to the deceased.

- Any individual assisting an heir in the process of assigning property ownership.

How to complete this form

- Identify yourself as the affiant by providing your name and address.

- Supply the decedent's details, including their name, date of death, and last known address.

- Answer questions related to the existence of a will and any appointed estate representatives.

- List the names and relationships of surviving family members and beneficiaries.

- Include details of any real estate owned by the decedent that may require transfer.

- Sign the affidavit in front of a notary public to validate your statements.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide complete information about the decedent's heirs.

- Leaving out important details regarding property ownership.

- Not having the affidavit notarized if required by local law.

- Incorrectly answering questions regarding existing wills or estate representatives.

Why complete this form online

- Immediate access to the Heirship Affidavit template, saving time and hassle.

- The ability to edit the document as needed before finalizing it.

- Convenience of completing the form from home without needing to visit a lawyerâs office.

Key takeaways:

- The Heirship Affidavit - Descent is essential for establishing heirs and transferring property when no will exists.

- Accuracy in completing the form is crucial for legal validity.

- Notarization is required for the affidavit to be enforceable.

Looking for another form?

Form popularity

FAQ

No, in Nebraska, you do not need to notarize your will to make it legal. However, Nebraska allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Is Probate Required in Nebraska? Probate is necessary in Nebraska for estates. However, there are a few exceptions that allow the estate to pass to the heirs without going through the legal process.

Joint tenancy with right of survivorship. Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Tenancy by the entirety. Community property with right of survivorship.

Close relatives. Certain relatives of the deceased person are given a $40,000 exemption from the state inheritance tax. In other words, they don't owe any tax at all unless they inherit more than $40,000. This tax exemption applies to these family members of the deceased person: parents.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

If you die without a will in Nebraska, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Nebraska must consider them your children, legally. For many families, this is not a confusing issue.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds (for example, in 2021 the federal estate tax exemption amount is $11.7 million for an individual), receipt of an inheritance does not result in taxable income for federal or state income tax

In Nebraska, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).