North Dakota Dissolution Package to Dissolve Corporation

Understanding this form

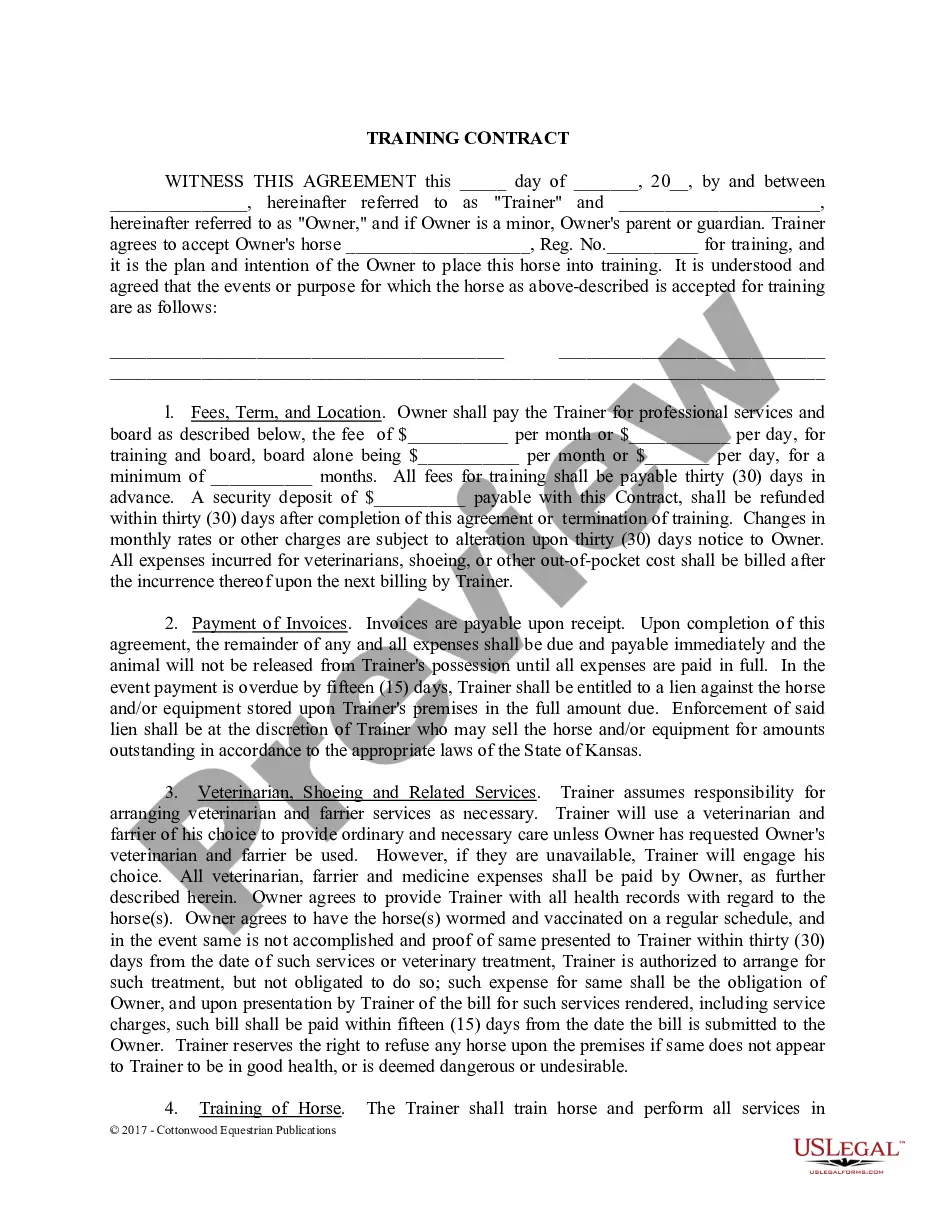

The North Dakota Dissolution Package to Dissolve Corporation provides all the necessary forms and instructions required for the voluntary dissolution of a corporation in North Dakota. This package includes clear instructions on the dissolution process, forms tailored for different scenarios, and essential information tailored to ensure compliance with state laws. Unlike forms for other types of business entities, this package specifically addresses the unique steps required for corporations.

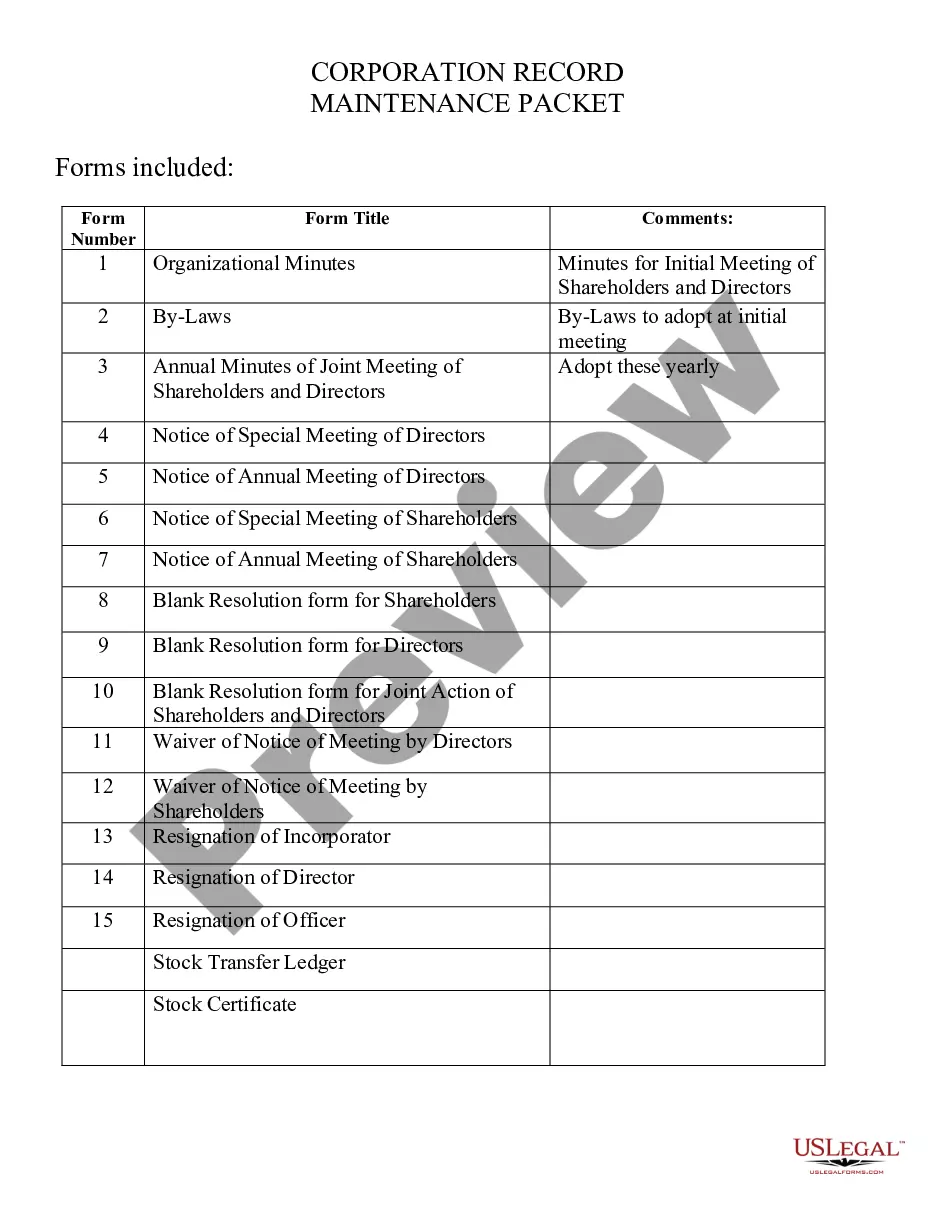

What’s included in this form

- Articles of Dissolution: Formal notification to the state that a corporation wishes to dissolve.

- Notice of Intent to Dissolve: A declaration of the corporationâs intent to cease operations.

- Resolution of Directors: Documentation reflecting the decision by the board members to dissolve the corporation.

- Notice to Creditors: Informing all known creditors of the dissolution process and the timeline for submitting claims.

- Claims Rejection Notice: Official communication to claimants regarding the acceptance or rejection of their claims against the corporation.

Situations where this form applies

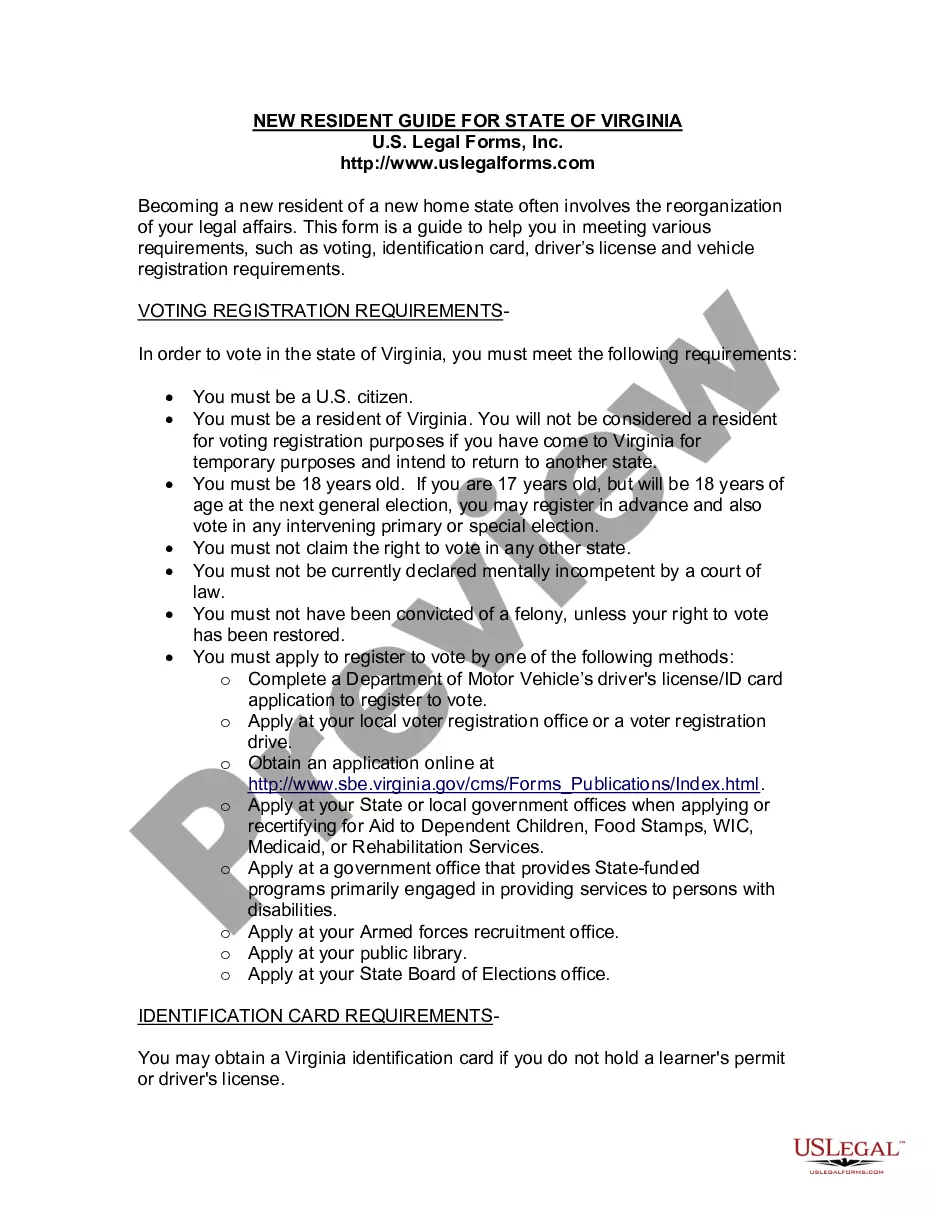

This dissolution package should be used when a corporation in North Dakota needs to formally cease operations. You might require this package when the owners decide to wind down the business due to various reasons such as economic challenges, changes in business strategy, or fulfilling its goals and plans. It is essential to utilize this package when voluntary dissolution is chosen over involuntary dissolution processes, such as court-supervised dissolution.

Intended users of this form

- Corporation owners or shareholders wishing to dissolve their company.

- Members of the board of directors responsible for making dissolution decisions.

- Shareholders looking to understand their rights and responsibilities during the dissolution process.

- Legal professionals assisting clients with corporate dissolution in North Dakota.

How to prepare this document

- Identify whether the corporation has issued shares. If not, complete Form 1. If it has, proceed to the next step.

- For corporations with issued shares, the board must adopt a resolution proposing dissolution using Form A. Schedule a meeting to obtain shareholder approval.

- Notify all shareholders of the upcoming meeting to discuss the dissolution using Form B; ensure all relevant communications are sent.

- Once approved, complete Form 2, Notice of Intent to Dissolve, and file it with the Secretary of State.

- Wipe down existing business operations by settling debts and notifying creditors with Form 3.

- Finally, file the Articles of Dissolution with the state using Form 5, after all obligations have been met.

Does this form need to be notarized?

This form does not typically require notarization unless specified by local law.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to notify all shareholders about the meeting to discuss dissolution.

- Not properly filing the Notice of Intent to Dissolve with the Secretary of State.

- Overlooking the requirement to notify creditors of the dissolution.

- Failing to resolve outstanding debts before completing the Articles of Dissolution.

Why use this form online

- Convenient access to all necessary forms and instructions in one package.

- Editable forms allow for customization to fit specific corporation needs.

- Instant download capability for immediate use without postal delays.

- Reliable legal language drafted by licensed attorneys ensuring compliance with state laws.

Looking for another form?

Form popularity

FAQ

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

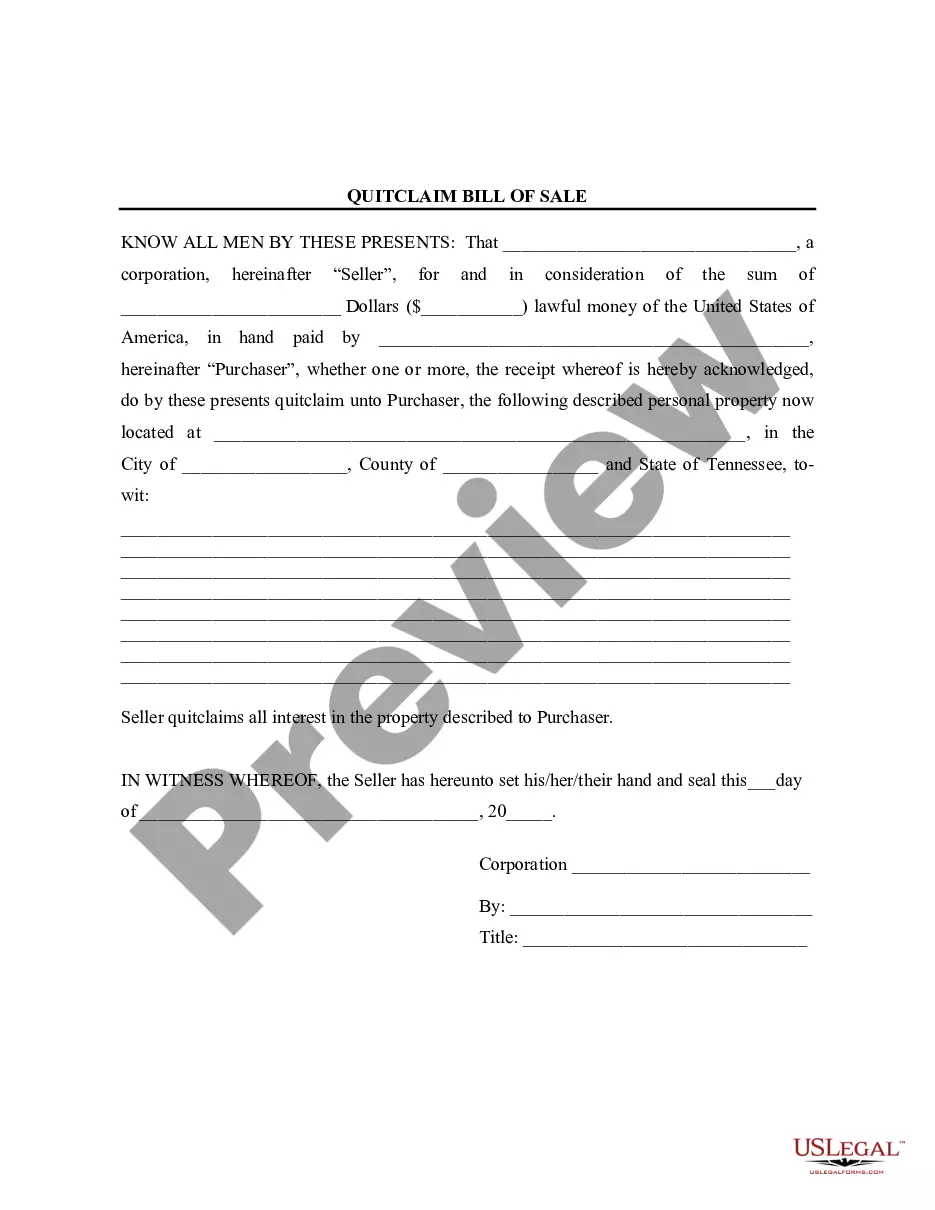

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

North Dakota requires business owners to submit their Articles of Dissolution and Termination online. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

Hold a Members meeting and record a resolution to Dissolve the North Dakota LLC. File a Notice of Dissolution with the ND Secretary of State. File all required Annual Reports with the North Dakota Secretary of State. Clear up any business debts. Pay all taxes and administrative fees owed by the North Dakota LLC.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.