Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion is a legal document filed in federal bankruptcy court by an individual debtor under Chapter 11 of the United States Bankruptcy Code. This motion seeks to have the court enter a discharge of the debtor's debt obligations due to the completion of the Chapter 11 reorganization plan. This motion is typically filed after the debtor has successfully completed all the requirements of the Chapter 11 plan, such as making all payments, submitting all required financial documents, and satisfying all other obligations. There are two types of Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion: a Motion for Entry of Final Decree and a Motion for Entry of Final Order. The Motion for Entry of Final Decree is used to request the court to enter a final decree confirming the debtor's successful completion of the Chapter 11 plan. The Motion for Entry of Final Order is used to request the court to enter a final order discharging the debtor's debts and obligations due to the successful completion of the Chapter 11 plan.

Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion

Description

How to fill out Missouri Individual Debtors Motion For Entry Of Chapter 11 Discharge Due To Plan Completion?

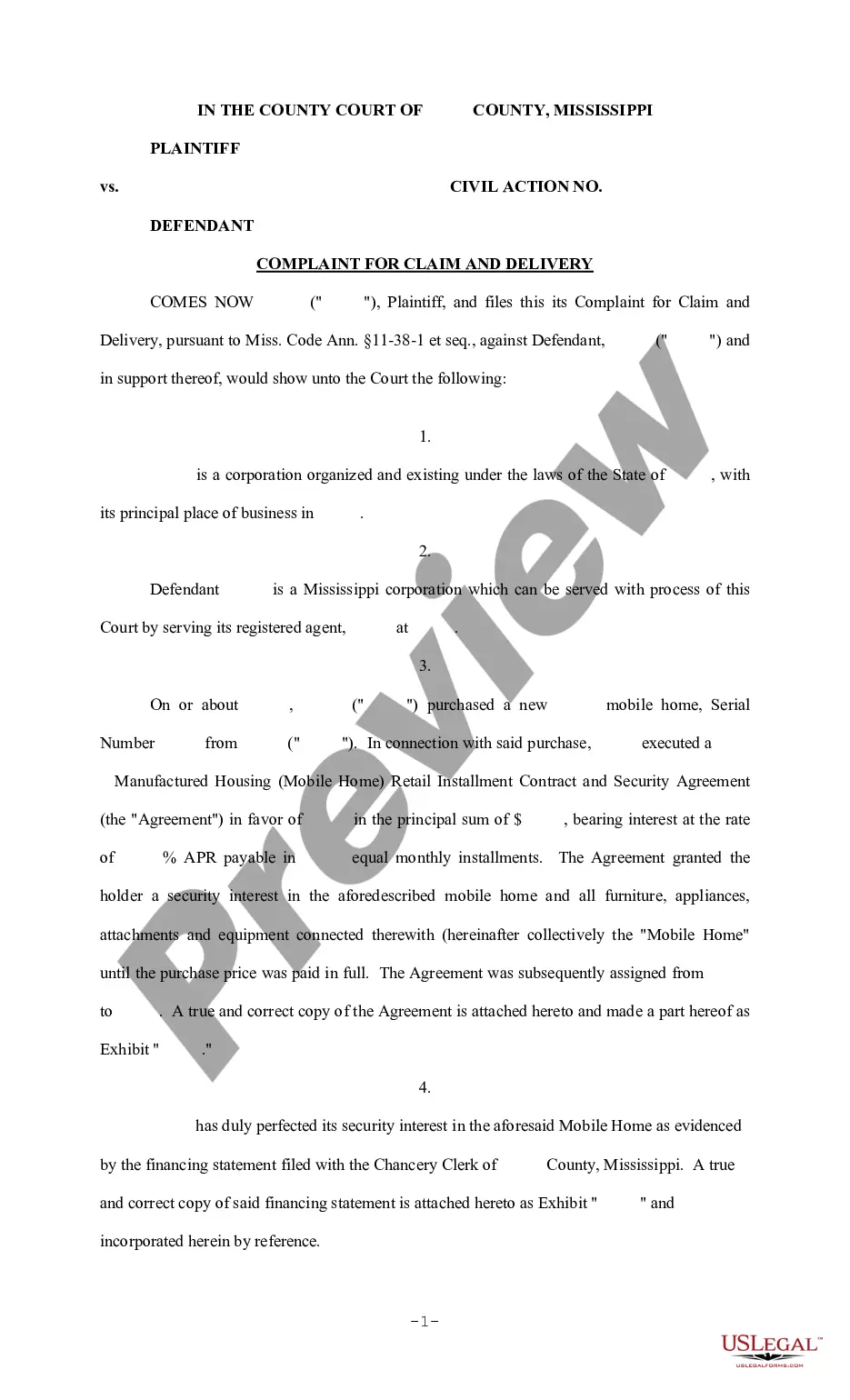

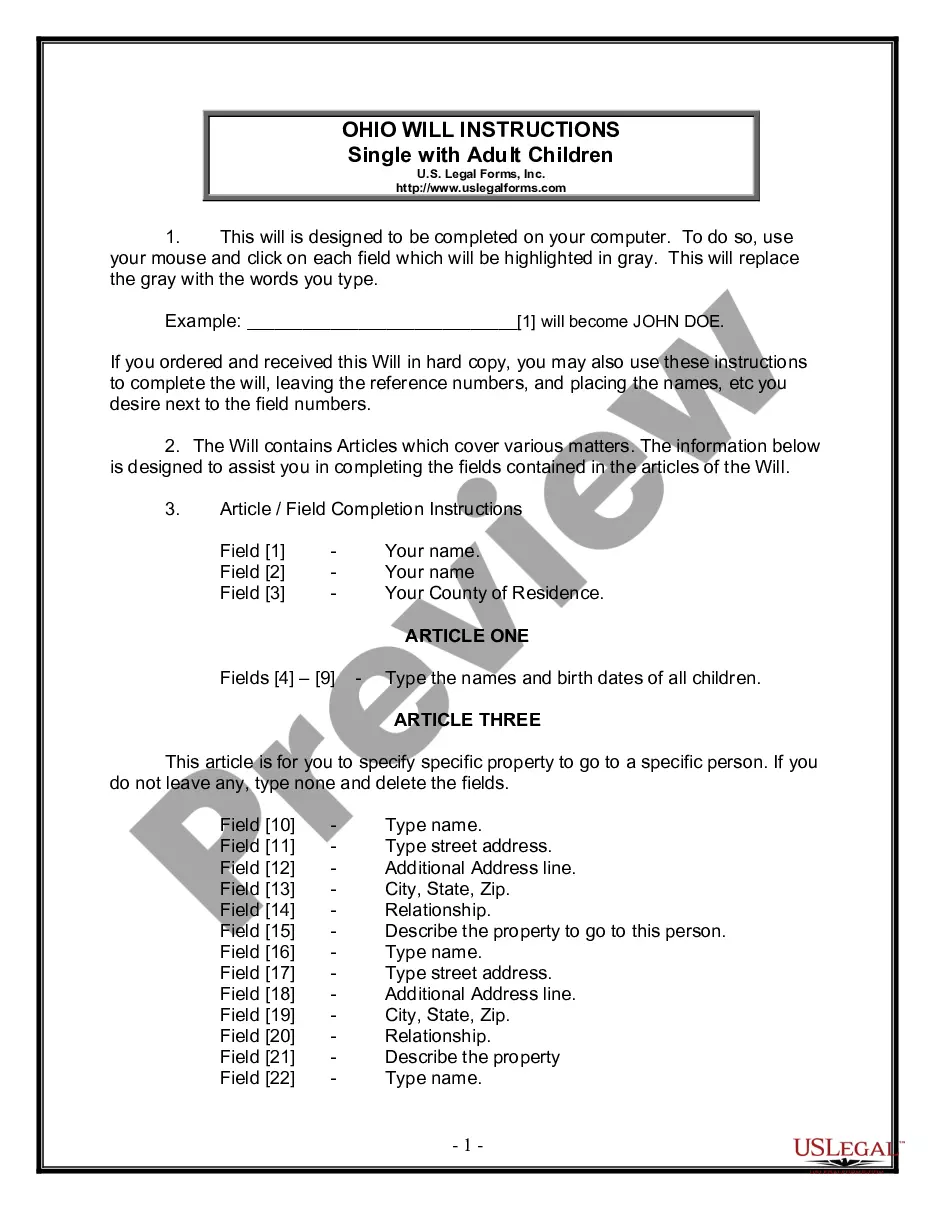

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are checked by our experts. So if you need to complete Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion, our service is the best place to download it.

Getting your Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Missouri Individual Debtors Motion For Entry of Chapter 11 Discharge Due To Plan Completion and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

A default occurs when a borrower stops making the required payments on a debt. Defaults can occur on secured debt, such as a mortgage loan secured by a house, or unsecured debt, such as credit cards or a student loan.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

An unsecured creditor must first file a legal complaint in court and obtain a judgment before proceeding with collection through wage garnishment and other types of liquidated borrower-owned assets.

A Chapter 11 reorganization plan outlines how a debtor proposes to pay off its outstanding debts. For most businesses who seek Chapter 11 bankruptcy, a reorganization plan will also propose a restructuring of operations to ensure that bankruptcy provides a more permanent solution to the debtor's financial problems.

A debtor is someone who owes a debt or obligation to someone else. Most commonly, this is the obligation to pay money.

The rights of Unsecured Creditors include: a share in any available funds, but only after costs of liquidation, priority payments and in particular, the Secured Creditors have been paid. an opportunity to take part in choosing the Liquidator in a Creditor's Voluntary Winding Up.

The automatic stay provides a period of time in which all judgments, collection activities, foreclosures, and repossessions of property are suspended and may not be pursued by the creditors on any debt or claim that arose before the filing of the bankruptcy petition.