North Carolina Last Will and Testament for a Single Person with Minor Children

About this form

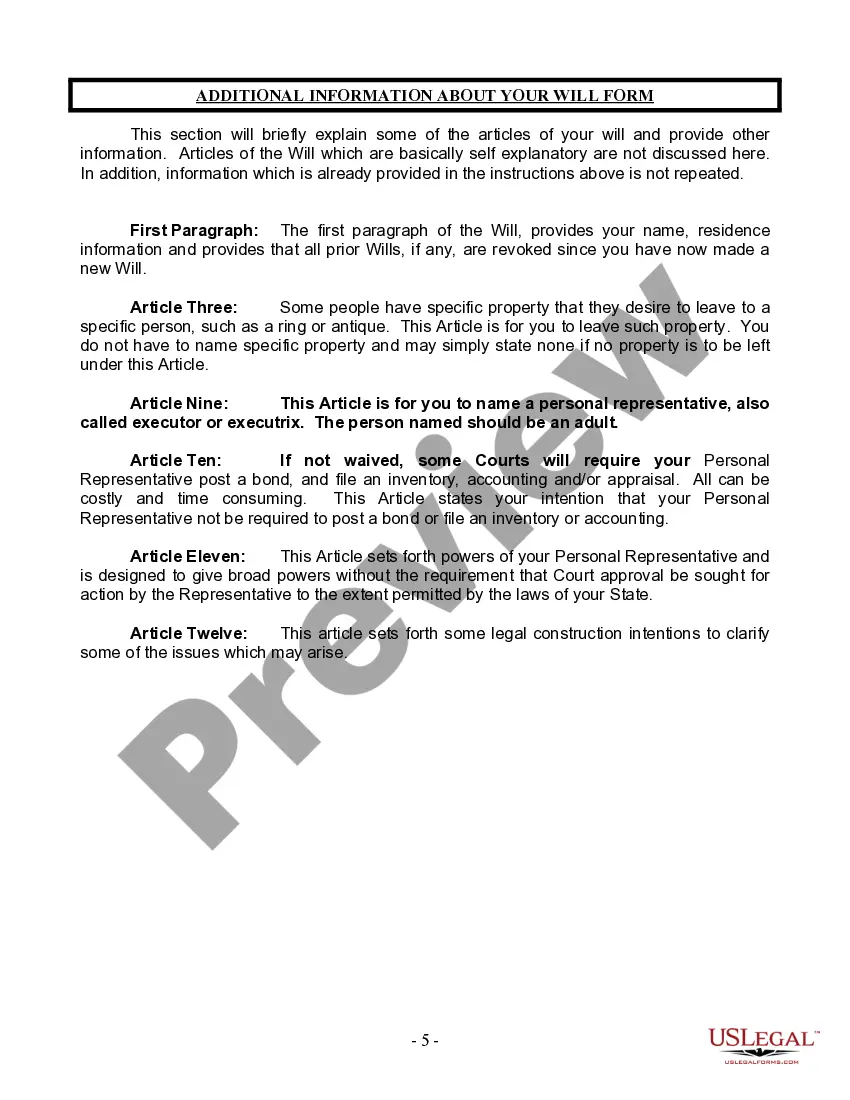

The Last Will and Testament for a Single Person with Minor Children is a legal document that outlines how a single individual wishes to distribute their assets after death while ensuring the care and financial security of their minor children. Unlike other wills, this specific form includes provisions for appointing guardians and trustees for minors, making it essential for single parents who want to secure their children's future.

Form components explained

- Identification of the testator (person creating the will).

- Appointment of a personal representative (executor) to manage the estate.

- Specifying beneficiaries, including naming who will inherit specific property.

- Establishment of a trust for minor children's inheritance until they reach a designated age.

- Appointment of a guardian for minor children.

- Self-proving affidavit requirements for easier probate processing.

When to use this document

This form should be used when a single parent wishes to establish a clear legal pathway for asset distribution after their death, particularly if they have minor children. It is appropriate in situations where the parent wants to appoint a guardian for their children and a trustee to manage any inherited assets until the children reach adulthood.

Who this form is for

- Single parents who have minor children.

- Individuals looking to ensure proper management of their estate after death.

- Those wishing to designate guardians for their children in the event of their passing.

- Anyone wanting to specify how their assets should be distributed, including setting up trusts for minors.

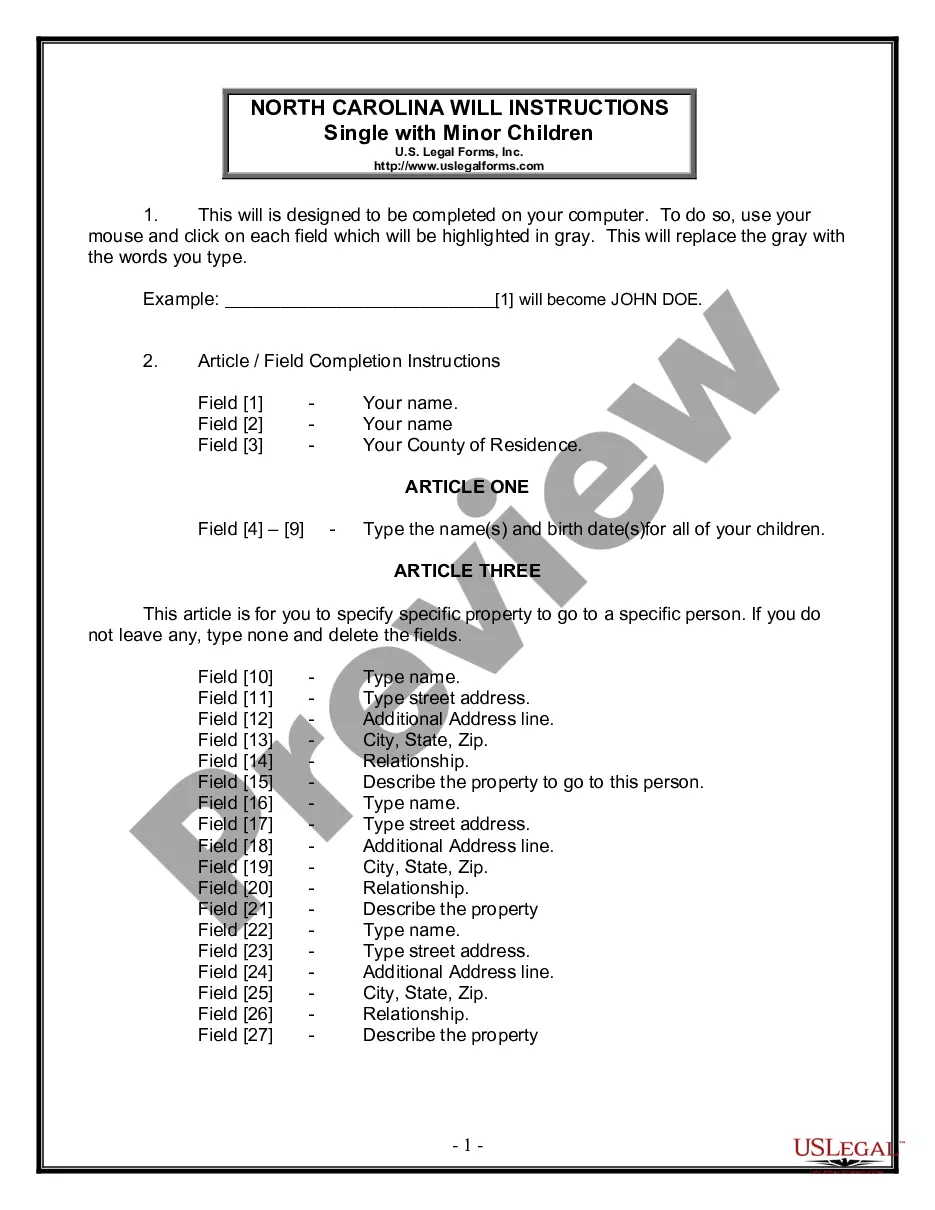

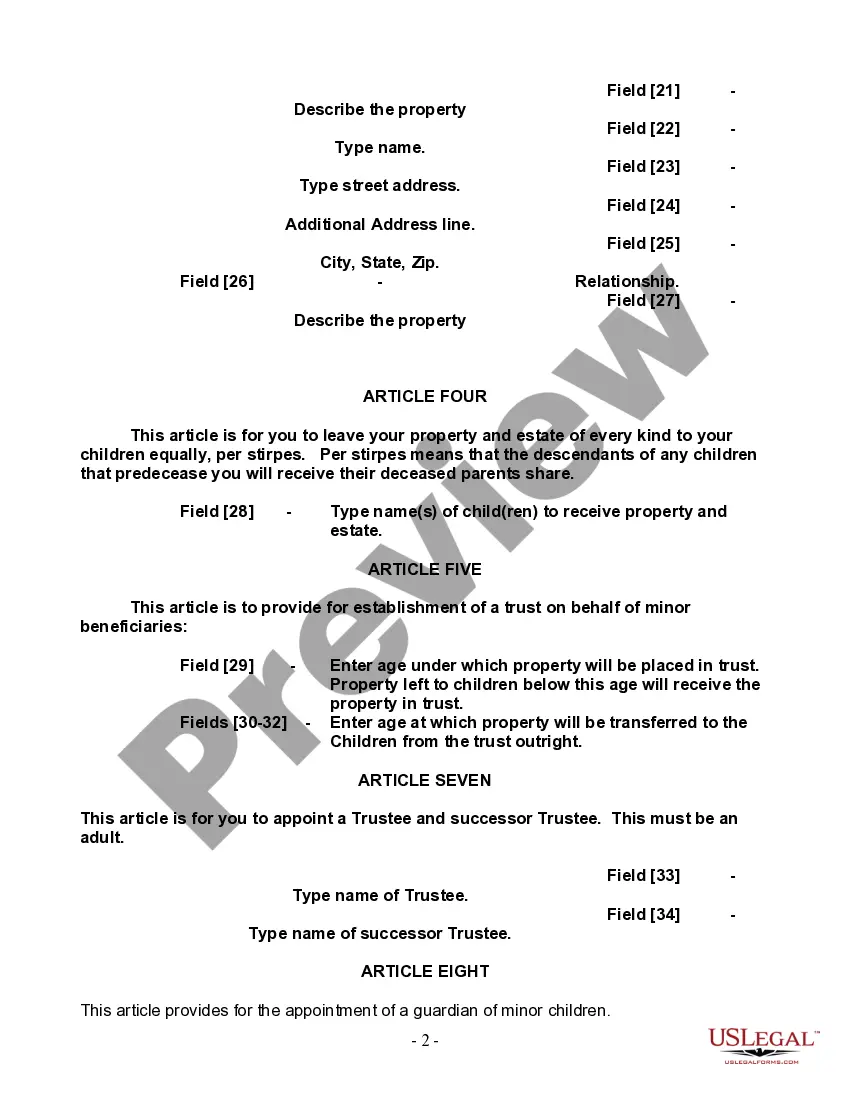

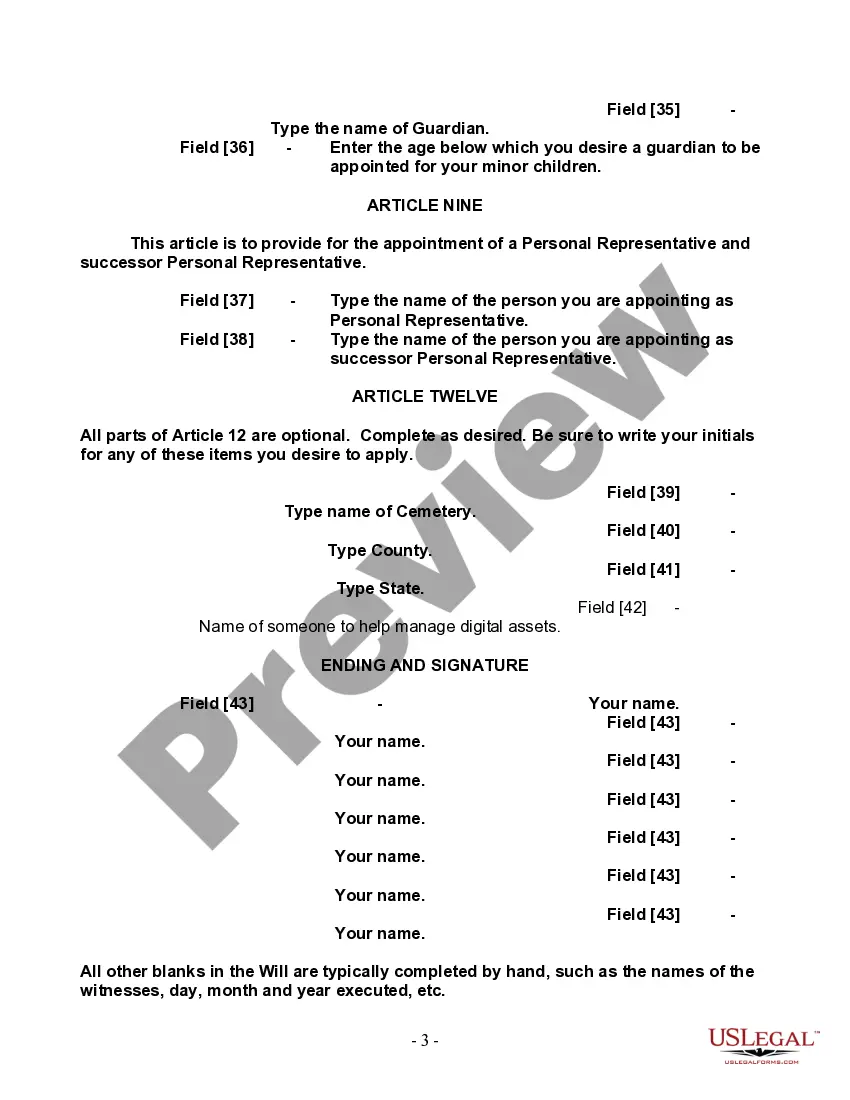

Steps to complete this form

- Identify yourself by entering your full name, address, and county of residence.

- List your minor children by providing their names and birthdates.

- Specify beneficiaries and detailed information about any specific bequests of property.

- Appoint a trustee for the property intended for your minor children.

- Designate a guardian for your children and a personal representative to manage your estate.

- Sign the will in the presence of two witnesses and, if applicable, have a notary public acknowledge your signature.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Common mistakes to avoid

- Failing to fully complete all required sections of the form.

- Not having the will signed in front of the required number of witnesses.

- Neglecting to update the will after significant life changes (e.g., marriage, additional children).

- Assuming that joint property will pass according to the will when it may not.

Benefits of completing this form online

- Convenient access to legal documents that can be completed at your own pace.

- Editable format allows for easy customization based on personal needs.

- Forms are drafted by licensed attorneys, ensuring compliance with applicable laws.

- Secure storage and quick downloading options for easy access.

Form popularity

FAQ

A will can also be declared invalid if someone proves in court that it was procured by undue influence. This usually involves some evil-doer who occupies a position of trust -- for example, a caregiver or adult child -- manipulating a vulnerable person to leave all, or most, of his property to the manipulator instead

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Yes, a last will and testament normally must be filed with the court. That applies whether or not the estate is going to probate.Also, if you are in possession of a signed will, most states legally require you to file the will with the appropriate county court if you are the executor.

Property in a living trust. One of the ways to avoid probate is to set up a living trust. Retirement plan proceeds, including money from a pension, IRA, or 401(k) Stocks and bonds held in beneficiary. Proceeds from a payable-on-death bank account.

You don't have to get a lawyer to draft your will. It's perfectly legal to write your own will, and any number of products exist to help you with this, from software programs to will-writing kits to the packet of forms you can pick up at your local drugstore.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.

While you can write your own last will and testament, it's very important to follow your state's requirements. If the court finds it invalid, someone other than your chosen executor could handle your estate and distribute your assets differently than you intended.

A Last Will and Testament only takes care of your stuff (your assets). A Living Will only takes care of your self (your health care). Having either one of these documents is good it's better than nothing! But having both (or otherwise addressing both sides of estate planning) is better.

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.